Handling Multi-Currency in Muscat: Clean Accounting for Imports & Travel

Understanding Multi-Currency Challenges in Muscat

Handling multi-currency in Muscat is an increasingly critical issue for SMEs, especially those involved in import activities and international travel. As Oman’s economy becomes more globally integrated, businesses face the challenge of managing payments and receipts in multiple currencies such as USD, EUR, and AED. This complexity impacts financial accuracy, cash flow forecasting, and adherence to local tax regulations. For SME owners and finance managers, improper handling of currency conversions can result in distorted profit margins, errors in VAT calculations, and increased audit risks. Grasping the core challenges related to exchange rates, timing differences, and currency fluctuations is essential for maintaining clean and reliable accounting in a multi-currency environment.

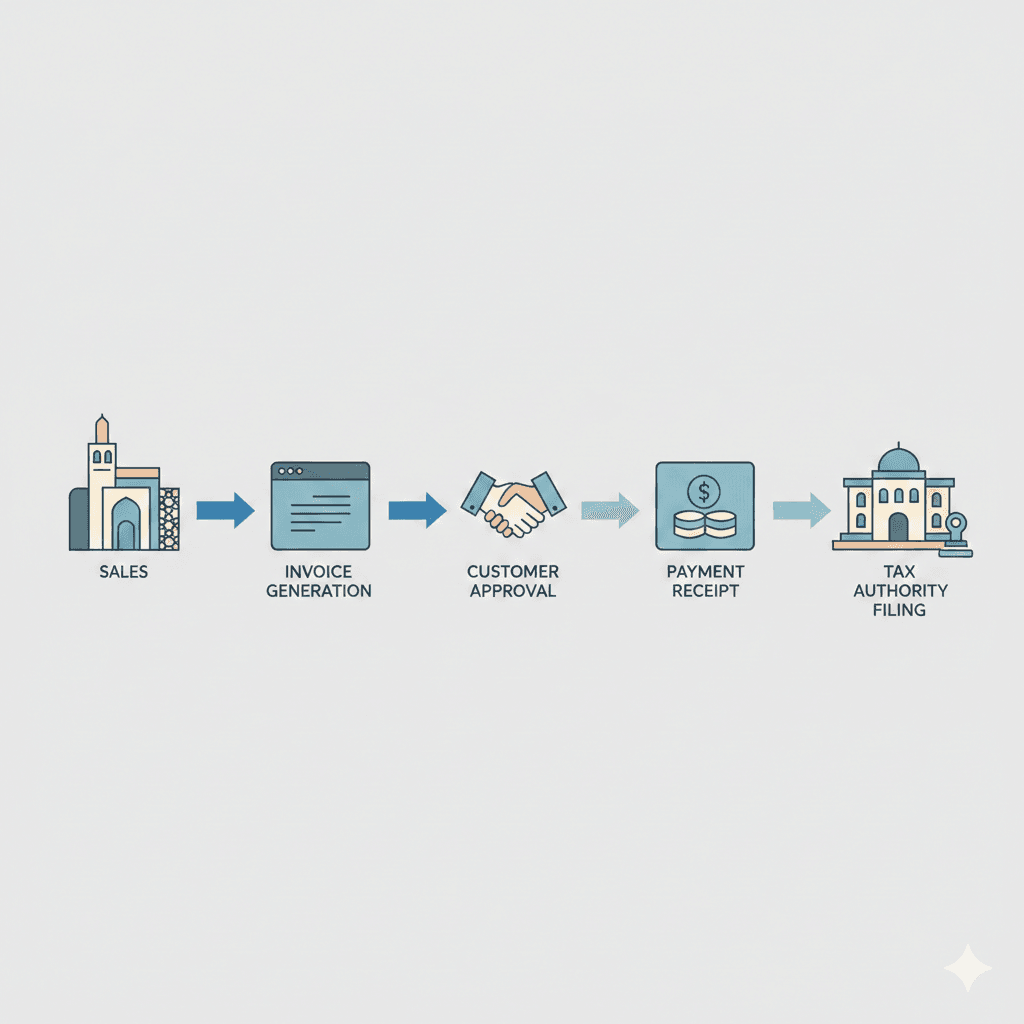

Businesses importing goods into Oman often deal with invoices denominated in foreign currencies, which need to be translated accurately into Omani Rials for accounting and tax purposes. Moreover, travel-related expenses incurred abroad further complicate the bookkeeping process by adding sporadic foreign currency transactions. Unlike single-currency accounting, these require systematic procedures to ensure exchange rate gains or losses are accounted for correctly. SME founders should be aware that local tax authorities in Oman require precise VAT reporting based on Omani Rial amounts, making the accurate handling of multi-currency transactions a compliance necessity. Clean accounting practices reduce the risk of costly penalties and simplify the audit process.

Leaderly’s advisory services emphasize the importance of clear multi-currency accounting frameworks tailored for Muscat SMEs. This means establishing consistent policies for exchange rate application, such as using Central Bank of Oman rates or agreed benchmarks at transaction dates. Finance managers should also consider the impact of timing—when transactions are recorded and payments settled—to correctly capture currency differences. In addition, the use of accounting software capable of handling multi-currency entries can streamline operations while ensuring compliance with Oman’s VAT and corporate tax rules. SMEs equipped with robust multi-currency controls gain a strategic advantage in financial clarity and decision-making.

Best Practices for Multi-Currency Imports Accounting

Managing imports accounting in multiple currencies requires both precision and adaptability for Muscat SMEs. First, businesses must accurately record the value of imported goods in Omani Rials upon receipt of the invoice. This includes applying the correct exchange rate on the date of the transaction, which often differs from the payment date. Proper documentation of exchange rates used and transparent reconciliation of any currency gains or losses is essential for audit trail integrity. Additionally, import-related expenses such as freight, insurance, and customs duties must be converted consistently to avoid distortions in cost accounting.

