Muscat Accounting for Non-Accountants: Essential Insights for SME Owners

Understanding Muscat Accounting Basics

Demystifying Accounting for Non-Finance Professionals

Muscat accounting for non-accountants begins with grasping the fundamental concepts that govern financial recordkeeping within Omani businesses. For many SME owners and entrepreneurs, accounting may seem complex or overly technical, but it fundamentally boils down to tracking money coming in and going out of a business. This involves maintaining accurate records of sales, expenses, assets, and liabilities. In the Muscat business environment, compliance with local regulations such as VAT and corporate tax obligations necessitates clarity in these records. Non-accountants must appreciate that accounting is not merely a bureaucratic task but a vital tool for decision-making and business growth. It provides real-time insights into a company’s financial health and supports strategic planning. A clear understanding reduces dependence on external advisors for everyday financial management and empowers owners to engage more effectively with professionals for complex matters.

Key Financial Statements Explained

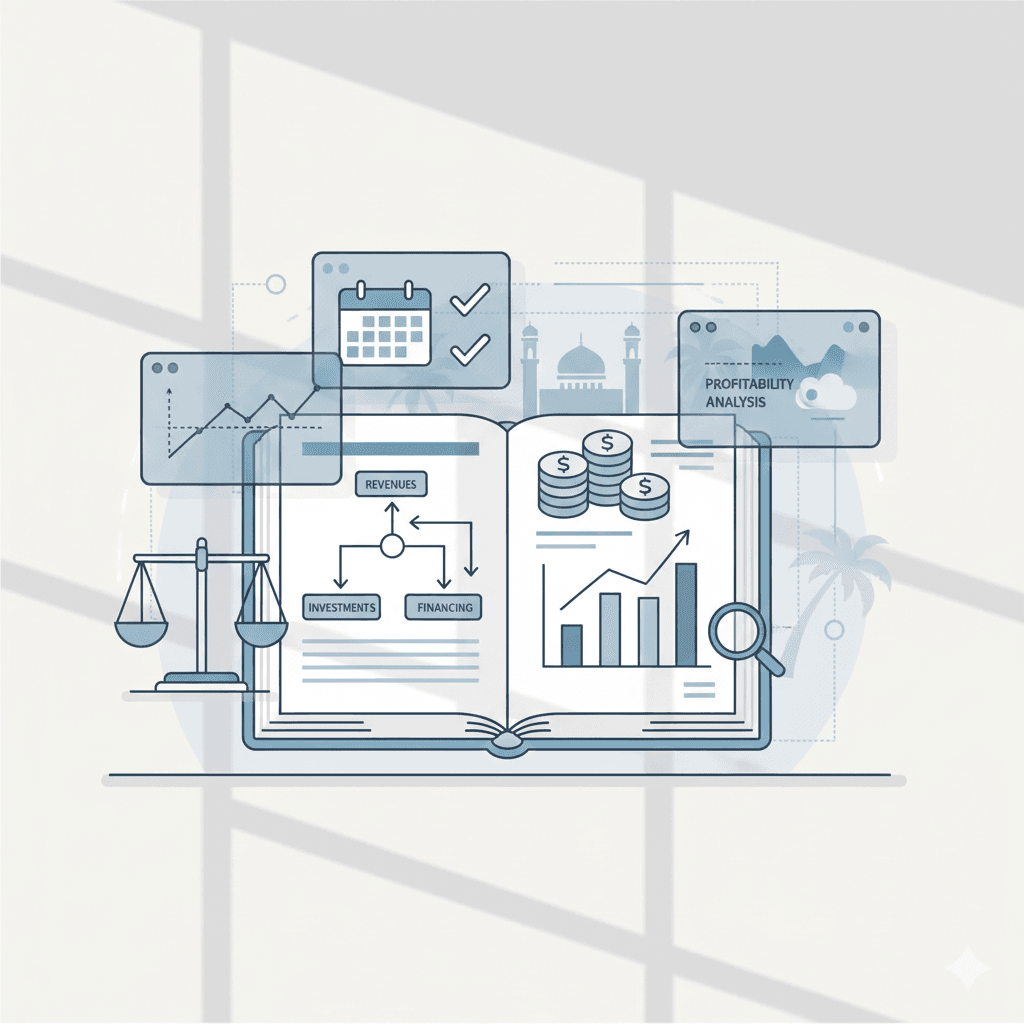

One of the main hurdles for non-accountants in Muscat is interpreting core financial statements: the balance sheet, income statement, and cash flow statement. The balance sheet provides a snapshot of what a business owns (assets) and owes (liabilities) at a specific point in time, with the difference representing equity. The income statement shows revenues, costs, and profits over a period, highlighting operational performance. Meanwhile, the cash flow statement tracks actual cash movement, revealing liquidity status crucial for operational continuity. Understanding these documents enables Muscat SMEs to monitor business performance, detect issues early, and comply with statutory reporting requirements. Furthermore, familiarity with these statements helps in communicating financial status to banks, investors, or tax authorities, ensuring smoother audits and funding processes.

