Muscat Business Owners Cashflow Statement: A Quick Guide to Understanding Cashflow in 15 Minutes

Understanding the Importance of Cashflow for Muscat Businesses

Muscat business owners cashflow statement management is essential for maintaining operational stability and driving growth. Unlike profit, which represents accounting earnings, cashflow reflects the actual liquidity available to the business at any given time. A thorough understanding of the cashflow statement allows entrepreneurs to track when and how much cash flows in and out, helping prevent unexpected shortages or liquidity challenges. This insight is particularly important in Oman’s dynamic economic landscape, where companies must navigate VAT compliance and shifting market conditions. The cashflow statement acts as a critical tool to forecast short-term financial health, enabling proactive decisions that align with local regulations and business realities.

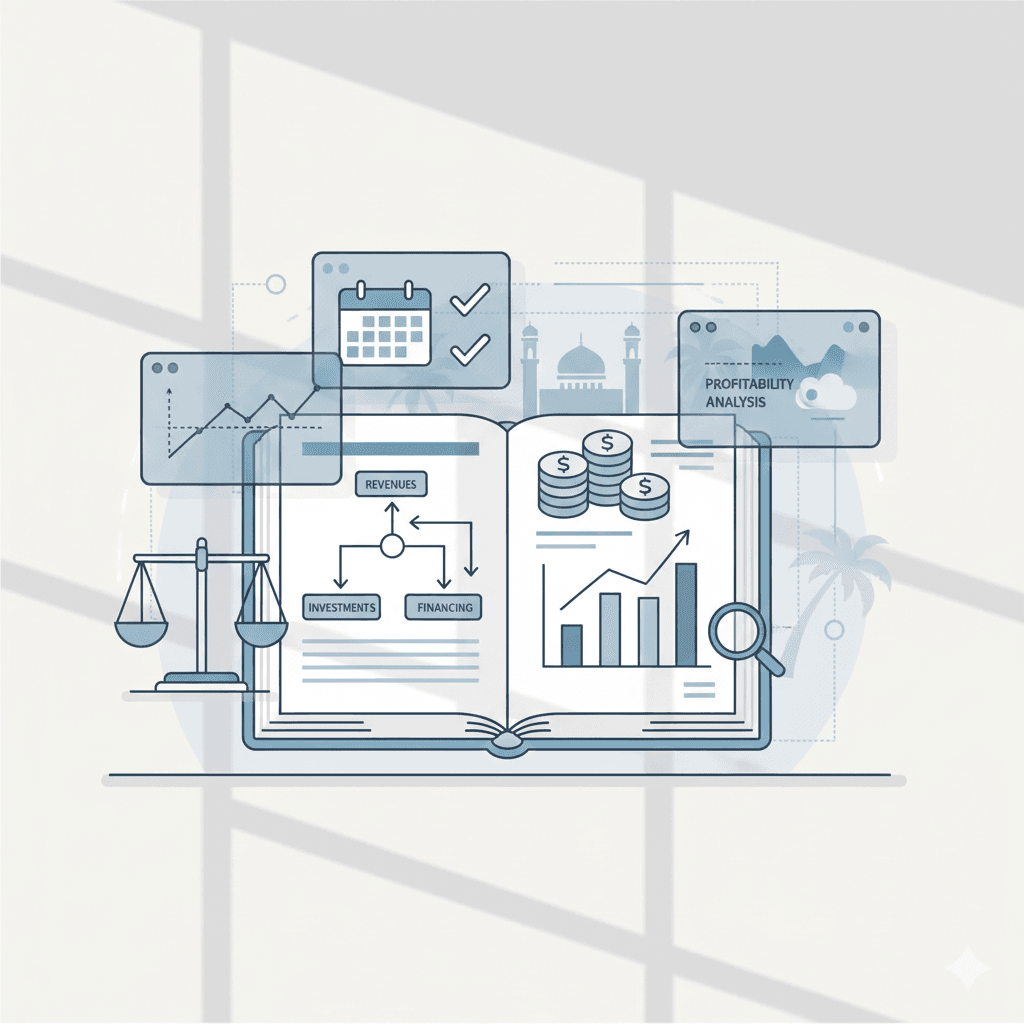

Basic Structure of the Cashflow Statement Explained

The cashflow statement breaks down cash movement into three main categories: operating activities, investing activities, and financing activities. For Muscat SMEs, this segmentation clarifies where cash originates and how it is spent. Operating activities reveal cash generated or used by core business functions like sales and payments to suppliers, reflecting the company’s ability to sustain itself from regular operations. Investing activities detail cash spent on assets or income from asset sales, critical for business expansion or modernization. Financing activities show cash flows related to debt, equity, or dividends, offering insight into capital management. Understanding these sections helps business owners in Muscat evaluate their company’s liquidity drivers and constraints, making it easier to plan for taxes, investment, and cash reserves.

