Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Muscat Payroll WPS Compliance for SMEs M…

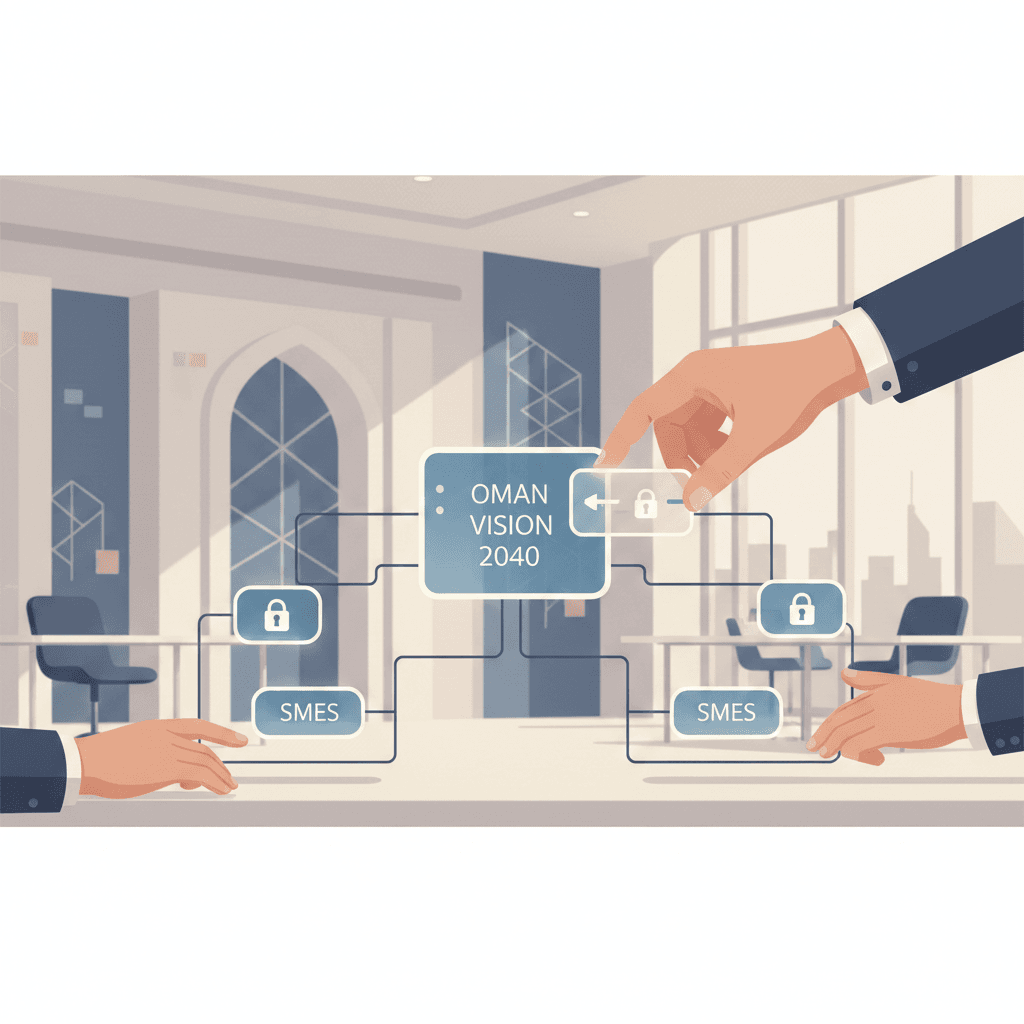

Muscat Payroll WPS Compliance for SMEs M… Oman Vision 2040 12-Month Plan: The Road…

Oman Vision 2040 12-Month Plan: The Road… Darsait Payment Controls for Retail and …

Darsait Payment Controls for Retail and … Subscription Businesses in Muscat Financ…

Subscription Businesses in Muscat Financ… Vendor Negotiation in Muscat: Using Cost…

Vendor Negotiation in Muscat: Using Cost… Oman Vision 2040 Data Protection Complia…