Local Regulations Impacting Accounting Practices

Oman’s tax landscape and regulatory framework significantly influence how Muscat businesses approach accounting. Since the introduction of VAT and the upcoming corporate tax, SMEs must align their accounting systems to ensure accurate tax calculation and timely filings. Non-accountants need to understand the importance of proper invoice management, expense documentation, and reconciliation processes to avoid penalties. Leaderly’s advisory services emphasize practical approaches to embedding these requirements within daily accounting routines, allowing non-finance professionals to maintain compliance without confusion. Recognizing that regulatory requirements continuously evolve is also key; thus, staying informed through trusted advisors or updated accounting software ensures that SMEs remain on the right side of the law.

Implementing Practical Accounting Systems in Muscat SMEs

Setting up an effective accounting system is essential for any SME in Muscat, particularly for owners without formal finance training. This system should facilitate easy recordkeeping, invoicing, and expense tracking. Cloud-based accounting software tailored for Omani regulations can simplify VAT application, financial reporting, and tax submissions, offering user-friendly dashboards for quick insights. Leaderly’s audit and accounting expertise often guides SMEs in selecting and customizing such tools, ensuring they meet local compliance while remaining accessible to non-accountants. Establishing routine bookkeeping habits and periodic financial reviews encourages disciplined cash management and minimizes errors. Additionally, aligning these systems with bank accounts and payment platforms streamlines transaction recording, further reducing the risk of inaccuracies.

Overcoming Common Accounting Challenges for Non-Accountants

Non-accountants in Muscat frequently encounter challenges such as misclassification of expenses, delayed invoicing, or confusion around tax codes. These issues can lead to inaccurate financial statements and compliance risks. Developing a basic understanding of accounting principles helps identify and correct these errors early. For example, distinguishing between capital and operational expenses affects tax treatment and financial health analysis. Leaderly’s advisory services offer practical training and hands-on support tailored to SMEs, focusing on avoiding these pitfalls while enhancing financial literacy. Non-accountants can also benefit from establishing clear workflows and checklists for accounting tasks, promoting consistency and accuracy in recordkeeping. Over time, this reduces dependence on external consultants for routine issues and improves confidence in financial management.

Leveraging Accounting for Strategic Growth in Muscat

Beyond compliance, Muscat accounting for non-accountants offers SMEs the opportunity to harness financial data for strategic advantage. Understanding cost structures, profit margins, and cash flow cycles enables owners to make informed decisions about pricing, investments, and resource allocation. Accurate accounting also supports feasibility studies and valuations, critical for expansion or attracting investors. Leaderly’s advisory team assists SMEs in interpreting financial data to develop robust business plans and manage risks proactively. By treating accounting as a management tool rather than a mere compliance task, non-accountants in Muscat can foster sustainable growth, optimize operations, and enhance competitiveness within the local and regional markets.

In conclusion, Muscat accounting for non-accountants is an indispensable skill for SME owners and entrepreneurs seeking financial clarity and operational resilience. While accounting may initially appear daunting, breaking it down into fundamental concepts and practical steps can empower business leaders to maintain control over their finances and fulfill regulatory obligations confidently. As Oman’s business environment evolves with new tax frameworks and increasing market demands, equipping non-finance professionals with these accounting insights becomes a strategic necessity rather than an option.

By adopting practical accounting systems tailored to Omani regulations and embracing ongoing financial literacy, SMEs in Muscat can strengthen their financial foundation and unlock opportunities for growth. Collaborating with trusted advisory partners like Leaderly ensures access to expert guidance when navigating complex taxation and audit challenges, enabling business owners to focus on innovation and expansion. Ultimately, a clear and confident approach to accounting transforms financial management from a compliance burden into a powerful business asset.

#Leaderly #MuscatAccountingForNonAccountants #Oman #Muscat #SMEs #Accounting #Tax #Audit