VAT Fines in Oman: Practical Strategies for Muscat SMEs to Minimise Compliance Risk

Understanding VAT Fines in Oman

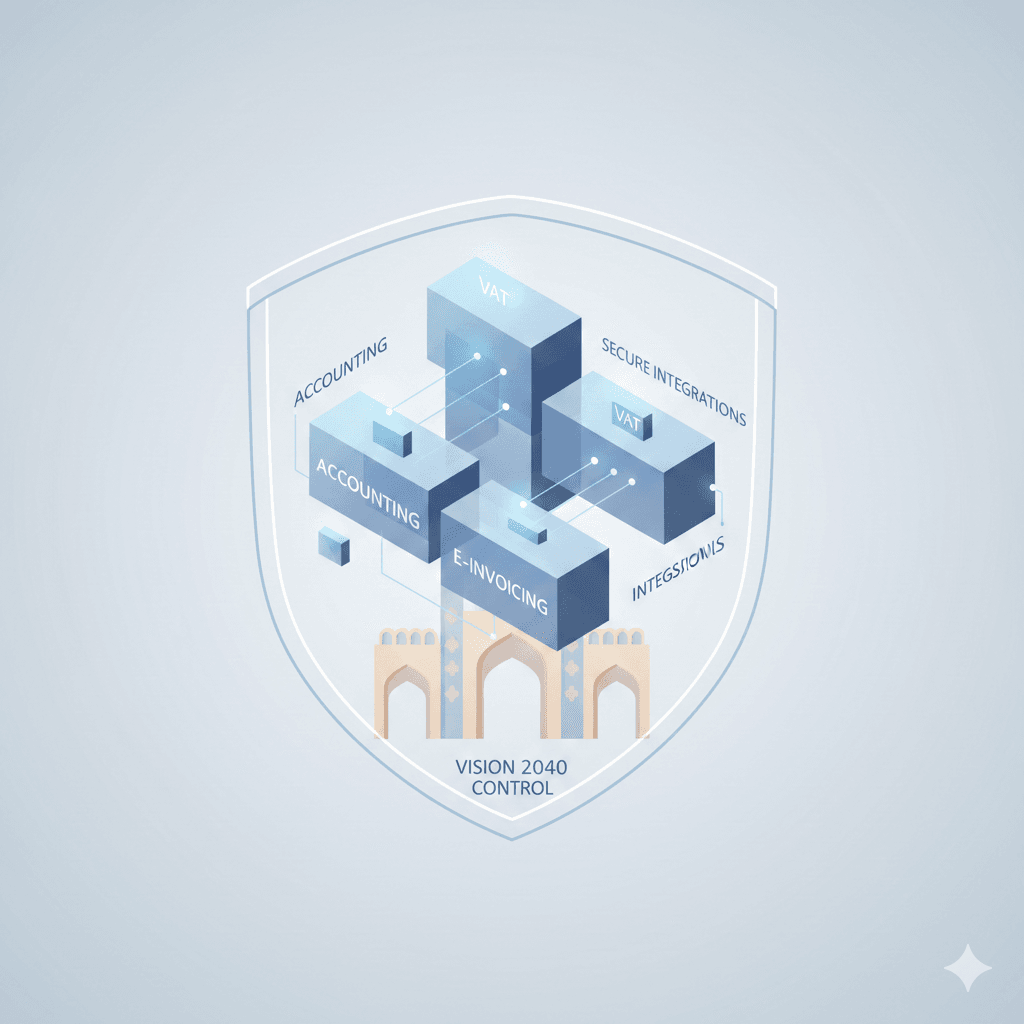

Value Added Tax (VAT) fines in Oman represent a significant risk for businesses operating in Muscat, especially for SMEs and entrepreneurs unfamiliar with the evolving tax landscape. Since Oman introduced VAT in April 2021, compliance has become essential for companies to avoid costly penalties. These fines are typically imposed when businesses fail to meet their VAT obligations, such as late filing, under-declaration, or non-registration. Understanding the specific triggers for VAT fines is crucial. The Oman Tax Authority has set clear regulations that outline the penalties for various infractions, and the amounts can vary depending on the nature and severity of the violation.

