Vision 2040 Managing Third-Party Risk in Oman’s Digital Economy: A Strategic Imperative for SMEs

Understanding Third-Party Risk Within Oman’s Digital Landscape

In the context of Vision 2040 Managing Third-Party Risk in Oman’s Digital Economy, businesses face evolving challenges as digital transformation accelerates across sectors. Third-party risk refers to the potential vulnerabilities an organisation inherits from its external partners, suppliers, or service providers. For SMEs in Oman, which are increasingly integrating digital tools and outsourcing essential functions, recognising these risks is critical. The digital economy in Muscat and broader Oman offers unprecedented opportunities for growth and innovation but also exposes companies to risks such as data breaches, compliance failures, and operational disruptions linked to third parties. Vision 2040’s focus on economic diversification and digital advancement amplifies the importance of proactive risk management tailored to local market realities and regulatory frameworks.

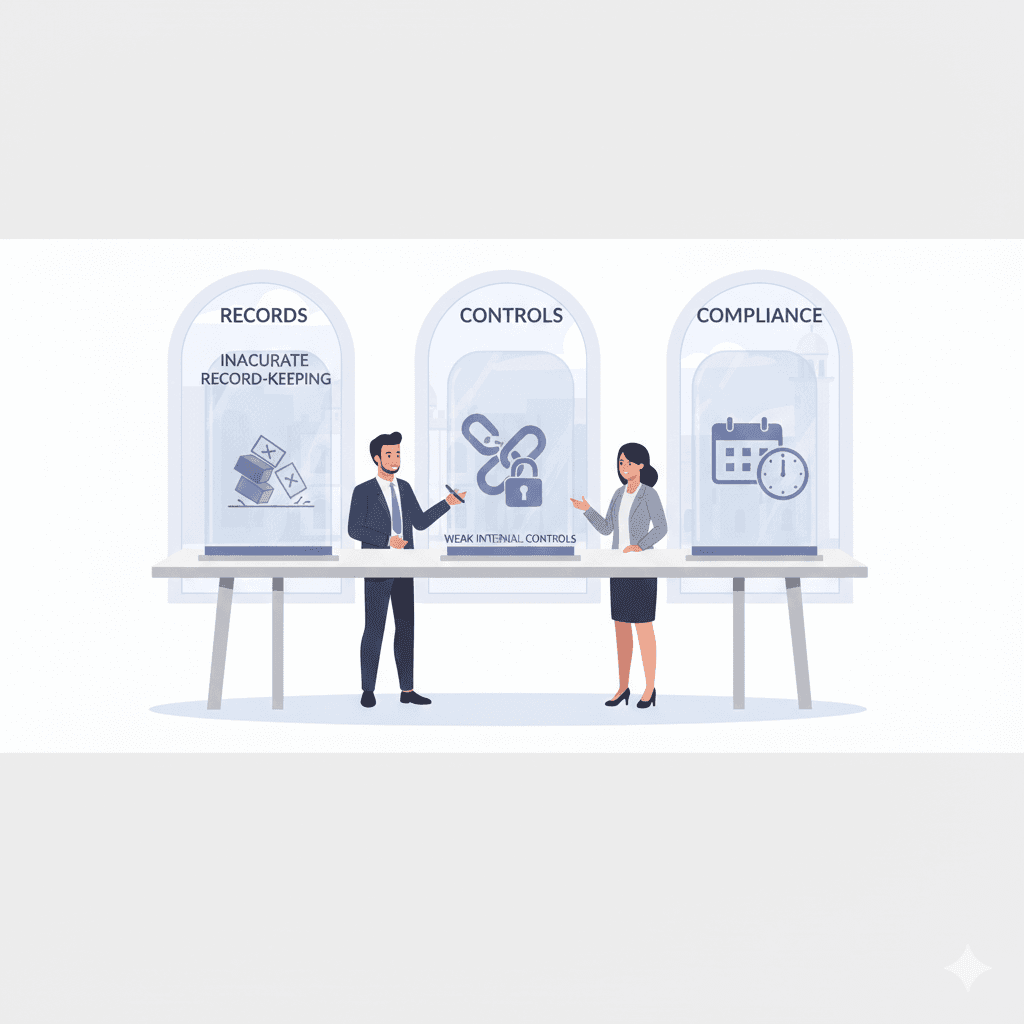

Regulatory Environment and Its Impact on Third-Party Risk Management

Oman’s regulatory landscape under Vision 2040 increasingly demands transparency, accountability, and resilience in business operations, especially regarding third-party engagements. For SMEs, understanding compliance requirements around data privacy, cybersecurity, and corporate governance is essential. VAT and corporate tax regulations also extend to transactions with suppliers and partners, making due diligence a critical step. The Muscat market has witnessed a rise in advisory services focused on risk assessment and audit readiness to align with these evolving rules. Vision 2040 Managing Third-Party Risk in Oman’s Digital Economy means SMEs must embed regulatory awareness into their vendor selection and contract management processes to safeguard both reputation and financial health.

Digital Risks and the Need for Technological Vigilance

The surge in digital platforms supporting Oman’s economic growth also introduces cyber vulnerabilities within third-party ecosystems. SMEs operating in Muscat’s digital economy must contend with risks like ransomware attacks, cloud service outages, and insecure software integrations. Vision 2040 Managing Third-Party Risk in Oman’s Digital Economy highlights the necessity for SMEs to adopt technological vigilance, ensuring that partners meet robust cybersecurity standards. This includes implementing continuous monitoring, penetration testing, and clear incident response protocols. Leveraging advisory expertise can help SMEs evaluate third-party technology resilience and tailor their internal controls to mitigate digital risks effectively.

Strategic Vendor Management for Sustainable Growth

Vision 2040 Managing Third-Party Risk in Oman’s Digital Economy calls for SMEs to move beyond transactional relationships and develop strategic partnerships with third parties. Effective vendor management is no longer just about cost or delivery but encompasses risk profiling, performance tracking, and collaborative governance. SMEs benefit from comprehensive audits and valuation exercises to ensure their third-party engagements align with business objectives and risk appetite. Muscat-based enterprises can use advisory services to implement frameworks that balance operational efficiency with risk mitigation, fostering sustainable growth aligned with Oman’s long-term economic goals.

