Oman Vision 2040 Secure Integrations: Ensuring Safety and Compliance in Banking and Payment Systems

The Importance of Secure Integrations in Oman’s Financial Landscape

Oman Vision 2040 Secure Integrations are pivotal for SMEs seeking to thrive in the Sultanate’s evolving economic environment. As digital transformation accelerates, the integration of business systems with banks and payment gateways becomes essential for efficient financial management. These integrations facilitate seamless payment processing, real-time financial reporting, and improved cash flow management, which are critical for SMEs navigating competitive markets. However, without robust security measures, these digital connections can expose businesses to cyber threats and regulatory non-compliance risks. Aligning with Oman Vision 2040’s emphasis on innovation and economic diversification, SMEs must prioritize secure integration strategies to safeguard sensitive financial data and ensure uninterrupted operations.

Regulatory Frameworks Guiding Secure Integrations in Oman

Under Oman Vision 2040, the government has strengthened the regulatory framework around digital financial services, emphasizing data protection and anti-fraud measures. Compliance with regulations such as the Central Bank of Oman’s cybersecurity guidelines and the Oman Data Protection Law is mandatory for SMEs integrating with financial institutions. These regulations require stringent controls over data transmission, authentication protocols, and system audits to minimize vulnerabilities. SMEs must work closely with their banking partners and payment gateway providers to understand and implement these regulatory requirements. Doing so not only protects businesses from legal penalties but also builds trust with customers and partners by demonstrating commitment to secure financial practices.

