Quality Audits in Muscat: Understanding Operational Excellence for SMEs

The Purpose of Quality Audits in Muscat’s SME Landscape

Why Muscat SMEs Must Prioritize Quality Audits

Quality audits in Muscat serve as a critical mechanism to ensure that small and medium-sized enterprises (SMEs) operate within the regulatory and operational frameworks demanded by Oman’s evolving business environment. Unlike mere compliance checks, quality audits focus deeply on operational integrity, accuracy in financial reporting, and the effectiveness of internal controls. For Muscat’s SME owners and finance managers, this means going beyond ticking boxes and engaging in audits that validate the robustness of business processes. In an economic climate where transparency and accountability are increasingly scrutinized, these audits provide assurance that the business is well-positioned for sustainable growth and resilience. Understanding this purpose allows SMEs to transform audits from a dreaded obligation into an opportunity for continuous improvement and risk mitigation.

Key Features Defining “Good” Quality Audits in Muscat

A good quality audit in Muscat is characterized by a systematic, thorough approach that encompasses not just financial accuracy but also operational efficiency and compliance with local regulations. It begins with clear audit planning tailored to the specific business context, including industry norms and Oman’s statutory requirements. Auditor independence and professionalism are essential to maintaining objectivity, while the audit scope must include key risk areas such as revenue recognition, expense controls, and inventory management. Furthermore, effective communication between auditors and the company’s management fosters a collaborative environment for addressing identified issues promptly. Such audits don’t end with a report; they include actionable insights that help SMEs optimize their operations and strengthen their financial standing within the local market.

The Role of Leadership in Supporting Quality Audits

For quality audits in Muscat to yield meaningful outcomes, SME leaders and finance managers must champion the process by fostering a culture of openness and accountability. Leadership involvement ensures that audit findings are taken seriously and translated into tangible improvements rather than being sidelined. In Oman’s business context, where personal relationships and trust play a significant role, leaders’ commitment to audit processes signals to stakeholders, including investors and regulators, that the company prioritizes integrity. This approach also encourages employees at all levels to embrace audit procedures as part of their daily work rather than as an annual hurdle. Ultimately, leadership’s proactive stance strengthens the entire audit cycle, making quality audits a cornerstone of operational excellence.

