Wadi Kabir accounting for workshops: Practical insights for managing maintenance and spare parts finances

Understanding the financial landscape of Wadi Kabir workshops

The unique challenges of accounting in workshop environments

Wadi Kabir accounting for workshops demands a clear understanding of the complex financial activities typical to maintenance and spare parts businesses. Workshops in Wadi Kabir, a vibrant industrial area in Muscat, often face unique accounting challenges, including tracking service revenues, managing inventory of spare parts, and controlling costs related to labor and materials. Unlike retail or simple service businesses, workshops handle both tangible goods and labor-intensive services, which complicates revenue recognition and expense allocation. Precise accounting is crucial not only for regulatory compliance but also for ensuring profitability in a competitive market. Business owners and finance managers must implement systems that accurately reflect operational realities, such as spare parts procurement cycles, warranty claims, and maintenance contracts.

Effective accounting practices in this context go beyond traditional bookkeeping; they involve detailed tracking of parts inventory, cost of goods sold (COGS), and labor costs tied to specific jobs. Moreover, given Oman’s VAT system, workshops must carefully manage VAT on spare parts sales and service fees, ensuring proper tax input credits and output tax charges. Failure to do so can lead to costly penalties and distorted financial reports. The financial landscape for workshops in Wadi Kabir thus requires a tailored approach that balances detailed operational data with regulatory demands, offering a clear picture of financial health and facilitating strategic decisions.

To meet these demands, businesses in Wadi Kabir often turn to professional advisory services that understand local market conditions and Oman’s tax framework. Partnering with expert auditors and accountants ensures the workshop’s financial data is accurate, transparent, and compliant with Oman’s evolving corporate tax and VAT regulations. This approach also helps owners evaluate financial performance and optimize profitability by aligning operational data with strategic financial insights.

Inventory management and accounting for spare parts in Wadi Kabir

Tracking and valuing spare parts for accurate financial reporting

One of the most critical aspects of Wadi Kabir accounting for workshops involves managing the inventory of spare parts. Spare parts represent a significant portion of workshop assets and directly impact cost control and service delivery efficiency. For effective accounting, workshops must implement robust inventory management systems that accurately track incoming and outgoing parts, reorder levels, and stock valuations. Proper inventory valuation methods—such as FIFO (First-In, First-Out) or weighted average cost—help reflect the true cost of parts used in maintenance work, ensuring the financial statements present a reliable picture of profitability.

Inaccurate inventory records can lead to misstated profits, cash flow issues, and operational disruptions. For example, overstocking parts ties up working capital unnecessarily, while understocking can cause delays in service and lost revenue. Additionally, the fluctuating prices of automotive or mechanical parts require workshops to regularly review inventory values to avoid financial distortions. This practice is especially vital in Oman’s dynamic market environment, where import duties, freight costs, and currency fluctuations can affect spare parts pricing.

From a tax perspective, Oman’s VAT rules require businesses to correctly account for VAT on both purchases and sales of spare parts. Input VAT incurred on purchases should be carefully documented to claim valid tax credits, while output VAT must be charged on parts sold to customers. The interplay between inventory management and VAT compliance makes accurate accounting indispensable. Workshops that leverage advisory support can streamline inventory processes, improve cost tracking, and ensure VAT is handled in full compliance with Oman’s tax authority requirements.

Cost control and revenue recognition in maintenance services

Aligning financial practices with operational realities

Wadi Kabir accounting for workshops also centers heavily on cost control and revenue recognition related to maintenance services. Unlike straightforward product sales, maintenance services involve a mix of labor hours, consumables, and spare parts, requiring nuanced accounting treatment. For SMEs in Wadi Kabir, accurately allocating costs to specific jobs and recognizing revenues only when services are rendered are fundamental to maintaining transparent and reliable financial records.

Proper job costing enables workshop owners to evaluate which services or maintenance types generate the highest margins and which may be incurring losses. Tracking labor hours, material usage, and subcontractor costs linked to each job ensures that pricing strategies are aligned with actual expenses. Furthermore, accounting for warranty work or service contracts requires diligent monitoring to avoid underestimating liabilities or overstating revenues.

In addition, Oman’s corporate tax framework emphasizes accurate profit measurement, making it essential for workshops to distinguish between operational expenses and capital expenditures. Workshops benefit from professional advisory services to implement accounting policies that comply with tax laws while providing actionable insights for business growth. Clear cost and revenue accounting not only supports tax compliance but also equips workshop managers with the information needed to optimize service offerings and enhance financial performance.

