Break-Even Analysis for Muscat SMEs: Essential Financial Insights for Sustainable Growth

Understanding Break-Even Analysis in the Context of Muscat SMEs

Why Break-Even Analysis Matters for Local Businesses

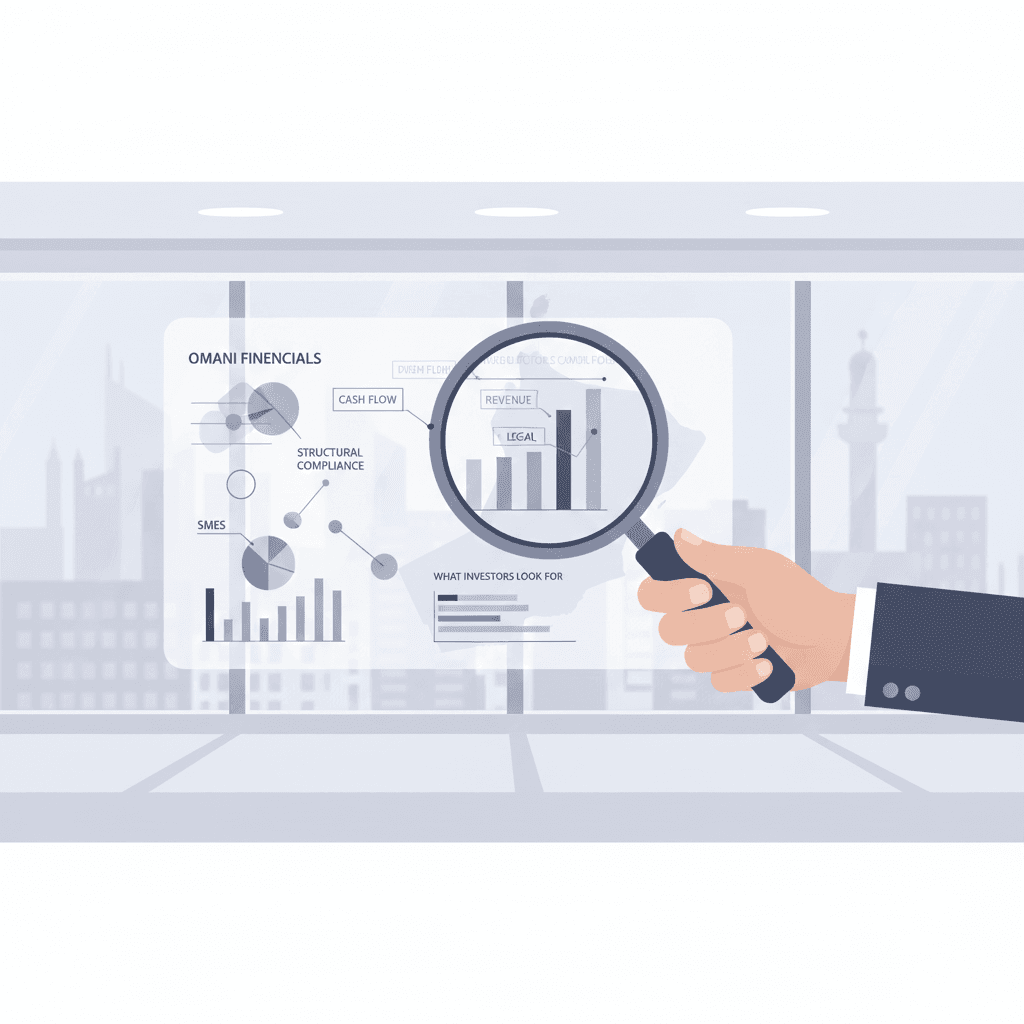

Break-Even Analysis for Muscat SMEs is a fundamental financial tool that every business owner and entrepreneur in Oman must understand. In Muscat’s dynamic economic environment, SMEs face unique challenges such as fluctuating market demand, evolving tax regulations, and competitive pressures. Break-even analysis provides a clear, actionable framework to determine the exact point at which a company covers its costs without generating a loss or profit. This clarity is especially vital for SMEs, where tight cash flow management and precise cost control often dictate survival. Unlike large corporations, SMEs in Muscat operate with limited financial buffers, making the break-even point a critical indicator of operational sustainability and growth potential. By focusing on break-even analysis, SME leaders can better anticipate the financial impact of pricing strategies, sales volumes, and cost structures in their specific market conditions.

In Oman, government initiatives and evolving tax policies like VAT and corporate tax are changing the financial landscape for SMEs. Understanding break-even analysis helps these businesses anticipate how such factors influence fixed and variable costs. For example, VAT affects pricing and cost management, directly impacting the break-even point. Leaderly’s advisory services often emphasize integrating taxation considerations into break-even calculations to avoid surprises and improve financial planning accuracy. When entrepreneurs grasp the break-even concept within the Muscat context, they gain an essential perspective that supports better budgeting, resource allocation, and risk assessment, empowering them to make informed decisions that drive their companies forward.

Moreover, break-even analysis is not just a theoretical concept but a practical management discipline for Muscat SMEs. It enables business owners and finance managers to evaluate the feasibility of new product launches, expansions, or market entry strategies. By calculating the minimum sales needed to cover costs, SMEs can align their operational goals realistically with financial capacity. This approach reduces guesswork and fosters a disciplined mindset toward growth. With Muscat’s diverse economy, including sectors like tourism, retail, and services, break-even analysis tailored to specific business models is invaluable for tailoring strategies that fit local market realities and regulatory frameworks.

Calculating the Break-Even Point: A Clear, Step-by-Step Guide for Muscat SMEs

From Cost Identification to Sales Targets

Break-Even Analysis for Muscat SMEs begins with accurate identification of costs, which divide into fixed and variable categories. Fixed costs remain constant regardless of production or sales volume and typically include rent, salaries, and insurance—common expenses for businesses operating in Muscat’s commercial hubs. Variable costs fluctuate directly with sales or production levels, such as raw materials, commissions, or utilities linked to operational intensity. Correctly classifying these costs is critical for precise break-even calculations, as misunderstanding them can lead to poor financial decisions and missed profitability targets.

The calculation itself is straightforward but requires reliable data. The break-even point in units is calculated by dividing total fixed costs by the contribution margin per unit—the difference between the unit selling price and variable cost per unit. This formula enables SMEs to understand how many products or services must be sold before the business covers its costs. For example, a retail SME in Muscat might calculate the break-even volume of a new product line by factoring in local supplier costs and selling prices adjusted for VAT. This approach ensures that the business remains compliant and financially viable within Oman’s regulatory environment.

Sales value break-even is another useful metric, especially for service-based SMEs common in Muscat’s economy. This is calculated by dividing total fixed costs by the contribution margin ratio (contribution margin per unit divided by selling price per unit). The result tells business owners the minimum sales revenue required to break even, guiding pricing and marketing strategies. Leaderly’s advisory teams frequently help SMEs align break-even analysis with taxation and accounting practices to produce actionable financial insights. The goal is to transform break-even calculations into practical tools that support operational planning, helping business owners stay ahead in a competitive marketplace.

Interpreting Break-Even Results to Make Informed Decisions

Using Break-Even Analysis for Strategic Financial Management

Once calculated, the break-even point offers more than just a number—it serves as a cornerstone for decision-making in Muscat SMEs. Business owners can assess the financial feasibility of projects, evaluate the impact of cost changes, and optimize pricing strategies accordingly. For instance, if fixed costs increase due to new regulatory fees or rent adjustments in Muscat, the break-even point will rise, signaling the need for higher sales or cost reductions to maintain profitability. Understanding these dynamics early helps SMEs avoid cash flow problems and enhances their ability to respond proactively to changing conditions.

Break-even analysis also assists in budgeting and forecasting. By setting clear sales targets based on break-even points, SMEs can develop realistic budgets aligned with cash flow needs and growth objectives. This is crucial in Oman, where SMEs must navigate VAT obligations and corporate tax requirements that affect net profitability. Leaders equipped with break-even insights can also assess the value of strategic investments, such as upgrading technology or expanding workforce capacity, by projecting how these changes influence fixed and variable costs. This level of financial control is essential for SMEs striving to scale sustainably in Muscat’s evolving business environment.

