Expense Claims in Oman: A Muscat Policy That Stops Leakage

Understanding Expense Claims in Oman and Their Role in Financial Control

Expense claims in Oman form a crucial part of how SMEs and businesses operating in Muscat manage their day-to-day expenditures. These claims refer to the process by which employees or business owners request reimbursement for costs incurred on behalf of the company, ranging from travel to office supplies and client entertainment. In Oman’s dynamic commercial landscape, managing these claims effectively is essential to prevent financial leakage—where funds are lost due to inefficiencies, errors, or fraud. A robust expense claim policy serves not only as a financial control mechanism but also supports transparency and compliance with Oman’s evolving tax regulations, including VAT and corporate tax requirements. Ensuring that all expense claims are properly documented and approved can protect SMEs from audit risks and costly penalties.

Moreover, expense claims directly impact cash flow management in Muscat-based businesses, where liquidity must be maintained carefully amid fluctuating market conditions. Without a strict policy, companies risk delayed reimbursements, employee dissatisfaction, and even abuse of funds. Well-defined guidelines tailored to the Omani context help business owners and finance managers maintain oversight, enforce consistency, and align spending with company budgets and strategic goals. This alignment enhances decision-making and preserves profitability. Given the increasing regulatory scrutiny in Oman, adopting a clear expense claims framework has become a best practice for SMEs seeking sustainable growth.

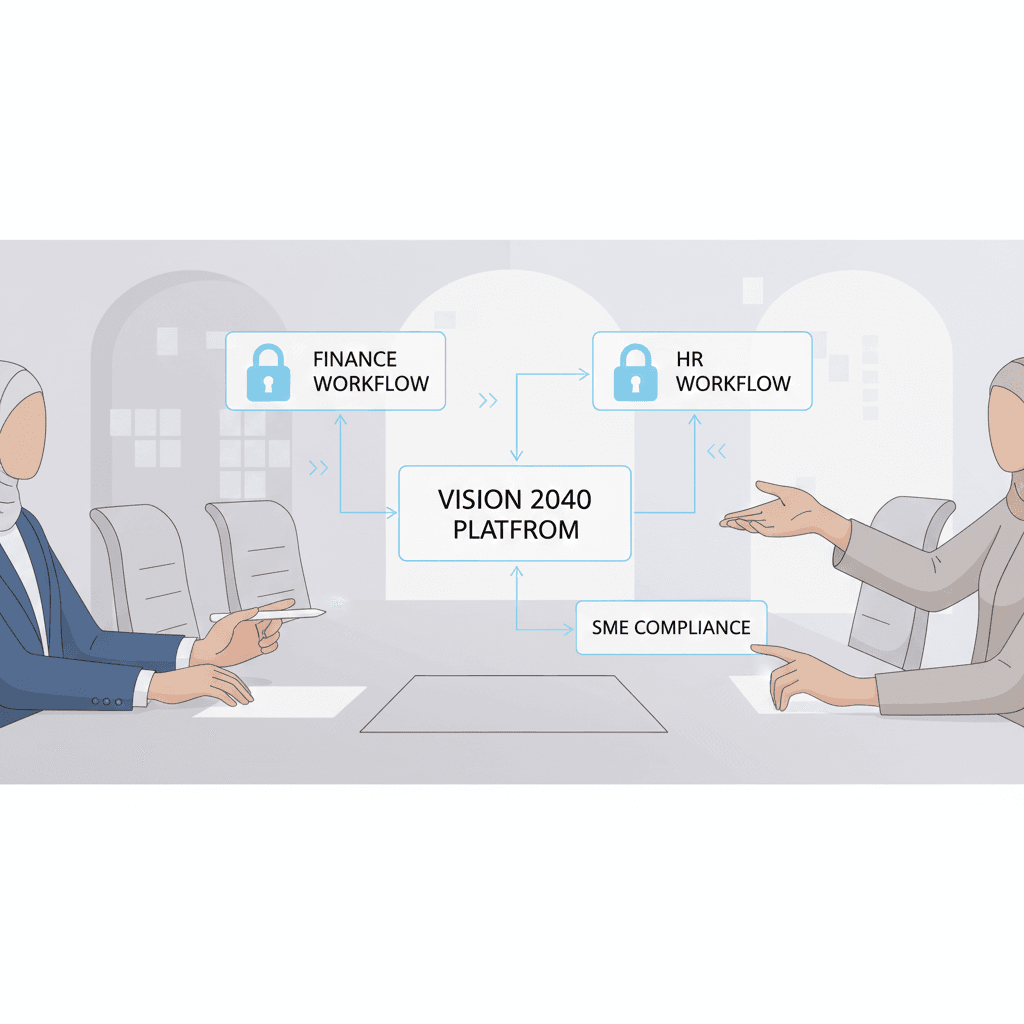

Finally, an effective expense claims process integrates seamlessly with broader accounting and audit practices, a service area where Leaderly specializes. By incorporating technological solutions and advisory expertise, businesses in Muscat can automate validation steps, streamline approvals, and maintain comprehensive records that support both internal audits and external regulatory requirements. This proactive approach not only reduces the risk of leakage but also builds stakeholder confidence and supports ongoing compliance with Oman’s financial laws.

Implementing Expense Claims Policies to Align with Oman’s VAT and Corporate Tax Laws

One of the most important considerations for SMEs in Muscat when setting up expense claims policies is compliance with Oman’s VAT and corporate tax legislation. Since Oman introduced VAT in 2021 and is progressively enforcing corporate tax laws, companies must ensure their expense documentation meets the legal requirements to claim deductions or recover VAT paid on business-related expenses. The policy should mandate detailed receipts, clear descriptions, and proper categorization of expenses to facilitate seamless VAT input tax recovery. Without this, SMEs risk losing valuable tax credits or facing penalties during tax audits.