Integrating Quality Audits with Oman’s Regulatory Framework

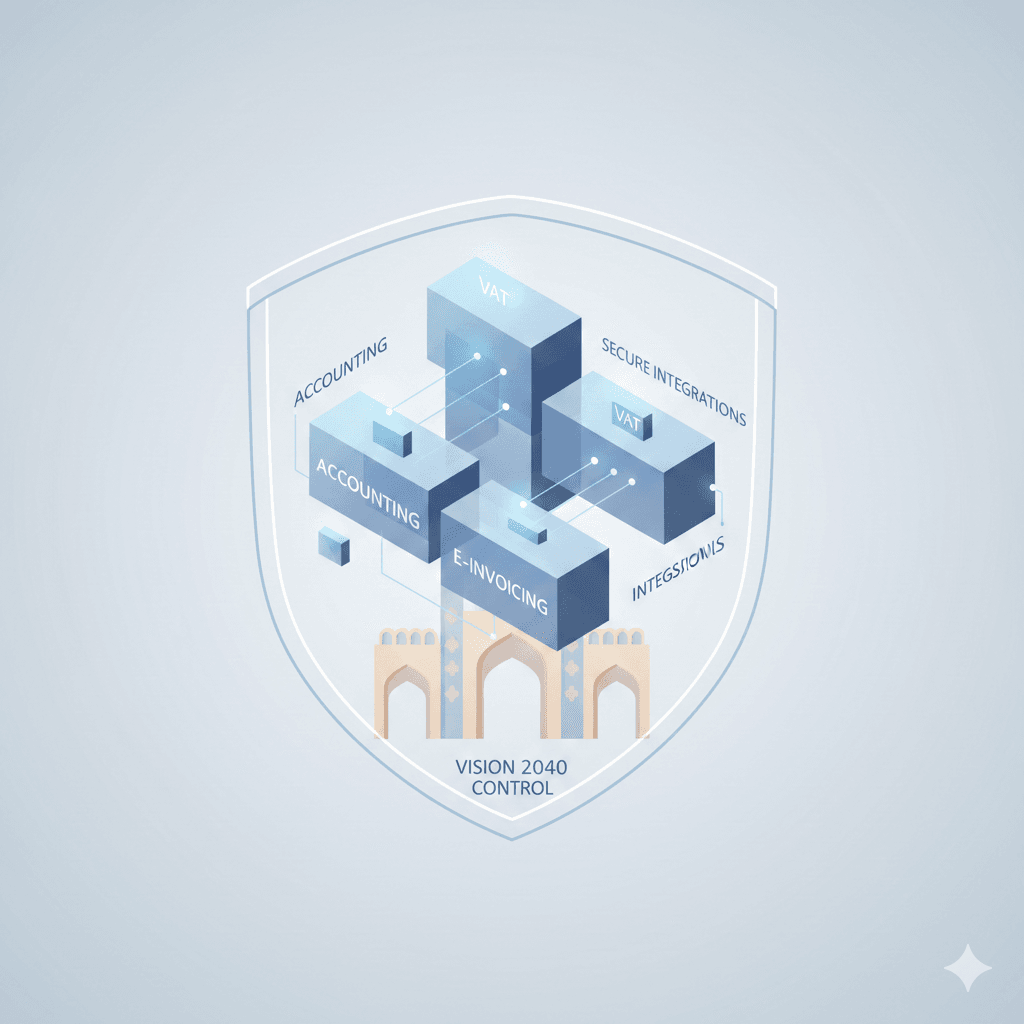

Quality audits in Muscat must align with Oman’s specific regulatory environment, which includes compliance with VAT laws, emerging corporate tax requirements, and financial reporting standards. SMEs face unique challenges adapting to these frameworks while maintaining smooth operations. A quality audit helps identify gaps in tax compliance or internal financial controls early, reducing the risk of costly penalties. Moreover, auditors versed in Oman’s regulations can provide valuable advisory support on VAT and corporate tax, ensuring businesses stay ahead of legal requirements. This integration not only safeguards the company’s legal standing but also reinforces operational transparency that benefits long-term partnerships and business reputation.

