Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Muscat VAT Corporate Tax Strategy What M…

Muscat VAT Corporate Tax Strategy What M… Muscat E-Commerce VAT Compliance for Onl…

Muscat E-Commerce VAT Compliance for Onl… How to Set Up Approval Workflows in Musc…

How to Set Up Approval Workflows in Musc… Azaiba Restaurant Cash Control Muscat Pr…

Azaiba Restaurant Cash Control Muscat Pr… Muscat VAT Invoicing Rules What Must Be …

Muscat VAT Invoicing Rules What Must Be … Muscat External Audit Readiness for Grow…

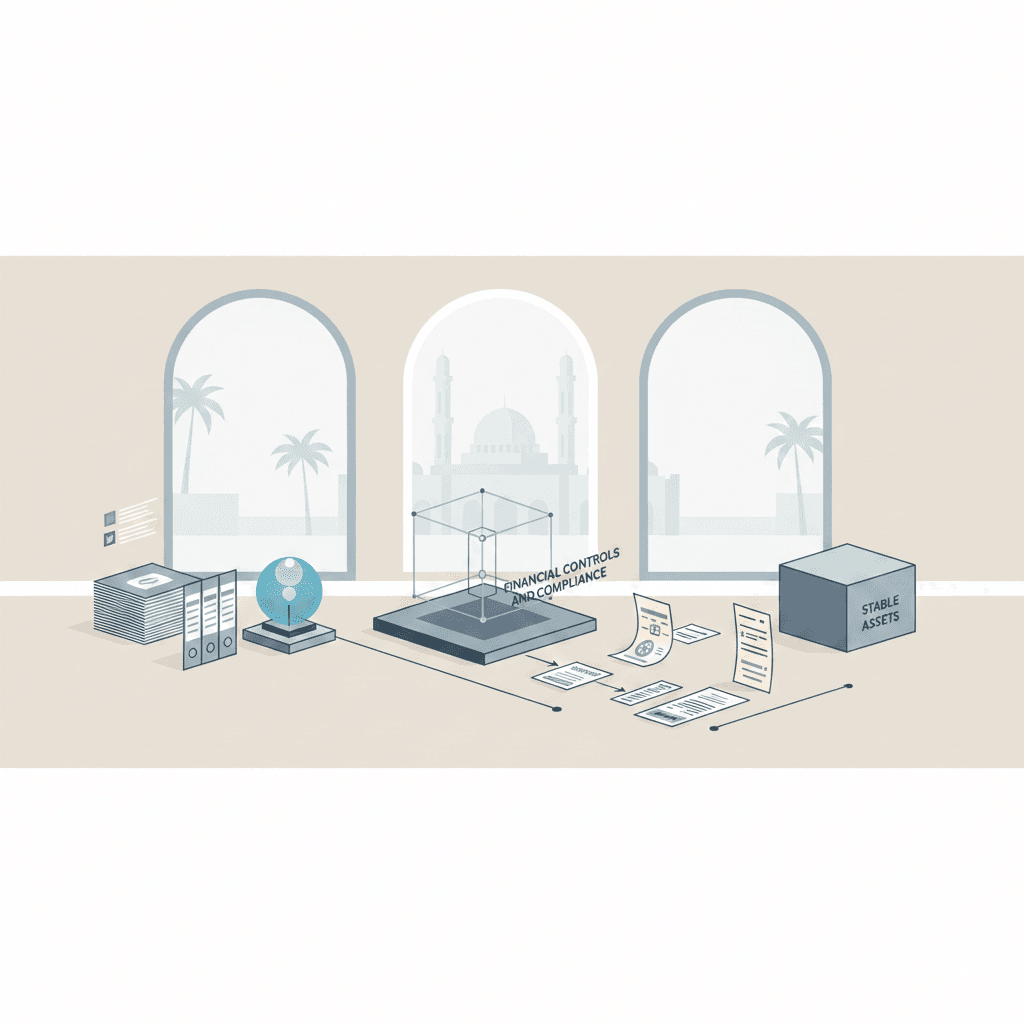

Muscat External Audit Readiness for Grow… Al Bustan hotel financial controls for s…

Al Bustan hotel financial controls for s… Al Amerat SME Accounting Basics for Fami…

Al Amerat SME Accounting Basics for Fami… Quality Audits in Muscat: What “Good” Lo…

Quality Audits in Muscat: What “Good” Lo… Al Mouj Financial Reporting Standards fo…

Al Mouj Financial Reporting Standards fo… E-Invoicing Security in Oman Preventing …

