Management Accounts in Muscat: Mastering Financial Insights for SMEs

Understanding the Purpose of Management Accounts in Muscat

Why Management Accounts Are Crucial for Omani SMEs

Management accounts in Muscat serve as a vital financial tool designed specifically to help business owners and SME leaders gain a clear and timely understanding of their company’s financial health. Unlike statutory financial statements prepared for regulatory compliance, these accounts focus on internal management needs, offering insights that support strategic decision-making and operational control. For businesses operating in Oman’s dynamic market environment, management accounts provide the detailed and current financial information needed to navigate economic shifts and regulatory changes such as VAT and corporate tax.

In essence, management accounts bridge the gap between raw financial data and actionable business intelligence. They include critical elements like profit and loss statements, balance sheets, and cash flow forecasts, often produced monthly or quarterly. This frequency ensures business owners can respond quickly to emerging trends or challenges. For SMEs in Muscat, where market conditions can shift rapidly, having access to updated and relevant financial reports is indispensable. These reports empower business owners to identify profitability drivers, cost inefficiencies, and cash flow concerns before they escalate into larger problems.

Understanding the true purpose of management accounts in Muscat is fundamental for entrepreneurs and finance managers alike. These accounts not only reflect past performance but also provide a forward-looking perspective that supports budgeting, forecasting, and resource allocation. By regularly reviewing management accounts, SMEs can sharpen their competitive edge, optimize operational efficiency, and maintain sustainable growth. The proactive use of management accounts thus becomes a cornerstone for business resilience in Oman’s evolving economy.

Key Components of Management Accounts in Muscat

Breaking Down the Financial Reports for Practical Use

Management accounts in Muscat typically consist of several core reports that offer a comprehensive overview of a business’s financial position. The primary components include the profit and loss statement (P&L), balance sheet, and cash flow statement, each serving a distinct function to guide decision-making. The P&L statement, for example, highlights revenue streams, costs, and ultimately the net profit or loss during a specific period. For Omani SMEs, this helps identify which products or services contribute most to the bottom line and where cost controls might be needed.

The balance sheet provides a snapshot of the company’s assets, liabilities, and equity at a given point in time. This report is critical for assessing liquidity and financial stability, factors that are especially important for businesses planning to expand or seeking financing in Muscat’s competitive market. Understanding how assets and liabilities are balanced allows finance managers to evaluate risk and operational capacity, ensuring that the business can meet both short-term obligations and long-term commitments.

Lastly, the cash flow statement tracks the movement of cash in and out of the business. Cash flow management is often a critical challenge for SMEs in Oman due to fluctuating market demand and payment cycles. The cash flow report reveals whether a company can sustain its operations, invest in growth, and meet payroll and supplier obligations on time. Together, these components of management accounts in Muscat provide a detailed, actionable financial story, empowering business leaders to make confident and informed choices that align with their strategic goals.

Common Challenges SMEs Face When Reading Management Accounts

Overcoming Misinterpretations and Enhancing Financial Literacy

While management accounts are powerful tools, many SMEs in Muscat encounter difficulties in interpreting them correctly. One frequent challenge is misunderstanding financial jargon or the significance of certain figures, which can lead to misguided decisions. For example, confusion between profitability and cash flow can cause some business owners to focus on reported profits while ignoring cash shortages that could threaten daily operations. This disconnect underscores the need for clear explanations and proper training in financial literacy tailored to the Omani business context.

Another common obstacle is the inconsistency or lack of timeliness in preparing management accounts. Without regular and reliable updates, the usefulness of these reports diminishes significantly. In Muscat, where business environments can be highly competitive and regulatory requirements frequently updated, delayed or incomplete management accounts can leave SMEs unprepared for critical decisions. Ensuring accurate, timely, and consistent reporting is therefore essential to maximize the strategic value of management accounts.

Finally, some SMEs struggle to align management accounts with their broader business objectives. Numbers on a page may seem disconnected from real-world business challenges or opportunities. Overcoming this requires not just financial understanding but also strategic thinking—being able to interpret the data to drive initiatives such as cost reduction, pricing strategy adjustment, or capital investment. Collaborating with advisory services that specialize in Oman’s business environment can help SMEs bridge this gap effectively, turning management accounts into a practical roadmap for sustainable success.

Leveraging Management Accounts in Muscat for Strategic Growth

Using Financial Insights to Drive Business Decisions

Once SMEs in Muscat grasp the essentials of management accounts, they can harness these insights to fuel strategic growth. One key application is in budgeting and forecasting, where past and current financial data guide realistic planning for future periods. This process helps SMEs allocate resources efficiently, anticipate funding needs, and identify growth opportunities within Oman’s evolving sectors such as tourism, logistics, and manufacturing. Management accounts serve as a foundation for these forward-looking financial models, providing clarity and confidence in decision-making.

Another strategic use is in performance monitoring and operational control. Regular review of management accounts enables business owners to track key performance indicators (KPIs) such as gross margins, operating expenses, and return on investment. This vigilance allows early detection of variances from planned outcomes and facilitates corrective actions before issues escalate. In Muscat’s business landscape, where agility is a competitive advantage, such financial discipline can significantly enhance an SME’s resilience and ability to capitalize on market changes.

Furthermore, management accounts in Muscat play a vital role in preparing for compliance with Oman’s taxation requirements, including VAT and the recently introduced corporate tax. Accurate and detailed financial records simplify tax reporting and reduce the risk of penalties. Beyond compliance, understanding the financial details within management accounts can also support tax planning strategies, helping SMEs optimize their tax position and free up cash for reinvestment. Integrating these financial insights into overall business strategy ensures SMEs not only survive but thrive in Oman’s regulatory environment.

