Muscat SME Financial Statements Compliance and Practical Reporting Reality in Oman

Muscat SME financial statements compliance as a business foundation

Muscat SME financial statements compliance is often the first serious financial responsibility that business owners encounter once operations move beyond basic cash tracking. In Oman, financial statements are not simply documents prepared for banks or regulators; they are the structured reflection of how a business actually performs, survives, and grows. Many SMEs in Muscat assume that financial statements are only required when a loan application or tax filing is due, but this mindset creates blind spots that can damage decision-making. Properly prepared statements help owners understand profitability, cash flow pressures, and capital structure in a way daily invoices never can. In practice, compliance means ensuring that income statements, balance sheets, and cash flow reports follow Omani commercial requirements and are consistent with supporting records. When these reports are delayed or inaccurate, business owners lose the ability to spot risks early. For SMEs operating in competitive sectors such as trading, services, or contracting, timely and compliant reporting is a strategic necessity rather than an administrative task. Advisors working closely with Muscat businesses see repeatedly that strong financial statements reduce disputes with partners, strengthen credibility with banks, and create confidence when dealing with authorities.

Understanding what regulators and banks expect in Muscat

Why structure and consistency matter more than complexity

Muscat SME financial statements compliance also depends on understanding the expectations of regulators, banks, and other stakeholders in Oman. Authorities do not look for complex international reporting language; they look for clarity, consistency, and traceability. Financial statements must align with commercial registration data, VAT filings, and corporate tax disclosures where applicable. Banks reviewing SME financials in Muscat focus heavily on whether revenue recognition is reasonable, expenses are supported, and assets are not overstated. Inconsistent figures across periods raise immediate concerns, even if the business is profitable. Many SMEs struggle because statements are prepared late, reconstructed from incomplete records, or adjusted repeatedly without explanation. This creates uncertainty and undermines trust. A well-prepared set of financial statements tells a coherent story of how the business earns, spends, and reinvests money. From a practical standpoint, this means maintaining proper documentation, reconciling bank accounts regularly, and reviewing figures before year-end pressure sets in. Financial advisors in Oman emphasize that compliance is not about satisfying forms; it is about presenting a reliable financial picture that stands up to external scrutiny.

