Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Darsait Traders VAT Documentation Ensuri…

Darsait Traders VAT Documentation Ensuri… Muscat Secure Finance HR Workflows

Muscat Secure Finance HR Workflows VAT in Healthcare Muscat: Common Scenari…

VAT in Healthcare Muscat: Common Scenari… Budgeting in Muscat: A Simple System for…

Budgeting in Muscat: A Simple System for… Mutrah Traders’ Guide: VAT Records and C…

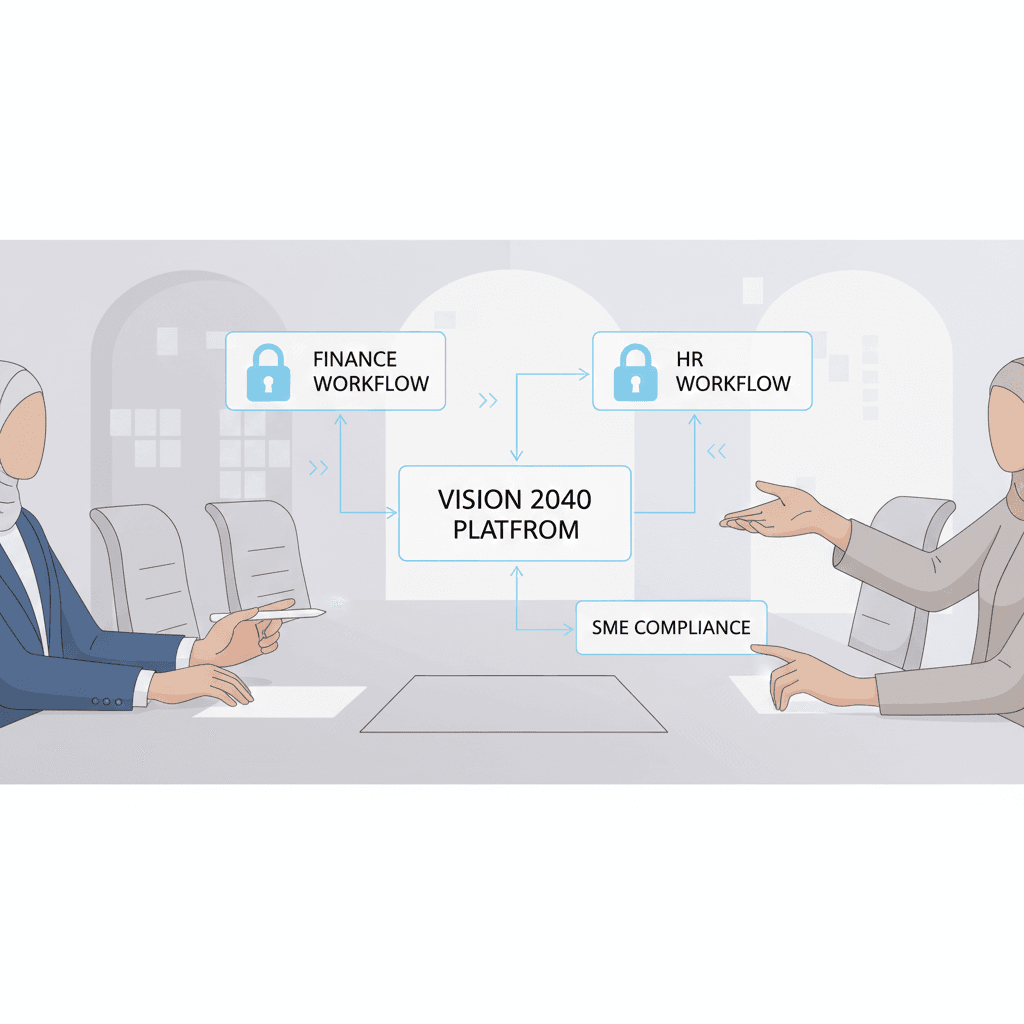

Mutrah Traders’ Guide: VAT Records and C… Vision 2040 Digital Transformation Risk …

Vision 2040 Digital Transformation Risk … Muscat Cyber Governance Framework Turnin…

Muscat Cyber Governance Framework Turnin… Management Accounts in Muscat How to Rea…

Management Accounts in Muscat How to Rea… Muscat Business Owners Cashflow Statemen…

Muscat Business Owners Cashflow Statemen… Oman Vision 2040 Email Security Why Busi…

Oman Vision 2040 Email Security Why Busi… Fraud Red Flags in Muscat: Finance Signa…

