Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Vision 2040 Cybersecurity Awareness Trai…

Vision 2040 Cybersecurity Awareness Trai… Payroll Errors in Oman The Most Common I…

Payroll Errors in Oman The Most Common I… Muscat VAT audit readiness for growing O…

Muscat VAT audit readiness for growing O… Accounting for Fixed Assets in Oman: Mus…

Accounting for Fixed Assets in Oman: Mus… Azaiba Restaurant Cash Control Muscat Pr…

Azaiba Restaurant Cash Control Muscat Pr… Oman Vision 2040 Email Security Why Busi…

Oman Vision 2040 Email Security Why Busi… Muscat Vendor Lock-In Strategy 2040 Buil…

Muscat Vendor Lock-In Strategy 2040 Buil… Oman Vision 2040 Digital Skills Essentia…

Oman Vision 2040 Digital Skills Essentia… Muscat E-Commerce Payment Reconciliation…

Muscat E-Commerce Payment Reconciliation… Petty Cash Controls in Muscat: Stop Leak…

Petty Cash Controls in Muscat: Stop Leak… VAT Recordkeeping in Muscat: What to Kee…

VAT Recordkeeping in Muscat: What to Kee… Muscat SME Loan Documentation Framework:…

Muscat SME Loan Documentation Framework:… Muscat Security-by-Design Strategy: Oman…

Muscat Security-by-Design Strategy: Oman… How to Reconcile Bank Accounts in Muscat…

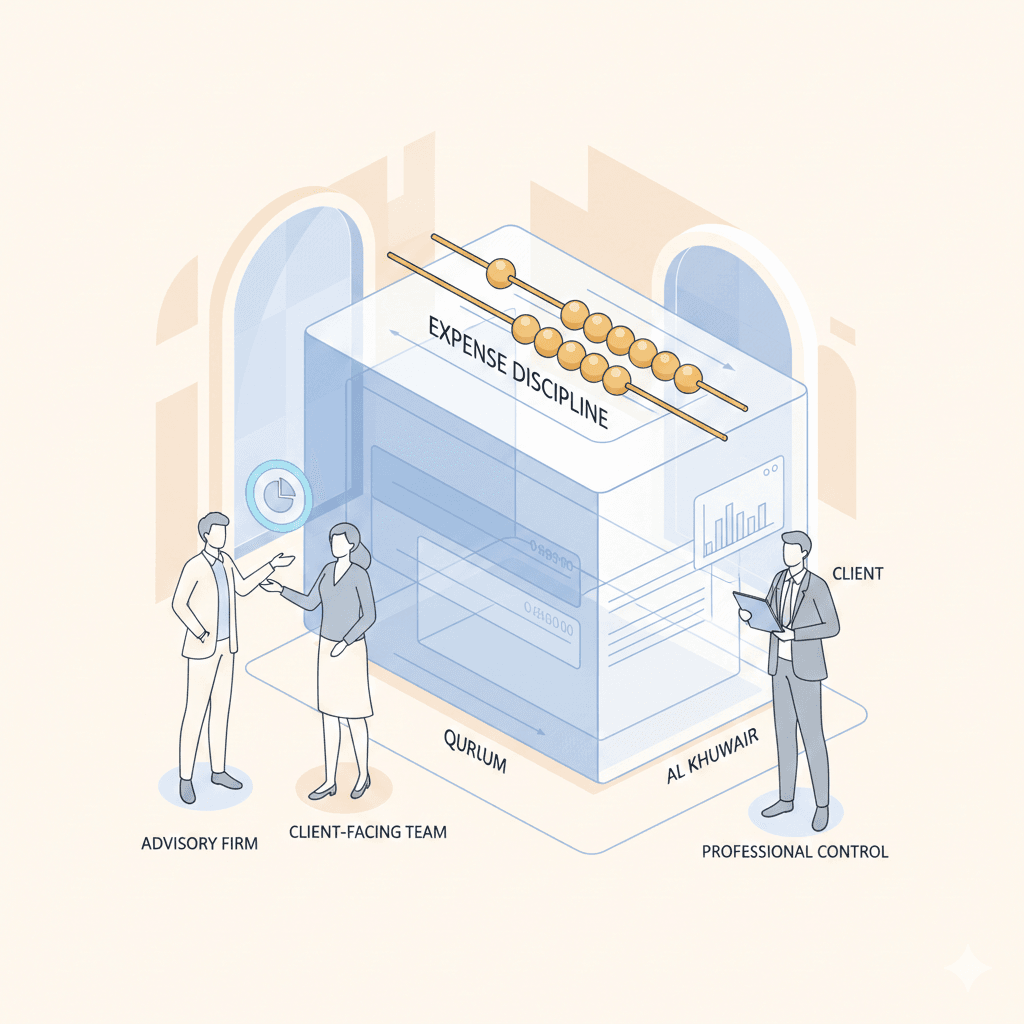

How to Reconcile Bank Accounts in Muscat… Qurum Al Khuwair Expense Governance Expe…

