Muscat Cyber Governance Framework and the Future of Omani Board Responsibility

Introduction: Why the Muscat Cyber Governance Framework Matters Now

The Muscat Cyber Governance Framework is emerging as one of the most important board-level disciplines for Omani companies navigating the transformation agenda of Oman Vision 2040. Over the last decade, cyber risk has shifted from a technical issue managed by IT departments into a strategic business concern with direct financial, regulatory, and reputational consequences. For SMEs and growing enterprises in Muscat and across Oman, this shift is not theoretical. Payment systems, VAT reporting platforms, digital invoicing, customer data, supplier portals, and cloud-based accounting environments now form the backbone of daily operations. Each digital touchpoint introduces potential exposure that can affect cash flow, legal standing, and even business survival. Boards are therefore being asked to treat cyber risk with the same seriousness as financial risk, liquidity planning, and regulatory compliance.

Under Vision 2040, Oman’s policy direction is clear: economic diversification, digital competitiveness, and trust in business systems must advance together. The Muscat Cyber Governance Framework supports this alignment by creating a structured way for business leaders to connect cybersecurity decisions to governance, strategy, and long-term sustainability. For finance managers and entrepreneurs, understanding this framework is no longer optional. It influences access to financing, partnership credibility, and compliance confidence. More importantly, it enables boards to convert cyber uncertainty into informed oversight, disciplined investment, and measurable resilience rather than reactive spending after incidents occur.

Cyber Risk as a Financial and Strategic Threat to Omani SMEs

Cyber risk under the Muscat Cyber Governance Framework is best understood not as an IT problem, but as a financial and strategic risk with direct implications for SME stability. When data breaches disrupt invoicing, tax submissions, or customer transactions, the immediate impact is revenue interruption. The secondary impact is often regulatory exposure, especially as Oman strengthens compliance enforcement around data protection, VAT filings, and corporate reporting. These risks ultimately appear on the financial statements, through unplanned costs, lost contracts, insurance claims, and potential penalties. For business owners in Muscat’s competitive environment, unmanaged cyber risk becomes an invisible drag on valuation and investor confidence.

Strategically, cyber exposure influences growth decisions. SMEs expanding into e-commerce, digital supply chains, or regional platforms face heightened expectations from banks, partners, and regulators. They are increasingly asked to demonstrate structured cyber governance alongside financial controls. This is where the Muscat Cyber Governance Framework intersects with core governance responsibilities. It gives boards a lens to evaluate cyber readiness the same way they evaluate credit risk, tax exposure, and capital structure. For finance managers, this means cyber investments are no longer discretionary expenses. They become governance instruments that protect enterprise value, stabilize cash flows, and support long-term strategic positioning within Oman’s digital economy.

Building Board-Level Ownership of Cyber Governance in Muscat

The defining principle of the Muscat Cyber Governance Framework is ownership. Cyber risk must be owned at the board level, not delegated entirely to technical teams. Effective boards in Oman are increasingly integrating cyber oversight into their regular governance cycles alongside financial performance, audit results, and regulatory compliance reviews. This integration ensures that cyber decisions are aligned with business strategy, risk appetite, and growth objectives rather than isolated technology projects.

Board ownership begins with structured reporting. Management must present cyber risks in financial language: potential revenue exposure, regulatory consequences, operational disruption costs, and brand impact. When cyber risks are framed this way, they become governance decisions rather than abstract technical threats. Boards can then prioritize investments, approve policies, and monitor performance using the same discipline applied to budgeting and compliance. For SMEs, this structured oversight builds resilience without overwhelming limited resources. It also strengthens relationships with external auditors, tax advisors, and regulatory bodies, who increasingly view cyber governance as part of overall corporate control. In practice, the Muscat Cyber Governance Framework enables Omani boards to connect technology risk directly to enterprise value and long-term sustainability.