VAT compliance adds another layer of complexity. Since VAT in Oman is calculated in Omani Rials, SMEs must translate the foreign currency invoice amounts and VAT charged into Rial equivalents before filing returns. Any discrepancy due to exchange rate fluctuations between invoice issuance and payment settlement should be carefully tracked and adjusted in accounting records. Leaderly’s tax advisory approach helps clients navigate these nuances by setting clear guidelines for exchange rate application and VAT treatment on imported goods, thereby reducing compliance risks.

For SMEs involved in regular imports, leveraging accounting systems designed for multi-currency transactions can greatly enhance efficiency. These systems automate currency conversions and track unrealized gains or losses, improving financial accuracy. Finance managers should also establish internal controls that enforce timely updates of exchange rates and periodic reviews of multi-currency accounts. Ultimately, clean accounting practices for multi-currency imports support accurate profitability analysis, help maintain regulatory compliance, and provide transparent financial reporting to stakeholders and auditors alike.

Managing Multi-Currency Travel Expenses for SMEs in Muscat

Travel expenses paid in foreign currencies present particular accounting challenges for SMEs in Muscat, especially when staff incur costs across multiple countries with varying currencies. These expenses may include airfare, accommodation, meals, and local transport, each requiring accurate conversion to Omani Rials for reimbursement, budgeting, and VAT compliance. Without structured procedures, discrepancies in exchange rates and inconsistent recording can lead to accounting errors and difficulty reconciling travel costs.

Implementing a standardized approach to multi-currency travel expense management is crucial. SME finance managers should require employees to submit expense claims supported by original receipts and specify the currency and date of each transaction. Applying the correct exchange rate—ideally the rate on the transaction date or a predetermined rate from a reputable source—ensures that reimbursements are fair and accounting records reflect true costs. Moreover, any currency gains or losses occurring between the time of expense and reimbursement must be recorded to maintain transparent financial records.

Leaderly’s advisory on travel expenses emphasizes the importance of integrating travel cost controls into the broader multi-currency accounting framework. This integration helps SMEs streamline VAT recovery where applicable and provides clear visibility on travel-related cash flows. Accounting software that supports multi-currency expense claims simplifies these processes and reduces administrative burden. By maintaining clean records and adhering to regulatory requirements, SMEs in Muscat can avoid disputes, improve budgeting accuracy, and enhance overall financial management.

Financial Controls and Compliance in a Multi-Currency Environment

Establishing robust financial controls is essential for SMEs operating in Muscat to effectively manage multi-currency transactions and maintain compliance. Controls include defining policies on which exchange rates to use, when to record transactions, and how to handle currency gains or losses. These guidelines should be documented and regularly reviewed to adapt to changes in the business environment or tax regulations. Without such controls, SMEs risk inconsistent accounting practices that complicate audit processes and raise red flags with Oman’s tax authorities.

Oman’s tax framework, including VAT and the newly introduced corporate tax, requires precise recording of all financial transactions in Omani Rials. Multi-currency accounting must therefore integrate seamlessly with these statutory requirements. Finance managers should ensure that currency conversion procedures align with official tax rules and that all necessary supporting documentation is maintained. Leaderly’s audit and accounting services play a pivotal role in helping SMEs design these controls, conduct internal reviews, and prepare for external audits, thereby reinforcing financial discipline and regulatory adherence.

Additionally, SMEs should consider the impact of currency volatility on financial statements and cash flow forecasts. Proactive management includes monitoring foreign exchange risks and implementing hedging strategies when appropriate. Advisory support from professionals like Leaderly can guide SMEs in Muscat through these complexities, delivering tailored solutions that balance operational needs with financial prudence. Clean, compliant multi-currency accounting ultimately strengthens a company’s financial health and supports sustainable growth in Oman’s competitive marketplace.

Technology Solutions for Multi-Currency Accounting in Muscat SMEs

Technology plays a vital role in simplifying multi-currency accounting for SMEs in Muscat. Modern accounting software often includes built-in features to automatically handle currency conversions, calculate exchange gains or losses, and generate VAT reports compliant with Omani tax laws. Selecting the right software can reduce manual errors, save time, and improve overall financial accuracy. For SME owners and finance managers, investing in these tools provides greater control over complex transactions and supports timely decision-making.

When choosing software, SMEs should consider solutions that allow real-time updates of exchange rates, integration with banking platforms, and detailed reporting capabilities. These features enable seamless management of import invoices and travel expenses across different currencies, ensuring all amounts are consistently converted to Omani Rials. Leaderly’s advisory services include helping clients evaluate and implement technology that fits their unique business needs, promoting best practices in financial management and compliance.

Beyond software, ongoing training for finance teams is critical to maximize the benefits of technology. Understanding how multi-currency features work, interpreting currency fluctuations, and aligning processes with tax regulations empower SMEs to maintain clean accounting records. By combining technology with expert advisory, SMEs in Muscat can confidently handle the complexities of multi-currency operations while focusing on core business growth.

Handling multi-currency accounting in Muscat requires a deliberate approach that balances accuracy, compliance, and operational efficiency. From managing import invoices to travel expenses, SMEs must establish clear policies and leverage technology to maintain clean financial records. With professional guidance and the right tools, Muscat businesses can navigate the challenges of currency fluctuations and regulatory demands, ensuring their financial statements reflect true performance and support informed decision-making. The ability to manage multi-currency transactions effectively is not just an accounting necessity but a strategic advantage for SMEs aiming to thrive in Oman’s evolving market.

#Leaderly #HandlingMultiCurrencyInMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit