Al Khuwair compliance documentation readiness as a practical checklist for SMEs

Understanding why Al Khuwair compliance documentation readiness matters

The commercial reality behind orderly records

Al Khuwair compliance documentation readiness is a daily operational necessity for companies operating in one of Muscat’s most commercially active districts, not an abstract concept reserved for large corporations. Al Khuwair hosts trading firms, professional services, technology providers, and family-owned enterprises that interact frequently with banks, regulators, landlords, and investors. In this environment, documentation is not simply stored for formality; it is actively examined to assess credibility, governance, and financial discipline. When records are incomplete or inconsistent, the issue is rarely confined to paperwork. It often signals weak internal controls, unclear decision-making authority, and unmanaged financial risk. For SME owners, this can translate into delayed financing, rejected tenders, strained partnerships, or regulatory scrutiny that consumes management time. Documentation readiness allows business leaders to respond confidently to requests instead of reacting under pressure. It also provides clarity internally, enabling managers to understand cash movements, contractual obligations, and compliance exposures. In Al Khuwair’s competitive landscape, companies that maintain orderly documentation demonstrate maturity and reliability. This perception directly influences how banks price risk, how counterparties negotiate terms, and how authorities engage with the business. Readiness therefore supports both compliance and commercial growth.

Core legal and structural records supporting compliance continuity

Building a stable documentary foundation

At the heart of Al Khuwair compliance documentation readiness lies a complete and up-to-date set of legal and structural records. These documents define the company’s identity, authority, and operating boundaries in Oman. Commercial registration certificates, updated shareholder agreements, and valid municipal licenses must reflect the current reality of the business, not its original setup. Many SMEs overlook updates after ownership changes, capital adjustments, or activity expansions, assuming informal understanding is sufficient. In practice, inconsistencies between records raise immediate concerns during reviews. Board resolutions, powers of attorney, and authorized signatory lists are equally critical, especially for companies engaging in financing or long-term contracts. They establish who can commit the business and under what conditions. Lease agreements for Al Khuwair premises, along with any amendments, must be readily available to confirm operating legitimacy. From an advisory perspective, gaps in these documents often emerge during restructuring, valuation, or due diligence exercises, creating avoidable delays. Maintaining a centralized, clearly indexed repository of structural records allows management to demonstrate continuity and control. It also supports smoother interactions with banks, auditors, and government entities without last-minute document reconstruction.

Financial records as the backbone of Al Khuwair compliance documentation readiness

From transactions to transparent reporting

Financial documentation forms the backbone of Al Khuwair compliance documentation readiness because it reflects how the business actually operates. Properly maintained general ledgers, trial balances, and reconciled bank statements provide a transparent trail of transactions over time. For SMEs, the challenge is often not the absence of data but its fragmentation across systems, spreadsheets, and personal records. Sales invoices, supplier bills, payroll files, and expense claims must align with accounting entries to demonstrate consistency. Fixed asset registers and inventory records are frequently underestimated, yet they play a significant role in assessing valuation accuracy and depreciation practices. Clear documentation of revenue recognition and cost allocation policies helps non-accountant owners explain financial outcomes logically. When these records are orderly, management discussions shift from justifying numbers to interpreting performance. Leaderly’s experience with Al Khuwair companies shows that businesses with disciplined financial documentation are better positioned for advisory engagements, including feasibility assessments and strategic planning. They can evaluate profitability by segment, understand cash flow timing, and make informed decisions without relying on assumptions or incomplete snapshots.

