Shati Al Qurum Expense Policies for Client-Facing Teams: Best Practices for SMEs

Defining Expense Policies in Shati Al Qurum’s Business Context

Setting clear financial boundaries

Shati Al Qurum expense policies for client-facing teams are essential for SMEs aiming to drive business growth in this dynamic commercial area. These policies regulate how employees handle and report business-related expenses, ensuring transparency and accountability. Serving as a financial framework, they provide operational control while empowering teams to nurture strong client relationships. In Oman’s changing economic environment, particularly within bustling hubs like Shati Al Qurum, SMEs encounter challenges such as cost fluctuations, regulatory compliance, and the necessity for financial discipline. Consequently, an effective expense policy goes beyond simple guidelines—it acts as a strategic safeguard for business resources and encourages consistent spending aligned with company objectives. Well-defined policies help curb overspending, minimize fraud risks, and simplify reimbursement procedures, enabling client-facing employees to concentrate on delivering value without administrative burdens.

Key Components of Expense Policies for Client Teams

Practical criteria for expenses

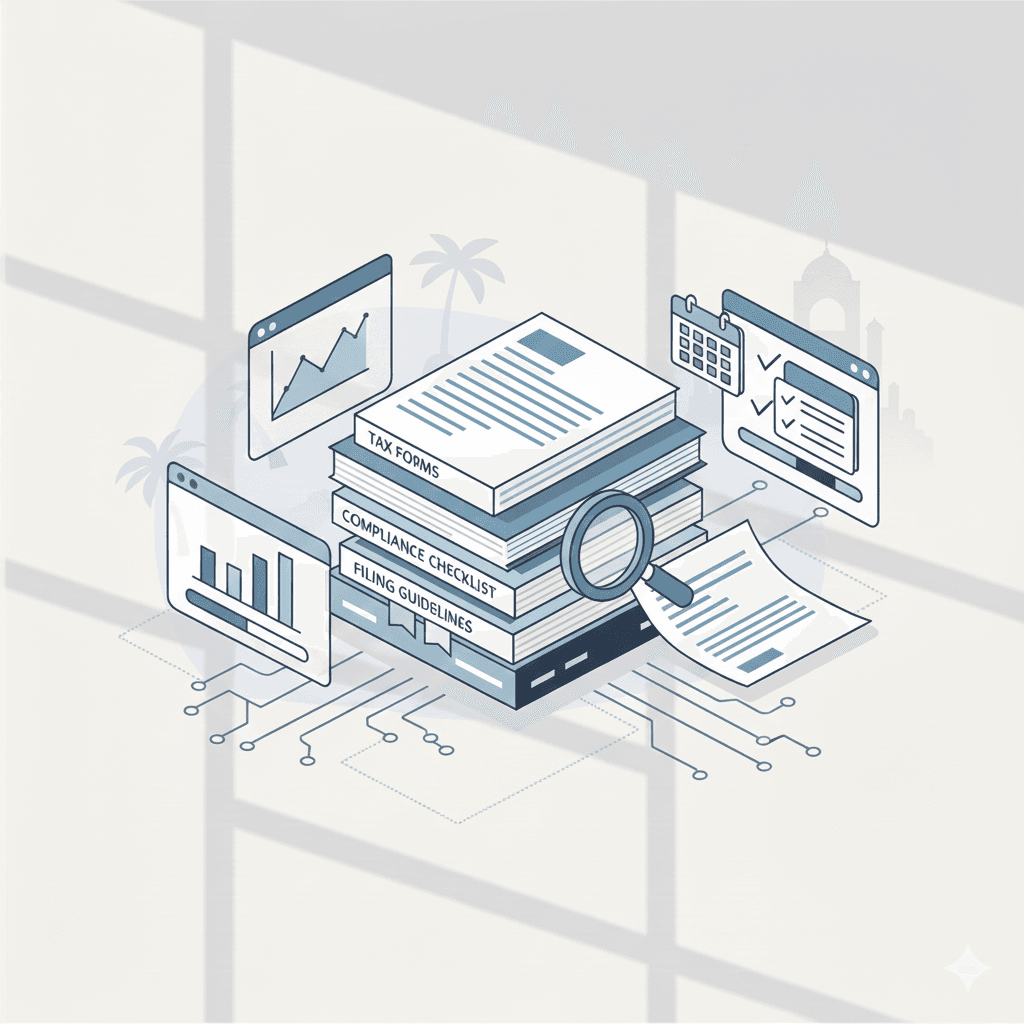

Effective expense policies in Shati Al Qurum should detail which costs are allowable, such as travel, meals, accommodation, and client entertainment, all common in client engagement roles. For SMEs, the policy must balance flexibility with control, allowing employees the discretion needed to respond to client needs while setting spending limits appropriate to the business scale. For example, specifying daily per diem rates or maximum thresholds for hotel stays helps keep costs predictable. Clear documentation requirements, such as mandatory receipts and pre-approval for large expenses, enhance transparency and support audit readiness. In Oman, compliance with VAT regulations also plays a crucial role in expense management, as VAT on business expenses can be reclaimed only when proper documentation is maintained. Policies should incorporate procedures that align with these tax requirements, reducing the administrative burden on finance teams and ensuring smooth financial reporting.

Integrating Expense Policies with Financial Systems in Oman SMEs

Streamlining compliance and reporting

Incorporating expense policies into the financial systems used by SMEs in Shati Al Qurum increases efficiency and accuracy. Digital tools for expense tracking and reimbursement help ensure policies are followed consistently and reduce errors. Integration with accounting software allows automatic classification of expenses and facilitates VAT tracking, essential for Omani SMEs operating under the Sultanate’s tax frameworks. Additionally, having clear policies reduces disputes or delays in reimbursements, improving employee satisfaction and operational flow. Leaders in Shati Al Qurum should view expense policies as part of broader financial governance, connecting them with audit controls and advisory processes offered by firms like Leaderly. This integrated approach helps SMEs stay compliant, control costs, and prepare for financial reviews or due diligence, supporting sustainable growth in a competitive market.

Training and Communication for Effective Policy Adoption

Empowering client-facing teams

