Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

VAT for Imports in Oman What Muscat Trad…

VAT for Imports in Oman What Muscat Trad… Vision 2040 Secure Integrations Oman: Li…

Vision 2040 Secure Integrations Oman: Li… Seeb Retail Revenue Integrity Management…

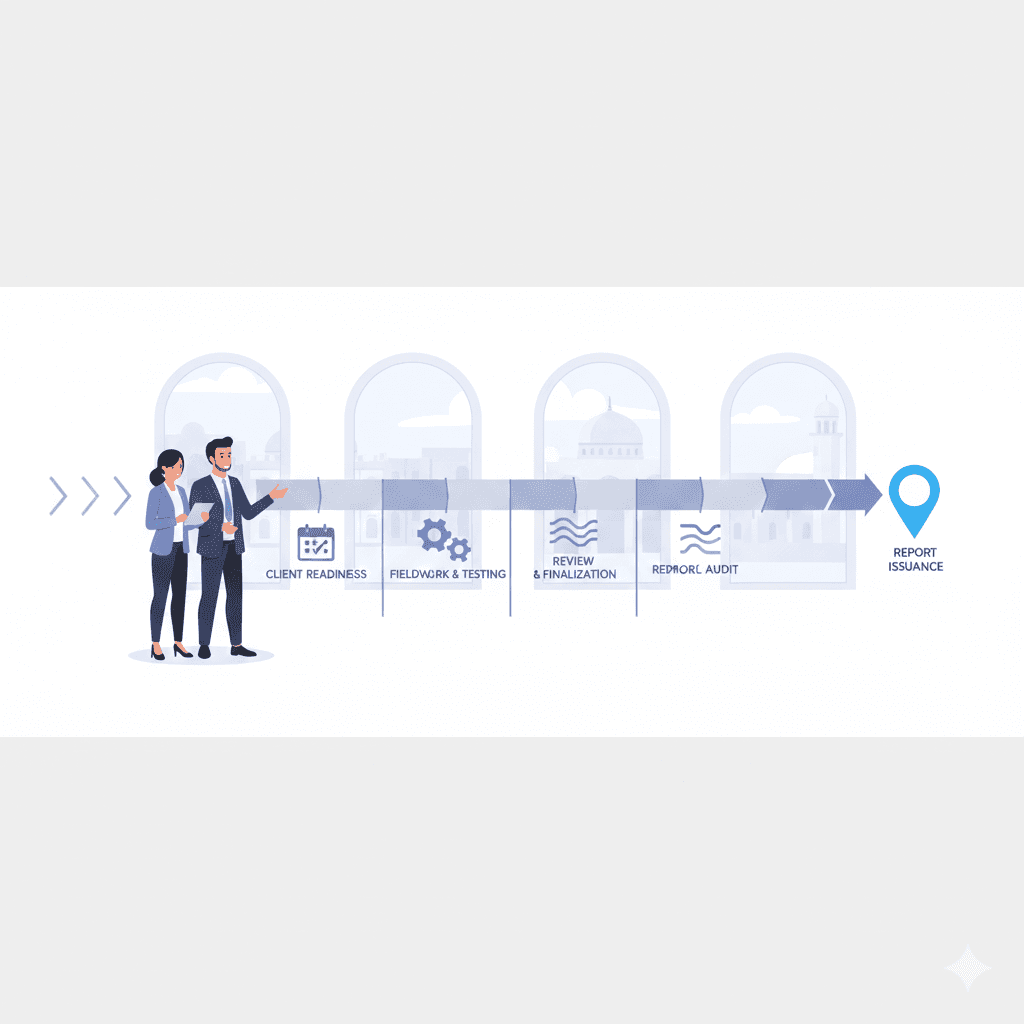

Seeb Retail Revenue Integrity Management… Muscat external audit timelines as a pla…

Muscat external audit timelines as a pla… Muscat Hybrid Work Security Strategy

Muscat Hybrid Work Security Strategy Ghala Accounting for Logistics: Managing…

Ghala Accounting for Logistics: Managing… Subscription Businesses in Muscat Financ…

Subscription Businesses in Muscat Financ… Muscat VAT Compliance Checklist 2025 for…

Muscat VAT Compliance Checklist 2025 for… Muscat E-Commerce VAT Compliance for Onl…

Muscat E-Commerce VAT Compliance for Onl… Oman Vision 2040 Digital Transformation …

Oman Vision 2040 Digital Transformation … Muscat assurance engagement choices expl…

