Oman Vision 2040 Secure Digital Payments: The Future of Commerce in Muscat

The Growing Importance of Secure Digital Payments in Oman

Understanding the Shift in Payment Trends

The Oman Vision 2040 secure digital payments initiative marks a pivotal moment for the Sultanate’s commerce ecosystem. As Oman accelerates its economic diversification goals, secure and efficient digital payment systems have become indispensable for business owners and SMEs striving to remain competitive. The traditional cash-based economy is gradually being supplanted by digital transactions, driven by government policies encouraging fintech innovation and cashless payments. This transformation is particularly significant for SMEs and entrepreneurs in Muscat, who stand to benefit from faster, more secure, and transparent payment mechanisms. Embracing secure digital payments reduces the risks associated with cash handling, minimizes fraud, and enhances customer trust—key factors that underpin sustainable business growth within Oman’s rapidly evolving market.

Aligning Secure Payments with Oman Vision 2040’s Economic Goals

Enhancing Financial Inclusion and Efficiency

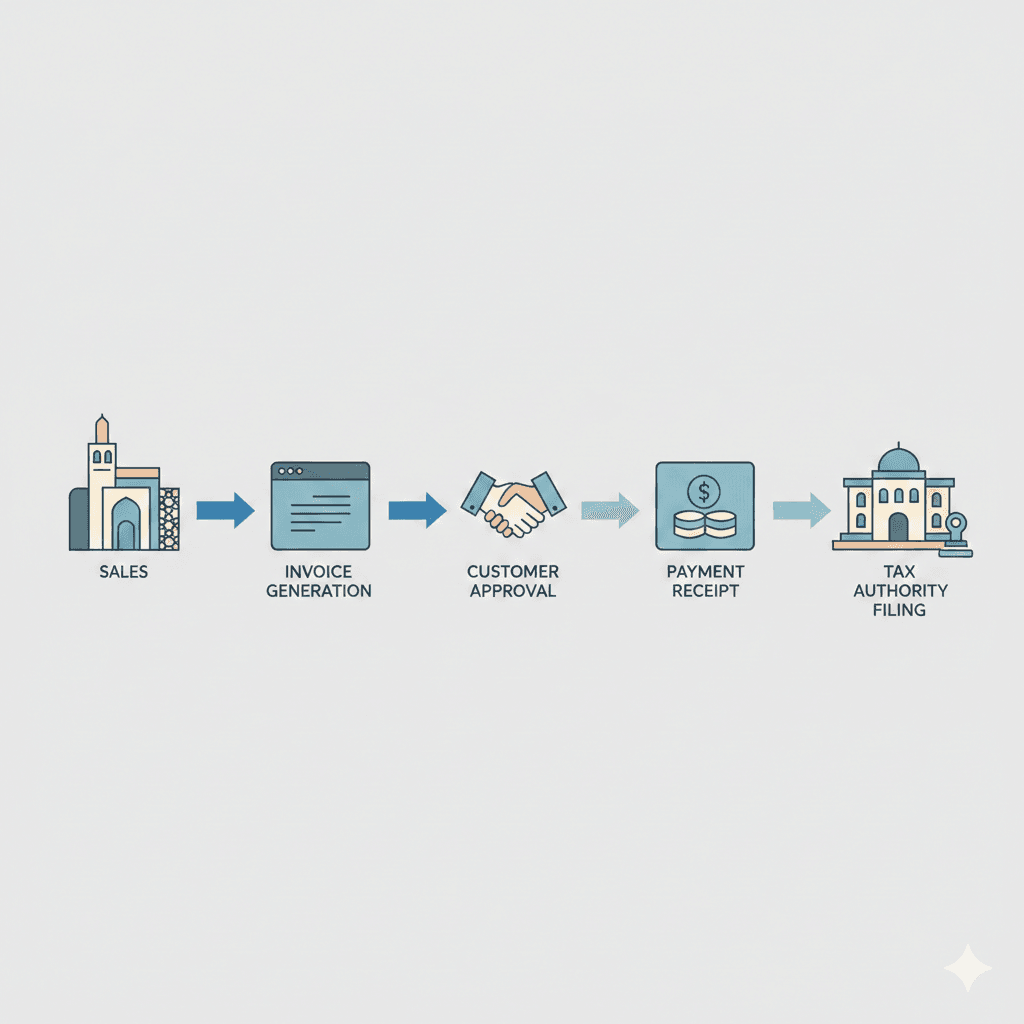

Oman Vision 2040 prioritizes financial inclusion, aiming to bring a larger segment of the population into the formal financial system. Secure digital payments play a crucial role in this by providing SMEs and individuals with accessible tools to engage in commerce without physical bank visits. This access supports broader economic participation and stimulates domestic spending, both essential to the vision’s target of a diversified and sustainable economy. Moreover, secure digital payment infrastructure contributes to increased efficiency in tax collection and regulatory compliance, supporting transparency initiatives spearheaded by Oman’s tax authorities. For business owners and finance managers, integrating these payment systems helps simplify VAT and corporate tax processes, aligning operations with local governance frameworks while minimizing administrative burdens.

