E-Invoicing Security in Oman: Safeguarding SMEs from Fraud and Data Breaches

Understanding E-Invoicing Security in Oman

The foundation for trustworthy digital transactions

E-Invoicing security in Oman has become a critical concern for businesses, especially SMEs, as the country advances its digital economy under Vision 2040. With the mandatory implementation of electronic invoicing by the Oman Tax Authority, organizations face new challenges in protecting invoice data from fraud and unauthorized access. E-invoices carry sensitive financial details that, if compromised, can lead to significant financial losses and reputational damage. Understanding how e-invoicing systems secure data through encryption, authentication, and audit trails is essential for business owners and finance managers. These technical safeguards prevent tampering and unauthorized manipulation of invoices, ensuring that transactions remain legitimate and verifiable.

Implementing e-invoicing security measures is not just a regulatory requirement but a strategic necessity for SMEs in Oman. The digital nature of e-invoicing exposes companies to cybersecurity risks that were previously uncommon in paper-based invoicing. Invoice fraud—such as falsified amounts, duplicated invoices, or fraudulent supplier details—can disrupt cash flow and complicate tax compliance. Therefore, businesses must ensure their invoicing platforms integrate advanced security protocols, including multi-factor authentication and secure access controls, to mitigate such risks effectively. Moreover, secure data storage and transmission practices must comply with Oman’s legal frameworks, protecting customer and vendor information from leaks and breaches.

For entrepreneurs and finance managers navigating this transition, understanding the specific risks tied to e-invoicing security in Oman is paramount. Besides technical solutions, fostering awareness and training among staff about phishing attempts and social engineering attacks adds an important human layer of defense. Aligning with professional advisory services that specialize in digital finance and compliance can provide tailored solutions to strengthen invoice integrity. Leaderly’s expertise in audit, taxation, and advisory roles equips SMEs with the tools to embed security at every stage of their e-invoicing processes, turning compliance into a competitive advantage.

The Role of Regulatory Compliance in Strengthening E-Invoicing Security

Aligning with Oman’s tax regulations to enhance trust

Oman’s regulatory framework for e-invoicing is designed to combat invoice fraud and protect data integrity while streamlining tax reporting processes. The Oman Tax Authority mandates real-time submission and validation of e-invoices, which creates a digital audit trail that discourages fraudulent activities. SMEs must comply with these requirements to avoid penalties and gain the benefits of a transparent, secure invoicing ecosystem. Adhering to these regulations helps businesses build credibility with customers and tax authorities, reducing disputes and enhancing operational efficiency.

These regulations also introduce specific technical standards that e-invoicing software providers must meet, such as digital signature use and secure transmission protocols. For SMEs, choosing compliant systems that meet these standards is vital to maintain legal conformity and protect against invoice manipulation or data interception during transmission. Leaderly’s advisory services help companies navigate these compliance complexities, advising on the best software solutions and practices tailored to the unique demands of Omani market conditions and regulatory expectations.

Beyond technical compliance, the regulatory environment encourages ongoing monitoring and auditing of invoicing activities. This vigilance allows SMEs to detect irregular patterns early, minimizing the risk of fraud escalation or data breaches. Internal audit functions, aligned with external regulatory standards, become a crucial part of this defense. Through expert financial audits and due diligence services, Leaderly supports SMEs in maintaining robust internal controls that underpin secure e-invoicing operations, enhancing overall business resilience.

