Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

How to Reconcile Bank Accounts in Muscat…

How to Reconcile Bank Accounts in Muscat… Shati Al Qurum Expense Policies That Kee…

Shati Al Qurum Expense Policies That Kee… Oman Vision 2040 Digital Transformation …

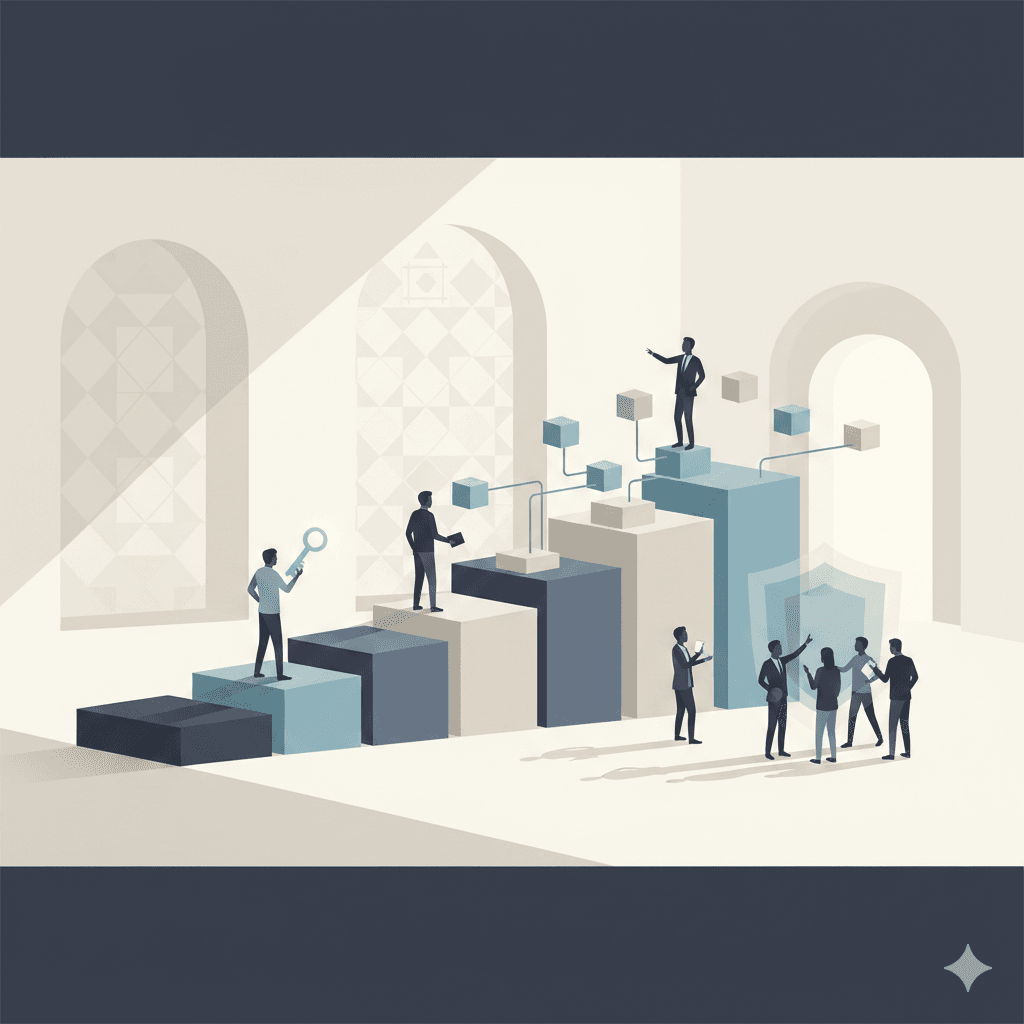

Oman Vision 2040 Digital Transformation … Leaderly Audit Readiness in Muscat: A Pr…

Leaderly Audit Readiness in Muscat: A Pr… Oman Vision 2040 Digital Skills Essentia…

Oman Vision 2040 Digital Skills Essentia… How to Choose an Accounting Firm in Musc…

How to Choose an Accounting Firm in Musc… Finance SOPs in Muscat: Standard Process…

Finance SOPs in Muscat: Standard Process… Muscat VAT audit readiness for growing O…

Muscat VAT audit readiness for growing O… Mutrah Retailers Cash Handling Controls …

