Bawshar SME KPI Governance and How Owners Can Structure Monthly Performance Reviews

Bawshar SME KPI Governance as the Strategic Anchor for Monthly Reviews

Bawshar SME KPI Governance transforms the way business owners and finance managers in Bawshar approach performance discussions, moving them away from informal, reactive conversations that rely heavily on raw numbers without meaningful analysis. This governance model reshapes monthly review meetings into structured leadership sessions that link financial results directly to operational actions. At its core, every KPI under Bawshar SME KPI Governance must answer a critical management question and inform a decision. In Bawshar’s competitive commercial landscape—spanning retail, services, logistics, and contracting sectors—owners cannot settle for meetings that simply recap figures. Instead, monthly agendas must emphasize strategic interpretation of results. Effective Bawshar SME KPI Governance starts by clearly defining what success looks like for the business and selecting a focused set of KPIs aligned with those goals. Typical indicators include revenue growth, cash conversion cycles, debtor days, project margins, staff productivity, VAT exposure, and working capital stability. Consistently reviewing these KPIs within a clear agenda empowers owners with forward-looking insights rather than reactive, after-the-fact explanations.

Designing the Opening Segment of the Meeting Around Bawshar SME KPI Governance

The first section of the monthly agenda should set the tone for disciplined governance. Under Bawshar SME KPI Governance, the opening segment is not about greetings or general updates; it is about aligning leadership on the month’s business reality. The meeting should begin with a concise executive overview prepared by finance management that frames the company’s financial and operational position in relation to prior months and agreed targets. This overview typically covers revenue performance by business line, gross margin behavior, major cost movements, cash position, receivables health, and short-term liabilities. For Bawshar-based SMEs, where cash flow volatility is common due to project billing cycles and customer payment behavior, this initial financial snapshot allows owners to immediately understand the company’s resilience and risk exposure. Bawshar SME KPI Governance requires that this opening discussion remains analytical, not defensive. Management must explain why variances occurred and what decisions they propose as a result. This anchors the entire meeting in accountability and decision-making from the first minutes.

Linking Financial Outcomes to Operational Drivers Through Bawshar SME KPI Governance

After establishing the financial context, the second segment of the agenda should focus on the operational drivers behind the numbers. Bawshar SME KPI Governance insists that every financial result be traced to real business activity. If margins compressed, was it due to pricing pressure, procurement inefficiencies, overtime labor, equipment downtime, or project scope creep? If revenue declined, did sales pipeline conversion weaken, or were projects delayed by regulatory approvals or client-side issues? In Bawshar’s competitive SME landscape, owners must continuously test whether their operational structure supports sustainable profitability. This portion of the meeting is where department heads and project managers contribute insight, not just data. The discussion should remain disciplined: identify the operational root causes, evaluate their impact on KPIs, and agree on corrective actions with assigned responsibility and timelines. Under Bawshar SME KPI Governance, this segment converts the review from a finance meeting into a leadership control mechanism.

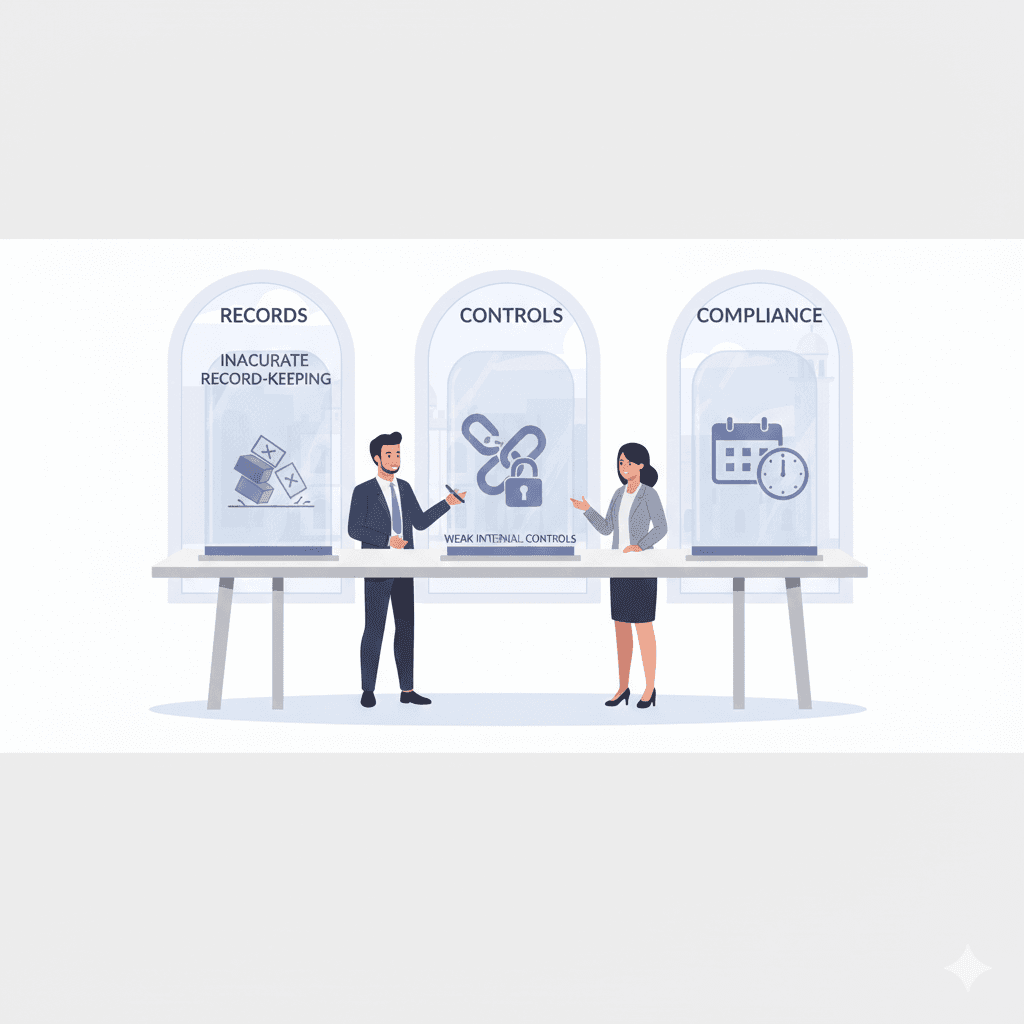

Embedding Compliance and Risk Monitoring within Bawshar SME KPI Governance

The third segment of the monthly agenda must address compliance, tax exposure, and risk indicators, areas that many Bawshar SMEs still treat as annual or crisis-driven concerns. Bawshar SME KPI Governance integrates regulatory awareness into routine management. This includes monitoring VAT position, corporate tax provisioning, receivables aging risk, supplier concentration, and any emerging legal or contractual exposures. For Omani SMEs, this discipline is essential as regulatory enforcement becomes more structured and financial transparency expectations rise. Finance managers should present clear indicators showing whether the business remains within acceptable compliance thresholds. Any unusual movements in VAT recoverability, tax provisions, or audit trail documentation should be highlighted immediately. Under strong Bawshar SME KPI Governance, potential risks are not postponed for external auditors or year-end reviews; they are identified monthly, discussed openly, and addressed before they escalate into costly disruptions.

Turning Insights into Action Plans Through Bawshar SME KPI Governance

Insights without execution deliver no value. The fourth part of the agenda is where Bawshar SME KPI Governance proves its effectiveness. This section converts the analysis from earlier discussions into formal management actions. Each agreed initiative must be documented with an owner, a deadline, and a measurable outcome. Whether the decision involves renegotiating supplier contracts, adjusting pricing models, accelerating collections, restructuring debt, or investing in process automation, it must connect directly to the KPIs reviewed earlier. Bawshar SMEs often struggle because corrective actions remain verbal and untracked, causing the same issues to resurface month after month. A well-run governance framework eliminates this pattern. By reviewing prior month action items at every meeting, leadership reinforces accountability and institutional discipline. Over time, Bawshar SME KPI Governance builds a performance culture where continuous improvement becomes routine rather than reactive.

Closing the Meeting with Strategic Alignment Under Bawshar SME KPI Governance

The final segment of the monthly agenda should lift the discussion above immediate numbers and connect performance to long-term strategy. Bawshar SME KPI Governance recognizes that owners must constantly balance short-term financial control with sustainable growth planning. This closing conversation may address expansion readiness, capital requirements, financing strategy, market positioning, or potential restructuring scenarios. In Bawshar’s evolving business environment, where opportunities in retail, services, logistics, and construction fluctuate with economic cycles, owners need structured strategic reflection. The finance function often supports this discussion with feasibility insights, valuation perspectives, or scenario modeling that informs leadership choices. By closing each monthly review with strategic clarity, Bawshar SME KPI Governance ensures that daily operations remain aligned with long-term business objectives rather than drifting into tactical survival mode.

The disciplined application of Bawshar SME KPI Governance transforms the monthly review meeting from a routine obligation into a powerful leadership instrument. When owners and managers adopt this framework, they gain consistent visibility over financial health, operational efficiency, compliance exposure, and strategic direction. The result is not simply better reporting, but better decisions made earlier, when correction is still affordable and growth opportunities can be captured with confidence.

For SMEs in Bawshar navigating rising competition, regulatory complexity, and tighter margins, this governance model delivers tangible stability. It supports the type of structured financial management, tax awareness, and advisory thinking that enables sustainable expansion and resilience. When implemented with discipline and professionalism, Bawshar SME KPI Governance becomes the cornerstone of long-term business leadership rather than just another management process.

#Leaderly #BawsharSMEKPIGovernance #Oman #Muscat #SMEs #Accounting #Tax #Audit