Oman E-Invoicing Fraud Mitigation Framework and the Strategic Transformation of Omani Enterprises

Oman E-Invoicing Fraud Mitigation Framework as a National Economic Safeguard

Why Vision 2040 made invoice integrity a strategic priority

The Oman E-Invoicing Fraud Mitigation Framework did not emerge simply as a technical upgrade but as a cornerstone of Oman Vision 2040’s financial governance agenda. Over the past decade, informal invoicing practices, fragmented accounting systems, and manual recordkeeping created systemic blind spots that allowed invoice manipulation, underreported revenue, and undocumented transactions to persist across multiple sectors. For SMEs in Muscat and across the Sultanate, these weaknesses translated into higher audit risk, unreliable financial data, and growing vulnerability to regulatory penalties as VAT and corporate tax regimes matured. By embedding electronic invoicing into the core of national financial infrastructure, Oman has effectively shifted from reactive enforcement to proactive risk containment. Each invoice becomes a verifiable data object, traceable across suppliers, customers, banks, and the Tax Authority. This transparency strengthens trust between businesses and regulators while protecting legitimate enterprises from unfair competition driven by fraudulent practices. For finance managers and founders, the framework creates a disciplined operating environment where revenue recognition, expense classification, and tax reporting are automatically aligned. This alignment reduces compliance costs over time, minimizes disputes, and stabilizes cash flow planning. In practical terms, the framework converts everyday invoicing from a clerical function into a strategic control mechanism that protects enterprise value.

Oman E-Invoicing Fraud Mitigation Framework and SME Operational Resilience

How digital invoices change internal risk management

Within SMEs, the Oman E-Invoicing Fraud Mitigation Framework reshapes internal control structures in ways many business owners underestimate. Traditional invoice handling relied heavily on trust in individual staff, informal approvals, and manual reconciliations that often lagged behind actual business activity. E-invoicing introduces automated validation rules, timestamping, standardized tax fields, and centralized storage, which collectively reduce opportunities for invoice tampering, duplicate billing, and fictitious supplier schemes. When integrated into accounting systems, these controls give finance teams real-time visibility over revenue cycles and cost patterns. For entrepreneurs scaling operations, this visibility becomes critical for detecting abnormal fluctuations before they become material losses. Banks and investors increasingly examine invoice data quality when assessing creditworthiness and valuation. Businesses operating under the framework therefore gain stronger credibility in financing negotiations. At the same time, management decisions become more data-driven, with accurate profit margins, tax liabilities, and working capital projections available at any moment. The framework does not remove the need for professional accounting judgment, but it elevates the baseline reliability of financial information, enabling advisory, valuation, and feasibility analysis to rest on verified transactional foundations.

Oman E-Invoicing Fraud Mitigation Framework and Regulatory Confidence

Building long-term trust with authorities and partners

Regulators view the Oman E-Invoicing Fraud Mitigation Framework as a fundamental pillar for sustaining Oman’s modern tax system. VAT implementation exposed how inconsistent invoicing practices created gaps between declared tax and economic reality. By standardizing invoice data and creating digital audit trails, authorities gain continuous oversight without intrusive inspection cycles. This does not only benefit the government; compliant businesses benefit from fewer disputes, faster tax refunds, and lower audit friction. Over time, enterprises that demonstrate stable compliance profiles are likely to experience smoother regulatory interactions and reduced compliance burden. From a commercial standpoint, partners and multinational clients increasingly require robust invoice controls when selecting Omani suppliers. Participation in the framework therefore expands market access, particularly for export-oriented SMEs seeking contracts with international firms. In effect, fraud risk reduction becomes a competitive advantage. The framework signals that Omani enterprises are operating under globally recognized standards of financial integrity, reinforcing Oman’s reputation as a reliable investment destination aligned with Vision 2040’s diversification objectives.

Oman E-Invoicing Fraud Mitigation Framework and Cash Flow Protection

Reducing hidden financial leakage in growing companies

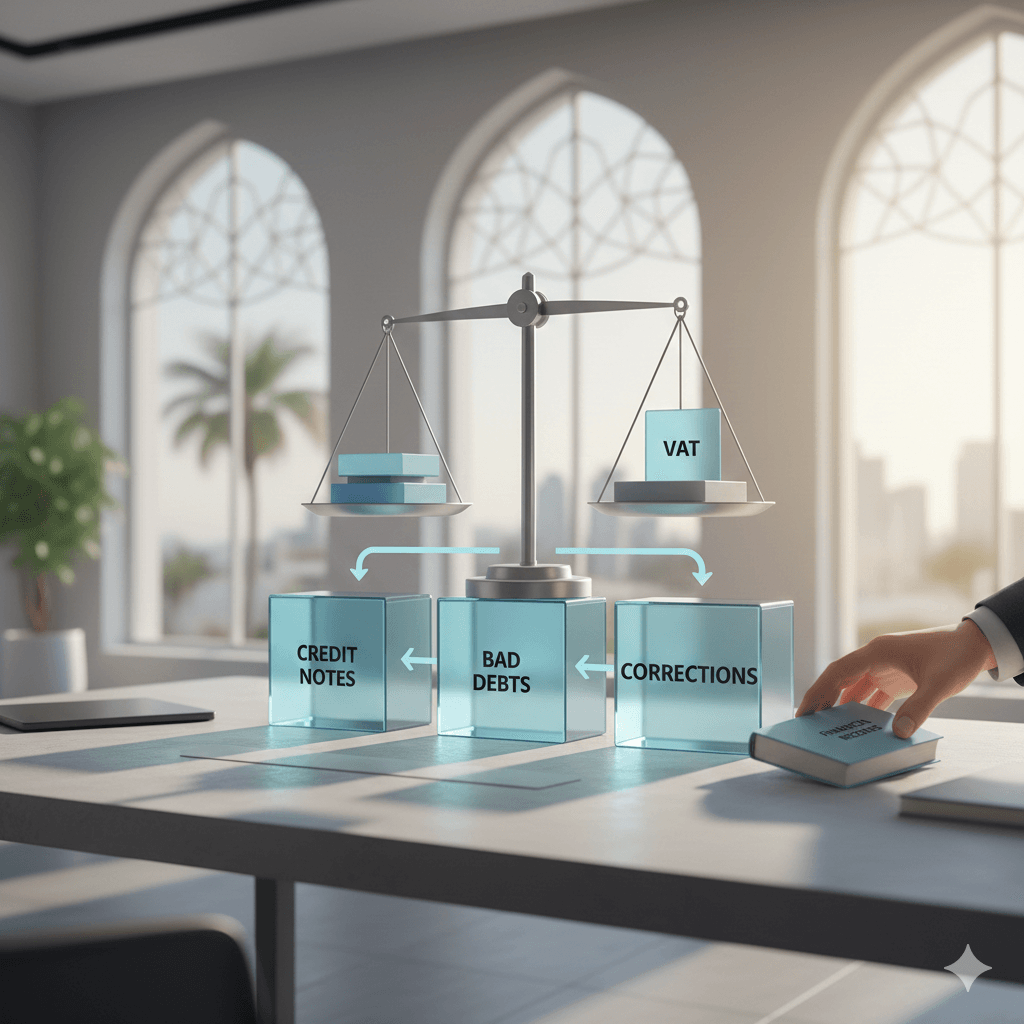

One of the least discussed benefits of the Oman E-Invoicing Fraud Mitigation Framework is its direct impact on cash flow preservation. Invoice fraud often manifests subtly through delayed billing, duplicate supplier claims, unauthorized credit notes, or manipulated tax amounts. These leakages erode margins quietly over months and years. With digital invoice validation and centralized records, discrepancies surface immediately. Finance managers can reconcile receivables and payables daily instead of monthly, significantly shortening the feedback loop between transaction and detection. For SMEs operating on tight margins, this control often marks the difference between sustainable growth and chronic liquidity stress. Moreover, accurate invoicing supports more precise VAT and corporate tax forecasting, allowing entrepreneurs to plan reserves and investments with confidence. The framework thus transforms financial management from reactive firefighting into proactive planning. When combined with professional accounting and advisory support, businesses can leverage this stability to pursue expansion, new product lines, or strategic partnerships without exposing themselves to unmanaged financial risk.

Oman E-Invoicing Fraud Mitigation Framework and Strategic Decision Making

From compliance tool to management intelligence engine

As data quality improves under the Oman E-Invoicing Fraud Mitigation Framework, the role of financial information within enterprises evolves. Accurate transactional data becomes the foundation for valuation, feasibility studies, and long-term strategy formulation. Entrepreneurs considering mergers, investor entry, or partial liquidation can rely on verifiable historical records, reducing uncertainty and negotiation friction. This reliability strengthens governance and accelerates deal execution. For SMEs, the transition is particularly significant because many growth barriers stem from unreliable financial reporting rather than market limitations. When management decisions rest on dependable invoice data, resource allocation improves, risk appetite becomes more disciplined, and growth plans become measurable. Over time, the framework contributes to the professionalization of Omani business culture, aligning everyday operational behavior with Vision 2040’s ambition for a globally competitive private sector.

Oman E-Invoicing Fraud Mitigation Framework and Long-Term Enterprise Value

Why fraud prevention is ultimately about valuation and continuity

Beyond immediate compliance benefits, the Oman E-Invoicing Fraud Mitigation Framework directly influences enterprise valuation and continuity planning. Businesses with clean, auditable invoice histories command higher valuations because buyers and investors can quantify risk accurately. In liquidation or restructuring scenarios, verified records accelerate due diligence and protect owners from prolonged disputes. Succession planning also benefits, as successors inherit transparent systems rather than opaque paper trails. Ultimately, the framework embeds financial discipline into the DNA of Omani enterprises. This discipline strengthens resilience against economic cycles, regulatory shifts, and market volatility. Fraud prevention is therefore not merely about avoiding penalties; it is about safeguarding the long-term economic value that entrepreneurs work decades to build.

In conclusion, the Oman E-Invoicing Fraud Mitigation Framework represents a structural transformation of how financial integrity is maintained within Omani enterprises. By aligning daily invoicing practices with Vision 2040’s governance objectives, it reduces systemic fraud risk, enhances regulatory confidence, and equips SMEs with stronger financial control mechanisms. What once functioned as a basic administrative process now operates as a central pillar of enterprise risk management and strategic planning.

For business owners, finance managers, and entrepreneurs, embracing the framework is no longer optional or purely regulatory. It is a strategic investment in operational stability, credibility, and long-term value creation. When supported by disciplined accounting, informed tax planning, and sound advisory insight, the framework becomes a powerful catalyst for sustainable growth in Oman’s evolving economic landscape.

#Leaderly #OmanE-InvoicingFraudMitigationFramework #Oman #Muscat #SMEs #Accounting #Tax #Audit