Integrating Advisory Services to Maximize Management Account Benefits

How Expert Guidance Elevates Financial Understanding

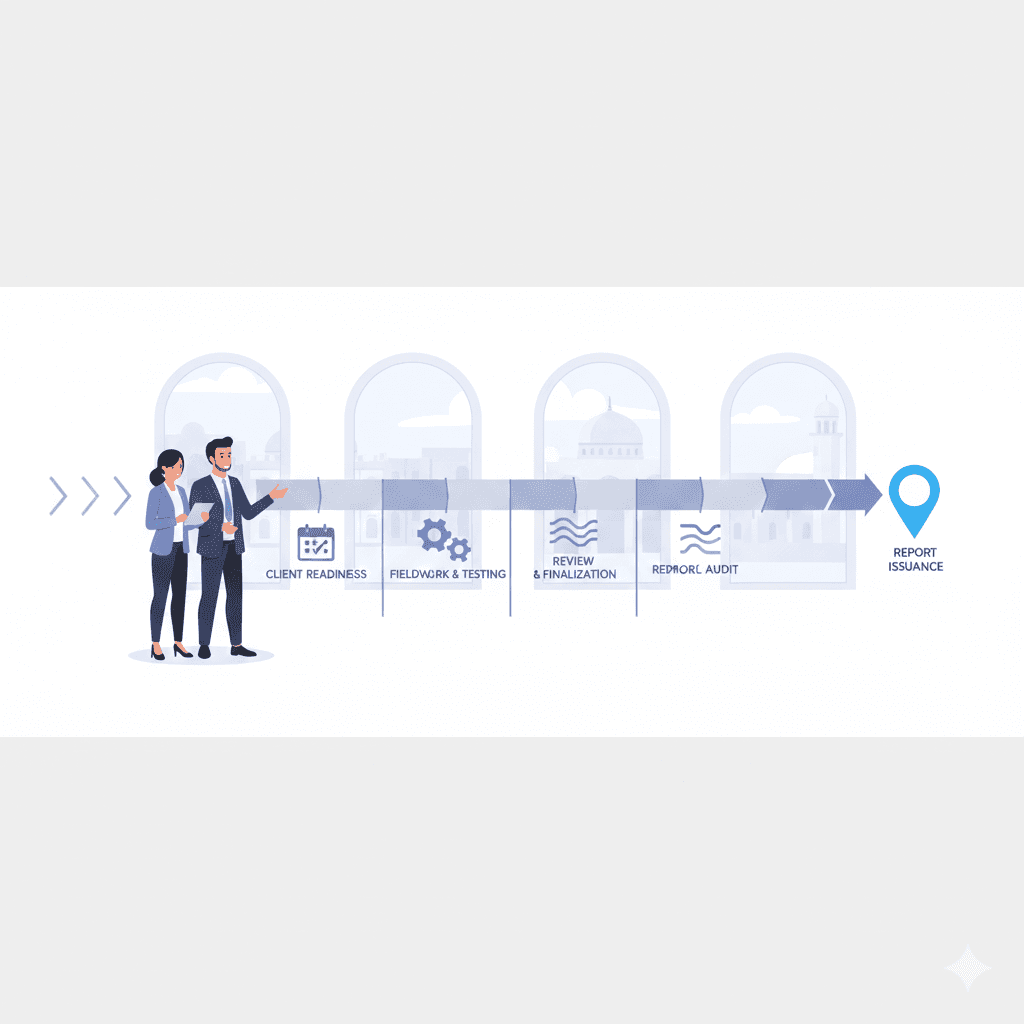

For many SMEs in Muscat, maximizing the value of management accounts requires more than just preparing reports—it demands expert interpretation and strategic advice. Engaging with advisory services, such as those offered by Leaderly, can transform raw financial data into actionable business intelligence tailored to Oman’s unique market dynamics. Advisors bring specialized knowledge in areas like feasibility studies, valuations, and due diligence, helping SMEs translate financial insights into practical steps for growth and risk management.

Advisory professionals also assist in refining the accounting processes that underpin management accounts, ensuring accuracy, timeliness, and regulatory compliance. This is particularly important for SMEs facing the complexities of Oman’s tax landscape, including VAT and corporate tax obligations. By integrating audit and accounting services with strategic advisory, businesses benefit from a holistic approach that supports both operational efficiency and long-term planning. This partnership enables SME leaders to focus on running their businesses with confidence, knowing their financial foundations are solid and transparent.

Moreover, advisory support plays a crucial role during critical business phases such as liquidation, mergers, or expansion. In these moments, management accounts provide the essential data needed to evaluate options and make informed decisions. Expert advisors help SMEs interpret these accounts within the broader context of market conditions and regulatory requirements in Muscat. This collaboration enhances the SME’s ability to navigate complex financial challenges and seize opportunities, reinforcing the importance of combining management accounts with professional guidance for sustainable business success.

Conclusion

Management accounts in Muscat are much more than routine financial reports; they are essential tools for steering SMEs toward strategic, informed, and confident decision-making. By understanding their purpose, core components, and common challenges, business owners and finance managers can unlock the full potential of these accounts to improve operational control, enhance financial planning, and ensure regulatory compliance. With the right approach, management accounts become a dynamic instrument that reflects both the current state and future possibilities of a business.

When coupled with expert advisory services, management accounts in Muscat empower SMEs to align their financial insights with practical growth strategies and risk mitigation. This integrated approach not only strengthens financial literacy but also creates a robust foundation for sustainable success within Oman’s unique economic landscape. Ultimately, mastering the art of reading management accounts equips SMEs with the clarity and confidence needed to thrive amid evolving market demands and regulatory frameworks.

#Leaderly #ManagementAccountsinMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit