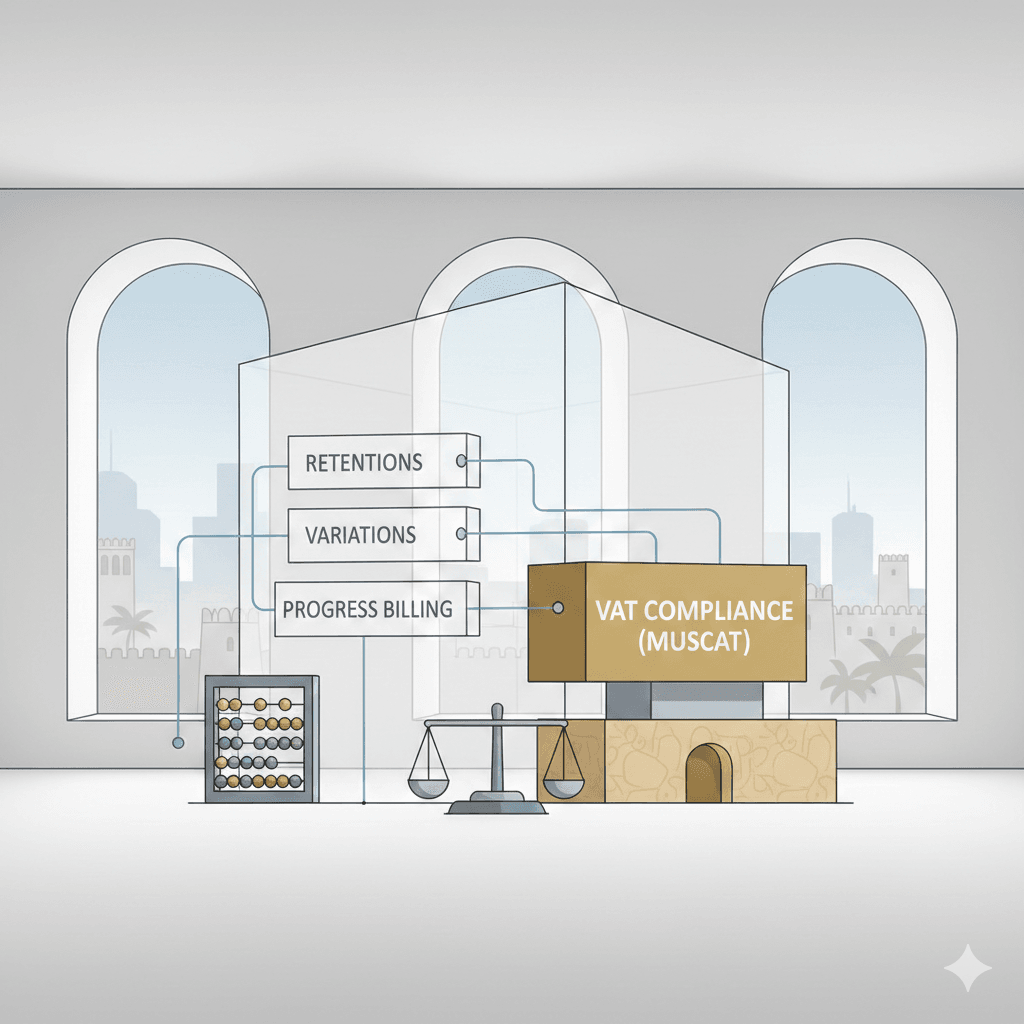

Ruwi VAT Compliance Framework: Practical VAT Guidance for Ruwi-Based Trading Businesses