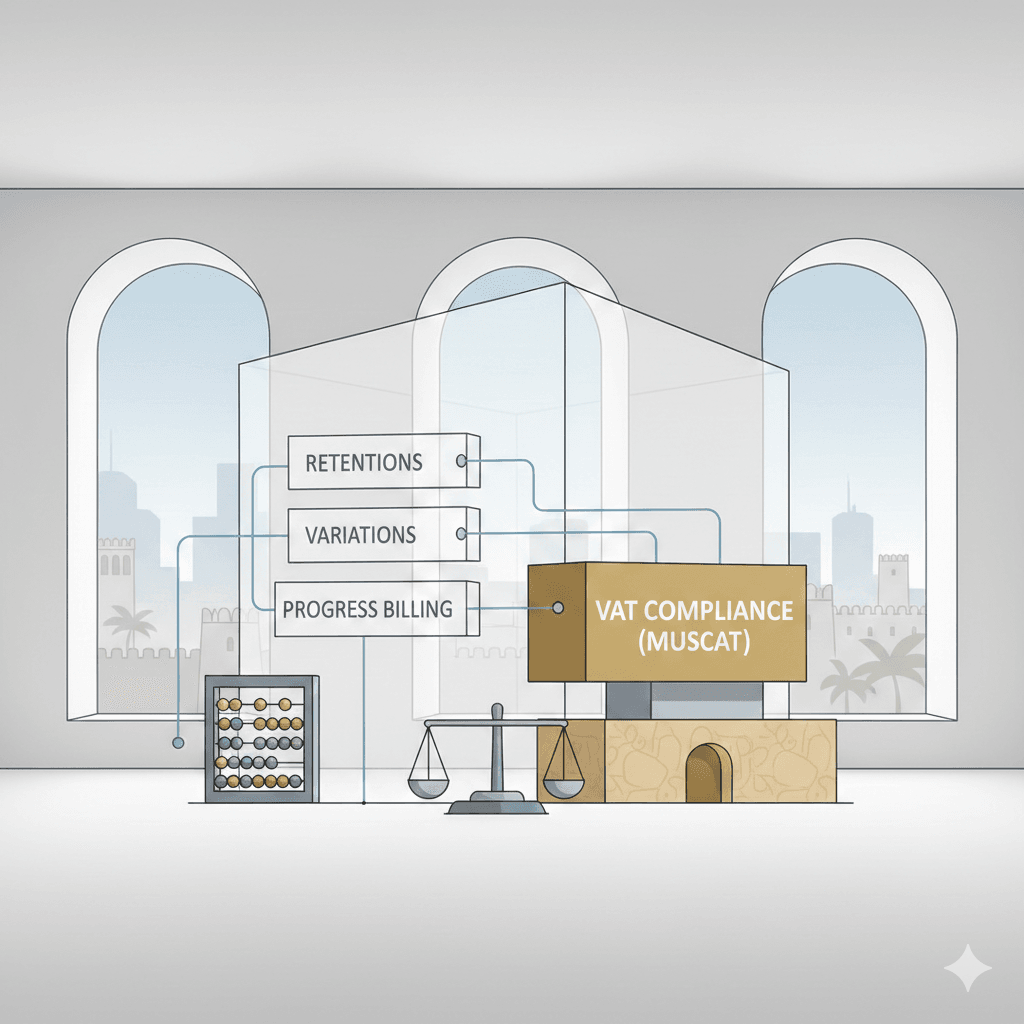

Qurum Al Khuwair Expense Governance Expe… VAT in Construction Muscat: Retentions, …

VAT in Construction Muscat: Retentions, … VAT for Imports in Oman What Muscat Trad…

VAT for Imports in Oman What Muscat Trad… Vision 2040 Cyber Resilience in Oman: Bu…

Vision 2040 Cyber Resilience in Oman: Bu… Oman Vision 2040 Digital Transformation:…

Oman Vision 2040 Digital Transformation:… Sidab Mutrah Waterfront Tourism Finance …

Sidab Mutrah Waterfront Tourism Finance …