Fraud Red Flags in Muscat: Finance Signa… Oman Vision 2040 Cloud Migration Navigat…

Oman Vision 2040 Cloud Migration Navigat… Feasibility Study for a New Shop in Ruwi…

Feasibility Study for a New Shop in Ruwi… Oman Vision 2040 Data Governance Essenti…

Oman Vision 2040 Data Governance Essenti… Al Wuttayah Internal Controls: Strengthe…

Al Wuttayah Internal Controls: Strengthe… Muscat KPI Dashboard Strategy for Sales,…

Muscat KPI Dashboard Strategy for Sales,… Virtual Audits in Oman: How Muscat Firms…

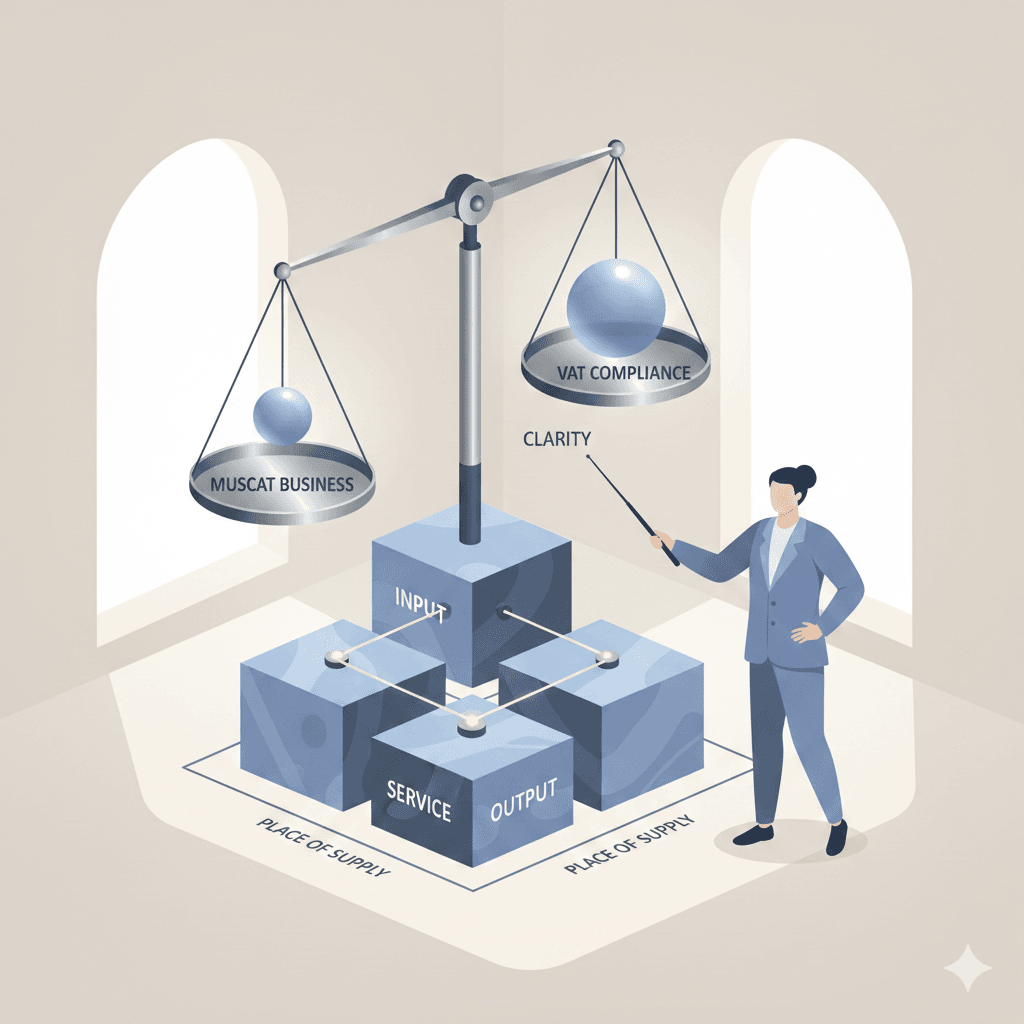

Virtual Audits in Oman: How Muscat Firms… VAT on Services in Oman: Place of Supply…

VAT on Services in Oman: Place of Supply… Cybersecurity in Oman The Vision 2040 Ri…

Cybersecurity in Oman The Vision 2040 Ri… Vision 2040 in Oman The Digital Transfor…

Vision 2040 in Oman The Digital Transfor…