Muscat Finance Transformation Compliance as the Strategic Engine of Omani Business Evolution

Context Setting: Why Muscat Finance Transformation Compliance Now Defines Competitiveness

Muscat Finance Transformation Compliance has moved from being a back-office concern to becoming a defining factor of competitiveness for Omani enterprises. Under Oman Vision 2040, the Sultanate’s economic model is shifting from administrative regulation to performance-driven governance, placing unprecedented responsibility on finance teams. For SMEs and growing businesses in Muscat, compliance is no longer about avoiding penalties; it has become the architecture that supports sustainable growth, investor confidence, and operational resilience. Regulatory frameworks around VAT, corporate tax, digital reporting, governance controls, and financial transparency now operate as interconnected systems rather than isolated requirements. When finance leaders align these elements into a unified compliance strategy, the organization gains clarity over cash flow, forecasting, risk exposure, and long-term capital planning. This transformation is particularly visible in Muscat, where regulatory enforcement, investor scrutiny, and international partnerships converge. Finance teams that still view compliance as paperwork are falling behind competitors who treat regulatory discipline as a strategic asset. Vision 2040 has essentially rewritten the role description of finance departments, elevating them from record keepers to architects of enterprise stability and growth.

Regulatory Evolution: How Vision 2040 Reframes Financial Accountability

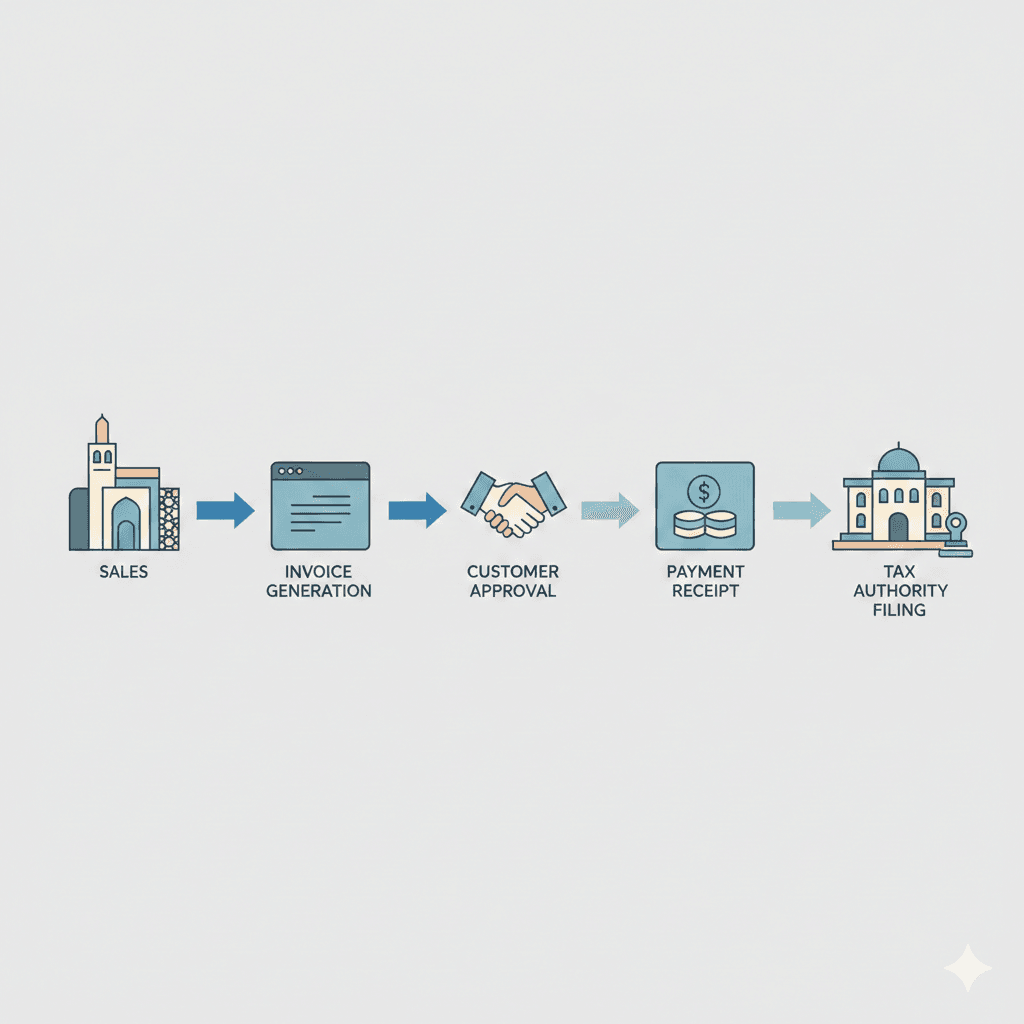

Under Vision 2040, the government has redesigned regulatory expectations to improve fiscal discipline, transparency, and economic diversification. Muscat Finance Transformation Compliance reflects this new regulatory landscape. Corporate tax frameworks, VAT administration, financial reporting obligations, and data governance rules are no longer fragmented. They operate together as a system of trust between the state, the market, and business leadership. For finance managers, this requires a shift in thinking from transactional compliance to continuous governance. Every procurement decision, payroll structure, investment plan, and financing agreement now interacts with tax exposure, audit readiness, and regulatory reporting. SMEs that adopt integrated compliance processes find it easier to scale, attract financing, and withstand regulatory scrutiny. Those that ignore the transformation struggle with delayed filings, audit complications, and unexpected tax liabilities. Vision 2040 has made it clear that regulatory adherence is inseparable from corporate performance, particularly in Muscat’s increasingly competitive business environment.

