Al Mouj Financial Reporting Standards: Essential Guidelines for Premium Service SMEs

Understanding Al Mouj Financial Reporting Standards

Foundation for Accurate Financial Management

Al Mouj Financial Reporting Standards have become a critical framework for premium service providers operating within this prestigious Muscat community. These standards serve as a structured guide that ensures financial transparency, accuracy, and consistency in reporting, which are essential to meeting Oman’s regulatory requirements. For SMEs offering high-end services, adhering to these standards is more than compliance—it signals trustworthiness to clients and investors alike. Accurate financial statements prepared under these guidelines reflect true business health, enabling better strategic decisions and smoother access to financing options. Importantly, these standards incorporate local tax laws, such as VAT and corporate tax obligations, creating a seamless bridge between operational finance and regulatory adherence.

Relevance to Premium Service SMEs in Al Mouj

Premium service providers in Al Mouj face unique financial reporting challenges due to the nature of their operations and clientele. These businesses often engage in contracts with high-value transactions and complex service delivery models, which demand precise revenue recognition and expense tracking. Al Mouj Financial Reporting Standards address these complexities by prescribing clear rules on how to capture service income, allocate costs, and present financial information. This specificity benefits SMEs by reducing the risk of financial misstatements, which can lead to penalties or loss of client confidence. Moreover, SMEs that follow these standards demonstrate a commitment to excellence and compliance, which is crucial in a competitive premium market where reputation impacts growth.

