Fraud Red Flags in Muscat: Identifying Critical Finance Signals Early

Understanding Fraud Red Flags in Muscat’s SME Environment

The importance of early detection in a growing market

In Muscat’s dynamic SME landscape, fraud red flags represent early warning signs that, if overlooked, can jeopardize business stability and growth. Local businesses operate in an environment where rapid expansion and regulatory shifts increase vulnerabilities to financial misconduct. Recognizing these signals promptly enables entrepreneurs and finance managers to safeguard assets, comply with Oman’s evolving regulations, and maintain stakeholder trust. For SMEs, which often have limited resources, detecting fraud early can prevent severe financial losses and reputational damage that might otherwise cripple the business. Moreover, understanding the specific fraud indicators that manifest within the Muscat market context helps tailor internal controls effectively, balancing growth ambitions with risk mitigation. This localised focus is critical because the types of fraud encountered in Oman, including invoice manipulation, payroll discrepancies, and unauthorized transactions, differ subtly from those in other regions, requiring a keen eye on unique red flags. In this environment, financial leaders must develop a systematic approach to monitoring these signals, incorporating both technology and human oversight. Without this, many SMEs risk becoming reactive rather than proactive in fraud detection, which often leads to costly investigations and penalties. The consequences can ripple across the company’s financial statements, affecting everything from cash flow to tax compliance under Oman’s corporate tax frameworks. Understanding these nuances makes a clear case for embedding fraud awareness into everyday financial operations, something that Leaderly’s advisory services emphasize for Omani businesses seeking sustainable growth.

Common Fraud Red Flags in Muscat Finance Departments

Spotting irregularities before they escalate

Muscat SMEs often encounter identifiable finance signals that indicate potential fraud, which should not be dismissed as mere accounting errors. Frequent discrepancies in financial records such as unexplained cash shortages, repeated accounting adjustments, or unusual vendor activity can suggest fraudulent behavior. In Oman’s business environment, certain patterns are especially prevalent: inflated expense claims, duplicated payments, and false invoicing are typical fraud mechanisms that start with subtle red flags. For example, irregularities in supplier payments, such as payments to unknown vendors or inconsistent invoice numbers, frequently signal vendor fraud. Payroll anomalies, including ghost employees or unexplained overtime payments, also emerge as common red flags within Muscat’s SME finance functions. Another key area to watch is the manipulation of financial reports to hide underperformance or misappropriation. Given the increasing regulatory scrutiny in Oman, including VAT and Corporate Tax audits, falsified reports can lead to serious legal repercussions. These indicators often arise from weak internal controls or lack of segregation of duties, which many growing SMEs in Muscat still struggle to implement. Leaders who recognize these signs early can initiate targeted investigations or advisory support, preventing losses and strengthening their compliance posture. By focusing on such local fraud patterns, Muscat’s finance managers can better tailor their risk management practices to the realities of the Omani market.

Building a Culture to Combat Fraud Red Flags in Muscat

Embedding integrity into business DNA

Effective fraud prevention in Muscat starts with cultivating a culture of transparency and accountability. SMEs must move beyond purely procedural approaches and embed ethical values into daily operations, ensuring that all employees understand the consequences of fraudulent behavior. Leadership plays a crucial role by setting a tone of zero tolerance for misconduct and encouraging open communication channels where concerns can be raised without fear of retaliation. Given that many SMEs in Muscat operate with lean teams, the risk of unchecked fraud increases if these cultural elements are missing. Investing in ongoing employee training on fraud awareness tailored to Oman’s legal and economic context empowers staff to recognize and report suspicious activities. This approach complements technical controls such as regular audits and reconciliations, creating a multi-layered defense. Furthermore, transparent hiring practices and thorough background checks reduce the risk of internal fraud. By fostering a vigilant workplace culture, SMEs not only minimize financial risks but also build confidence with clients, investors, and regulatory bodies. Leaderly’s advisory teams often work closely with Muscat businesses to develop customized fraud prevention strategies that integrate culture-building with practical financial controls, reinforcing long-term sustainability.

