Muscat SMEs finance outsourcing: Key indicators for transitioning from bookkeeping to comprehensive finance management

Understanding the evolving financial needs of Muscat SMEs

Muscat SMEs finance outsourcing often becomes necessary when managing finances starts with basic bookkeeping but quickly outgrows its capabilities. For many small and medium enterprises in Muscat, bookkeeping—covering daily transaction records, invoice tracking, and simple ledger maintenance—is adequate during the early stages of business. However, as these businesses expand, the increasing volume and complexity of financial operations reveal the limitations of relying solely on bookkeeping. It is essential for Muscat SMEs to identify when their financial management demands exceed bookkeeping and to transition toward full finance outsourcing. This shift is vital for maintaining accurate financial control, complying with Oman’s evolving tax regulations, and supporting strategic decision-making. Recognizing these needs early helps prevent costly mistakes and operational inefficiencies down the line.

Identifying key growth triggers prompting finance outsourcing

Several practical triggers indicate when Muscat SMEs should consider moving beyond bookkeeping. One clear signal is when the business starts dealing with complex financial transactions such as multi-currency dealings, inventory valuation, or managing payroll with increasing employee numbers. Another important factor is compliance with Oman’s tax regime, including VAT and the newly implemented Corporate Tax, which demand precise calculations, filings, and audits that bookkeeping alone cannot support effectively. Additionally, businesses experiencing rapid growth or entering new markets often require financial forecasting, budgeting, and risk assessment, functions typically outside the scope of bookkeeping but integral to full finance outsourcing. Recognizing these triggers early ensures SMEs are well-positioned to manage their financial health proactively.

Challenges of relying solely on bookkeeping for growing SMEs in Muscat

While bookkeeping is a foundational activity, Muscat SMEs that continue to depend solely on it often face several challenges. For one, bookkeeping does not provide the analytical insights needed for strategic planning, such as cash flow management or profitability analysis. This can lead to missed opportunities or unnoticed financial risks. Additionally, as tax laws in Oman become more complex, SMEs risk non-compliance or penalties without expert guidance on VAT and Corporate Tax regulations. Bookkeeping systems may also struggle to integrate with other business functions, limiting scalability. These challenges underline the need for comprehensive finance outsourcing solutions that bring expertise, technology, and process integration tailored to the unique demands of SMEs in Muscat.

Benefits of full finance outsourcing for Muscat SMEs

Transitioning to full finance outsourcing offers Muscat SMEs access to a breadth of financial expertise and services beyond basic bookkeeping. Outsourcing partners provide end-to-end financial management, including accurate accounting, tax compliance, audit readiness, and financial advisory tailored to Omani market conditions. This comprehensive approach enhances data accuracy, reduces compliance risks, and frees internal resources to focus on core business activities. Furthermore, finance outsourcing enables better financial forecasting and decision-making support, critical for SMEs navigating growth or market changes. For many Muscat businesses, partnering with a specialized finance outsourcing provider like Leaderly ensures they remain compliant with Oman’s tax laws while optimizing financial performance.

Key considerations for choosing a finance outsourcing partner in Muscat

Selecting the right finance outsourcing partner is a strategic decision for Muscat SMEs moving beyond bookkeeping. Key considerations include local expertise, particularly in Omani VAT and Corporate Tax regulations, ensuring accurate filings and timely compliance. The partner should demonstrate a strong advisory capability to support feasibility studies, valuations, and due diligence—services that become increasingly valuable as SMEs expand or seek investment. Integration of modern financial technology is another important factor, as it ensures real-time reporting and transparency. Lastly, the provider’s experience with SMEs in Muscat is crucial, offering tailored solutions that accommodate the unique business environment and growth trajectories typical in the region.