Financial Implications of Third-Party Risk in SMEs

Financial management under Vision 2040 Managing Third-Party Risk in Oman’s Digital Economy requires SMEs to recognize the cost implications of third-party failures, including regulatory fines, legal liabilities, and operational downtime. Transparent accounting practices and tax compliance for outsourced services are paramount to avoid unexpected financial exposures. Leaderly’s integrated audit and tax advisory approach enables SMEs to maintain accurate financial records reflecting third-party engagements and comply with VAT and corporate tax requirements. Proactive risk management in financial reporting enhances investor confidence and strengthens business resilience in the face of third-party disruptions.

Building a Culture of Risk Awareness and Continuous Improvement

Vision 2040 Managing Third-Party Risk in Oman’s Digital Economy ultimately depends on cultivating a corporate culture that prioritizes risk awareness and continuous improvement. SMEs must train management and staff to identify potential third-party risks and respond swiftly to emerging threats. Integrating advisory-led due diligence, periodic audits, and valuation reviews ensures that risk controls evolve alongside business growth. This dynamic approach aligns with Oman’s Vision 2040 ambition of fostering innovative, responsible enterprises equipped to thrive in a digitally interconnected economy. Embedding such practices within the SME framework promotes resilience and long-term competitiveness in Muscat and beyond.

In conclusion, Vision 2040 Managing Third-Party Risk in Oman’s Digital Economy represents a critical strategic imperative for SMEs seeking to navigate the complexities of a rapidly evolving business environment. By understanding the unique risks associated with third-party relationships and leveraging local regulatory frameworks, SMEs can safeguard their operations against financial, operational, and reputational threats. Effective vendor management and technological vigilance are essential components that, when combined with robust audit and advisory services, support sustainable growth within Oman’s ambitious digital transformation agenda.

Practical application of these principles empowers business owners, finance managers, and entrepreneurs in Muscat and across Oman to confidently embrace digital innovation while mitigating risks inherent in third-party dependencies. Aligning closely with Leaderly’s integrated service offerings, SMEs gain access to expert guidance tailored for the local context—strengthening compliance, enhancing financial transparency, and reinforcing operational resilience. This holistic approach ensures that Oman’s SMEs not only survive but thrive as foundational contributors to the nation’s Vision 2040 digital economy.

#Leaderly #Vision2040ManagingThirdPartyRisk #Oman #Muscat #SMEs #Accounting #Tax #Audit