Internal Controls and Fraud Red Flags in Muscat SMEs

Practical frameworks for detection and prevention

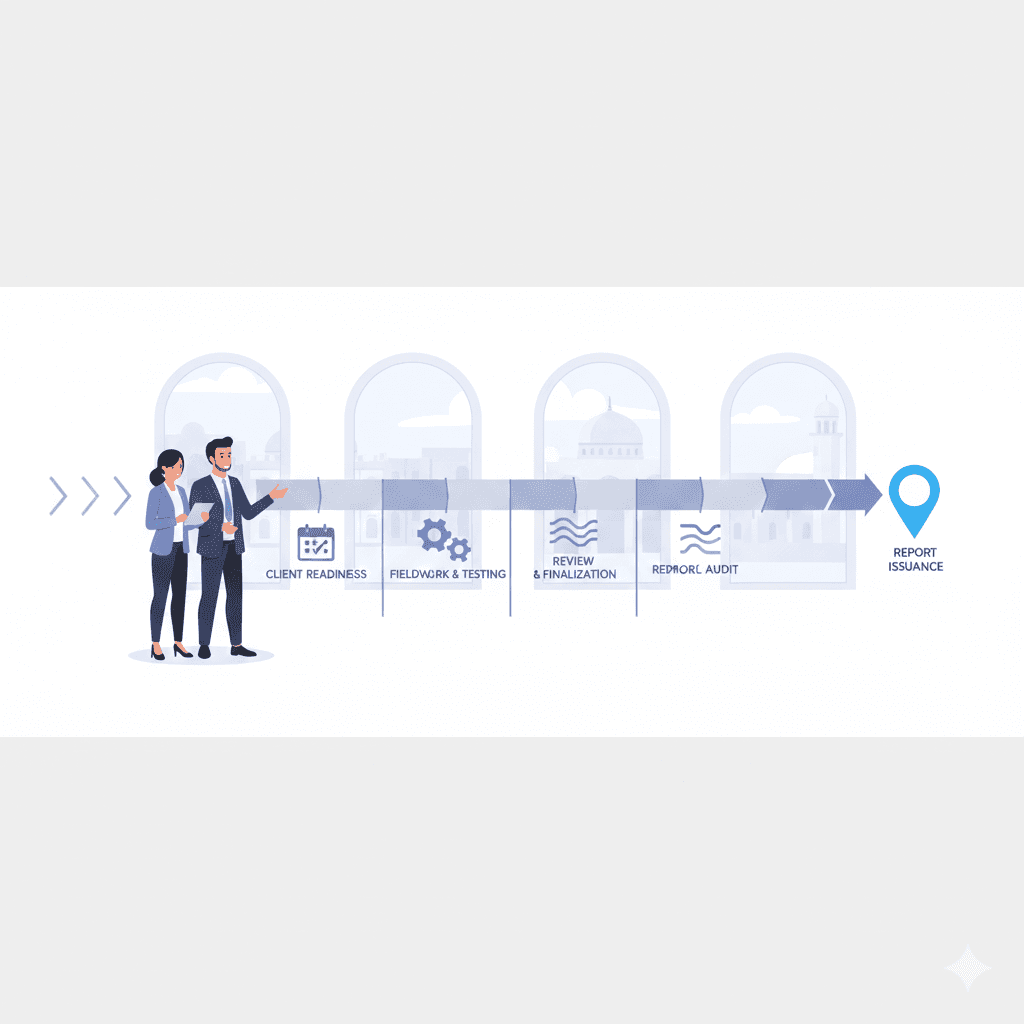

For SMEs in Muscat, robust internal controls form the backbone of identifying and mitigating fraud red flags. These controls include segregation of duties, approval hierarchies, and systematic reconciliations tailored to the size and nature of the business. A common vulnerability in many local SMEs arises from overlapping roles where financial responsibilities are concentrated in a few hands, increasing the risk of undetected fraud. Implementing clear policies that define responsibilities and enforce checks on key financial transactions is essential to minimize this risk. Regular internal audits, both scheduled and surprise, help uncover anomalies that might otherwise go unnoticed. Such audits are particularly relevant in Oman’s regulatory landscape where VAT and corporate tax authorities expect precise financial documentation. SMEs that integrate digital accounting systems with automated controls can more easily flag unusual patterns such as sudden vendor changes or abnormal expense fluctuations. Leaderly’s expertise in audit and accounting advisory supports Muscat-based SMEs in establishing these controls, ensuring that they are not only compliant but also proactive in fraud prevention. Effective internal controls thus serve as a practical tool to reduce exposure to financial irregularities and enhance operational resilience.

Regulatory Impact on Fraud Red Flags in Muscat Finance

Understanding compliance as a deterrent

The regulatory framework in Oman, particularly in Muscat, significantly shapes how SMEs detect and respond to fraud red flags. Recent enhancements in corporate tax legislation and VAT enforcement increase the need for accurate financial reporting and thorough audit trails. Failure to comply can result in steep penalties, including fines and reputational harm, making early fraud detection imperative. SMEs that overlook minor fraud signals risk triggering more extensive investigations by Oman’s tax authorities, which could disrupt operations and drain resources. Moreover, regulatory bodies increasingly encourage transparency and governance, making it essential for SMEs to maintain robust documentation and internal controls that flag inconsistencies. These frameworks also require companies to perform due diligence and risk assessments that include fraud risk. Understanding these regulatory pressures helps finance managers align their fraud prevention efforts with legal obligations, reducing both financial and compliance risks. Leaderly’s advisory services assist SMEs in navigating these regulations, ensuring that fraud detection mechanisms support full compliance and foster trust with authorities and stakeholders alike.