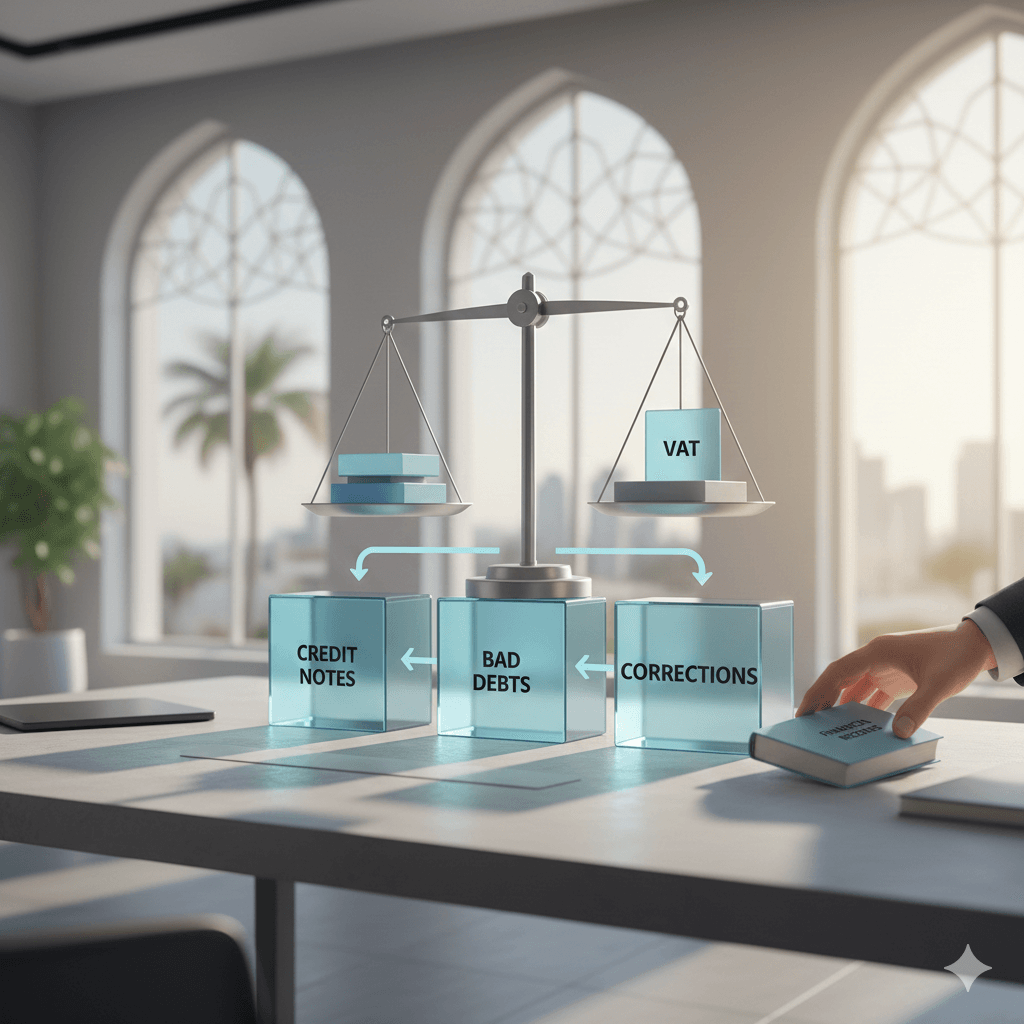

VAT compliance challenges for Wadi Kabir workshops

Ensuring tax accuracy in a complex regulatory environment

Navigating VAT compliance is a key challenge for workshops in Wadi Kabir, where transactions encompass both goods (spare parts) and services (maintenance). Oman’s VAT system imposes a 5% tax on taxable supplies, requiring workshops to maintain precise records for both input and output VAT. The mixed nature of workshop sales increases the risk of VAT errors, such as misclassifying services or goods, which can lead to inaccurate tax filings or disputes with tax authorities.

Workshops must also contend with the documentation requirements mandated by Oman’s tax regulations, including proper invoicing, retention of purchase and sales records, and timely VAT return submissions. Non-compliance may result in penalties, interest, and reputational damage. This complexity underscores the importance of implementing integrated accounting software tailored to the workshop’s operations, capable of automatically calculating VAT liabilities and generating compliant reports.

Professional tax advisory services play a vital role in guiding workshops through VAT audits and regulatory updates, minimizing risk and ensuring ongoing compliance. Leaderly’s expertise in VAT advisory supports SMEs in Wadi Kabir by offering tailored solutions that align financial processes with Oman’s tax laws, enhancing confidence in the accuracy of financial reporting and tax payments.

Leveraging audit and advisory services to strengthen financial management

Building trust and strategic insight through expert guidance

Audit and advisory services are instrumental for workshops in Wadi Kabir to maintain financial integrity and support sustainable growth. External audits provide an independent review of financial statements, helping to identify errors, inefficiencies, or risks within accounting processes. For SMEs, audits not only satisfy regulatory requirements but also instill confidence among investors, suppliers, and customers.

Advisory services extend beyond compliance by offering strategic guidance tailored to workshop businesses. These include feasibility studies for expansion, valuation services for asset management, liquidation advice if needed, and due diligence support for partnerships or financing. Such expertise allows workshop owners to make informed decisions grounded in robust financial data and local market insights.

By aligning with professional audit and advisory providers like Leaderly, workshops can integrate best practices in accounting, tax, and operational efficiency. This partnership strengthens financial management capabilities, reduces compliance risks, and positions SMEs in Wadi Kabir for long-term success within Oman’s evolving business environment.

Wadi Kabir accounting for workshops is a multifaceted discipline that requires careful attention to inventory management, cost control, VAT compliance, and the strategic use of audit and advisory services. For business owners and finance managers operating in this specialized sector, mastering these financial elements is essential to sustaining profitability and regulatory compliance. The complexities of accounting for both maintenance services and spare parts sales in Oman’s dynamic market make professional support indispensable.

Ultimately, workshops in Wadi Kabir that embrace rigorous accounting standards and leverage expert advisory resources will be better positioned to optimize their financial health and growth potential. This approach enables SMEs to navigate regulatory changes confidently while focusing on delivering quality maintenance services and efficient spare parts management, thereby securing their competitive edge in Muscat’s vibrant industrial landscape.

#Leaderly #WadiKabir accounting for workshops #Oman #Muscat #SMEs #Accounting #Tax #Audit