For SMEs in Muscat, the consequences of VAT fines go beyond the immediate financial impact. Non-compliance can damage reputations and disrupt cash flows, which are critical for small businesses. Moreover, VAT regulations require timely and accurate record-keeping, which can be challenging without dedicated finance resources. Businesses that underestimate the complexity of VAT compliance may face unexpected fines, making it vital for finance managers and entrepreneurs to invest in proper understanding and processes. By staying informed and proactive, Muscat companies can mitigate the risks associated with VAT fines and build a foundation for sustainable growth.

Leaderly’s advisory expertise in VAT compliance is designed to help Muscat SMEs navigate these challenges. Our team emphasizes a clear understanding of Oman’s VAT laws combined with tailored accounting practices to prevent fines. SMEs that engage in regular internal audits, accurate tax reporting, and proactive advisory services tend to experience fewer compliance issues. This not only reduces the risk of fines but also supports better financial management and strategic planning within Oman’s competitive market environment.

Common Causes of VAT Fines Among Muscat SMEs

Identifying common causes of VAT fines is the first step toward minimizing compliance risk. For many Muscat SMEs, errors often arise from late VAT returns submission or failure to file altogether. The Oman Tax Authority requires strict adherence to deadlines, and missing these can lead to automatic penalties. Another frequent cause is the incorrect calculation of VAT due, where businesses might understate their tax liabilities due to insufficient knowledge or poor accounting systems. This miscalculation can trigger audits and further fines.

Non-registration is a critical issue, particularly for smaller enterprises just reaching the VAT registration threshold. SMEs unaware of the obligation to register can incur substantial fines, as the Oman Tax Authority mandates registration once turnover exceeds a specific amount. Additionally, insufficient documentation, such as missing invoices or incomplete financial records, can lead to penalties during tax audits. Many businesses in Muscat face challenges maintaining compliant records due to resource constraints or lack of standardized processes.

Another contributing factor to VAT fines is the failure to adjust for VAT on exempt or zero-rated supplies correctly. Misclassification of supplies can confuse VAT reporting and expose businesses to risks. To address these issues, Muscat SMEs benefit from practical guidance on VAT rules and regular advisory check-ins, ensuring their accounting systems are aligned with Oman’s VAT framework. Leaderly’s integrated approach combines accounting accuracy with regulatory compliance, providing SMEs with the tools to avoid common pitfalls and maintain clean financial records.