Key Figures and Terminology to Focus on for Quick Analysis

In reading a cashflow statement efficiently, Muscat business owners should prioritize certain figures and terms to extract the essential financial story. Net cash from operating activities is the most telling metric—it indicates if the business’s core operations are producing enough cash to sustain day-to-day needs. Similarly, free cashflow, derived from operating cash minus capital expenditures, signals how much cash remains for debt repayment or reinvestment. Terms like depreciation and amortization, while non-cash expenses, affect operating cash indirectly and should be understood to avoid confusion. Recognizing the difference between cash inflows and outflows in financing activities also helps in assessing the company’s financial strategy and risk profile, especially in a market with rising corporate tax and VAT obligations.

Common Cashflow Challenges Faced by SMEs in Muscat

Many SMEs in Muscat struggle with cashflow management due to delayed receivables, unexpected expenses, and seasonality of business cycles. Delays in customer payments often strain liquidity, forcing owners to rely on short-term credit or overdrafts, which increases financing costs. Additionally, Oman’s VAT system requires careful cash planning to ensure timely payment of tax liabilities without disrupting business operations. Seasonality—common in retail, tourism, and services sectors—creates periods of cash surplus and shortage that need to be balanced strategically. Understanding the cashflow statement helps identify these patterns early, enabling business owners to take corrective measures like adjusting payment terms or seeking advisory services to optimize cash management and tax planning.

Leveraging Cashflow Statements for Strategic Decision Making

Beyond day-to-day liquidity management, the cashflow statement is a strategic tool that can guide Muscat SMEs in growth planning and risk mitigation. It provides transparency into how cash is allocated and highlights areas where operational efficiency can improve. For example, a negative cashflow from investing activities could indicate ongoing business expansion, which should be matched with sufficient cash reserves or financing plans. Conversely, persistent negative operating cashflow warrants immediate action to revise pricing, control costs, or renegotiate payment terms. Finance managers can also use cashflow insights to prepare for corporate tax liabilities and ensure compliance with Oman’s evolving regulations. Leaderly’s advisory services often emphasize these cashflow analyses to help clients make informed decisions based on realistic financial conditions rather than projections alone.

Practical Tips for Muscat Business Owners to Read Cashflow Statements Efficiently

To master cashflow reading in 15 minutes, Muscat business owners should adopt a focused approach: first, scan the net cash from operating activities to assess core business health. Next, review investing and financing activities to understand cash use and capital structure. Keep an eye on trends by comparing current periods with prior ones to detect anomalies or improvements. Use financial ratios related to cashflow, such as the operating cashflow ratio, to quantify liquidity strength. Importantly, integrate VAT and corporate tax considerations into cashflow planning to avoid surprises. Finally, leveraging audit and accounting expertise ensures accuracy and compliance, helping uncover discrepancies or areas for optimization. These steps create a practical roadmap that fits Muscat’s SME environment and aligns with Leaderly’s commitment to helping businesses manage cash effectively.

In conclusion, Muscat business owners must view the cashflow statement not merely as a financial report but as a dynamic management tool. It reveals the real-time liquidity position and provides actionable insights for operational efficiency, tax compliance, and strategic growth. By dedicating just 15 minutes to a focused review of their cashflow statements, SME founders and finance managers can anticipate challenges, seize opportunities, and build resilience in an evolving Omani market.

This pragmatic approach empowers business leaders to enhance cash management, align financial practices with local regulations, and strengthen their company’s foundation. Integrating cashflow analysis with expert advisory services further elevates financial oversight, ensuring SMEs in Muscat thrive sustainably amid competitive pressures and economic shifts.

#Leaderly #MuscatBusinessOwnersCashflowStatement #Oman #Muscat #SMEs #Accounting #Tax #Audit