Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Accounting Software in Oman: What Muscat…

Accounting Software in Oman: What Muscat… Fraud Red Flags in Muscat: Finance Signa…

Fraud Red Flags in Muscat: Finance Signa… Muscat Hybrid Work Security Strategy

Muscat Hybrid Work Security Strategy Muscat Tax & VAT Compliance: How to…

Muscat Tax & VAT Compliance: How to… How to Handle Advances in Muscat Staff, …

How to Handle Advances in Muscat Staff, … Vision 2040 Secure Document Management O…

Vision 2040 Secure Document Management O… Muscat e-invoicing process map for SMEs …

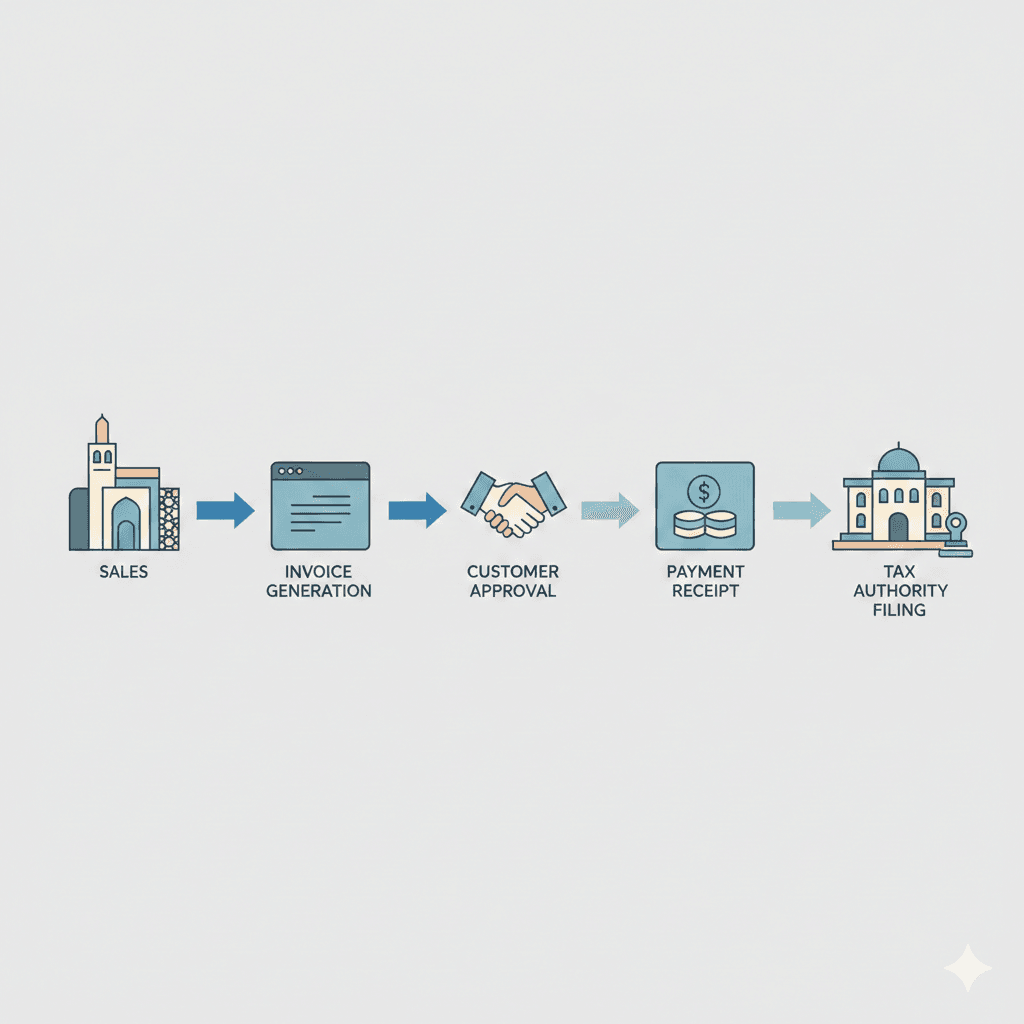

Muscat e-invoicing process map for SMEs … Muscat Year-End Close Framework for a Sm…

Muscat Year-End Close Framework for a Sm… E-Invoicing in Oman: What Businesses Mus…

E-Invoicing in Oman: What Businesses Mus… Scenario Planning in Oman Muscat Finance…

Scenario Planning in Oman Muscat Finance… Mutrah Market Financial Controls Bookkee…

Mutrah Market Financial Controls Bookkee… Muscat SME Chart of Accounts Design for …

Muscat SME Chart of Accounts Design for … Ghala Accounting for Logistics: Managing…

Ghala Accounting for Logistics: Managing… Azaiba VAT for Restaurants: Navigating V…

Azaiba VAT for Restaurants: Navigating V… Oman Vision 2040 Cloud Security: Practic…

Oman Vision 2040 Cloud Security: Practic… Muscat Audit Questions What Auditors Ask…

Muscat Audit Questions What Auditors Ask… Wadi Kabir Workshops Parts Labor Warrant…

Wadi Kabir Workshops Parts Labor Warrant… Vision 2040 E-Invoicing Implementation i…

Vision 2040 E-Invoicing Implementation i… Muscat SME Banking Readiness Framework: …

Muscat SME Banking Readiness Framework: … Leaderly Accounting Services in Muscat: …

Leaderly Accounting Services in Muscat: …