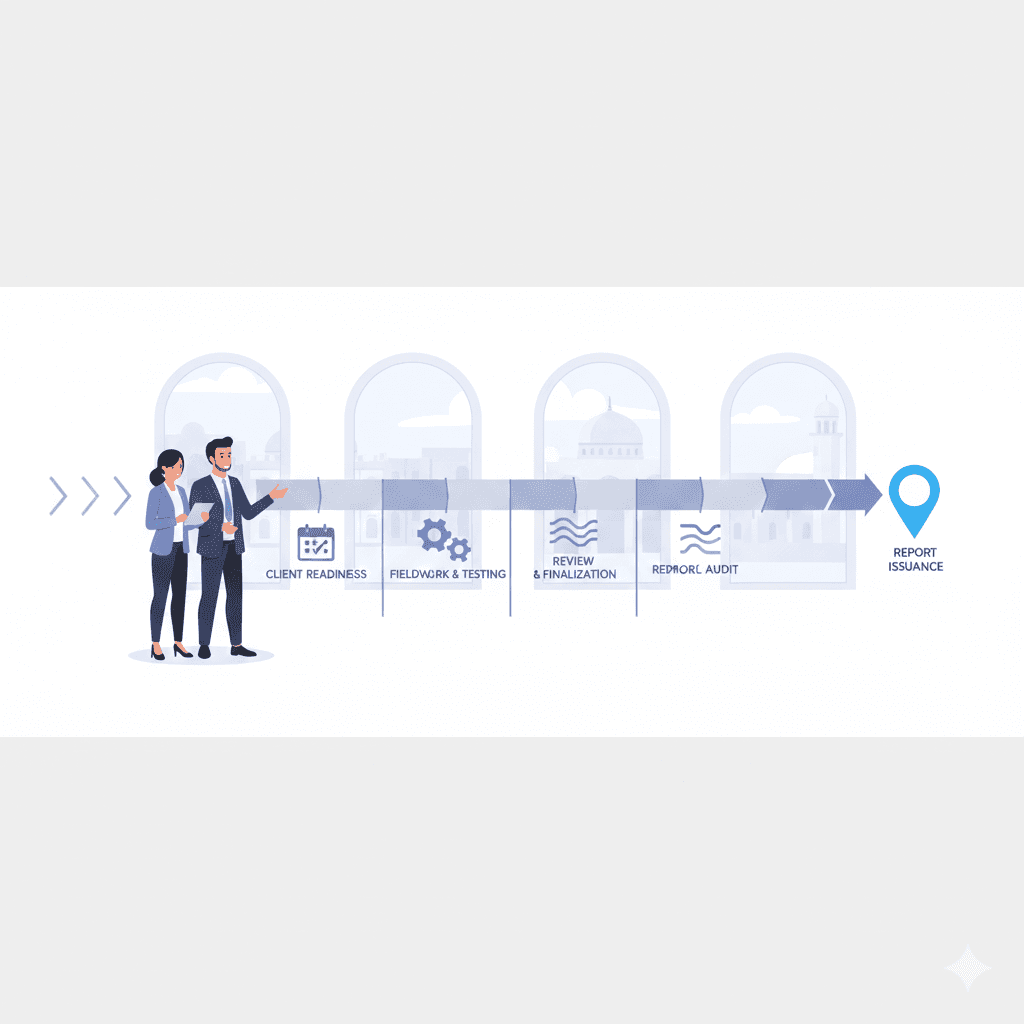

Operational Impact: Finance Teams as Transformation Leaders

The operational consequences of Muscat Finance Transformation Compliance are profound. Finance teams are now expected to lead organizational change by embedding regulatory intelligence into daily operations. This includes designing internal controls that support audit readiness, implementing accounting systems that produce accurate real-time data, and aligning tax planning with business strategy. SMEs often underestimate how much operational risk accumulates when compliance systems remain fragmented. Inconsistent documentation, unclear approval hierarchies, and weak internal controls create exposure that grows as the business expands. Vision 2040 encourages companies to build scalable governance structures early, allowing finance teams to guide leadership with reliable financial insight. The most effective finance leaders in Muscat are those who translate complex regulations into clear operational policies that managers across departments can follow. In doing so, they convert compliance from a burden into a management tool that improves decision quality and organizational stability.

Strategic Alignment: Connecting Compliance with Business Growth

Muscat Finance Transformation Compliance becomes truly powerful when aligned with business growth objectives. Under Vision 2040, government incentives, foreign investment initiatives, and capital market development all favor organizations that demonstrate financial transparency and regulatory maturity. Finance teams that integrate compliance planning with growth strategy position their companies for funding access, partnership opportunities, and regional expansion. This involves structuring financial models that reflect tax efficiency, designing capital structures that satisfy regulatory requirements, and preparing corporate documentation that withstands due diligence scrutiny. SMEs in Muscat often reach growth plateaus not because of market limitations but because their financial governance cannot support expansion. When compliance is built into strategic planning, businesses move with confidence, knowing that regulatory exposure is controlled. Advisory expertise, including feasibility analysis, valuation planning, and due diligence preparation, becomes essential at this stage, helping finance leaders translate regulatory complexity into strategic advantage.

Risk Management: Building Institutional Resilience Through Compliance

Risk management under Vision 2040 is no longer confined to insurance policies and contingency reserves. Muscat Finance Transformation Compliance now functions as the foundation of enterprise risk control. Tax miscalculations, weak audit trails, improper revenue recognition, and poor documentation can rapidly escalate into financial crises. SMEs in Muscat face heightened scrutiny from regulators, lenders, and partners who expect robust compliance frameworks. Finance teams must therefore design governance