Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Muscat Digital Finance Transformation un…

Muscat Digital Finance Transformation un… Azaiba VAT for Restaurants: Navigating V…

Azaiba VAT for Restaurants: Navigating V… Vision 2040 Secure Collaboration Tools f…

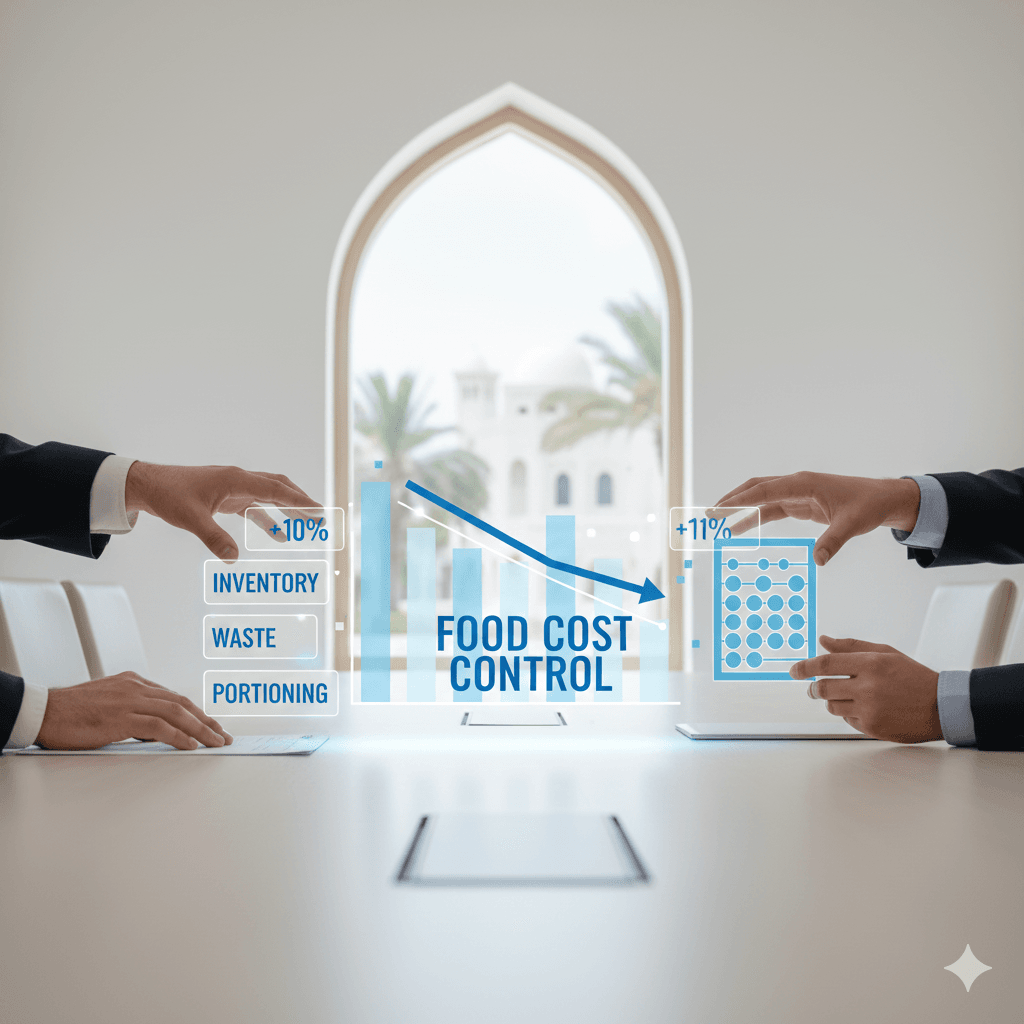

Vision 2040 Secure Collaboration Tools f… Restaurant Accounting in Muscat: Food Co…

Restaurant Accounting in Muscat: Food Co… Muscat Secure File Exchange Compliance i…

Muscat Secure File Exchange Compliance i… Azaiba Hospitality Finance Daily Sales R…

Azaiba Hospitality Finance Daily Sales R… Muscat Vendor Lock-In Strategy 2040 Buil…