Embedding Cyber Governance Into Financial and Regulatory Compliance

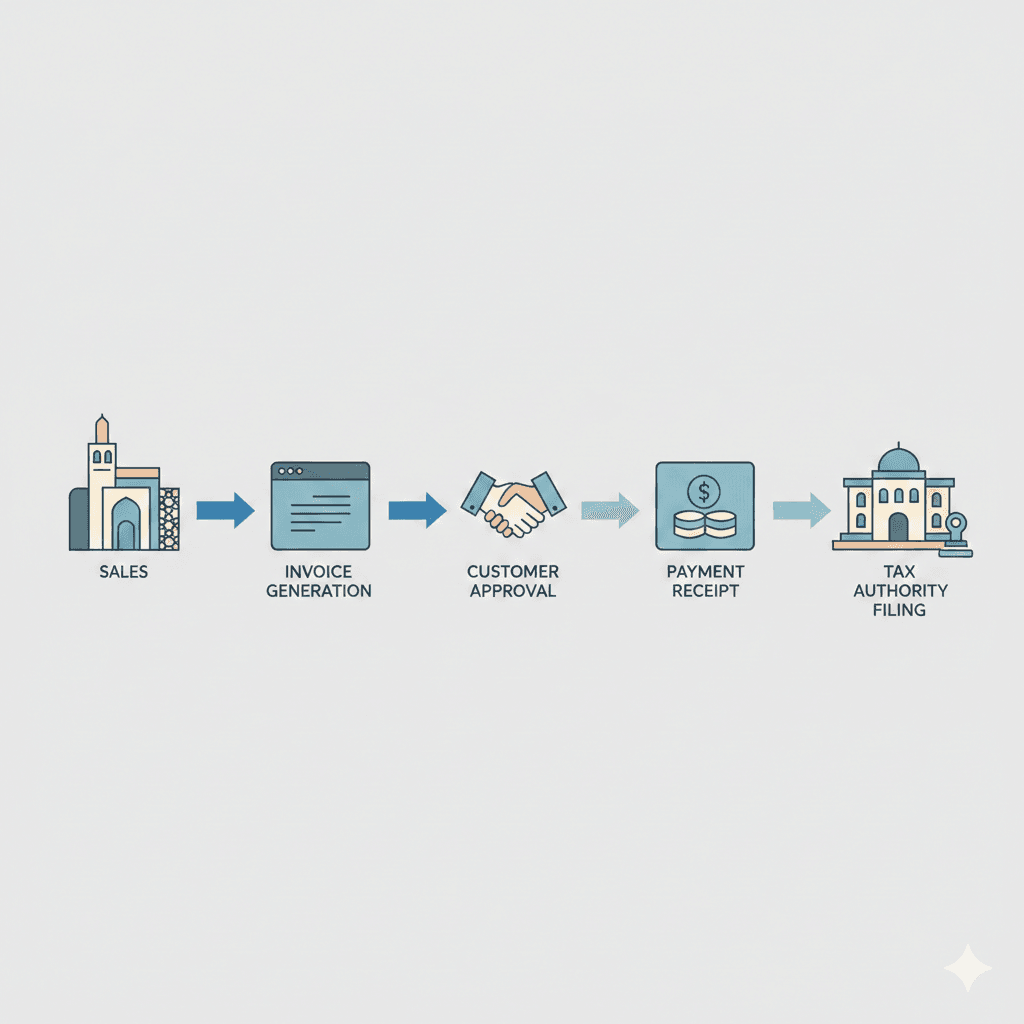

Within the Muscat Cyber Governance Framework, cyber governance and financial compliance are inseparable. Oman’s regulatory landscape now links data integrity, reporting accuracy, and system security in ways that directly affect VAT compliance, corporate tax obligations, and statutory reporting. A disruption to financial systems caused by a cyber incident can delay tax filings, distort financial statements, and trigger regulatory scrutiny. For SMEs operating with lean teams, the financial fallout of such disruption can be severe.