Muscat assurance engagement choices expl… Darsait Payment Controls for Retail and …

Darsait Payment Controls for Retail and … Oman Vision 2040 Secure Digital Onboardi…

Oman Vision 2040 Secure Digital Onboardi… VAT Recordkeeping in Muscat: What to Kee…

VAT Recordkeeping in Muscat: What to Kee… Muscat Data-Driven Pricing Framework for…

Muscat Data-Driven Pricing Framework for… How to Fix Messy Books in Muscat: A Step…

How to Fix Messy Books in Muscat: A Step… Oman Vision 2040 Digital Trust: Building…

Oman Vision 2040 Digital Trust: Building… Muscat Business Owners Cashflow Statemen…

Muscat Business Owners Cashflow Statemen… Leaderly Accounting Services in Muscat: …

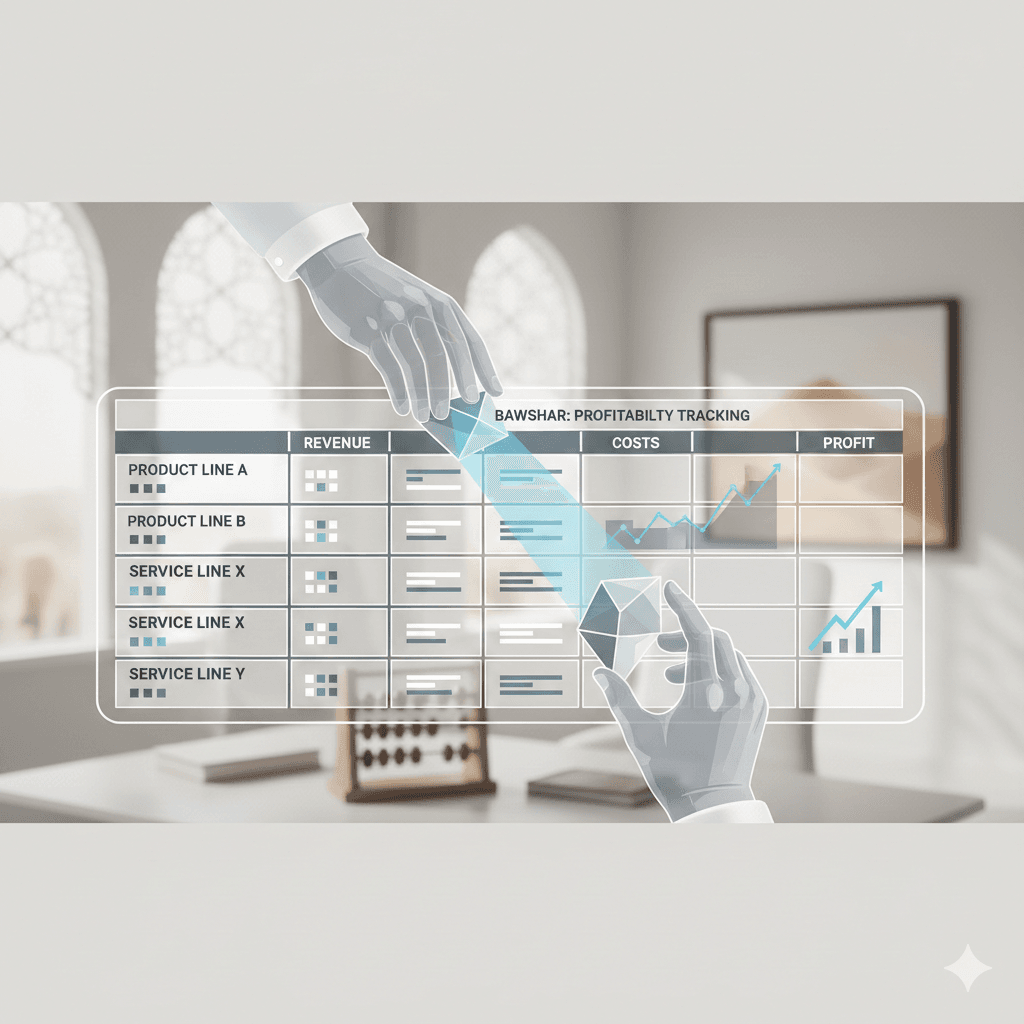

Leaderly Accounting Services in Muscat: … Bawshar Profitability Tracking by Produc…

Bawshar Profitability Tracking by Produc…