Muscat Contracting Firms Retentions: Best Practices for Variations and Revenue Recognition

Understanding Retentions in Muscat Contracting Firms

What Are Contract Retentions and Why They Matter

Muscat contracting firms retentions play a crucial role in the financial management of construction projects across Oman. In this sector, retentions represent a portion of contract payments withheld by clients or contractors as a safeguard to guarantee the satisfactory completion of work and the correction of any defects. Typically, this withheld amount ranges from 5% to 10% of the total contract value and is retained until the agreed retention period ends, often several months after project completion. For SME contracting firms, managing retentions effectively is vital to preserve liquidity, control cash flow risks, and ensure precise financial reporting. Poor handling of retentions can cause cash flow shortages and complicate the revenue recognition process in line with Oman’s evolving accounting standards.

How Variations Impact Contract Value and Financial Reporting

Navigating Changes in Contract Scope and Cost

Variations, or change orders, are inevitable in Muscat’s contracting landscape, driven by project modifications, unforeseen site conditions, or client requests. These changes alter the originally agreed contract price and timeline, impacting both cash flow and accounting. Properly managing variations is critical to avoid disputes and ensure that additional costs or credits are accurately reflected in financial statements. For contracting SMEs, tracking variations meticulously helps maintain transparency with clients and supports sound decision-making. In Oman, accounting standards require that variations be incorporated into revenue and cost calculations only when they are approved and measurable, emphasizing the need for robust contract management and documentation practices.