For expense policies to be effective, SMEs in Shati Al Qurum must invest in training client-facing teams on policy details and rationale. Employees often encounter situations requiring quick judgment, so understanding the scope and limits of expense allowances is essential. Training sessions can clarify policy points, demonstrate how to submit claims, and explain consequences of non-compliance. Open communication channels allow employees to seek advice before incurring unusual expenses, reducing risk and fostering trust. In Oman’s SME sector, where resources are often limited, a well-informed team contributes significantly to financial discipline. By framing expense policies as enablers rather than constraints, companies can encourage responsible spending that aligns with both client satisfaction and corporate financial health.

Addressing Cultural and Market Realities in Shati Al Qurum

Adapting policies to local business customs

Expense policies in Shati Al Qurum must reflect local business etiquette and client expectations. In Oman, hospitality and relationship-building often involve entertaining clients, which requires some degree of flexibility. Policies should acknowledge these cultural nuances while setting clear financial guardrails. For instance, specifying acceptable venues or expense categories tailored to client preferences can help employees navigate social protocols without risking financial irregularities. Moreover, considering local market pricing and seasonal cost variations ensures policies remain realistic and fair. Tailoring expense policies to these regional factors helps SMEs maintain competitiveness and uphold professional standards that resonate with Omani business culture.

Leveraging Advisory Support for Policy Optimization

Continuous improvement through expert guidance

SMEs in Shati Al Qurum benefit greatly from advisory services that review and optimize expense policies regularly. Partnering with firms like Leaderly can provide insights on industry best practices, regulatory updates, and emerging financial risks. Advisors can help tailor policies to specific business models and client sectors, ensuring both compliance and operational flexibility. This ongoing support aids SMEs in adapting to evolving tax laws, such as changes in VAT or corporate tax regimes in Oman, while embedding stronger internal controls. Through due diligence and valuation services, advisory experts also help identify cost-saving opportunities within expense management, enhancing profitability and financial sustainability.

Establishing robust expense policies for client-facing teams in Shati Al Qurum is a vital step towards strengthening SME financial management and client service quality. By defining clear guidelines, integrating systems, and addressing cultural nuances, businesses can foster responsible spending that supports growth and compliance. Empowered teams, supported by continuous advisory input, are better positioned to navigate the complexities of Oman’s business environment with confidence.

Ultimately, effective expense policies are not merely administrative necessities but strategic enablers for SMEs in Shati Al Qurum. They promote transparency, reduce risks, and improve financial control, all while allowing client-facing teams the flexibility to excel. With clear policies and expert guidance, SMEs can achieve greater operational efficiency and build stronger client relationships, essential for long-term success in Oman’s dynamic market.

#Leaderly #ShatiAlQurumExpensePolicies #Oman #Muscat #SMEs #Accounting #Tax #Audit