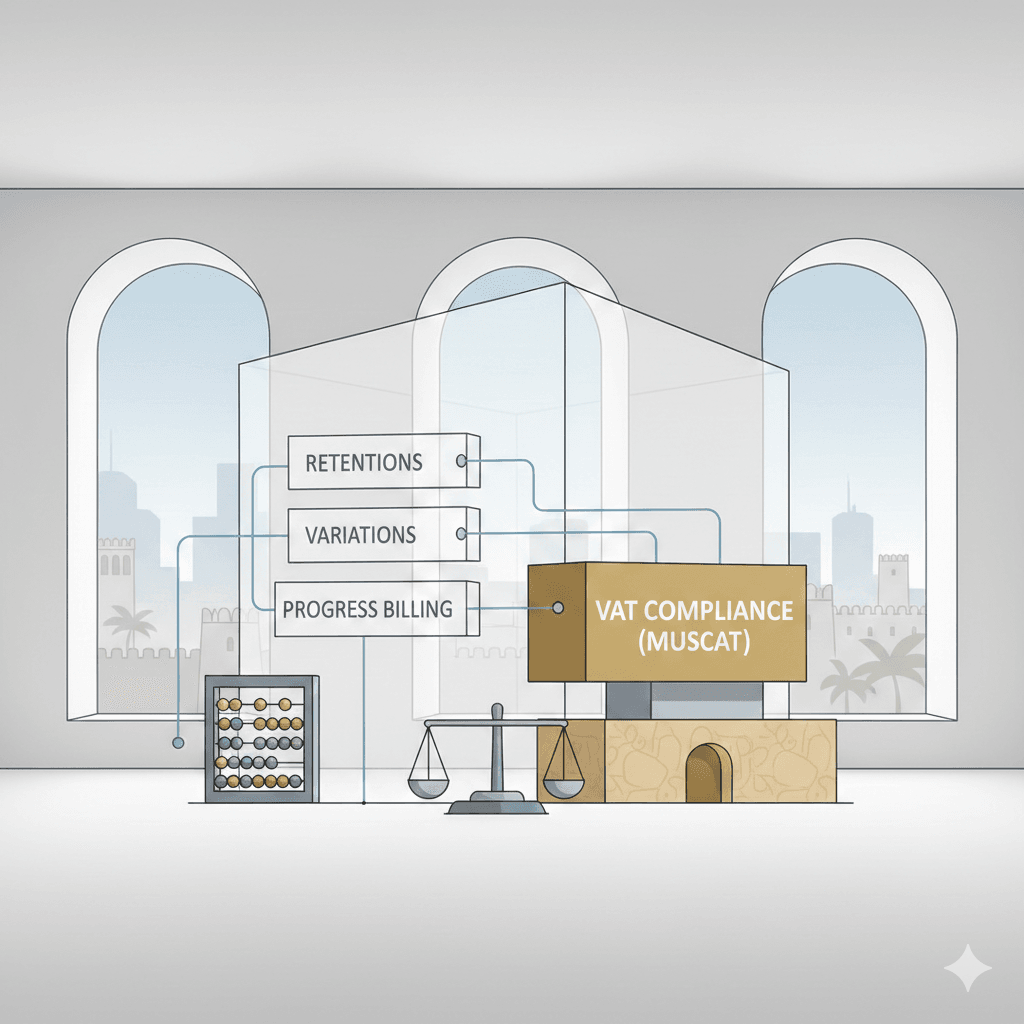

Oman Vision 2040 Data Protection Complia… VAT in Construction Muscat: Retentions, …

VAT in Construction Muscat: Retentions, … Muscat Secure File Exchange Compliance i…

Muscat Secure File Exchange Compliance i… Oman Vision 2040 Digital Transformation:…

Oman Vision 2040 Digital Transformation:… Madinat Al Sultan Qaboos Bookkeeping Sys…

Madinat Al Sultan Qaboos Bookkeeping Sys… How to Build a Clean Audit Trail in Musc…

How to Build a Clean Audit Trail in Musc… VAT on Real Estate in Muscat: Key Treatm…

VAT on Real Estate in Muscat: Key Treatm… Growth Planning in Muscat Finance Checkl…

Growth Planning in Muscat Finance Checkl… Management Accounts in Muscat How to Rea…

Management Accounts in Muscat How to Rea… VAT Fines in Oman: How Muscat Businesses…

VAT Fines in Oman: How Muscat Businesses… Feasibility Studies in Muscat: What a Ba…

Feasibility Studies in Muscat: What a Ba… Finance Tech Stack for Muscat SMEs: Tool…

Finance Tech Stack for Muscat SMEs: Tool… Oman Vision 2040 Digital Trust: Building…

Oman Vision 2040 Digital Trust: Building… Muscat SME Identity Access Governance: T…

Muscat SME Identity Access Governance: T… Digital Transformation in Oman: How Visi…

Digital Transformation in Oman: How Visi…