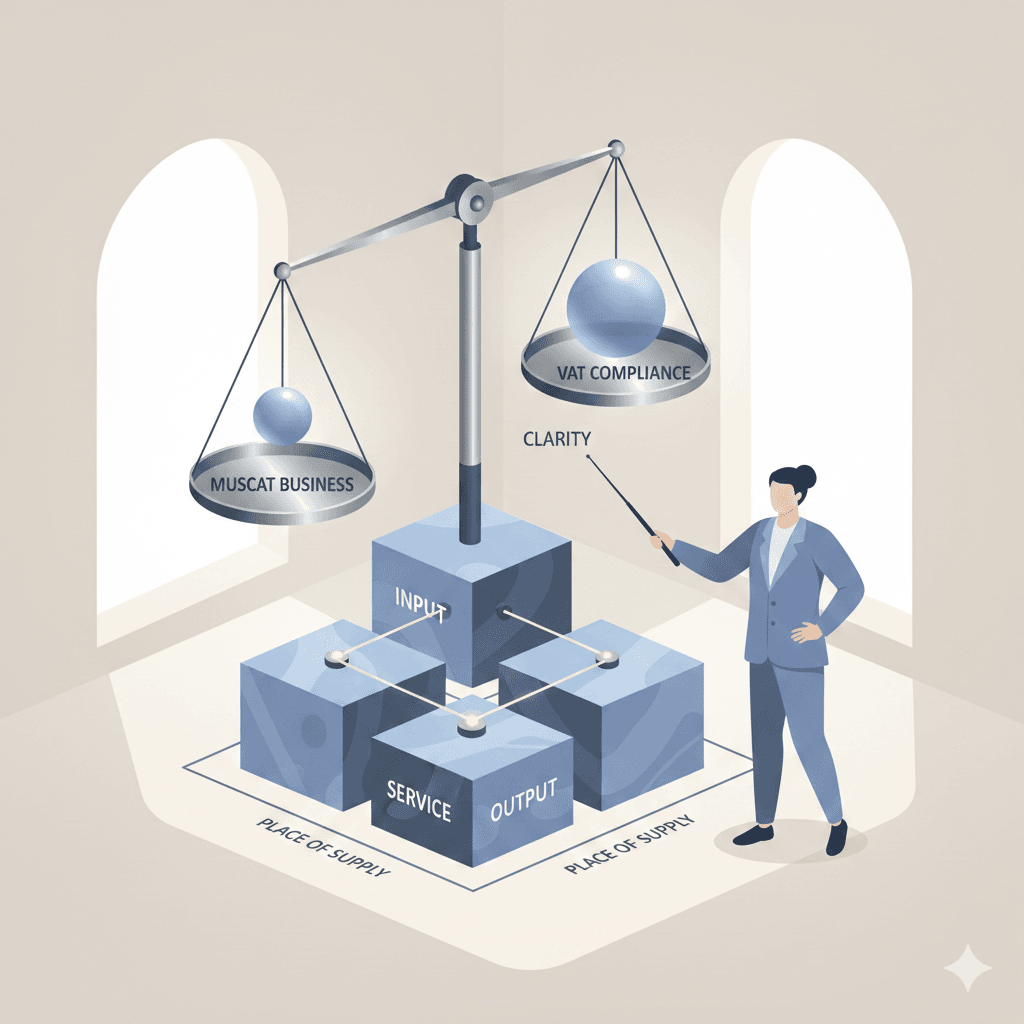

Mutrah Retailers Cash Handling Controls … VAT on Services in Oman: Place of Supply…

VAT on Services in Oman: Place of Supply… VAT in Healthcare Muscat: Common Scenari…

VAT in Healthcare Muscat: Common Scenari… Muscat Audit Kickoff Preparation

Muscat Audit Kickoff Preparation Muscat VAT Compliance Checklist 2025 for…

Muscat VAT Compliance Checklist 2025 for… Oman Cybersecurity Culture: Training You…

Oman Cybersecurity Culture: Training You… Muscat E-Invoicing Compliance Framework …

Muscat E-Invoicing Compliance Framework … Oman Vision 2040 Digitizing Procurement …

Oman Vision 2040 Digitizing Procurement … Muscat VAT Return Compliance: …

Muscat VAT Return Compliance: … Muscat SME Governance Board-Ready Report…

Muscat SME Governance Board-Ready Report… Darsait Traders VAT Documentation Ensuri…

Darsait Traders VAT Documentation Ensuri… Securing APIs in Oman A Vision 2040 Esse…

Securing APIs in Oman A Vision 2040 Esse…