By embedding cyber controls into financial processes, businesses create a unified risk management structure. This includes protecting accounting platforms, securing transaction records, safeguarding customer data, and maintaining reliable backups for audit and reporting purposes. Finance managers play a central role here, translating cyber risks into financial controls and ensuring that compliance frameworks reflect digital realities. Advisors supporting Omani businesses increasingly integrate cyber governance into audit planning, tax risk assessments, and due diligence engagements. This integrated approach strengthens corporate governance while improving transparency and trust with banks, investors, and regulators. Ultimately, the Muscat Cyber Governance Framework allows SMEs to treat cyber resilience as a core component of financial discipline rather than an external technical obligation.

Aligning Cyber Governance With Growth and Valuation Objectives

Growth under Oman Vision 2040 demands that businesses become both digitally capable and structurally trustworthy. The Muscat Cyber Governance Framework directly influences how SMEs in Muscat and beyond are valued, financed, and perceived in the market. Potential investors, strategic partners, and acquirers increasingly assess cyber governance alongside financial performance. Weak cyber controls can reduce valuation, increase transaction risk, and complicate due diligence processes. Conversely, structured cyber governance signals maturity, reliability, and operational strength.

For entrepreneurs planning expansion, exit, or regional partnerships, cyber governance becomes a strategic asset. It supports scalability by ensuring that systems can grow securely and that compliance obligations remain manageable. It also reduces uncertainty during feasibility assessments, valuations, and restructuring initiatives. Advisory professionals working with Omani enterprises now routinely evaluate cyber governance as part of broader business diagnostics. This reflects a growing understanding that cyber resilience is foundational to sustainable growth. The Muscat Cyber Governance Framework provides the architecture that connects digital trust with long-term business ambition in Oman’s evolving economy.

Practical Implementation for Omani SMEs Without Overburdening Operations

Implementing the Muscat Cyber Governance Framework does not require excessive bureaucracy or enterprise-scale budgets. For SMEs, practicality is essential. The framework focuses on clarity of responsibility, structured oversight, and continuous improvement rather than complex technical systems. Boards begin by defining cyber risk ownership, establishing reporting routines, and integrating cyber topics into governance discussions. Management aligns financial controls, compliance procedures, and operational safeguards with identified risks.

Over time, this creates a culture where cyber governance becomes part of everyday decision-making. Finance teams coordinate closely with advisors to ensure that tax filings, audits, and regulatory interactions reflect strong digital controls. Entrepreneurs gain confidence that their businesses are resilient, compliant, and attractive to partners. Importantly, the framework evolves with the business, adapting as operations expand and regulatory expectations shift. This adaptive approach ensures that cyber governance remains a strategic enabler rather than a constraint. For Omani SMEs navigating Vision 2040’s transformation, this balanced implementation is what converts cyber risk into sustained competitive advantage.

Conclusion

The Muscat Cyber Governance Framework represents a fundamental shift in how Omani businesses understand and manage cyber risk. It moves cyber security out of isolated technical departments and firmly into the boardroom, where financial strategy, compliance, and long-term growth decisions are made. By aligning cyber governance with Oman Vision 2040’s ambitions, SMEs gain more than protection; they gain credibility, stability, and strategic clarity. Cyber resilience becomes a visible indicator of management quality, financial discipline, and corporate maturity.

For business owners, finance managers, and entrepreneurs across Muscat and Oman, the practical value is clear. Structured cyber governance strengthens financial reporting, supports tax and regulatory compliance, improves valuation outcomes, and enhances investor confidence. It allows leadership teams to make informed decisions, manage uncertainty, and pursue growth with confidence. As digital transformation accelerates, those who embed the Muscat Cyber Governance Framework into their governance architecture will be best positioned to thrive in Oman’s next phase of economic development.

#Leaderly #MuscatCyberGovernanceFramework #Oman #Muscat #SMEs #Accounting #Tax #Audit