Proactive Compliance: Best Practices for Muscat Businesses

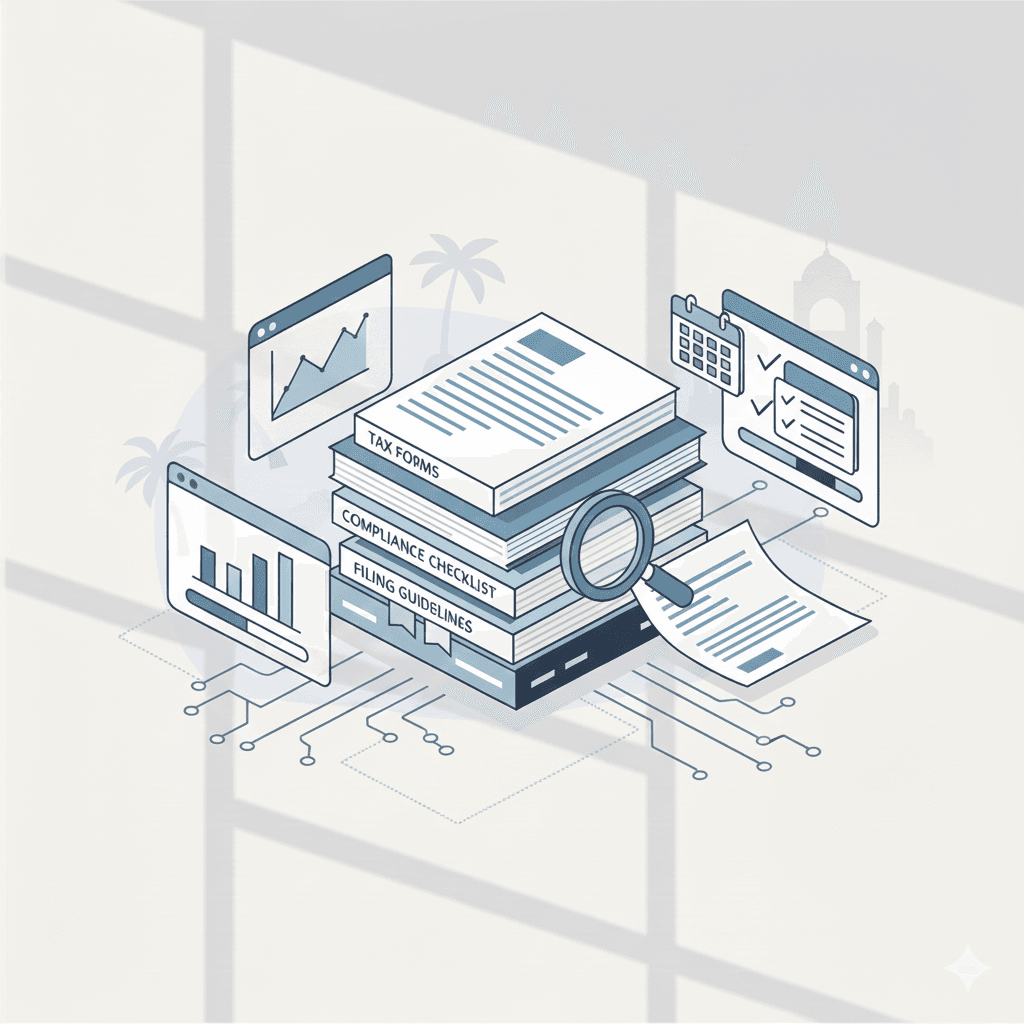

To reduce the risk of VAT fines, Muscat businesses must adopt proactive compliance strategies that embed VAT responsibilities into their daily operations. One fundamental best practice is to establish a reliable VAT filing calendar, ensuring all tax returns are prepared and submitted before deadlines. This requires assigning clear roles within the finance team and leveraging technology to automate reminders and reporting where possible. A consistent VAT calendar helps prevent costly late submission penalties and strengthens internal accountability.

Equally important is maintaining detailed, accurate records of all transactions subject to VAT. This includes proper invoice management and categorization of sales and purchases according to VAT rules. Muscat SMEs should regularly reconcile their VAT records with accounting entries to identify discrepancies early. By conducting internal reviews or audits periodically, businesses can detect and correct errors before they escalate into penalties. Leaderly encourages clients to use this practice as part of a wider risk management framework, which includes training staff on VAT regulations and keeping updated with any legal changes in Oman’s tax environment.

Finally, Muscat businesses should seek advisory support to navigate the complexities of VAT compliance effectively. Expert advice can help SMEs interpret legislation correctly, apply VAT exemptions appropriately, and manage complex transactions such as imports and exports. Regular consultations with tax advisors also ensure companies remain prepared for any tax audits and can respond promptly to inquiries from the Oman Tax Authority. Leaderly’s advisory services focus on building compliance resilience, giving SMEs the confidence to focus on business growth while minimizing VAT-related risks.

Leveraging Technology to Minimize VAT Fines in Muscat

Technology plays a critical role in helping Muscat SMEs reduce VAT compliance risks. Modern accounting software tailored for Oman’s VAT system can automate VAT calculations, generate compliant invoices, and streamline filing processes. Using such tools reduces manual errors that often lead to fines. Digital record-keeping also facilitates easy retrieval of transaction data during audits, demonstrating transparency to tax authorities and enhancing compliance credibility.