Practical Steps for SMEs to Adopt Secure Digital Payments

Overcoming Barriers and Leveraging Technology

For SMEs in Oman, adopting secure digital payments can initially appear daunting due to concerns around technology costs and cybersecurity risks. However, the Vision 2040 framework provides guidance and incentives that ease this transition. Practical steps include partnering with regulated payment service providers that comply with Oman’s cybersecurity standards and the Central Bank of Oman’s directives. SMEs should also focus on educating their staff and customers on the benefits and safe use of digital payment platforms. From an advisory perspective, it is vital to conduct feasibility studies and due diligence to select solutions that integrate seamlessly with existing accounting and tax systems. This ensures that SMEs not only safeguard financial transactions but also optimize cash flow management, compliance, and audit readiness, aligning their growth trajectory with Oman’s broader economic transformation.

Digital Payments as a Catalyst for Business Innovation

Driving New Business Models and Customer Engagement

The shift towards secure digital payments under Oman Vision 2040 is fostering innovation across Muscat’s SME landscape. Digital transactions enable businesses to explore new models such as subscription services, instant payments, and integrated loyalty programs that were previously difficult to implement with cash-only systems. Entrepreneurs and finance managers can harness real-time payment data to better understand customer behavior and tailor offerings accordingly. Moreover, streamlined payment processes reduce overhead costs, freeing resources to invest in product development and market expansion. This innovative approach not only enhances competitiveness but also supports the vision’s emphasis on building a knowledge-based economy driven by technology and entrepreneurship.