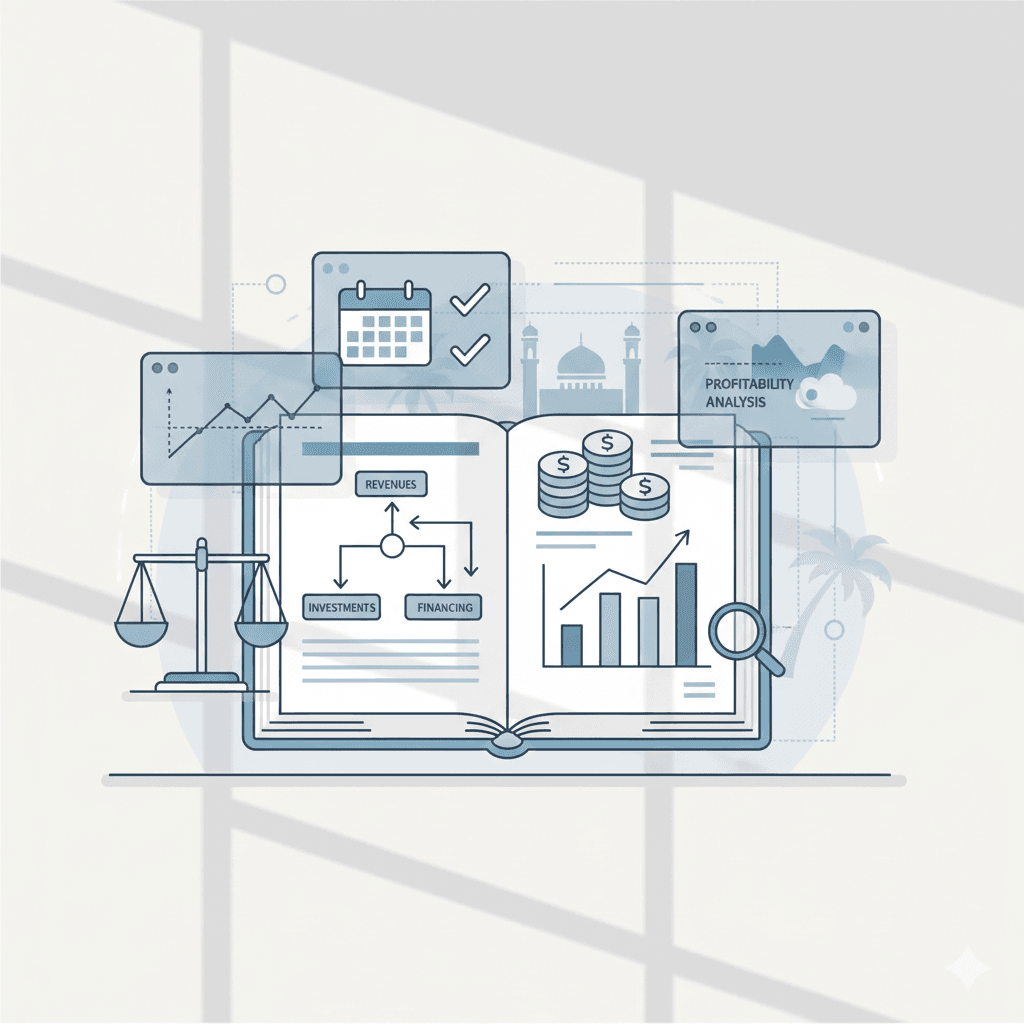

The Essentials of Revenue Recognition for Contracting Firms

Recognizing Income Accurately Under Oman’s Financial Framework

Revenue recognition in the contracting industry can be complex, particularly with long-term contracts common in Muscat. The key principle is to recognize revenue in a way that reflects the transfer of control of work to the client over time. Oman-based SMEs must apply methods such as the percentage-of-completion approach to match income with work progress accurately. This approach requires reliable estimates of total contract costs and progress measurement. Incorrect revenue recognition can lead to misleading financial results, affecting tax obligations and business planning. Aligning revenue recognition with regulatory compliance, including VAT and corporate tax laws overseen by authorities in Oman, ensures that contracting firms maintain financial integrity and stakeholder confidence.

Practical Strategies for Managing Retentions Efficiently

Improving Cash Flow and Risk Management

For Muscat contracting firms, managing retentions effectively involves not only understanding contract terms but also actively negotiating retention release schedules and monitoring outstanding retention balances. SMEs should maintain a clear schedule of retention receivables and payables to anticipate cash flow gaps. Additionally, exploring financial advisory services such as retention bond alternatives can reduce the strain on working capital. Careful coordination with audit and accounting professionals ensures retentions are correctly accounted for as current assets or liabilities, reflecting their impact on financial statements. Proactive retention management mitigates risks of delayed payments and supports smoother project closure, enhancing overall business sustainability.

Addressing Variations with Robust Contract Controls

Documenting and Approving Changes to Minimize Disputes

Implementing stringent controls around variations is critical for contracting firms in Muscat to safeguard profitability and compliance. This means establishing clear processes for submitting variation claims, obtaining formal client approvals, and updating contract values promptly. SMEs should leverage advisory services to assess the feasibility and financial impact of proposed changes before approval. Proper documentation ensures that variations are auditable, reducing the risk of disputes or financial losses. Accurate recording of variation costs and revenues also aids in precise corporate tax and VAT calculations, fulfilling regulatory expectations in Oman’s evolving tax environment.

Integrating Revenue Recognition with Contract and Tax Compliance

Aligning Accounting Practices with Oman’s Regulatory Framework

Revenue recognition in Muscat contracting firms must align with both accounting standards and tax regulations. SMEs face the dual challenge of reflecting revenue fairly in financial statements while ensuring compliance with VAT and corporate tax requirements. Utilizing advisory services for due diligence on contracts and tax impact assessments helps contracting firms optimize their revenue recognition methods. Accurate cost tracking and periodic financial reviews support timely tax filings and audit readiness. By integrating accounting, audit, and tax considerations, contracting SMEs strengthen their financial control environment and enhance credibility with banks, investors, and government authorities.

In conclusion, Muscat contracting firms face unique financial challenges due to the complexities of retentions, contract variations, and revenue recognition. By understanding the critical role of retentions and proactively managing them, SMEs can safeguard their cash flow and avoid liquidity risks. Equally important is the disciplined handling of contract variations through robust controls and transparent documentation, ensuring that changes to contract values are accurately captured and reflected.

Moreover, revenue recognition must be carefully aligned with Oman’s regulatory standards to produce financial statements that reflect true economic performance while satisfying tax compliance requirements. Contracting firms that integrate audit, accounting, and advisory practices into their financial processes will be better positioned to maintain operational stability, meet regulatory demands, and confidently pursue growth opportunities in the competitive Muscat construction sector.

#Leaderly #MuscatContractingFirmsRetentions #Oman #Muscat #SMEs #Accounting #Tax #Audit