Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Feasibility Studies in Muscat: What a Ba…

Feasibility Studies in Muscat: What a Ba… Muscat SME internal control systems that…

Muscat SME internal control systems that… Al Khuwair Multi-Branch Financial Contro…

Al Khuwair Multi-Branch Financial Contro… Oman Vision 2040 Cloud Security: Practic…

Oman Vision 2040 Cloud Security: Practic… Sidab Mutrah Waterfront Tourism Finance …

Sidab Mutrah Waterfront Tourism Finance … Oman Vision 2040 Digital Skills Essentia…

Oman Vision 2040 Digital Skills Essentia… Oman Vision 2040 Secure Integrations: Ho…

Oman Vision 2040 Secure Integrations: Ho… Muscat SME Loan Documentation Framework:…

Muscat SME Loan Documentation Framework:… Muscat Digital Finance Transformation un…

Muscat Digital Finance Transformation un… Oman Vision 2040 Secure E-Invoicing The …

Oman Vision 2040 Secure E-Invoicing The … Oman E-Invoicing Fraud Mitigation Framew…

Oman E-Invoicing Fraud Mitigation Framew… MSQ Consultants Oman Profitability Track…

MSQ Consultants Oman Profitability Track… Muscat Accounting for Non-Accountants: A…

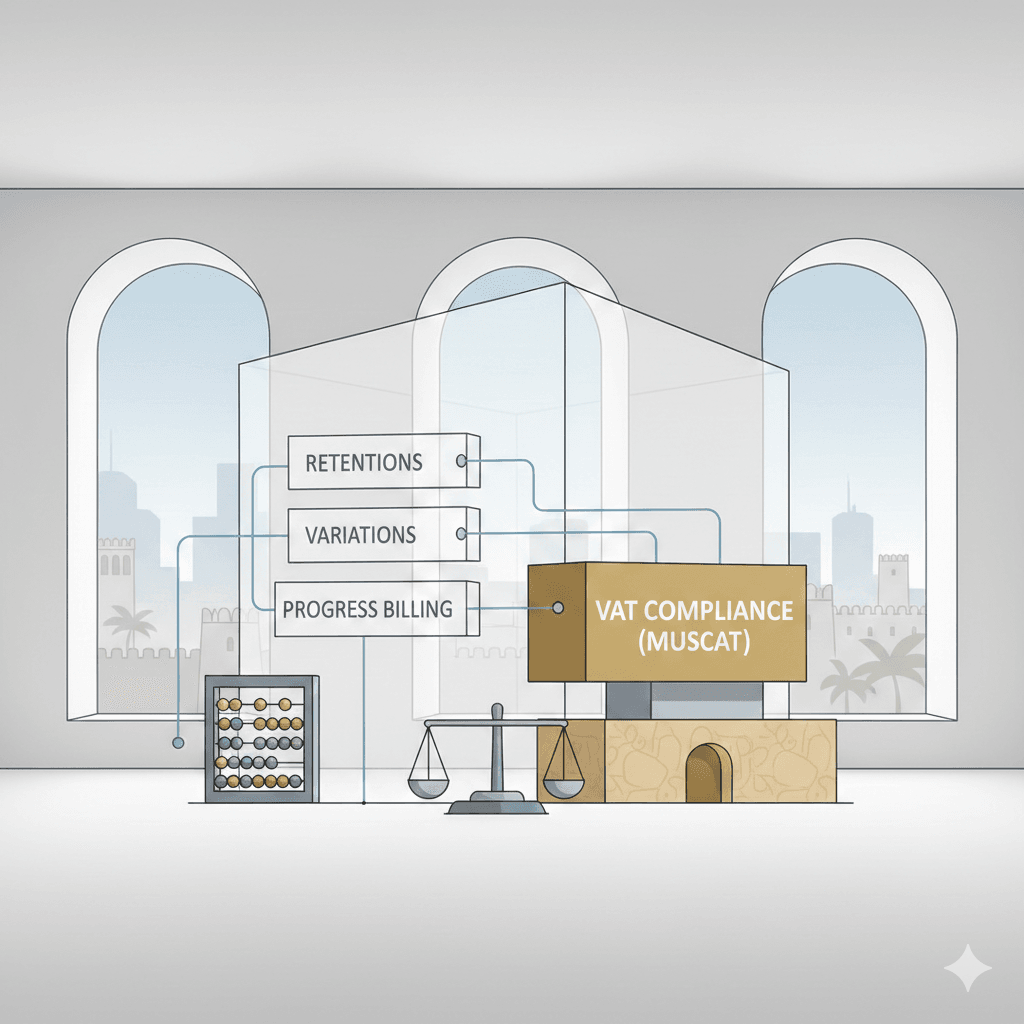

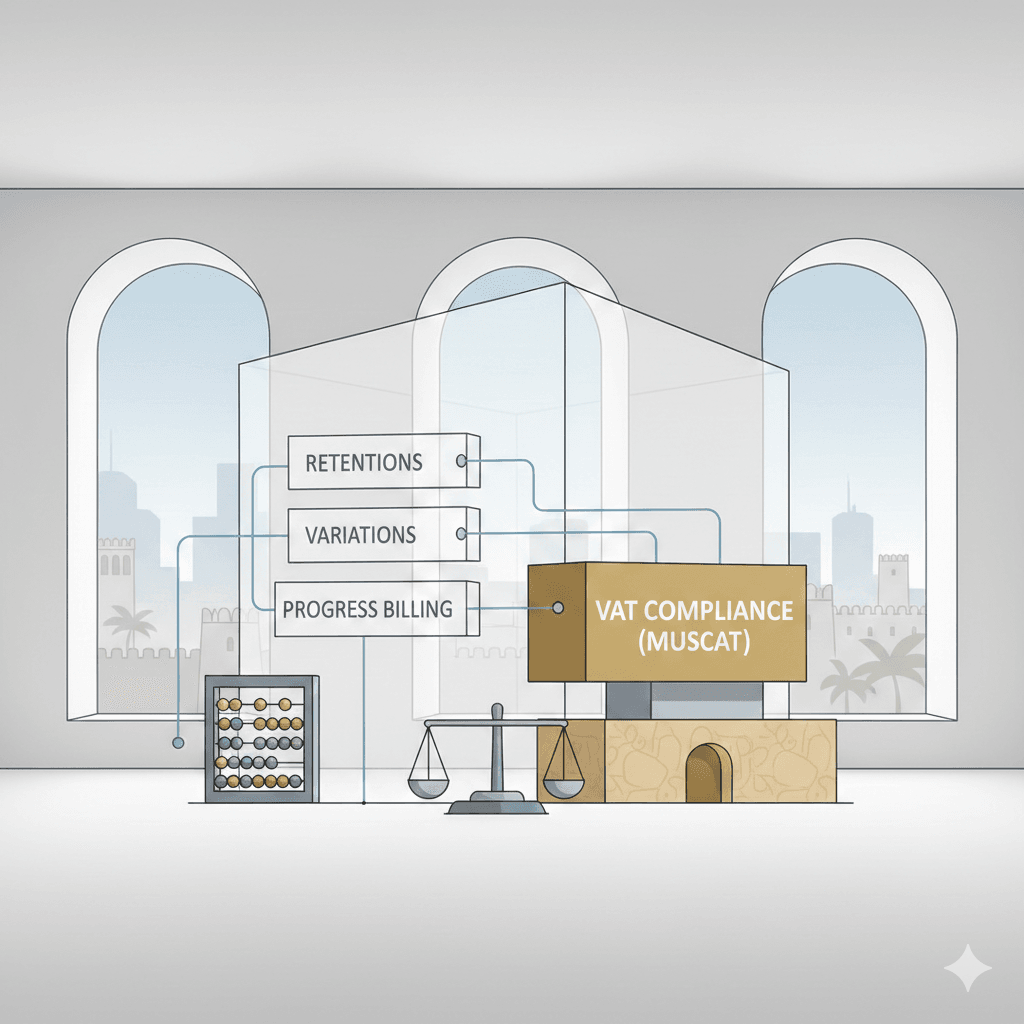

Muscat Accounting for Non-Accountants: A… Muscat Contracting Firms Retentions Mana…

Muscat Contracting Firms Retentions Mana… Muscat Finance Health Check 25 Questions…

Muscat Finance Health Check 25 Questions… Azaiba SMEs Service Pricing How to Price…

Azaiba SMEs Service Pricing How to Price… Subscription Businesses in Muscat Financ…

Subscription Businesses in Muscat Financ… Segregation of Duties in Small Muscat Te…

Segregation of Duties in Small Muscat Te… Muscat monthly bookkeeping close checkli…

Muscat monthly bookkeeping close checkli… Business Valuation in Muscat: Preparing …

Business Valuation in Muscat: Preparing …