Common compliance gaps seen in Muscat SMEs

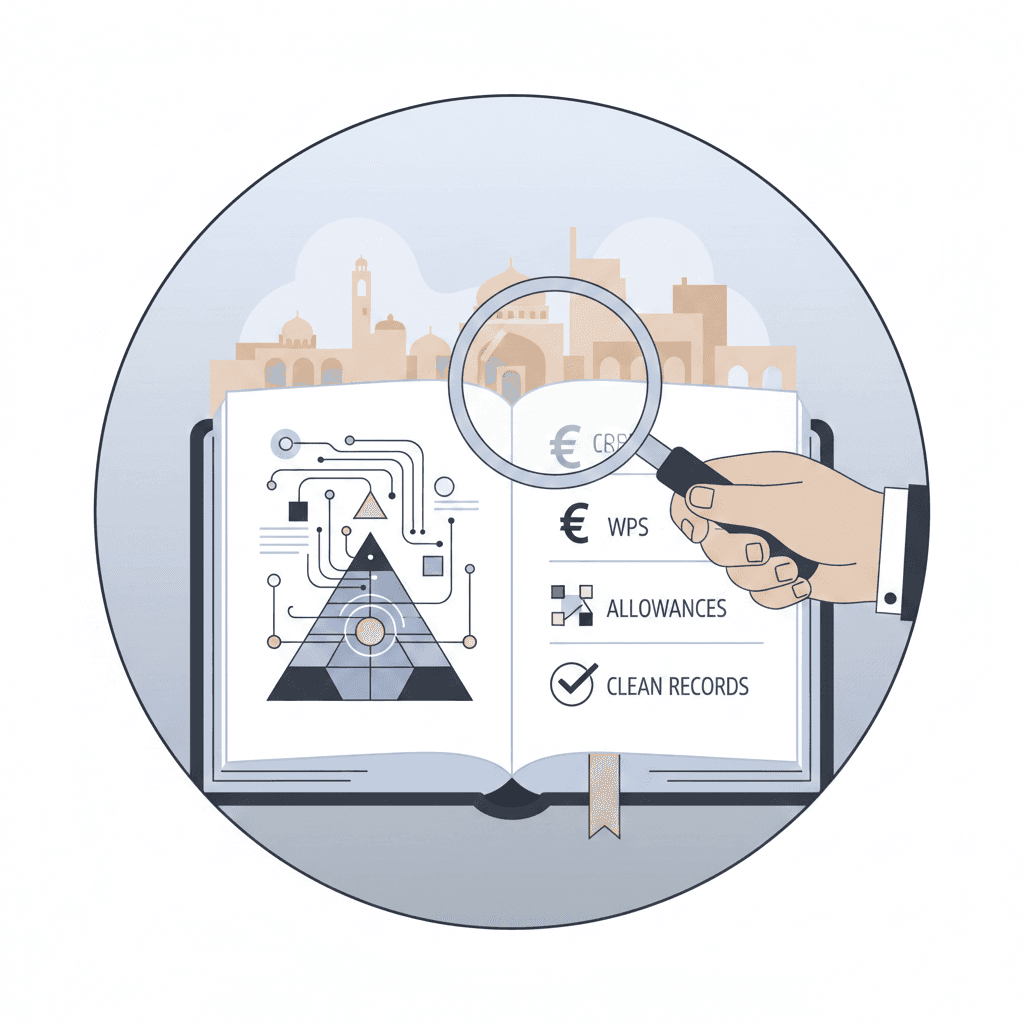

Muscat SME financial statements compliance frequently breaks down due to avoidable operational habits rather than complex regulations. One common issue is mixing personal and business transactions, which distorts expenses and liabilities. Another is relying on informal bookkeeping that cannot support year-end reporting requirements. SMEs may also underestimate the impact of inventory valuation, receivables aging, or long-outstanding payables on their balance sheet. These issues become critical when financial statements are reviewed for VAT audits, corporate tax assessments, or due diligence during partnerships and exits. In Oman’s business environment, authorities expect records to be maintained in an orderly manner, even for smaller enterprises. When statements are prepared without proper reconciliation, owners may unknowingly overstate profits or understate obligations, leading to compliance risks later. Addressing these gaps early helps SMEs avoid corrective filings, penalties, and strained relationships with stakeholders. Experienced advisors working with Muscat businesses often focus on strengthening internal processes first, ensuring that financial statements reflect reality rather than assumptions made under time pressure.

Using financial statements as a management tool in Muscat

Muscat SME financial statements compliance should not be viewed only as a regulatory obligation but as a management tool that supports better decisions. When owners review their financial statements regularly, they gain insight into margins, cost structures, and cash flow cycles unique to their operations in Oman. This information becomes critical when negotiating supplier terms, setting pricing strategies, or planning expansion. Financial statements also reveal trends that are not obvious from bank balances alone, such as rising overheads or declining collection efficiency. SMEs that treat reporting as an annual exercise often miss these warning signs. In contrast, those that integrate financial review into monthly or quarterly routines are better positioned to adapt to market changes. In Muscat’s dynamic SME landscape, where competition and regulatory expectations continue to evolve, informed decision-making is a competitive advantage. Advisory professionals frequently observe that businesses with strong reporting discipline are more resilient during economic fluctuations because they understand their financial position clearly and can act decisively.