Practical Strategies for Preventing Invoice Fraud in Omani SMEs

Implementing effective controls to safeguard financial transactions

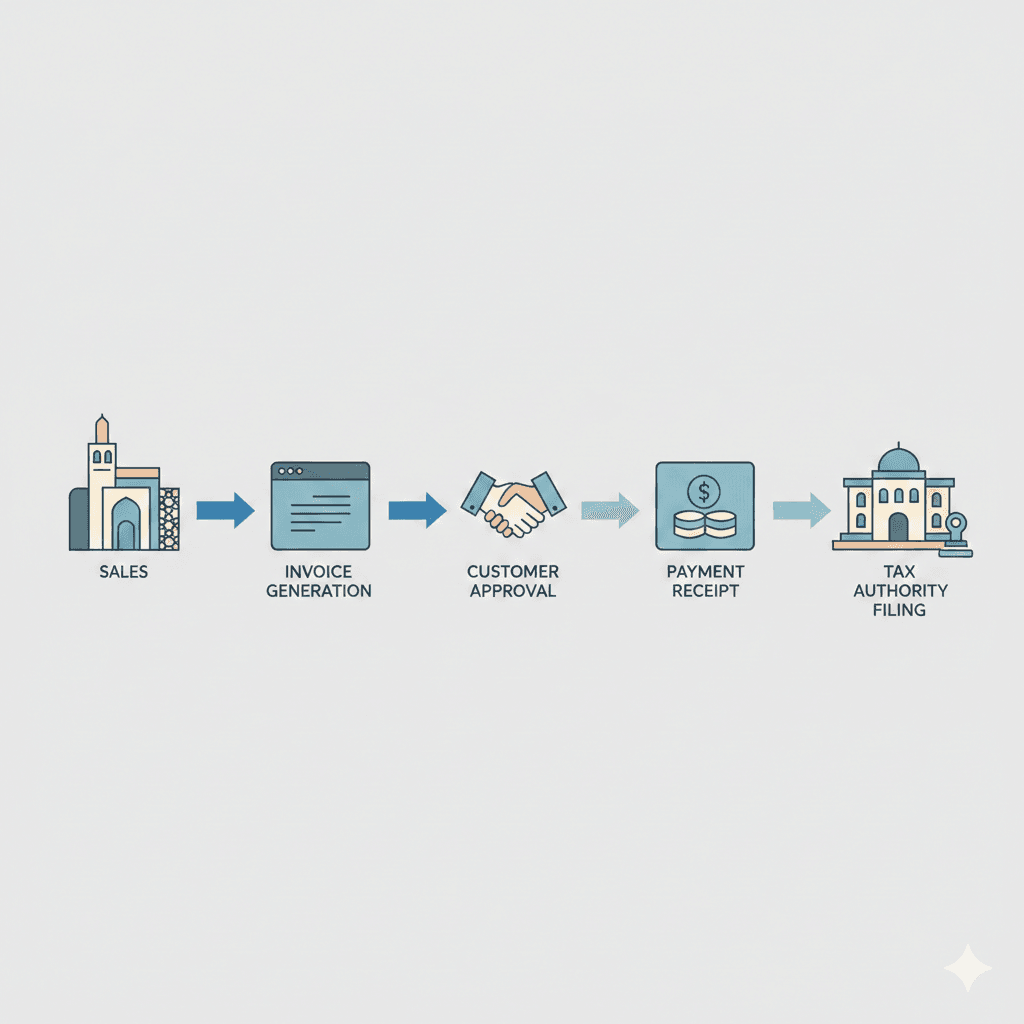

Preventing invoice fraud within Omani SMEs requires a blend of technology, process controls, and personnel vigilance. Firstly, automation within e-invoicing systems reduces manual intervention, thereby lowering the risk of human error and fraudulent alterations. Automation tools can flag suspicious activities such as duplicate invoice numbers or unusually high amounts that deviate from historical trends. Integrating these capabilities into daily financial operations helps maintain invoice accuracy and trustworthiness.

Secondly, segregation of duties is a fundamental control in preventing fraud. SMEs should clearly separate responsibilities related to invoice creation, approval, and payment to avoid conflicts of interest. This internal control ensures that no single individual can manipulate the invoicing process unchecked. Training employees on fraud awareness and the importance of following established protocols further strengthens these measures.