Integrating Tax Compliance into Reporting Practices

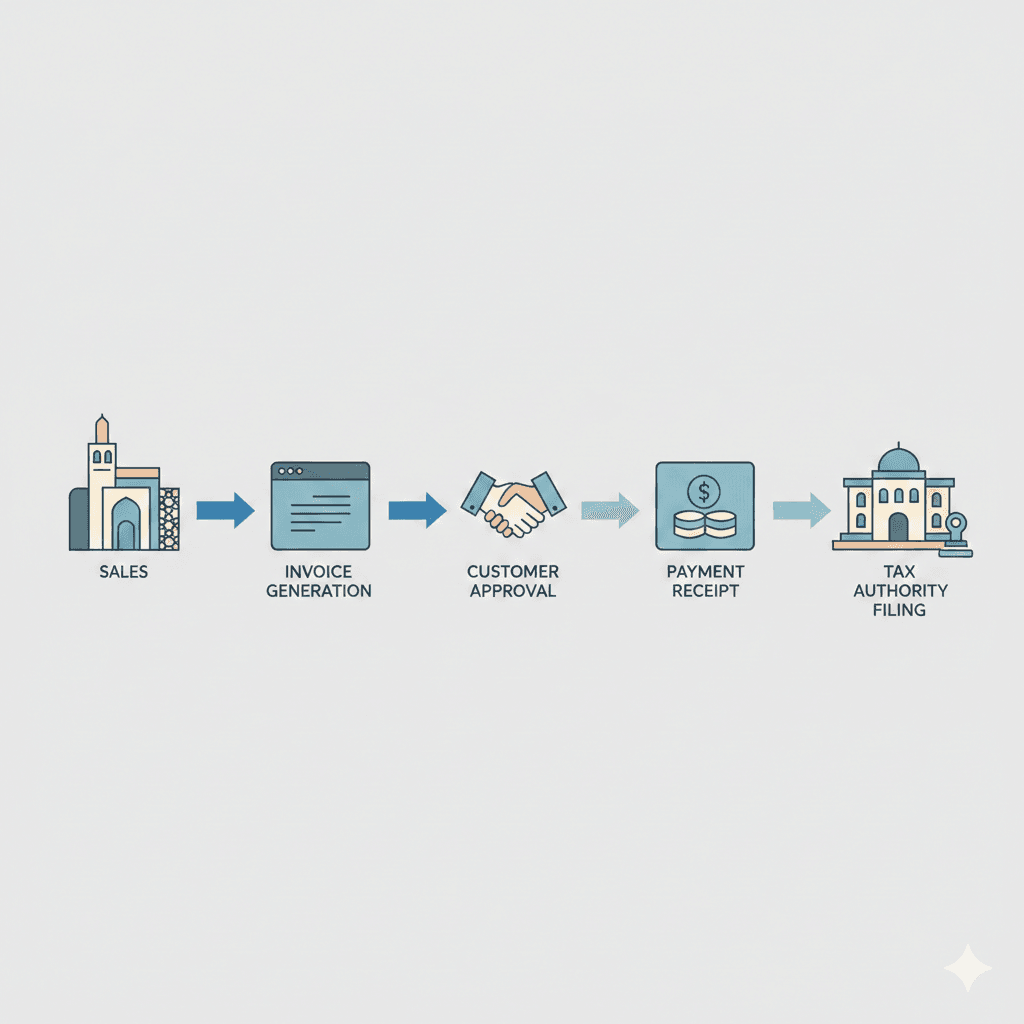

One of the pillars of Al Mouj Financial Reporting Standards is their alignment with Oman’s evolving tax landscape, particularly VAT and corporate tax regulations. Premium service providers must integrate tax compliance seamlessly into their accounting and reporting practices to avoid costly errors and audits. These standards provide a comprehensive approach for SMEs to record taxable transactions correctly, apply the appropriate VAT rates, and prepare tax returns with accuracy. This integration is vital because financial reporting and taxation are interdependent; proper reporting ensures accurate tax filings, while tax compliance validates financial integrity. Through this alignment, SMEs gain the confidence to focus on growth and client service without being bogged down by tax complexities.

Practical Steps to Implement Reporting Standards in Al Mouj

Adopting Al Mouj Financial Reporting Standards requires deliberate planning and execution tailored to the operational realities of premium service SMEs. The first step involves assessing existing financial processes to identify gaps in compliance and reporting quality. Business owners should ensure their accounting systems are capable of handling the specific reporting requirements, including detailed transaction categorization and comprehensive documentation. Staff training is equally important, as teams must understand the nuances of the standards to maintain consistent application. Partnering with a trusted financial advisor, such as Leaderly, can facilitate this transition by providing expertise in audit, accounting, and advisory services specifically geared towards Oman’s SME landscape. This support enables businesses to implement standards efficiently and sustainably.

Leveraging Advisory Services for Enhanced Financial Governance

Beyond compliance, Al Mouj Financial Reporting Standards open opportunities for SMEs to strengthen their overall financial governance. Advisory services play a key role in helping businesses interpret these standards in the context of their strategic goals. For premium service providers, advisory can include feasibility studies to understand the financial impact of new projects, valuations that reflect accurate business worth, and due diligence for potential partnerships or expansions. These advisory services, naturally aligned with the reporting standards, equip SMEs with deeper insights and better decision-making tools. By embracing advisory support, SMEs not only meet statutory requirements but also build robust financial structures that drive long-term success in Al Mouj’s competitive environment.

Benefits of Consistent Financial Reporting for Growth

Consistent application of Al Mouj Financial Reporting Standards equips premium service SMEs with credible financial information that enhances stakeholder confidence. Reliable financial reporting attracts investors and financial institutions by reducing perceived risks and clarifying business viability. Additionally, it improves internal management capabilities, allowing owners and finance teams to monitor performance accurately and manage resources effectively. Over time, this discipline fosters operational efficiency and positions the business for sustainable growth. In Al Mouj, where premium services cater to discerning clients, these financial practices reflect professionalism and preparedness, ultimately translating into stronger market positioning and business resilience.

In conclusion, Al Mouj Financial Reporting Standards are indispensable for premium service providers seeking to excel in Muscat’s sophisticated market. These standards not only ensure compliance with Oman’s tax and regulatory framework but also provide a foundation for transparent, reliable, and actionable financial information. SMEs adopting these standards gain a competitive edge through improved financial clarity, enhanced governance, and stronger stakeholder trust.

For premium service SMEs in Al Mouj, integrating these standards with expert advisory and accounting support creates a robust platform for managing complexities and achieving growth ambitions. Leaderly’s tailored services align naturally with these needs, helping businesses navigate financial reporting and tax compliance confidently. Embracing Al Mouj Financial Reporting Standards is thus a strategic imperative for any premium service SME committed to excellence and sustainable success in Oman’s dynamic business environment.

#Leaderly #AlMoujFinancialReportingStandards #Oman #Muscat #SMEs #Accounting #Tax #Audit