Ruwi VAT Compliance Framework and the New Trading Reality

Why Ruwi’s commercial ecosystem demands structured VAT discipline

The Ruwi VAT Compliance Framework has become one of the most critical operational pillars for trading businesses operating in Muscat’s historic commercial heart. Ruwi is not only a trading hub but also a dense ecosystem of importers, distributors, and multi-channel merchants whose transaction volumes and cross-border exposure place them at higher regulatory risk than many other Omani districts. Since the introduction of VAT in Oman, many SMEs in Ruwi have struggled to move beyond basic return filing into real compliance management. The framework approach shifts VAT from a quarterly task into a continuously monitored financial process embedded within daily operations. Importers must track landed costs, customs declarations, input tax recovery, and valuation adjustments, while distributors face supply chain VAT timing differences, discount treatments, and multi-invoice structures. Without a structured Ruwi VAT Compliance Framework, these moving parts often drift into error long before management realizes the exposure. What distinguishes successful Ruwi firms is not sophisticated software alone, but disciplined internal procedures that connect purchasing, logistics, sales, finance, and reporting. This alignment allows VAT obligations to become predictable and controllable rather than reactive. For SMEs, especially family-owned trading houses common in Ruwi, this shift brings stability, reduces audit risk, and strengthens financial credibility with banks, suppliers, and regulators alike.

Ruwi VAT Compliance Framework and Import Transaction Control

Managing VAT from port clearance to warehouse booking

The Ruwi VAT Compliance Framework places particular emphasis on import documentation because import VAT errors remain the most expensive compliance failure for trading houses. When goods enter Oman, VAT is triggered at customs before the goods even reach the warehouse. Many SMEs treat this VAT as a temporary cash issue rather than a compliance obligation, leading to mismatches between customs declarations, supplier invoices, and internal accounting. Under a proper framework, every shipment begins with a reconciliation between the customs entry, commercial invoice, bill of lading, and the accounting purchase record. This ensures the VAT base value reflects freight, insurance, and incidental charges, not just supplier pricing. Importers in Ruwi frequently handle mixed consignments, duty exemptions, or special valuation scenarios, which makes manual handling risky. A disciplined framework assigns responsibility across procurement, logistics, and finance so that VAT recovery is secured on time and supporting documentation is preserved for audit. When this structure is in place, SMEs avoid the common cash flow strain of delayed VAT recovery and reduce the likelihood of assessments during tax inspections. Over time, the Ruwi VAT Compliance Framework becomes a commercial advantage, not merely a regulatory obligation.

Ruwi VAT Compliance Framework and Distributor Pricing Stability

How VAT discipline protects margins in competitive markets

Distributors in Ruwi operate in intensely competitive pricing environments where minor errors in VAT handling can erase entire profit margins. The Ruwi VAT Compliance Framework helps distributors stabilize pricing by ensuring VAT is consistently treated across credit notes, rebates, volume discounts, and promotional arrangements. Without this structure, businesses frequently under-collect VAT from customers or misapply zero-rated or exempt classifications, exposing themselves to retroactive tax liabilities. A mature framework establishes pre-approval procedures for commercial arrangements so that finance teams review VAT impact before commercial commitments are finalized. This proactive model prevents pricing decisions from being made in isolation from tax consequences. For example, bundled offers, long-term supply agreements, and consignment arrangements all carry unique VAT implications in Oman. By embedding VAT analysis into commercial planning, distributors in Ruwi can confidently expand market share without accumulating unseen regulatory risks. Over time, this alignment supports stronger relationships with key customers who benefit from transparent invoicing and fewer disputes. Ultimately, the Ruwi VAT Compliance Framework allows distributors to protect both their margins and their reputation in Muscat’s demanding trading landscape.