Aligning compliance with tax and advisory requirements

Reducing risk through integrated financial oversight

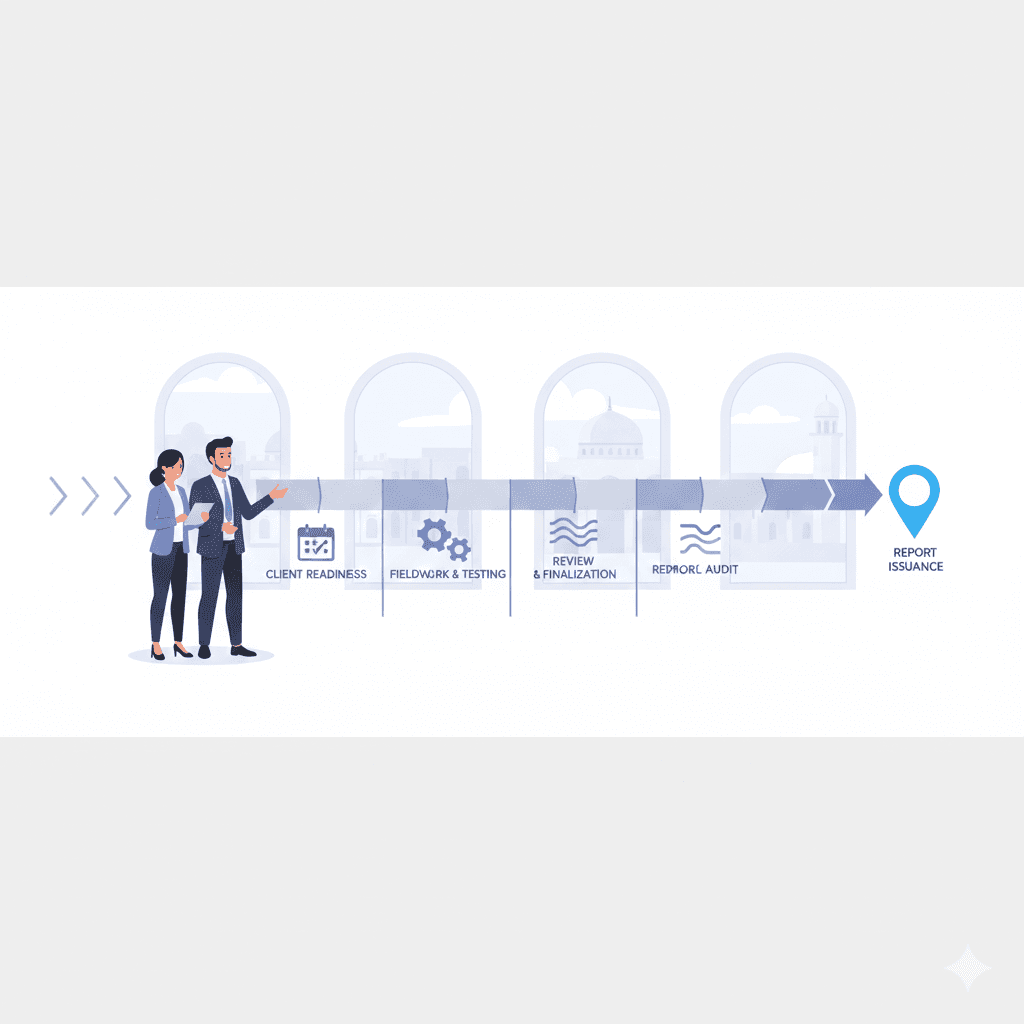

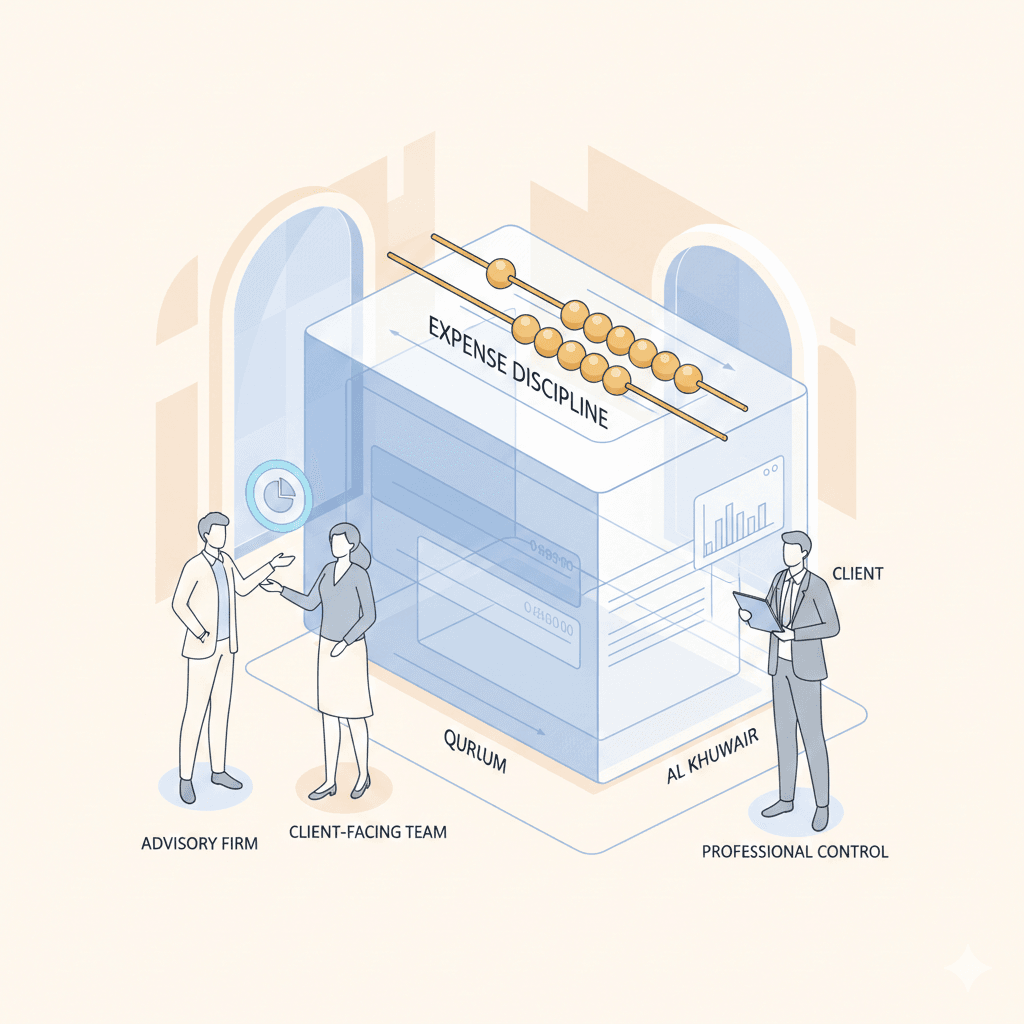

Muscat SME financial statements compliance is closely linked to taxation and advisory considerations in Oman. VAT returns, corporate tax filings, and audit requirements all rely on accurate underlying financial data. When statements are prepared properly, tax compliance becomes smoother and less stressful. Conversely, weak financial reporting increases the likelihood of adjustments, disputes, and penalties. From an advisory perspective, financial statements are the foundation for feasibility studies, valuations, and restructuring decisions. Whether an SME is considering liquidation, bringing in investors, or expanding operations, reliable financial data is essential. Advisors supporting Muscat businesses emphasize that compliance is not about reacting to deadlines but about building systems that support long-term sustainability. Integrated oversight ensures that financial, tax, and strategic decisions are aligned rather than handled in isolation. This approach reduces risk and provides owners with confidence that their business is compliant, transparent, and prepared for future opportunities.

Building sustainable reporting practices for growing SMEs

Muscat SME financial statements compliance ultimately depends on establishing sustainable reporting practices that grow with the business. As SMEs expand, transaction volumes increase, regulatory exposure widens, and stakeholder expectations rise. What worked for a startup phase may no longer be sufficient. Investing