In addition, integrated software solutions can track VAT due dates and flag any potential late submissions well in advance, helping finance teams prioritize their VAT responsibilities. For smaller SMEs with limited finance capacity, cloud-based systems provide accessible, scalable solutions that keep VAT compliance manageable and cost-effective. These platforms often include regular updates to align with changing VAT regulations in Oman, ensuring that businesses do not lag behind regulatory developments.

Leaderly supports Muscat businesses in selecting and implementing appropriate technology tools that fit their size and industry. Beyond software, we emphasize the importance of training teams to maximize these tools’ benefits. By combining technology with sound advisory and accounting practices, SMEs can significantly reduce the chance of VAT fines. This approach empowers business owners and finance managers to focus on operational priorities, knowing their VAT obligations are handled efficiently and accurately.

How Expert Advisory Can Reduce VAT Compliance Risk

Expert advisory is invaluable for Muscat SMEs seeking to minimize VAT fines. Navigating Oman’s VAT laws without specialist knowledge can be daunting, especially for businesses with complex operations or rapid growth. Advisors bring deep insight into the nuances of VAT compliance, from understanding exemptions and zero-rating to managing cross-border transactions. Their guidance helps SMEs anticipate potential issues before they become compliance failures.

Advisory services from firms like Leaderly include tailored feasibility studies and due diligence assessments that evaluate a business’s VAT risk exposure. These analyses allow SMEs to address gaps in their accounting or reporting systems early. When fines do occur, expert advisors can assist in negotiations or appeals with the Oman Tax Authority, ensuring the business’s interests are represented effectively. For SMEs focused on sustainable growth in Muscat, this strategic support is essential.

Moreover, continuous advisory engagement ensures SMEs remain updated on any regulatory changes, such as adjustments in VAT rates or filing procedures. This ongoing relationship helps avoid surprises and ensures that VAT compliance is integrated into the company’s strategic planning. By partnering with experienced advisors, Muscat businesses can confidently manage their VAT obligations and reduce the risk of costly fines, supporting long-term financial health and regulatory alignment.

Building a Compliance Culture to Avoid VAT Penalties

Beyond processes and technology, cultivating a culture of compliance within Muscat SMEs is fundamental to minimizing VAT fines. This means embedding VAT awareness into the company’s values, training employees on their roles in tax compliance, and promoting transparency in financial dealings. When everyone understands the importance of VAT rules and their personal accountability, the likelihood of errors and oversights diminishes significantly.

Leadership plays a crucial role in establishing this culture. Business owners and finance managers must prioritize compliance by allocating resources to VAT training and ensuring that policies are clearly communicated. Encouraging open communication between departments reduces misunderstandings about VAT-related procedures, such as invoice issuance or expense reporting. In turn, this reduces risks associated with inconsistent practices or undocumented transactions.

Leaderly advocates for compliance as a continuous journey rather than a one-time effort. By fostering a compliance culture, Muscat SMEs not only protect themselves from VAT fines but also enhance their credibility with stakeholders, including customers, suppliers, and regulators. This cultural commitment to responsible financial management supports sustainable growth and reinforces a positive reputation in Oman’s business community.

VAT fines in Oman are a serious concern for Muscat’s SMEs, but they are manageable with the right knowledge, tools, and mindset. Businesses that understand the causes of fines, implement best practices, leverage technology, seek expert advice, and build a strong compliance culture position themselves for success and financial stability in Oman’s evolving tax environment.

Ultimately, reducing VAT compliance risk is not just about avoiding penalties; it is about enabling Muscat businesses to operate with confidence and focus on growth. Through diligent preparation and strategic advisory partnerships, SMEs can transform VAT compliance from a burden into a foundation for business resilience and opportunity.

#Leaderly #VAT Fines in Oman #Oman #Muscat #SMEs #Accounting #Tax #Audit