Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Expense Claims in Oman: A Muscat Policy …

Expense Claims in Oman: A Muscat Policy … Oman Vision 2040 Incident Response Plann…

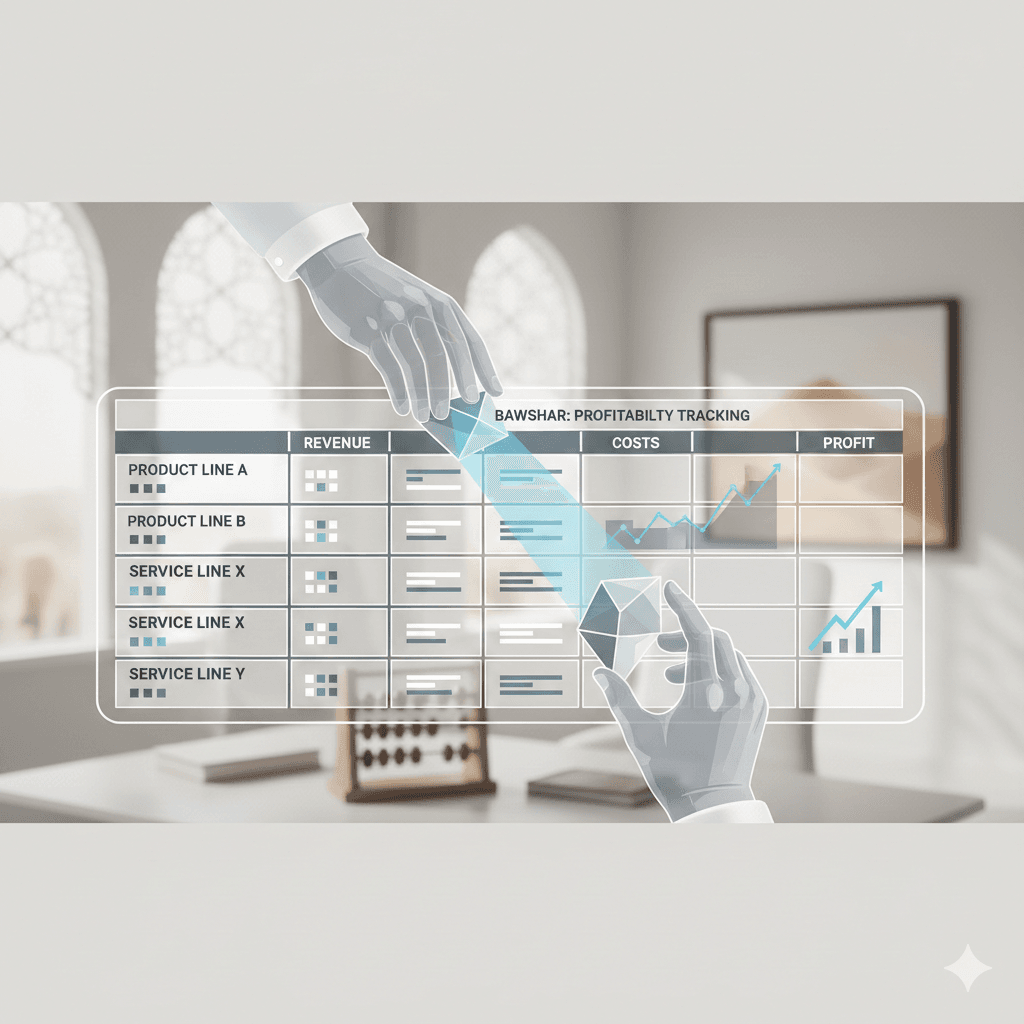

Oman Vision 2040 Incident Response Plann… Bawshar Profitability Tracking by Produc…

Bawshar Profitability Tracking by Produc… VAT for Education Providers in Muscat: P…

VAT for Education Providers in Muscat: P… Oman Vision 2040 Digital Transformation:…

Oman Vision 2040 Digital Transformation:… Muscat VAT Return Compliance: …

Muscat VAT Return Compliance: … Cybersecurity in Oman The Vision 2040 Ri…

Cybersecurity in Oman The Vision 2040 Ri… Muscat SMEs Customer Credit Limits: How …

Muscat SMEs Customer Credit Limits: How … Ghala Accounting for Logistics: Managing…

Ghala Accounting for Logistics: Managing… Oman Vision 2040 Digitizing Procurement …

Oman Vision 2040 Digitizing Procurement … Vision 2040 Secure Finance Data Lake Oma…

Vision 2040 Secure Finance Data Lake Oma… Muscat Hybrid Work Security Strategy

Muscat Hybrid Work Security Strategy Vision 2040 in Oman The Digital Transfor…

Vision 2040 in Oman The Digital Transfor… Muscat Business Continuity Resilience Wh…

Muscat Business Continuity Resilience Wh… Digital Transformation in Oman: How Visi…

Digital Transformation in Oman: How Visi… Setting Up a Logistics Firm in Ghala: Co…

Setting Up a Logistics Firm in Ghala: Co… Muscat Accounting for Non-Accountants: A…

Muscat Accounting for Non-Accountants: A… How to Build a Business Plan in Muscat T…

How to Build a Business Plan in Muscat T… Oman Vision 2040 Email Security Why Busi…

Oman Vision 2040 Email Security Why Busi… Expense Categorization in Muscat: How to…

Expense Categorization in Muscat: How to…