Lastly, secure digital identity management is key. Ensuring that only authorized personnel have access to invoicing platforms through role-based permissions and multi-factor authentication limits opportunities for internal or external fraudsters to compromise data. Regularly updating passwords and monitoring access logs are practical steps SMEs can take to detect and respond quickly to potential breaches. Leaderly’s audit and advisory teams work closely with businesses to design these security frameworks, providing tailored guidance that aligns with Oman’s evolving digital finance landscape.

Securing Sensitive Data in E-Invoicing Systems

Protecting SME financial information against data leaks

Data protection in e-invoicing systems is critical to safeguarding SMEs from breaches that could expose sensitive financial and business information. E-invoices contain client details, pricing, and transaction history, all of which are attractive targets for cybercriminals. Secure encryption of data both in transit and at rest prevents unauthorized interception and access. SMEs must ensure their e-invoicing platforms use the latest encryption standards and regularly update their security patches.

Cloud-based invoicing solutions, increasingly popular in Oman for their flexibility, come with shared responsibility models. This means that while the provider secures the infrastructure, SMEs must enforce strong internal policies on user access and data handling. Backups and disaster recovery plans are also essential to protect against data loss and maintain business continuity. Leaderly’s advisory services support SMEs in evaluating cloud security risks and implementing appropriate safeguards aligned with Oman’s legal data protection requirements.

Beyond technology, SMEs must also manage third-party risks carefully. Vendor and partner security policies directly impact the overall security posture of e-invoicing systems. Due diligence in selecting technology providers and regular security assessments can identify vulnerabilities before they lead to data leaks. Leaderly’s due diligence and audit expertise help businesses establish trustworthy relationships with their technology partners, ensuring end-to-end security in the invoicing lifecycle.

Building Resilience Through Continuous Monitoring and Audit

Proactive approaches to maintain e-invoicing security in Oman

Continuous monitoring and periodic audits form the backbone of sustainable e-invoicing security in Oman’s SME sector. Real-time monitoring of invoicing activities allows businesses to detect anomalies that may indicate fraud or data breaches quickly. Employing automated alerts and analytics tools enables finance teams to respond proactively rather than reactively, minimizing potential damage. Such vigilance is particularly important given the rising sophistication of cyber threats targeting digital financial processes.

Periodic internal and external audits are equally important for verifying the effectiveness of security controls and regulatory compliance. These audits provide an independent assessment of an SME’s e-invoicing environment, identifying gaps and recommending improvements. The audit process also strengthens investor and stakeholder confidence by demonstrating a commitment to transparency and risk management. Leaderly’s audit services offer SMEs detailed insights into their financial systems and compliance posture, empowering them to take corrective actions promptly.

Building resilience in e-invoicing security also requires continuous staff training and policy updates. Cybersecurity is a constantly evolving field, and maintaining awareness among employees helps prevent social engineering attacks and insider threats. Leaderly supports SMEs in developing comprehensive training programs and security policies that reflect current risks and Oman-specific regulatory requirements. Together, these measures build a culture of security that underpins business sustainability and growth.

In conclusion, e-invoicing security in Oman represents a pivotal challenge and opportunity for SMEs striving to protect their financial integrity in a rapidly digitalizing economy. By understanding the technical and regulatory landscape, implementing practical fraud prevention controls, and securing sensitive data effectively, businesses can mitigate risks and enhance trust with stakeholders. Continuous monitoring and professional audit services are indispensable for maintaining this security and adapting to evolving threats.

Leaderly’s expertise uniquely positions it to support Omani SMEs in this journey, providing tailored advisory, taxation, and audit solutions that integrate security into every stage of e-invoicing. Embracing robust e-invoicing security practices is not only about compliance but about future-proofing business operations, ensuring SMEs remain competitive and resilient as Oman advances its digital economy.

#Leaderly #E-InvoicingSecurityInOman #Oman #Muscat #SMEs #Accounting #Tax #Audit