Muscat Vendor Lock-In Strategy 2040 Buil… Oman Vision 2040 Secure Digital Onboardi…

Oman Vision 2040 Secure Digital Onboardi… Seeb bookkeeping setup for new businesse…

Seeb bookkeeping setup for new businesse… VAT in Healthcare Muscat: Common Scenari…

VAT in Healthcare Muscat: Common Scenari… Wadi Kabir Workshops Job Costing Setup f…

Wadi Kabir Workshops Job Costing Setup f… Muscat Digital Audit Transformation: Fro…

Muscat Digital Audit Transformation: Fro… Muscat Vision2040 Reporting Analytics: B…

Muscat Vision2040 Reporting Analytics: B… Payables in Muscat Vendor Controls That …

Payables in Muscat Vendor Controls That … VAT on Services in Oman: Place of Supply…

VAT on Services in Oman: Place of Supply… Muscat Business Owner’s Guide to Financi…

Muscat Business Owner’s Guide to Financi… Ruwi VAT Compliance Framework for Import…

Ruwi VAT Compliance Framework for Import… Muscat online sales reconciliation for S…

Muscat online sales reconciliation for S… Hiring an Accountant in Muscat Skills Ch…

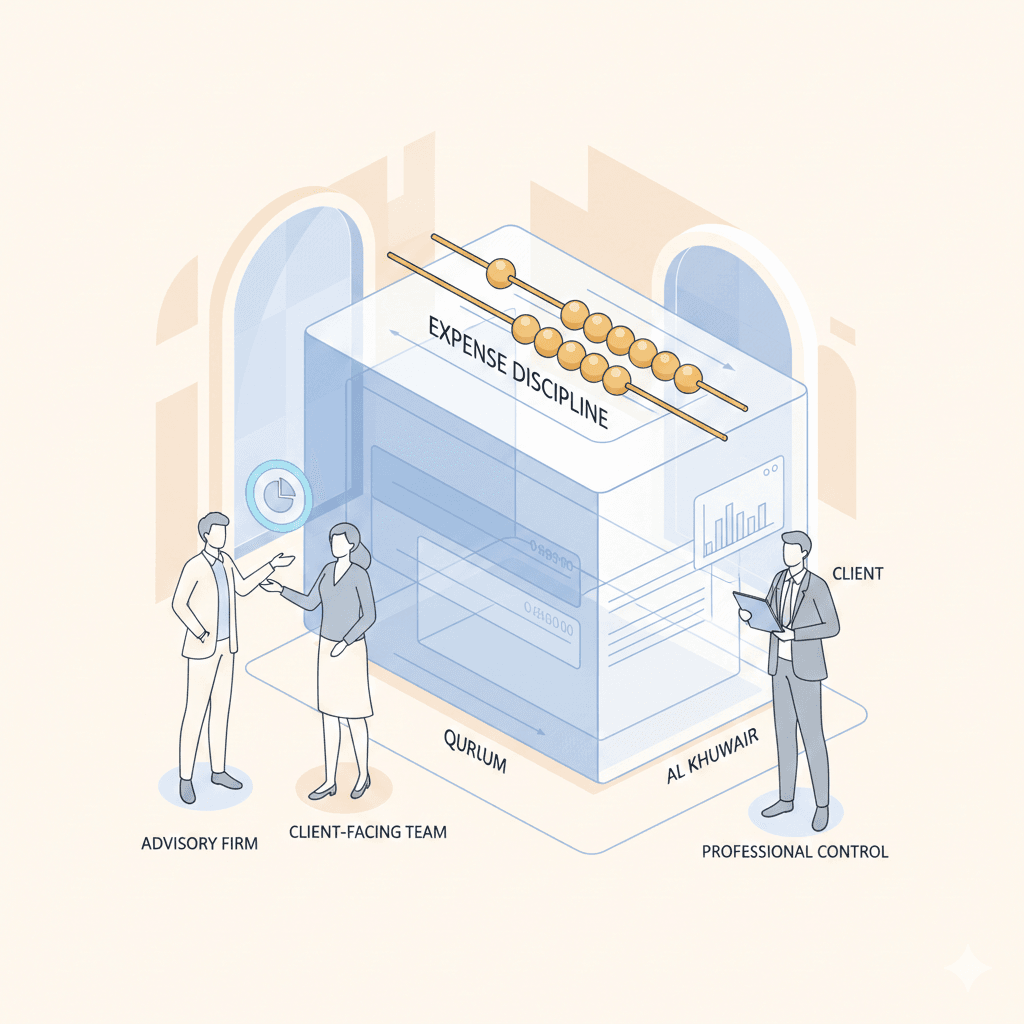

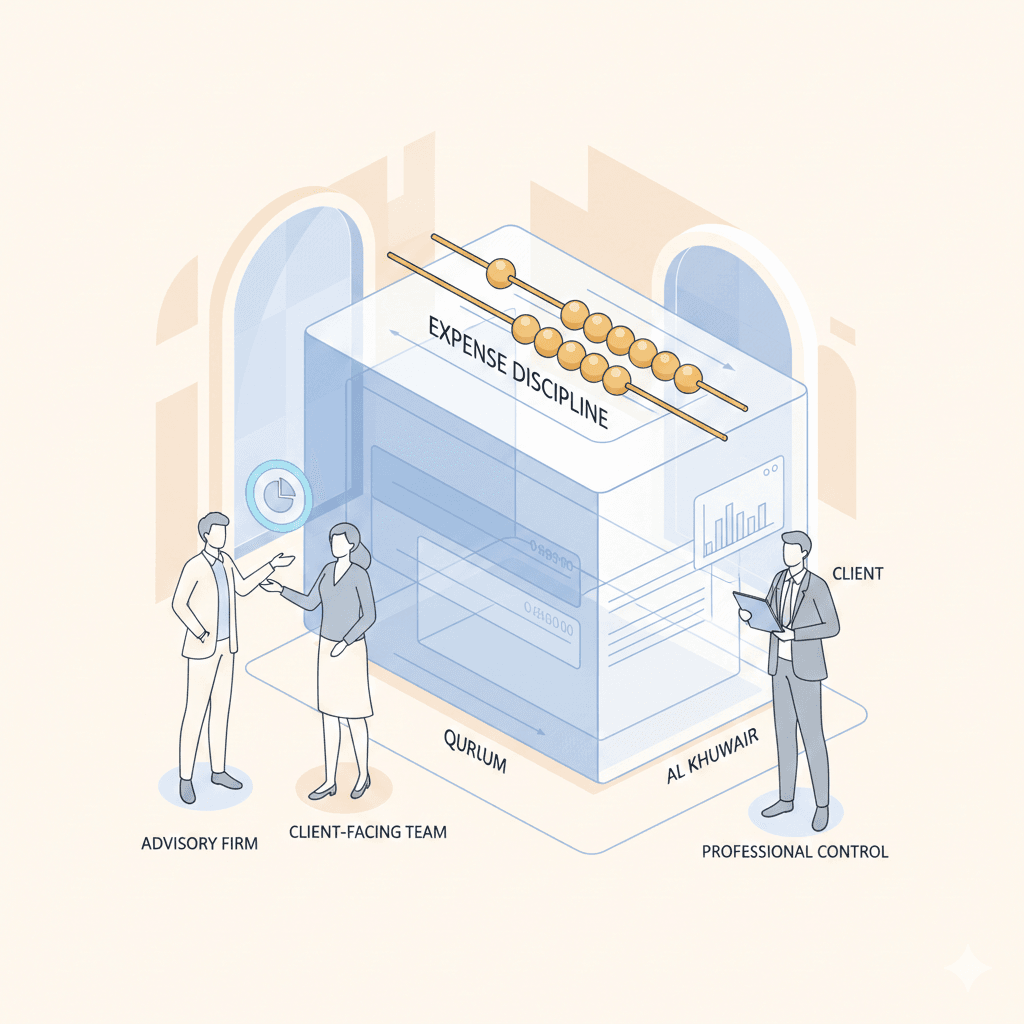

Hiring an Accountant in Muscat Skills Ch… Shati Al Qurum Expense Policies That Kee…

Shati Al Qurum Expense Policies That Kee…