Technology’s Role in Detecting Fraud Red Flags in Muscat

Leveraging digital tools for enhanced oversight

Digital transformation in Muscat’s SME sector offers powerful opportunities to detect fraud red flags through advanced data analytics and automation. Financial software solutions can automatically identify suspicious transactions, such as duplicate payments or abnormal expense claims, by analyzing large volumes of data that manual reviews might miss. These tools enable real-time monitoring, giving finance managers immediate insight into potential risks. In a market like Muscat, where SMEs are rapidly adopting technology, integrating these digital safeguards enhances the effectiveness of traditional audit and control measures. Additionally, cloud-based accounting systems facilitate secure record-keeping and improve transparency by allowing multiple authorized users to access and verify data. This reduces the risk of data manipulation and supports compliance with Oman’s tax and audit requirements. However, technology alone is not enough; it must be paired with skilled human oversight to interpret alerts and take appropriate action. Leaderly provides advisory support in selecting and implementing these technologies, ensuring that Muscat SMEs leverage them to create a proactive fraud detection environment. Embracing digital solutions is thus a critical step toward safeguarding financial integrity in Oman’s evolving business ecosystem.

Fraud Red Flags in Muscat demand vigilant attention from SME leaders who seek to protect their financial health and reputation. By understanding the unique fraud signals common in the local market, building a strong ethical culture, and implementing practical internal controls, businesses can significantly reduce their exposure to financial misconduct. Furthermore, aligning these efforts with Oman’s regulatory environment enhances compliance and minimizes costly penalties.

Integrating modern technology with human expertise creates a robust framework that detects anomalies early and enables swift corrective action. This multifaceted approach empowers SMEs in Muscat to navigate growth challenges confidently, maintaining resilience against fraud risks while reinforcing trust with stakeholders and regulators. With focused strategies tailored to Oman’s specific business context, companies can transform fraud red flags from threats into opportunities for strengthening financial governance and sustainable success.

#Leaderly #FraudRedFlagsInMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit