Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Azaiba VAT for Restaurants: Navigating V…

Azaiba VAT for Restaurants: Navigating V… Al Ghubrah Cashflow Management

Al Ghubrah Cashflow Management VAT for Education Providers in Muscat: P…

VAT for Education Providers in Muscat: P… Muscat Strategic Advisory Framework When…

Muscat Strategic Advisory Framework When… Al Amerat SME Accounting Basics for Fami…

Al Amerat SME Accounting Basics for Fami… Oman Vision 2040 Digital Trust: Building…

Oman Vision 2040 Digital Trust: Building… Sidab Mutrah Waterfront Tourism Finance …

Sidab Mutrah Waterfront Tourism Finance … Vision 2040 Secure Automation Transformi…

Vision 2040 Secure Automation Transformi… Muscat Year-End Close Framework for a Sm…

Muscat Year-End Close Framework for a Sm… Muscat Contracting Firms Retentions Mana…

Muscat Contracting Firms Retentions Mana… Muscat Vision2040 CyberTrust Framework: …

Muscat Vision2040 CyberTrust Framework: … Manufacturing in Muscat Costing Basics f…

Manufacturing in Muscat Costing Basics f… Restaurant Accounting in Muscat: Food Co…

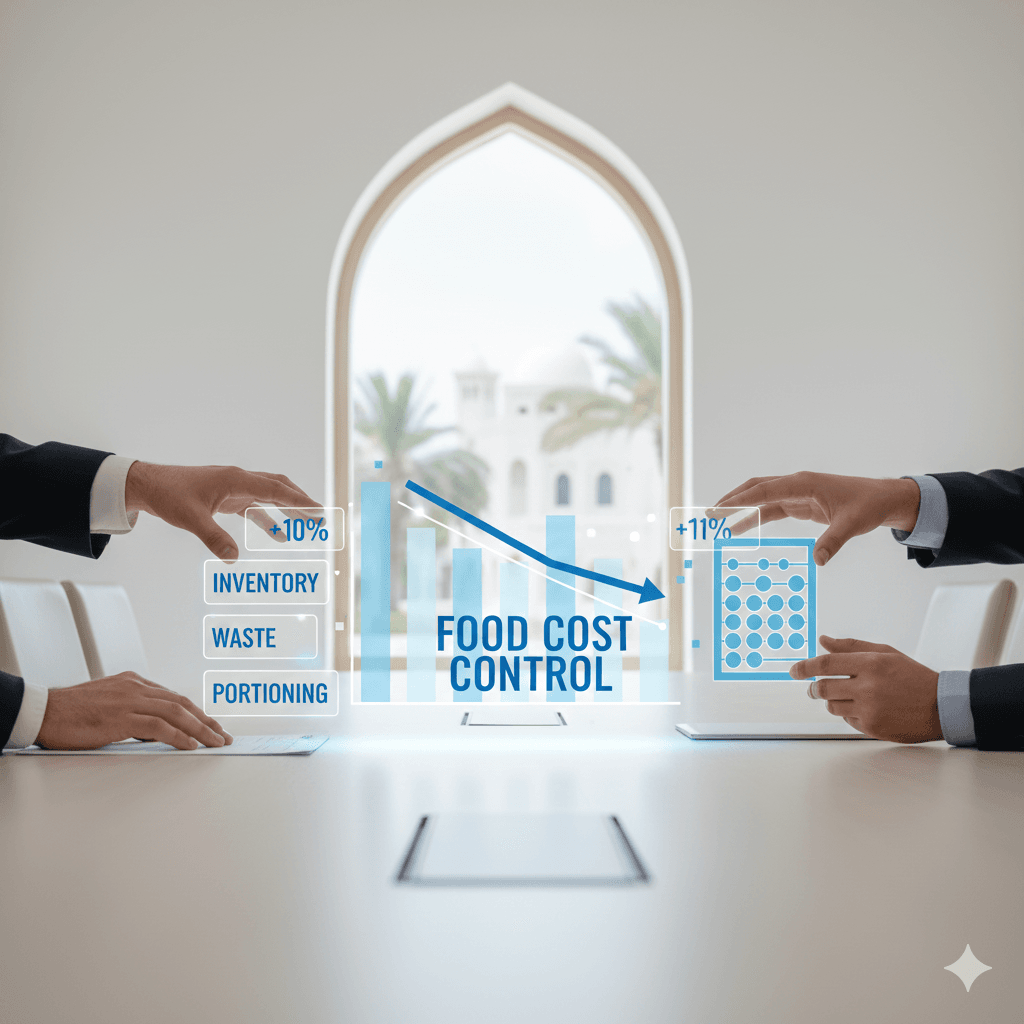

Restaurant Accounting in Muscat: Food Co… Financial Policies in Oman: Muscat Templ…

Financial Policies in Oman: Muscat Templ… Oman Vision 2040 E-Invoicing: Transformi…

Oman Vision 2040 E-Invoicing: Transformi… Travel & Entertainment Policy in Mu…

Travel & Entertainment Policy in Mu… Vision 2040 Secure Finance Data Lake Oma…

Vision 2040 Secure Finance Data Lake Oma… Muscat Digital Identity Compliance Why D…

Muscat Digital Identity Compliance Why D… VAT for Exports from Muscat: Evidence Re…

VAT for Exports from Muscat: Evidence Re… Petty Cash Controls in Muscat: Stop Leak…

Petty Cash Controls in Muscat: Stop Leak…