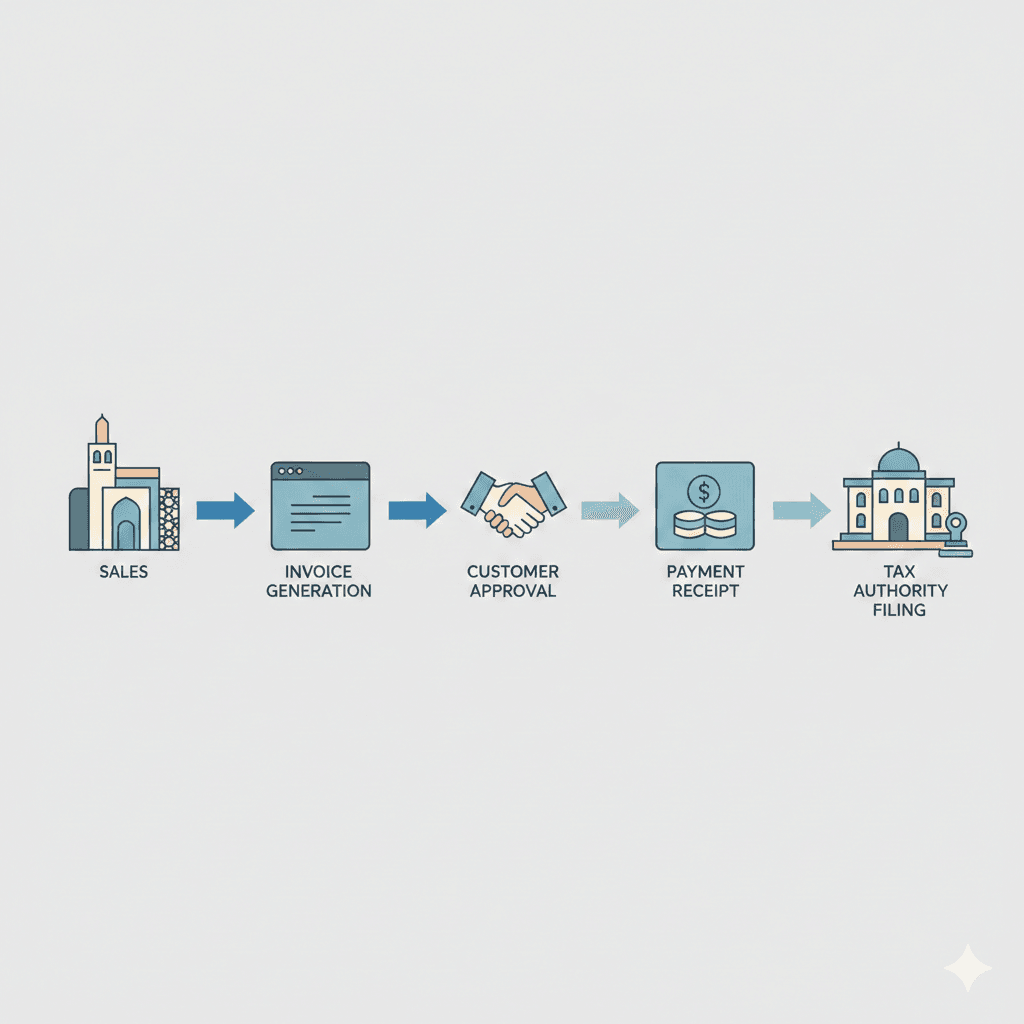

Tax-related documentation and regulatory alignment in Al Khuwair

Reducing exposure through clarity

Tax-related records are a sensitive but essential component of Al Khuwair compliance documentation readiness. Oman’s evolving tax environment requires SMEs to maintain clear, traceable documentation supporting filings and calculations. VAT-related invoices, credit notes, and adjustment records must be consistent with declared returns. Supporting schedules explaining exemptions, zero-rated supplies, or apportionments are equally important to avoid misunderstandings during reviews. For corporate tax, computation workings, carryforward schedules, and supporting contracts provide context behind reported figures. SMEs often underestimate the importance of correspondence with authorities, assuming only filed returns matter. In reality, clarification letters, assessments, and responses form part of the compliance narrative. Well-organized tax documentation reduces uncertainty and demonstrates good faith, even when interpretations differ. It also supports advisory discussions around optimization and risk management rather than damage control. Companies in Al Khuwair that maintain disciplined tax records experience fewer disruptions and are better prepared for changes in regulation. This readiness enables leadership to focus on growth initiatives instead of retroactively explaining past decisions.

Operational and contractual documents completing the readiness picture

Linking operations to financial outcomes

Beyond legal and financial records, operational and contractual documents complete Al Khuwair compliance documentation readiness by linking day-to-day activities to reported results. Customer contracts, supplier agreements, and service-level commitments explain revenue streams and cost structures in practical terms. Employment contracts, leave policies, and payroll summaries provide context for staffing costs and obligations. For SMEs, informal arrangements are common, particularly with long-standing partners or staff. However, undocumented terms create ambiguity when questions arise about pricing, deliverables, or termination rights. Insurance policies, asset maintenance records, and compliance certificates further demonstrate risk awareness. When these documents are organized and accessible, management can clearly articulate how the business functions. This clarity supports advisory services such as valuation or liquidation analysis, where understanding contractual rights and obligations is essential. In Al Khuwair’s diverse business environment, operational documentation often differentiates resilient companies from those vulnerable to disputes or misunderstandings. Readiness in this area signals disciplined management rather than excessive bureaucracy.

Sustaining Al Khuwair compliance documentation readiness over time

From one-time effort to embedded practice

Maintaining Al Khuwair compliance documentation readiness is not a one-off project but an ongoing management practice. Businesses that treat documentation as a periodic clean-up exercise often fall back into disorder as transactions accumulate. Sustainable readiness requires clear responsibility allocation, regular reviews, and simple processes aligned with the company’s scale. Digital storage solutions, consistent naming conventions, and periodic internal checks reduce dependency on individuals’ memory. Importantly, readiness improves when documentation supports decision-making rather than existing solely for compliance. When managers reference records to evaluate performance or negotiate terms, accuracy becomes a shared priority. Advisory support can help SMEs design documentation frameworks proportionate to their operations, avoiding unnecessary complexity. Over time, this discipline builds confidence internally and externally. For Al Khuwair companies aiming to expand, attract investors, or restructure, sustained readiness shortens timelines and reduces stress. It transforms documentation from a perceived burden into a strategic asset supporting growth and resilience.

For SMEs operating in Al Khuwair, compliance documentation readiness represents more than preparedness for external review; it reflects the overall health of the business. Organized records enable owners to understand their company’s true position, respond calmly to regulatory or commercial requests, and engage advisors productively. When documentation accurately mirrors operations, discussions shift toward improvement rather than explanation. This clarity supports informed decision-making across financing, taxation, and strategic planning, creating a stable platform for sustainable growth in Muscat’s competitive environment.

By embedding disciplined documentation practices into daily operations, Al Khuwair companies strengthen credibility and reduce avoidable risk. Readiness allows leadership to focus on opportunities rather than administrative recovery, and it aligns naturally with professional advisory support when needed. For SMEs seeking confidence, continuity, and control, investing in structured documentation is not an overhead but a practical step toward long-term resilience and value creation.

#Leaderly #AlKhuwaircompliancedocumentationreadiness #Oman #Muscat #SMEs #Accounting #Tax #Audit