Muscat SME Finance Playbook: Strategic Financial Management for Omani Businesses

Understanding the Financial Landscape for Muscat SMEs

Why Financial Acumen is Crucial for Growth

Muscat SME Finance Playbook begins with a clear understanding of the unique financial environment within which Omani small and medium enterprises operate. SMEs in Muscat face a distinct combination of regulatory requirements, market fluctuations, and economic opportunities that necessitate precise financial management. Unlike larger corporations, SMEs often lack extensive financial resources, making it imperative to leverage accounting, audit, tax, and advisory services strategically to maintain liquidity and compliance. Understanding cash flow cycles, VAT obligations, and emerging corporate tax frameworks in Oman can empower SMEs to position themselves competitively. The financial landscape in Muscat is also shaped by government initiatives promoting diversification and SME development, making financial agility and clarity essential to capitalize on these opportunities. This playbook addresses these challenges and outlines actionable financial frameworks for Muscat SMEs to thrive.

Key Financial Regulations Impacting Muscat SMEs

Navigating VAT and Corporate Tax in Oman

The introduction of Value Added Tax (VAT) and the gradual implementation of corporate tax regulations have transformed the financial obligations of SMEs in Muscat. This section of the Muscat SME Finance Playbook delves into the practical aspects of VAT registration thresholds, compliance deadlines, and filing requirements specific to Oman’s evolving tax system. SMEs must ensure accurate accounting records and timely tax filings to avoid penalties and sustain smooth operations. Additionally, understanding the corporate tax provisions, including exemptions and allowances, is vital for strategic tax planning. Leaderly’s advisory expertise helps SMEs interpret these laws in the context of their business models, offering tailored strategies that reduce tax burdens while ensuring full compliance. Staying updated with the Oman Tax Authority’s guidelines and leveraging professional audit services safeguards SMEs from unexpected liabilities.

Effective Accounting Practices for Muscat SMEs

Building Robust Financial Foundations

Sound accounting practices form the backbone of financial stability for SMEs in Muscat, and the Muscat SME Finance Playbook emphasizes this foundation. Proper bookkeeping, accurate financial statements, and periodic reconciliations enable businesses to maintain transparency and build trust with stakeholders, including banks, investors, and regulatory bodies. Adopting accounting systems that align with Omani standards and international best practices improves operational efficiency and facilitates decision-making. Leaderly’s audit and accounting services support SMEs in establishing tailored accounting frameworks that suit their scale and industry, ensuring compliance with Oman’s Commercial Companies Law and accounting standards. By integrating advisory services, SMEs can also anticipate cash flow challenges and optimize financial performance proactively, rather than reactively addressing issues.

Auditing: More Than Just Compliance

Ensuring Accuracy and Building Credibility

The Muscat SME Finance Playbook highlights audit as a critical tool not only for regulatory compliance but also for strengthening financial governance. While Omani regulations require audits for certain categories of companies, SMEs can leverage audits beyond the legal necessity to uncover inefficiencies, detect risks, and enhance internal controls. A thorough audit conducted by qualified professionals like Leaderly provides independent assurance on financial statements, boosting credibility with partners, lenders, and potential investors. This transparency is particularly valuable for SMEs seeking funding or partnerships in Muscat’s competitive business environment. Audit findings often reveal areas for cost optimization and improved financial practices, contributing directly to long-term sustainability and growth.

Advisory Services Tailored to Muscat SMEs

From Feasibility to Liquidation: Strategic Financial Guidance

Advisory services complete the Muscat SME Finance Playbook by offering strategic insights across the business lifecycle. Whether planning expansion, conducting valuation for investment, assessing feasibility of new projects, or preparing for liquidation, SMEs require expert guidance to make informed decisions. Leaderly’s advisory team understands the nuances of the Muscat market and Oman’s regulatory context, providing bespoke advice that aligns with each SME’s goals and constraints. This proactive approach helps entrepreneurs anticipate challenges, seize growth opportunities, and navigate complex financial scenarios with confidence. By integrating advisory services with audit, tax, and accounting, SMEs benefit from a holistic financial management strategy tailored to the dynamic environment of Muscat.

Building a Financial Culture for Sustainable Growth

Empowering SMEs Through Knowledge and Systems

The final section of the Muscat SME Finance Playbook stresses the importance of cultivating a financial culture within SMEs. Beyond compliance and reporting, fostering financial literacy among leadership and staff promotes better budgeting, forecasting, and risk management. Implementing robust financial systems and leveraging technology suited to Omani SMEs can automate routine tasks, reduce errors, and provide real-time insights. Leaderly encourages SMEs to adopt continuous improvement in financial practices through training and regular advisory check-ins. This cultural shift not only enhances operational efficiency but also prepares SMEs to adapt to economic changes and regulatory updates in Oman. Ultimately, a strong financial culture forms the foundation for resilience and competitive advantage in Muscat’s growing SME sector.