How finance outsourcing supports sustainable growth and audit readiness

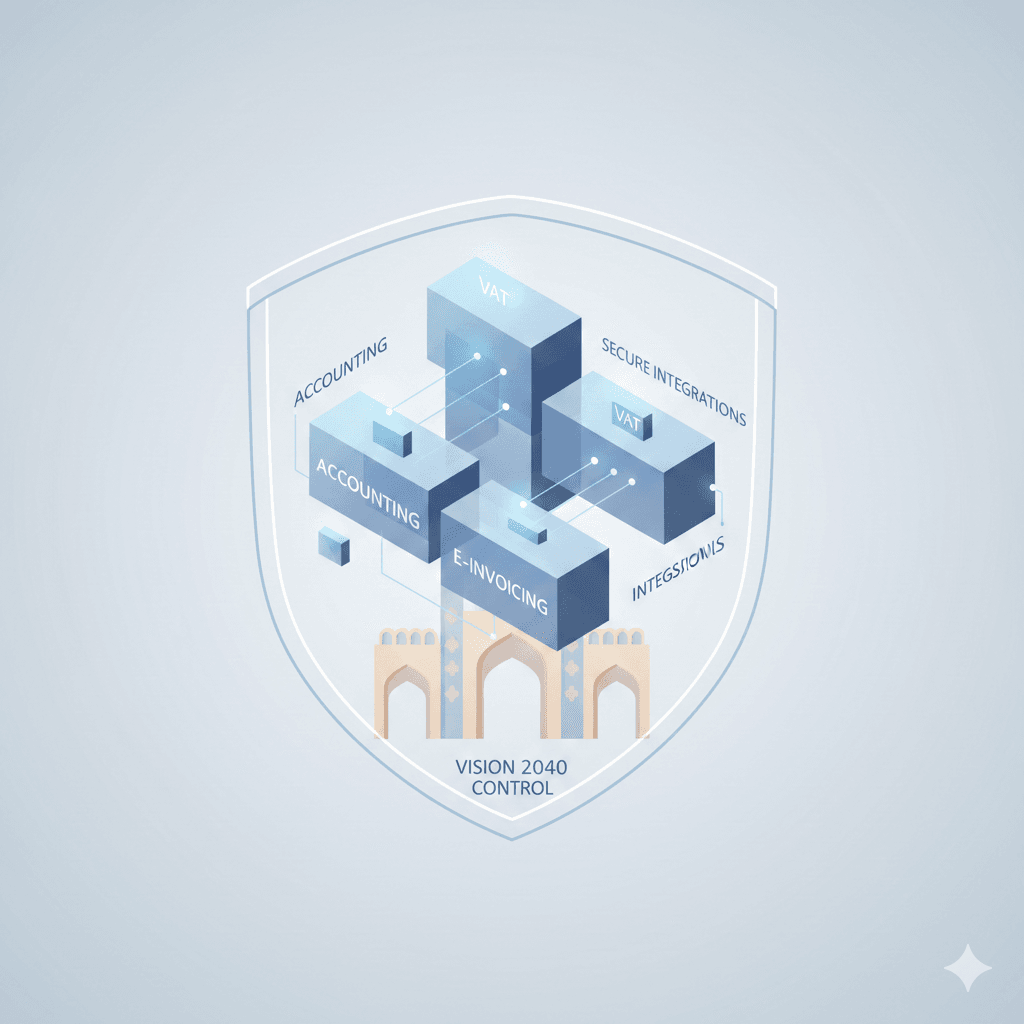

For Muscat SMEs, finance outsourcing is not just about managing current financial tasks but also preparing for sustainable growth and regulatory scrutiny. An outsourced finance team helps establish robust internal controls, standardizes financial processes, and ensures accurate documentation—all essential elements for smooth audit experiences. This proactive approach reduces the likelihood of financial discrepancies and audit issues, which can be disruptive and costly. Moreover, ongoing financial advisory and reporting enhance transparency for stakeholders and support informed decision-making. Ultimately, full finance outsourcing equips Muscat SMEs with the tools and expertise to navigate growth challenges confidently while maintaining compliance and financial integrity.

In conclusion, Muscat SMEs finance outsourcing becomes essential when basic bookkeeping no longer meets the complexity and scale of business financial management needs. Recognizing the triggers that warrant this transition allows businesses to safeguard their financial health, improve compliance with Oman’s tax regulations, and position themselves for sustainable growth. By partnering with an experienced finance outsourcing provider, SMEs gain access to comprehensive services that extend beyond bookkeeping—covering accounting, taxation, advisory, and audit readiness tailored to Muscat’s unique business environment. This strategic move is not only about operational efficiency but also about empowering business owners and finance managers with clarity and confidence in their financial decision-making.

Ultimately, embracing full finance outsourcing marks a critical step forward for Muscat SMEs seeking to thrive in a competitive and regulated market. It frees businesses from the operational burdens of financial administration, allowing them to focus on innovation and expansion. More importantly, it ensures that financial management aligns with best practices, regulatory requirements, and strategic objectives. With the right finance outsourcing partner, Muscat SMEs can transform their financial operations into a powerful asset that drives growth, mitigates risks, and fosters long-term success.

#Leaderly #MuscatSMEsfinanceoutsourcing #Oman #Muscat #SMEs #Accounting #Tax #Audit