Compliance and Risk Management in Digital Payment Systems

Ensuring Security and Regulatory Alignment

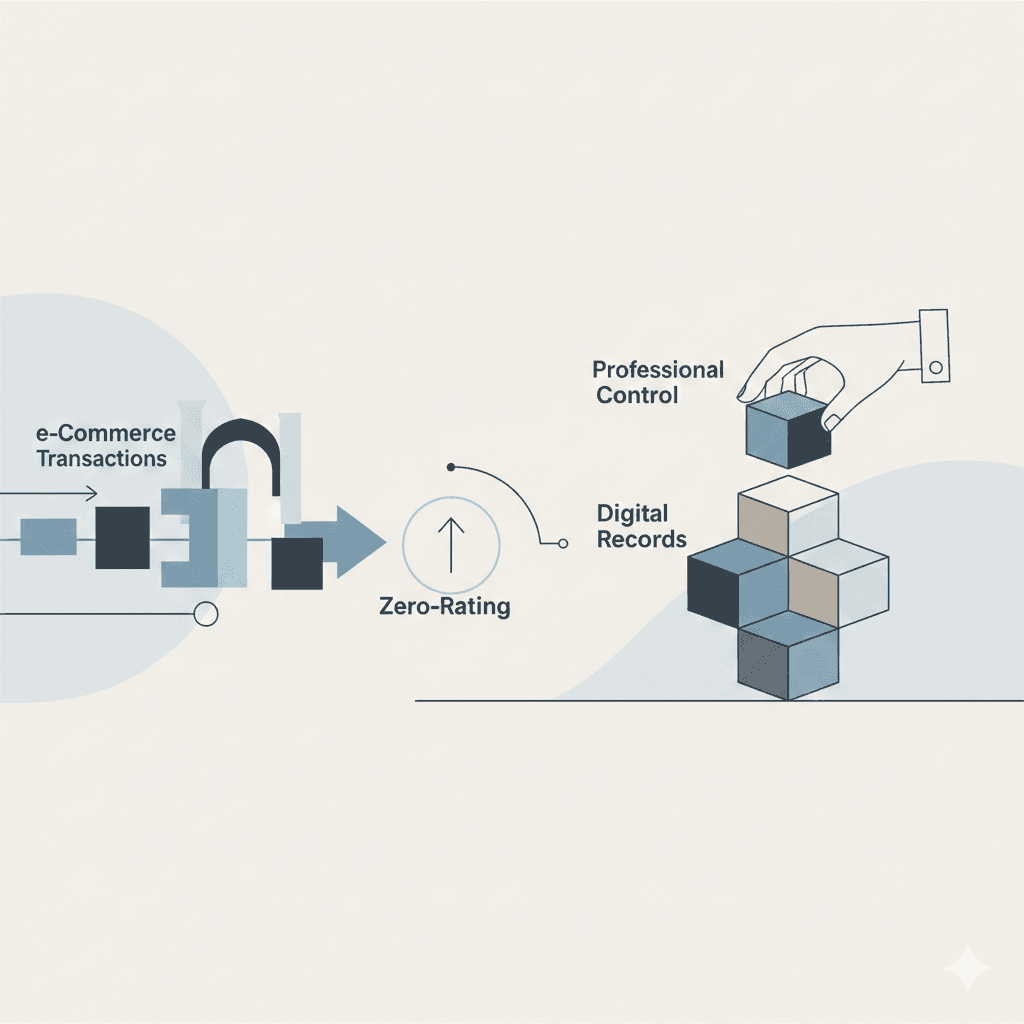

Implementing secure digital payment solutions in Oman requires a careful balance of innovation and compliance. The regulatory environment is evolving alongside Vision 2040, with stringent requirements around data privacy, anti-money laundering (AML), and cybersecurity protections. SMEs must ensure their payment platforms meet these standards to avoid legal risks and protect their reputation. Advisory services can assist with comprehensive risk assessments and help design internal controls tailored to each business’s operational scale. Aligning payment systems with Oman’s tax laws, including VAT and corporate tax obligations, ensures businesses remain audit-ready and benefit from smooth regulatory interactions. Proactive management of these risks supports not only operational security but also builds confidence among customers and partners, essential for long-term business sustainability.

The Role of Leaderly in Supporting Secure Digital Payments Adoption

Integrating Advisory and Compliance Services

Leaderly’s expertise in audit, taxation, and advisory services positions it as a valuable partner for SMEs navigating the transition to secure digital payments. By providing feasibility studies, due diligence, and valuation services, Leaderly helps businesses identify the most suitable digital payment solutions aligned with Oman Vision 2040. Leaderly’s accounting and audit services ensure accurate financial reporting and compliance with evolving tax regulations, including VAT and corporate tax frameworks integral to digital commerce. Furthermore, ongoing advisory support assists SMEs in managing risks associated with cybersecurity and regulatory compliance, turning the adoption of secure digital payments into a strategic advantage. This partnership approach empowers Oman’s SMEs to thrive in a digital economy while contributing to the nation’s broader economic ambitions.

Oman Vision 2040 secure digital payments represent more than a technological upgrade—they are a foundational element for the Sultanate’s future commerce landscape. By prioritizing secure, efficient, and inclusive payment systems, Oman is setting a course that empowers SMEs and entrepreneurs to innovate, grow, and compete on a global scale. The practical adoption of these payment technologies, supported by trusted advisory and compliance services, ensures that businesses can navigate risks and capitalize on new opportunities with confidence.

For business owners and finance managers in Muscat and beyond, embracing secure digital payments is both a necessity and a strategic move. It aligns with Oman’s vision for economic diversification and financial inclusion while delivering tangible benefits such as improved cash flow management, compliance ease, and customer trust. As Oman continues to develop its digital economy, SMEs positioned to leverage secure digital payment systems will play a critical role in driving the nation’s sustained growth and prosperity.

#Leaderly #OmanVision2040SecureDigitalPayments #Oman #Muscat #SMEs #Accounting #Tax #Audit