Furthermore, break-even analysis supports risk management by identifying margins of safety—the difference between actual or projected sales and the break-even sales level. A wide margin of safety indicates financial resilience, while a narrow margin signals vulnerability to sales downturns. SMEs in Muscat can use this information to build contingency plans and prioritize operational efficiency. Through advisory and audit services, Leaderly helps business owners incorporate break-even analysis into comprehensive financial reviews, ensuring that SMEs maintain transparency, compliance, and strategic agility amid Oman’s competitive marketplace.

Optimizing Cost Structures for Better Break-Even Performance

Strategies for Cost Management in Muscat SMEs

Optimizing cost structures is a direct way to improve the break-even position for Muscat SMEs. Fixed costs, often less flexible, can be managed through strategic lease negotiations, outsourcing non-core activities, or adopting cost-efficient technologies. Given the high rental costs in Muscat’s prime commercial areas, SMEs should critically evaluate their office or retail space requirements, balancing location benefits against fixed expenses. Cost control in this area can significantly reduce the break-even sales threshold, enabling greater financial stability.

Variable cost management also plays a vital role. SMEs can negotiate better supplier contracts, leverage local sourcing to reduce logistics expenses, or improve operational workflows to minimize waste. For example, in Muscat’s retail sector, efficient inventory management reduces storage costs and spoilage, directly impacting variable costs. By continuously reviewing and adjusting these elements, SMEs can enhance their contribution margins, thus lowering the volume of sales required to break even. Leaderly’s advisory teams support these efforts by conducting due diligence and feasibility studies that highlight cost-saving opportunities tailored to the Muscat market.

Investing in staff training and automation technologies can further improve cost efficiency. Labor costs, a significant fixed or semi-variable expense, can be optimized by enhancing employee productivity and automating repetitive tasks. This not only helps reduce costs but also improves service quality and customer satisfaction. For SMEs in Muscat, where the labor market can be competitive and costly, these strategies provide a sustainable path to maintain profitability. Integrating these insights with taxation and audit practices ensures SMEs remain compliant while maximizing their financial health.

Leveraging Break-Even Analysis for Growth and Investment Decisions

Supporting Expansion Plans with Financial Clarity

Break-Even Analysis for Muscat SMEs is a critical tool when considering expansion or new investments. It allows entrepreneurs and finance managers to forecast how changes in fixed or variable costs will affect profitability thresholds. For example, opening a new branch or launching an additional product line involves significant fixed costs that alter the break-even point. By quantifying these impacts, SMEs can evaluate whether projected sales volumes justify the investment and identify the minimum performance targets to avoid losses.

Leaderly’s advisory services often incorporate break-even analysis within broader financial modeling to guide investment decisions. This approach helps SMEs in Muscat assess risk and return profiles in light of local market conditions and regulatory obligations, such as VAT and corporate tax impacts. It also informs capital allocation, ensuring that resources are directed to initiatives with the highest potential for sustainable profitability. With clear break-even targets, SMEs can secure financing with confidence, presenting data-backed business cases to investors and lenders.

Furthermore, continuous monitoring of the break-even point allows SMEs to adjust strategies as market conditions evolve. This agility is vital in Muscat’s competitive environment, where shifts in consumer behavior, supplier pricing, or regulatory frameworks can quickly affect financial performance. Break-even analysis thus becomes an ongoing management discipline rather than a one-time calculation. It empowers SMEs to maintain focus on profitability while pursuing growth, ensuring long-term viability and contribution to Oman’s economic development.

Conclusion

Break-Even Analysis for Muscat SMEs is more than just a financial calculation; it is an essential strategic tool that underpins sound business decision-making in Oman’s unique market environment. By clearly identifying the sales volume and revenue required to cover all costs, SMEs gain invaluable insights that support operational planning, cost management, and risk mitigation. This clarity fosters a proactive approach to managing cash flow and pricing strategies, enabling businesses to thrive despite market uncertainties and regulatory complexities such as VAT and corporate tax.

For SMEs operating in Muscat, integrating break-even analysis with Leaderly’s comprehensive advisory, accounting, taxation, and audit services provides a robust framework for sustainable growth. It enables business leaders to make informed investment decisions, optimize cost structures, and confidently navigate the competitive landscape. Ultimately, mastering break-even analysis equips SMEs with the financial discipline and agility necessary to build resilience and capitalize on opportunities in Oman’s evolving economy.

#Leaderly #Break-EvenAnalysisforMuscatSMEs #Oman #Muscat #SMEs #Accounting #Tax #Audit