Ruwi VAT Compliance Framework and Trading House Risk Management

Building financial resilience through structured governance

For large and mid-sized trading houses in Ruwi, VAT risk is not merely about filing returns correctly but about governance and long-term resilience. The Ruwi VAT Compliance Framework integrates VAT into internal control systems, management reporting, and strategic decision-making. This means that senior management receives regular VAT exposure reports, exception summaries, and reconciliation dashboards rather than learning about issues during inspections. Trading houses typically manage complex networks of suppliers, agents, and overseas principals, each introducing VAT classification challenges around agency relationships, commission structures, and place-of-supply rules. A framework approach formalizes contract reviews so VAT consequences are identified before agreements are signed. When aligned with broader accounting, audit, and advisory processes, this structure ensures financial statements accurately reflect VAT positions and potential liabilities. For many Ruwi businesses seeking bank financing, expansion partners, or valuation assessments, this level of discipline significantly enhances credibility. It also simplifies due diligence processes when businesses consider mergers, acquisitions, or partial exits. In this way, the Ruwi VAT Compliance Framework evolves from a compliance tool into a strategic asset that supports sustainable growth.

Ruwi VAT Compliance Framework and SME Capability Building

Transforming staff from clerks into compliance custodians

A core strength of the Ruwi VAT Compliance Framework lies in its focus on people and processes rather than systems alone. Many SMEs in Ruwi rely heavily on a single accountant or external consultant, creating vulnerability when staff change or business volumes grow. A proper framework distributes VAT knowledge across procurement, sales, logistics, and finance, supported by clear documentation and standardized procedures. Training becomes an ongoing process, not a one-time event, enabling teams to understand why VAT controls matter rather than merely how to process invoices. This cultural shift reduces dependency on individual employees and creates institutional memory within the organization. When SMEs reach this stage of maturity, they experience fewer operational disruptions during regulatory updates, inspections, or leadership transitions. Over time, this capability building strengthens relationships with auditors, tax advisors, and financial institutions who see evidence of responsible management. In Muscat’s competitive SME environment, such internal strength often becomes a decisive factor in securing new contracts, partnerships, and financing opportunities. The Ruwi VAT Compliance Framework therefore supports not only technical compliance but organizational resilience.

Ruwi VAT Compliance Framework as a Growth Enabler

Aligning regulatory control with strategic expansion

When properly implemented, the Ruwi VAT Compliance Framework does more than prevent penalties; it actively enables growth. Businesses with predictable VAT cash flows can plan inventory cycles, expansion projects, and working capital needs with greater accuracy. Importers expand product lines with confidence, distributors enter new markets without fear of hidden tax exposure, and trading houses structure partnerships knowing that VAT implications are already managed. This stability allows management to focus on strategy rather than constant problem-solving. As SMEs mature, this framework integrates seamlessly with broader financial disciplines such as corporate tax planning, audit readiness, and advisory engagements related to feasibility studies, valuations, and even liquidation planning when necessary. The strongest Ruwi firms view VAT not as an isolated tax obligation but as part of an integrated financial architecture supporting long-term sustainability. In a regulatory environment that continues to evolve, such preparation is no longer optional. The Ruwi VAT Compliance Framework stands as a blueprint for SMEs seeking to professionalize operations, protect value, and compete effectively in Oman’s dynamic commercial economy.

For Ruwi-based importers, distributors, and trading houses, the journey toward strong VAT discipline begins with recognizing that compliance is a continuous process rather than a periodic obligation. The Ruwi VAT Compliance Framework brings structure, clarity, and accountability into daily operations, transforming VAT from a regulatory risk into a manageable financial component. By aligning people, processes, and reporting, SMEs gain control over cash flow, protect margins, and reduce exposure to costly disputes with regulators. This operational maturity strengthens trust with banks, partners, and authorities while positioning businesses for sustainable expansion within Oman’s evolving commercial landscape.

Ultimately, SMEs that embed the Ruwi VAT Compliance Framework into their core financial culture move beyond survival toward strategic leadership. They operate with confidence during audits, engage advisors from a position of strength, and make commercial decisions supported by reliable financial data. In a trading environment as competitive and complex as Ruwi, such discipline is not a luxury but a necessity for long-term success.

#Leaderly #RuwiVATComplianceFramework #Oman #Muscat #SMEs #Accounting #Tax #Audit