systems that detect and prevent risk before it materializes. This includes establishing internal audit processes, maintaining comprehensive financial documentation, and conducting regular compliance reviews. Businesses that invest early in structured financial governance find that they absorb economic shocks more effectively and recover faster from operational disruptions. The result is not just regulatory security but organizational resilience that supports long-term growth in an increasingly demanding commercial environment.

Human Capital: Developing the New Generation of Finance Leadership

The success of Muscat Finance Transformation Compliance ultimately depends on people. Vision 2040 has elevated the professional expectations placed on finance managers, controllers, and CFOs. Technical knowledge of accounting and taxation must now be matched with strategic insight, regulatory intelligence, and leadership skills. Finance professionals in Muscat are expected to communicate complex regulatory issues in practical language that guides executive decision-making. Training, professional development, and exposure to advisory disciplines such as valuation, liquidation planning, and corporate restructuring are becoming essential. SMEs that invest in developing their finance teams build institutional knowledge that cannot be easily replicated by competitors. Over time, this human capital advantage translates into better governance, stronger investor relationships, and higher enterprise value. The transformation of finance leadership is therefore not a secondary outcome of Vision 2040; it is one of its central objectives.

The journey of Muscat Finance Transformation Compliance reflects the deeper ambitions of Oman Vision 2040: building a diversified, resilient, and globally competitive economy. For SMEs and business leaders, this journey requires abandoning the outdated view of compliance as an administrative necessity and embracing it as a strategic discipline. When finance teams integrate regulatory governance with operational planning, risk management, and growth strategy, they create organizations capable of adapting to regulatory evolution without sacrificing momentum. The businesses that thrive in Muscat’s emerging economy will be those whose finance functions provide leadership, not merely support.

As regulatory complexity increases and market expectations rise, finance teams become the custodians of institutional trust. Their work determines whether a company attracts investors, secures financing, withstands audits, and navigates taxation with confidence. Vision 2040 offers Omani enterprises a clear roadmap, but it is through disciplined financial governance that this vision becomes operational reality. SMEs that commit to continuous improvement in compliance and financial leadership position themselves not just to survive change, but to shape the future of Omani business.

#Leaderly #MuscatFinanceTransformationCompliance #Oman #Muscat #SMEs #Accounting #Tax #Audit