in proper financial controls, timely reconciliations, and professional review becomes essential. Many Muscat SMEs benefit from periodic advisory support to assess whether their reporting practices remain fit for purpose. This does not mean overcomplicating systems but ensuring accuracy, consistency, and compliance. Business owners who take this approach are better prepared for audits, tax reviews, and strategic transitions. Over time, strong financial reporting becomes part of the company culture rather than a year-end burden. In Oman’s evolving business environment, SMEs that prioritize financial discipline position themselves for stability and growth, while those that delay compliance often face avoidable challenges.

Muscat SME financial statements compliance is not a one-time task but an ongoing discipline that shapes how businesses operate and grow in Oman. When financial statements are prepared accurately and reviewed regularly, they provide clarity that supports better decisions, smoother compliance, and stronger credibility with stakeholders. For SME owners, understanding the purpose behind the numbers transforms reporting from an obligation into a valuable management tool.

By treating financial statements as a living reflection of business performance, Muscat SMEs can reduce risk, improve planning, and approach regulatory requirements with confidence. With the right advisory guidance and disciplined practices, compliance becomes a source of stability rather than stress, allowing business owners to focus on sustainable growth in a competitive market.

#Leaderly #MuscatSMEfinancialstatementscompliance #Oman #Muscat #SMEs #Accounting #Tax #Audit