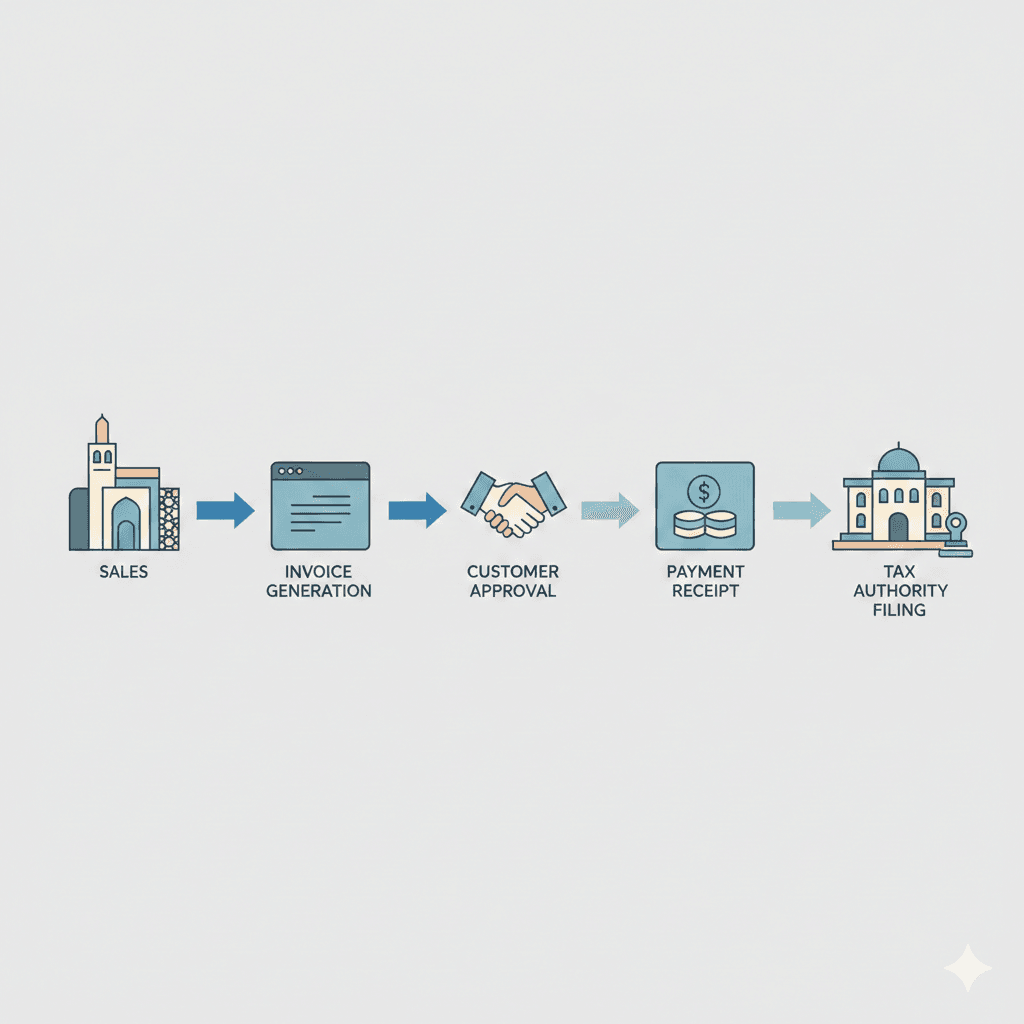

Technological Foundations for Secure Banking and Payment Integrations

Technological robustness is at the core of Oman Vision 2040 Secure Integrations. SMEs must leverage advanced security technologies such as end-to-end encryption, multi-factor authentication, and secure APIs to protect transactional data. Cloud-based solutions with strong compliance certifications offer scalability and resilience, enabling SMEs to adapt quickly to evolving cyber threats. Additionally, real-time monitoring and automated alerts can detect unusual activities early, reducing the risk of financial losses. By investing in these technologies, SMEs not only comply with Vision 2040’s digital goals but also create a competitive advantage through operational efficiency and enhanced customer experience.

Practical Steps for SMEs to Achieve Secure Integrations

To implement Oman Vision 2040 Secure Integrations effectively, SMEs should adopt a phased approach beginning with a comprehensive risk assessment. Identifying key integration points with banks and payment gateways helps prioritize security efforts and resource allocation. Collaborating with trusted technology partners ensures the deployment of solutions that meet both technical and regulatory standards. Regular staff training on cybersecurity best practices complements technological safeguards by fostering a culture of vigilance. Furthermore, SMEs should incorporate continuous auditing and compliance checks, ideally supported by advisory services like those offered by Leaderly, to maintain secure and compliant integration over time.

Challenges Facing SMEs in Secure Integration Efforts

While Oman Vision 2040 Secure Integrations present clear benefits, SMEs face several challenges in implementation. Limited technical expertise and budget constraints can impede adoption of advanced security solutions. Additionally, navigating complex regulatory requirements without dedicated compliance teams increases the risk of errors. Integration projects may also encounter compatibility issues between legacy systems and modern banking APIs. Overcoming these challenges requires strategic planning and external advisory support to align technical, operational, and compliance aspects. Leaderly’s advisory services are well positioned to assist SMEs in addressing these hurdles through tailored feasibility studies and due diligence, ensuring integration projects succeed without compromising security or compliance.

Future Outlook: Secure Integrations as a Pillar of Oman’s Economic Growth

Looking ahead, Oman Vision 2040 Secure Integrations will become increasingly integral to the country’s digital economy and SME ecosystem. As Oman advances toward a cashless society, the reliance on secure, efficient banking and payment connections will grow exponentially. SMEs that proactively secure their integrations will be better positioned to capitalize on emerging opportunities such as e-commerce expansion, fintech partnerships, and regional trade. This evolving landscape will also demand continuous innovation in security measures and regulatory adherence. Ultimately, embedding secure integration practices aligns with Oman Vision 2040’s broader goals of sustainable growth, enhanced transparency, and international competitiveness.

Conclusion

Oman Vision 2040 Secure Integrations are not merely a technical requirement but a strategic imperative for SMEs seeking longevity and success in Oman’s dynamic market. By understanding the regulatory landscape, investing in robust technologies, and adopting disciplined risk management practices, businesses can protect themselves against the growing threats of cyber risks while enhancing operational efficiency. This approach ensures that SMEs remain compliant with national standards and retain the trust of customers and partners.

For SMEs in Oman, securing integrations with banks and payment gateways is a clear pathway to achieving the digital transformation goals set out by Oman Vision 2040. The practical benefits of secure integration—reliable cash flow, enhanced data security, and streamlined operations—directly contribute to business resilience and growth. With the right guidance and support, including expert advisory services from firms like Leaderly, SMEs can confidently navigate the complexities of secure integrations and build a future-ready financial infrastructure.

#Leaderly #OmanVision2040SecureIntegrations #Oman #Muscat #SMEs #Accounting #Tax #Audit