Technology and Tools Enhancing Audit Quality in Muscat

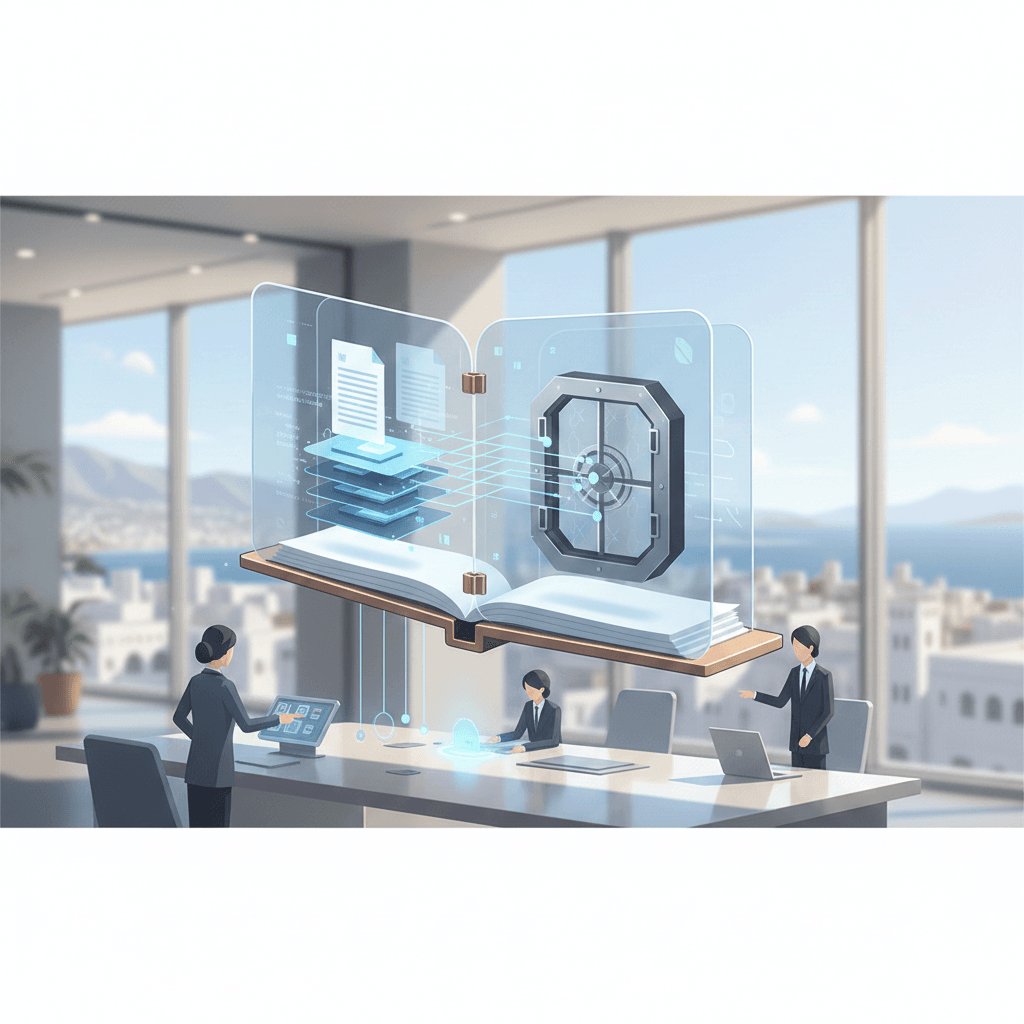

In Muscat’s dynamic SME sector, leveraging modern audit technologies is becoming a defining factor of quality audits. Digital tools that automate data collection, perform analytics, and support real-time risk assessment allow auditors to uncover issues that manual processes might miss. For SMEs, this means faster audits with more precise results and less disruption to daily operations. Incorporating software solutions also aligns with Leaderly’s advisory approach, which emphasizes feasibility and efficiency. In addition, technology enhances documentation quality and audit trail reliability, making it easier for Muscat SMEs to demonstrate compliance during regulatory reviews or investment due diligence. Thus, embracing these tools is a strategic step towards audit excellence and operational improvement.

Practical Benefits of Quality Audits for Muscat SMEs

Beyond compliance, quality audits in Muscat deliver practical value that impacts an SME’s bottom line and strategic decisions. Effective audits reveal operational inefficiencies, financial misstatements, or potential fraud risks that, if left unchecked, can erode profitability. By addressing these early, SMEs improve cash flow management, inventory control, and expense tracking. Additionally, quality audits enhance credibility with banks and investors by providing verified financial data, which can be critical for securing financing or expanding business. The insights gained from audits also inform leadership decisions around growth, pricing, and risk management, positioning SMEs to capitalize on market opportunities with confidence.

In conclusion, quality audits in Muscat represent far more than a compliance exercise; they are a vital tool for SMEs seeking operational excellence and sustainable success. By understanding their purpose, embracing thorough audit practices, and integrating these efforts with Oman’s regulatory demands, business leaders can unlock significant value. The proactive involvement of leadership and the adoption of modern technologies further amplify these benefits, transforming audits into strategic assets rather than annual chores.

For SMEs operating in Muscat, investing in quality audits is a step toward greater transparency, efficiency, and growth readiness. When audits are conducted with professionalism, clarity, and practical insight, they build stronger foundations for business resilience. This holistic approach aligns seamlessly with the services offered by firms like Leaderly, which combine audit rigor with advisory expertise tailored to Oman’s unique business landscape. Ultimately, quality audits empower Muscat SMEs to confidently navigate challenges and seize future opportunities, ensuring long-term success in a competitive marketplace.

#Leaderly #QualityAuditsInMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit