Digital Transformation in Oman: The Financial Revolution Under Vision 2040

Digital Transformation in Oman: A Visionary Shift in Financial Practices

Setting the stage for Oman’s economic modernization

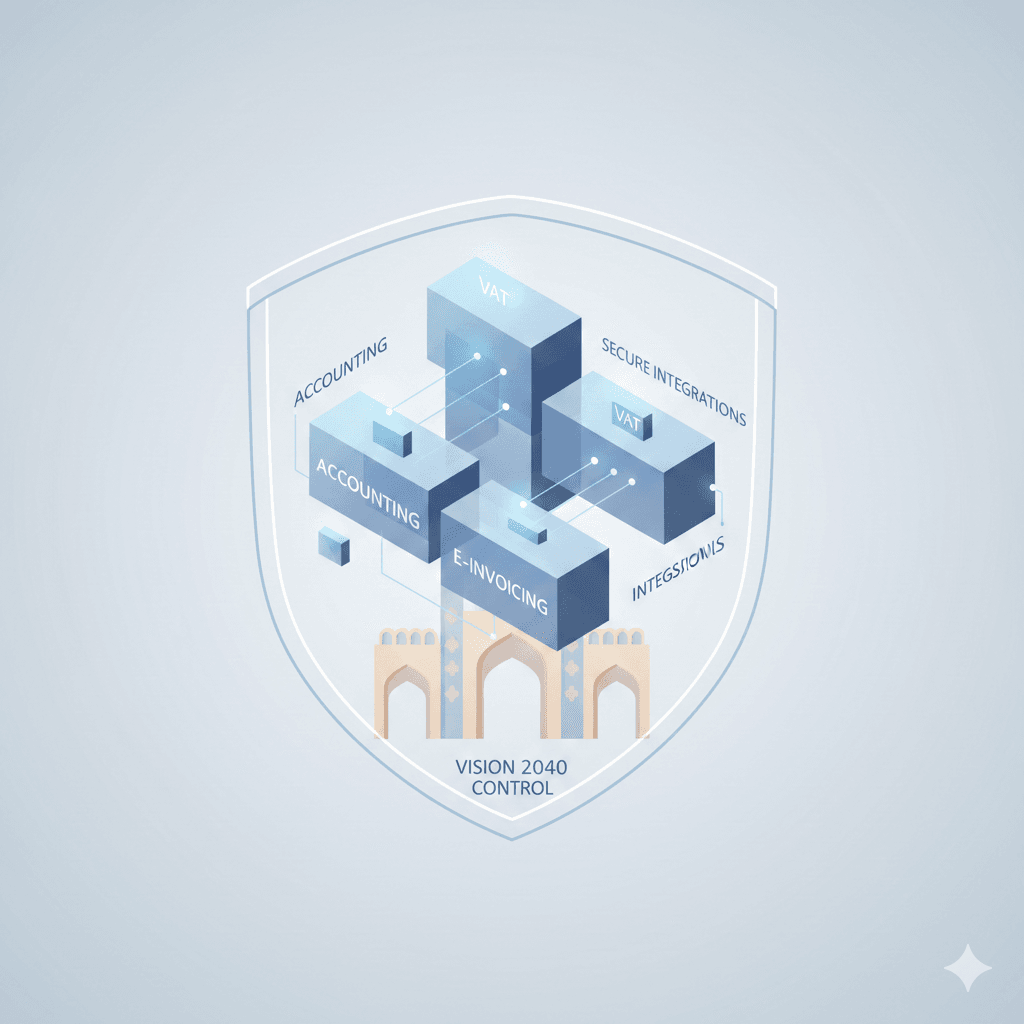

Digital Transformation in Oman is not just a buzzword but a fundamental change reshaping how businesses handle financial operations under the umbrella of Vision 2040. This national strategy prioritizes innovation and technology as cornerstones for economic diversification beyond oil dependency. For SMEs and entrepreneurs, this means adapting to new digital tools and platforms that streamline finance management, enhance accuracy, and improve compliance. Financial processes traditionally reliant on manual systems are being replaced with automation, cloud-based accounting, and integrated tax solutions. These changes foster transparency and efficiency, enabling SMEs to better track cash flows, manage expenses, and forecast growth. Vision 2040’s focus on digital adoption reflects Oman’s commitment to global competitiveness and sustainability, empowering business owners with tools that align with modern market demands.

The Role of Government Initiatives in Driving Finance Digitalization

From e-invoicing mandates to digital tax systems

Government initiatives under Vision 2040 have accelerated the pace of digital transformation in Oman’s finance sector. One key driver is the mandatory adoption of e-invoicing and digital VAT reporting, designed to ensure accurate tax collection and reduce fraud. These regulations require SMEs and larger enterprises to transition to electronic invoicing systems integrated with the Oman Tax Authority’s platforms. The shift promotes real-time data sharing, faster processing, and reduced paperwork, which significantly lightens the administrative load on businesses. Moreover, digital tax platforms improve compliance rates and provide clearer audit trails, helping finance managers avoid penalties. Leaderly’s advisory services naturally support companies in navigating these regulatory changes by offering practical guidance on technology integration and compliance strategies. As Oman advances, businesses that embrace these digital reforms are better positioned to sustain growth and meet future fiscal challenges.

Technology’s Impact on SME Financial Management

Enhanced decision-making through digital tools

Digital Transformation in Oman empowers SMEs to harness technology for smarter financial management, moving beyond basic bookkeeping to strategic planning. Cloud-based accounting software, automated invoicing, and AI-powered analytics offer real-time insights into business performance. For entrepreneurs and finance managers, this means quicker access to accurate financial data, enabling proactive cash flow management, budget adjustments, and risk mitigation. Technology also facilitates easier collaboration between finance teams and external advisors, such as auditors and tax consultants, enhancing transparency and control. Additionally, digital platforms support scenario planning and valuation exercises critical for business growth and investment readiness. Leaderly’s audit and advisory services align with this shift by providing expertise that complements digital finance tools, ensuring SMEs leverage their data effectively to make informed, compliant, and growth-oriented decisions.

Adapting Corporate Taxation to a Digital Era

Corporate tax compliance in an increasingly automated landscape

The introduction of corporate tax in Oman under Vision 2040 has coincided with increased digitalization of tax processes, creating both opportunities and challenges for businesses. Digital Transformation in Oman’s corporate tax framework simplifies filing, calculation, and payment through dedicated electronic platforms. This automation reduces human error and accelerates processing times, which benefits SMEs that might otherwise face complex compliance hurdles. However, the digital approach also demands that businesses invest in compatible financial systems and train staff accordingly. Failure to adapt risks delays and penalties, underscoring the need for practical, tailored advisory support. Leaderly’s taxation services provide crucial guidance on integrating digital tax compliance within broader financial management practices, helping SMEs maintain accuracy and timeliness. Ultimately, this digital tax environment enhances transparency and accountability, aligning Oman with international fiscal standards.

Financial Advisory in Oman’s Digital Future

Feasibility, valuation, and due diligence in a tech-driven world

As Oman’s business environment transforms digitally, financial advisory services evolve to meet the demands of data-driven decision-making. Digital Transformation in Oman enhances the availability of accurate, real-time financial information critical for feasibility studies, business valuations, and due diligence processes. These services rely on integrating digital financial records, automated reporting, and predictive analytics to provide more precise and timely advice. Entrepreneurs and SME owners benefit from this evolution by gaining clearer insights into their company’s financial health and growth prospects. Additionally, digital tools facilitate smoother liquidation and restructuring processes when needed, reducing risks and uncertainties. Leaderly’s advisory team is well-positioned to guide clients through this transition, blending traditional financial expertise with modern digital capabilities to optimize outcomes and ensure regulatory compliance.

Building Financial Resilience Through Digital Transformation

Long-term benefits for Oman’s SMEs

The broader impact of Digital Transformation in Oman extends beyond immediate efficiency gains to fostering resilience and adaptability among SMEs. By adopting integrated financial technologies aligned with Vision 2040, businesses gain agility to respond to market fluctuations and regulatory changes. Automation reduces operational bottlenecks, freeing finance teams to focus on strategic initiatives and growth planning. Enhanced data quality supports better risk assessment and financial forecasting, crucial for securing funding or partnerships. Furthermore, digital finance systems strengthen internal controls, reducing the likelihood of errors or fraud, and improving audit readiness. As Omani SMEs continue to embrace these changes, they build stronger foundations for sustainable growth and competitive advantage in a global economy increasingly shaped by technology and innovation.

Digital transformation is thus a pivotal element in shaping the future of finance in Oman under Vision 2040, offering both challenges and tremendous opportunities for SMEs and entrepreneurs alike.

Digital Transformation in Oman represents a strategic leap forward in aligning financial management practices with the country’s long-term economic ambitions. By embracing new technologies and regulatory frameworks, business owners and finance professionals can unlock efficiencies, ensure compliance, and make smarter decisions that drive growth. The ongoing digital shift demands commitment but promises clear rewards in operational excellence and market readiness. For Oman’s SMEs, this evolution is not just about keeping pace with global trends but about positioning themselves as leaders in an increasingly digital economy. With the right advisory support and proactive adaptation, businesses can confidently navigate the complexities of digital finance and fully benefit from the opportunities Vision 2040 creates.

#Leaderly #DigitalTransformationinOman #Oman #Muscat #SMEs #Accounting #Tax #Audit