Leaderly’s advisory services highlight the necessity of educating employees and finance teams on the specific documentation and approval criteria that meet Oman’s tax authorities’ expectations. An expense claim policy should incorporate standardized forms and digital tools that prompt claimants to provide the necessary information for tax compliance. This includes specifying which expenses qualify for VAT deduction and which do not, thereby minimizing confusion and accidental non-compliance. A Muscat-specific policy that integrates these rules ensures the company is audit-ready and avoids surprises in its tax liabilities.

Additionally, a clear expense claims policy aids companies in corporate tax planning by enabling accurate tracking of deductible expenses. This transparency can influence a business’s tax position and overall financial strategy. For SMEs operating under tight budgets, capturing every allowable deduction is critical to optimize taxable income and reinvest savings into growth initiatives. Leaderly’s expertise in taxation supports SMEs in designing these policies to match their operational realities while adhering to Oman’s legal framework, ultimately safeguarding financial health and ensuring compliance.

Training and Technology: Enhancing Expense Claims Compliance in Muscat SMEs

A policy alone is insufficient if employees and management do not understand its importance or lack the tools to enforce it effectively. Therefore, Muscat-based SMEs should invest in ongoing training and modern expense management software to reduce errors and improve compliance. Training should focus on the practical aspects of claim submission, common pitfalls, and the consequences of policy breaches, tailored to the Omani business environment. By empowering staff with clear knowledge, companies foster a culture of accountability and financial discipline.

Technological solutions, such as cloud-based expense tracking and mobile apps, help SMEs automate approval workflows, ensure consistent application of policy rules, and provide real-time visibility into spending patterns. This reduces administrative burden and human error, while accelerating reimbursement processes, which boosts employee morale. Furthermore, these systems generate reports useful for internal audits and external reviews by tax authorities, aligning perfectly with Leaderly’s audit and advisory services. Integrating technology also supports data security and record retention practices mandated by Oman’s regulations.

Moreover, leveraging technology and training together positions SMEs to adapt quickly to regulatory changes or shifts in business needs. For example, if Oman’s VAT rates or corporate tax policies evolve, having a flexible and well-understood expense claims framework allows businesses to update their processes smoothly without disrupting operations. This agility is crucial for SMEs in Muscat navigating a competitive marketplace and complex financial landscape.

Preventing Financial Leakage Through Rigorous Approval and Monitoring

At the core of stopping leakage in expense claims is a rigorous approval process tailored to the size and structure of the SME. In Oman, where many SMEs are family-owned or closely held, establishing clear roles and segregation of duties within the approval chain is essential to prevent conflicts of interest and misuse of funds. Leaderly advises companies to implement multi-tiered approvals based on claim amount thresholds, ensuring larger expenditures receive heightened scrutiny. This layered approach mitigates risks and reinforces accountability.

Monitoring expense claims through regular audits and reconciliations also helps identify anomalies or trends indicative of potential leakage. Muscat businesses should schedule periodic reviews of claim submissions against budgets and business activity to detect unusual patterns. Leveraging Leaderly’s audit expertise, SMEs can design internal controls that balance oversight with operational efficiency, minimizing disruption while safeguarding assets. Such controls also provide credible documentation during statutory audits and build trust with investors or lenders.

Ultimately, an expense claims policy that incorporates these control measures fosters disciplined spending and reduces opportunities for errors or fraud. Preventing leakage not only protects the bottom line but also supports a transparent financial culture that enhances the reputation and sustainability of SMEs operating in Oman’s competitive economy.

Aligning Expense Claims Policies with Business Growth and Strategic Objectives

As SMEs in Muscat grow, their expense management needs evolve, requiring policies that adapt to increasing transaction volumes and diverse expense categories. Leaderly encourages companies to periodically review and refine their expense claims policies to reflect operational realities and strategic goals. For example, expanding international travel or new client entertainment initiatives might necessitate updated guidelines or higher approval limits. Maintaining alignment with business objectives ensures expense policies remain relevant and effective.

A mature expense claims policy also integrates with broader financial planning and reporting processes. By categorizing expenses consistently and linking them to projects or departments, SMEs gain better insights into profitability drivers and cost control opportunities. This information supports smarter budgeting and forecasting decisions, contributing to long-term business sustainability. Leaderly’s advisory services assist SMEs in developing these integrative frameworks that bring financial clarity and agility.

Finally, clear and adaptable expense policies enhance employee trust and satisfaction by setting transparent expectations around reimbursements. This contributes positively to workplace culture and productivity, which are vital as SMEs scale operations in Oman. A strategic approach to expense claims is therefore not only a financial safeguard but a business enabler that underpins sustainable growth.

Conclusion

Expense claims in Oman are far more than routine financial transactions; they are a strategic lever for controlling costs, ensuring compliance, and safeguarding business integrity. For SMEs in Muscat, developing and maintaining a well-crafted expense claims policy that incorporates Oman’s VAT and corporate tax requirements is essential to prevent leakage and optimize financial performance. Such policies foster transparency, enhance audit readiness, and support smooth operations that align with local regulations and business realities.

Moreover, combining clear policies with employee training, technological tools, and robust approval controls empowers SMEs to manage expense claims efficiently while adapting to evolving business needs. This integrated approach builds financial discipline and confidence, positioning SMEs for sustainable growth in Oman’s competitive market. By leveraging Leaderly’s expertise in audit, accounting, and advisory services, businesses can design expense claim frameworks that not only protect their bottom line but also enable strategic agility and success.

#Leaderly #ExpenseClaimsinOman #Oman #Muscat #SMEs #Accounting #Tax #Audit