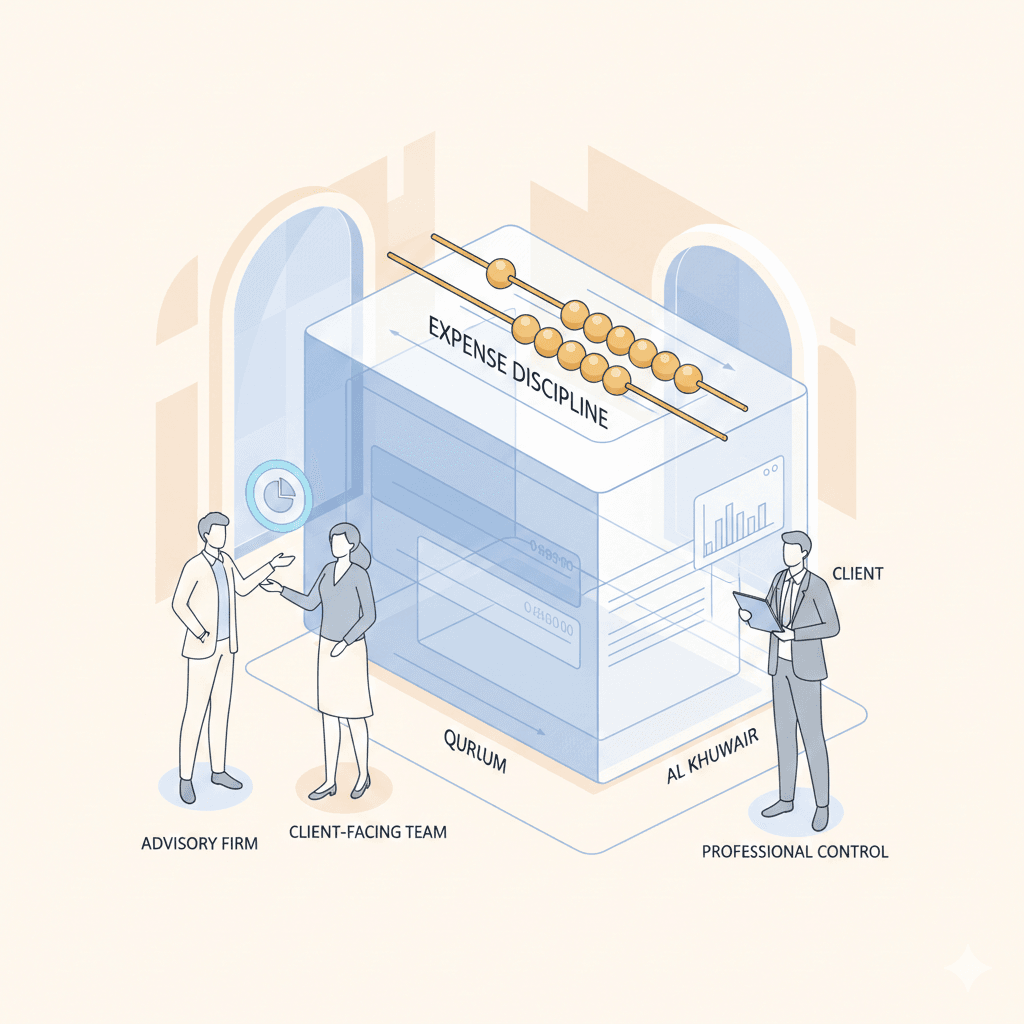

Muscat SMEs face a distinct and evolving financial landscape that requires more than basic bookkeeping or sporadic tax filings. The Muscat SME Finance Playbook integrates audit, tax, accounting, and advisory functions into a cohesive strategy designed specifically for the needs of businesses in Oman’s capital. By understanding local regulations, adopting sound financial practices, and leveraging expert advisory support, SMEs can navigate challenges with agility and position themselves for sustainable success. This holistic approach not only ensures compliance but also unlocks opportunities for growth, investment, and enhanced credibility in the marketplace.

For SMEs operating in Muscat, partnering with a trusted financial advisor like Leaderly means access to specialized expertise that translates into practical solutions tailored to Oman’s unique business environment. Whether it is optimizing tax liabilities, ensuring audit readiness, or guiding strategic financial decisions, the integrated services offered support SMEs at every stage of their journey. With the right financial playbook, Muscat SMEs can confidently build strong foundations today and seize the opportunities of tomorrow’s economy.

#Leaderly #MuscatSMEFinancePlaybook #Oman #Muscat #SMEs #Accounting #Tax #Audit