Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Muscat Month-End Close Framework for Hig…

Muscat Month-End Close Framework for Hig… Muscat Vision2040 Audit Digitization

Muscat Vision2040 Audit Digitization Oman Vision 2040 Secure Automation: How …

Oman Vision 2040 Secure Automation: How … Mutrah Market Financial Controls Bookkee…

Mutrah Market Financial Controls Bookkee… Oman Vision 2040 Digitizing Procurement …

Oman Vision 2040 Digitizing Procurement … Muscat Strategic Advisory Framework When…

Muscat Strategic Advisory Framework When… Payables in Muscat Vendor Controls That …

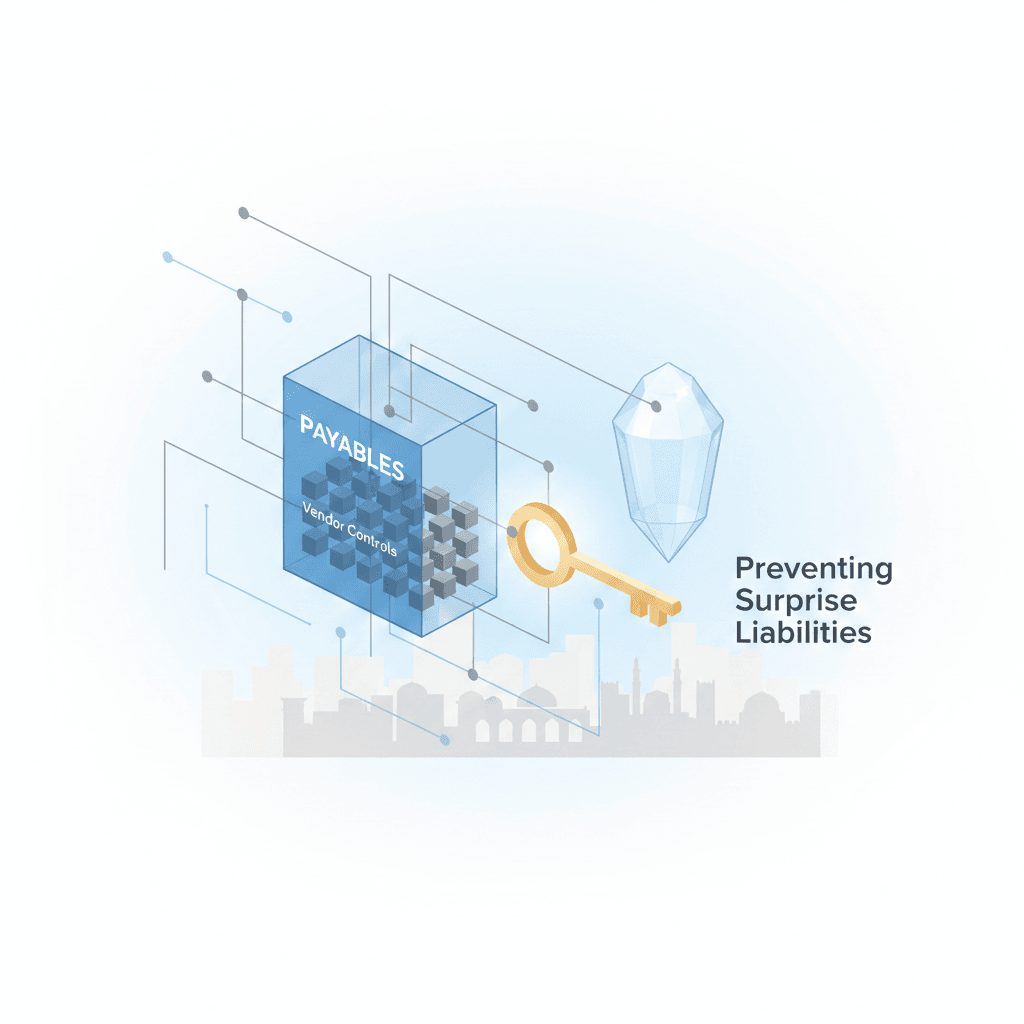

Payables in Muscat Vendor Controls That … E-Invoicing Security in Oman Preventing …

E-Invoicing Security in Oman Preventing … Setting Up a Logistics Firm in Ghala: Co…

Setting Up a Logistics Firm in Ghala: Co… The Muscat SME Accounting Calendar: Mont…

The Muscat SME Accounting Calendar: Mont… Al Ghubrah Cashflow Management

Al Ghubrah Cashflow Management VAT on Real Estate in Muscat: Key Treatm…

VAT on Real Estate in Muscat: Key Treatm… VAT Fines in Oman: How Muscat Businesses…

VAT Fines in Oman: How Muscat Businesses… Muscat VAT Invoicing Rules What Must Be …

Muscat VAT Invoicing Rules What Must Be … Risk Assessment in Oman: A Muscat Guide …

Risk Assessment in Oman: A Muscat Guide … Vision 2040 Cyber Resilience for Omani B…

Vision 2040 Cyber Resilience for Omani B… Handling Multi-Currency in Muscat Clean …

Handling Multi-Currency in Muscat Clean … Vision 2040 Secure Automation Transformi…

Vision 2040 Secure Automation Transformi… Azaiba VAT for Restaurants: Navigating V…

Azaiba VAT for Restaurants: Navigating V… Finance Tech Stack for Muscat SMEs: Tool…

Finance Tech Stack for Muscat SMEs: Tool…