E-Invoicing Security in Oman Preventing … Vision 2040 Digital Transformation Oman:…

Vision 2040 Digital Transformation Oman:… Vision 2040 Cybersecurity Metrics Oman L…

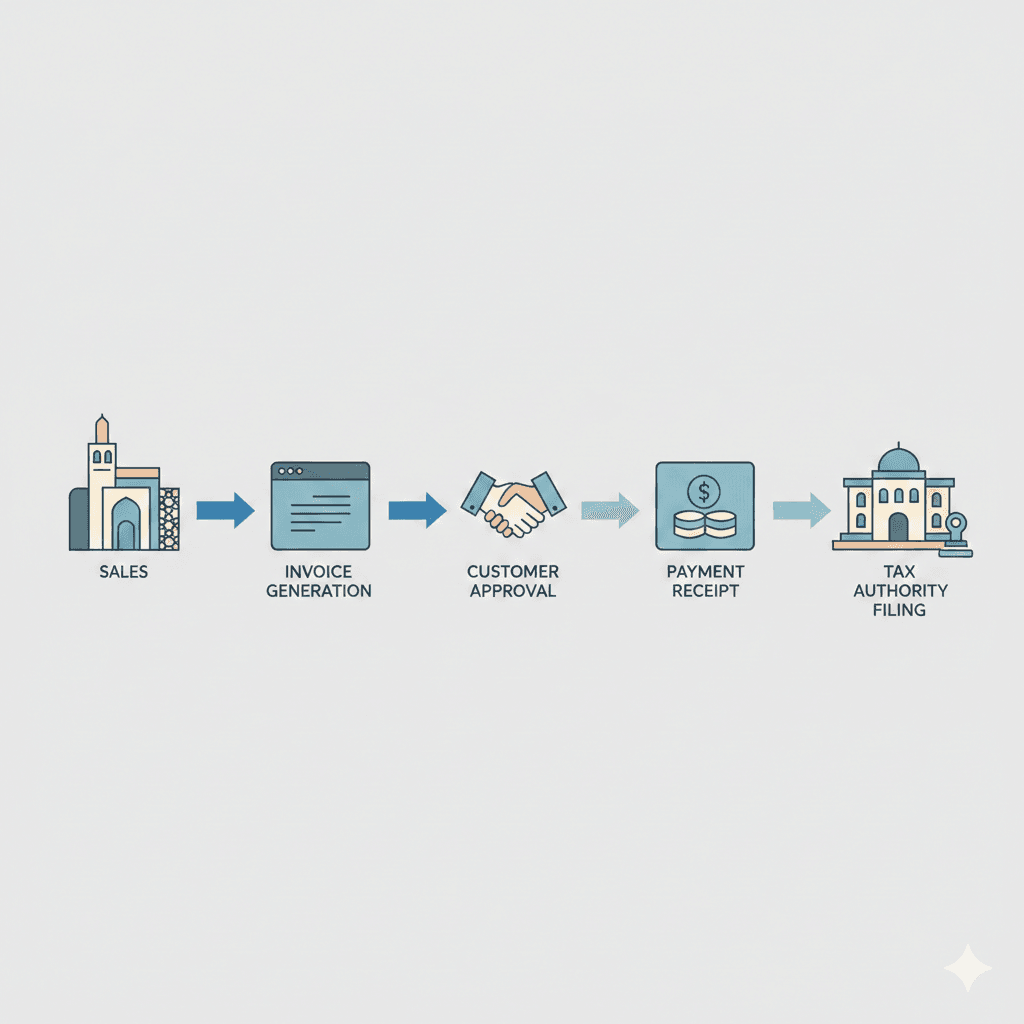

Vision 2040 Cybersecurity Metrics Oman L… Muscat e-invoicing process map for SMEs …

Muscat e-invoicing process map for SMEs … Muscat Finance Transformation Strategy: …

Muscat Finance Transformation Strategy: … Cash vs. Accrual in Muscat: Which Accoun…

Cash vs. Accrual in Muscat: Which Accoun… Virtual Audits in Oman: How Muscat Firms…

Virtual Audits in Oman: How Muscat Firms… Clinic Accounting in Muscat: Patient Bil…

Clinic Accounting in Muscat: Patient Bil… Wadi Kabir Workshops Job Costing Setup f…

Wadi Kabir Workshops Job Costing Setup f… Payroll Errors in Oman The Most Common I…

Payroll Errors in Oman The Most Common I…