Azaiba Hospitality Finance: Streamlining Daily Sales Reconciliation for SMEs in Muscat

Understanding Daily Sales Reconciliation in Azaiba’s Hospitality Sector

The Cornerstone of Financial Control for Hospitality SMEs

Azaiba Hospitality Finance relies heavily on daily sales reconciliation, a vital process in Muscat’s bustling hospitality sector known for its cafes, restaurants, and boutique hotels. This process involves carefully matching daily sales recorded across various channels—such as point-of-sale systems, online bookings, and cash registers—with the actual cash, card payments, and bank deposits received. For SMEs in Azaiba’s hospitality industry, mastering daily sales reconciliation goes beyond meeting regulatory requirements; it serves as a crucial control to ensure accurate revenue reporting and prompt detection of discrepancies or fraud. The complexity of multiple sales channels and payment methods increases the risk of errors if reconciliation is overlooked or poorly handled. By implementing consistent daily reconciliation routines, hospitality SMEs can protect their cash flow, minimize financial risks, and build confidence with stakeholders and tax authorities.

Key Challenges in Azaiba Hospitality Finance and Sales Reconciliation

Hospitality businesses in Azaiba face unique challenges when it comes to daily sales reconciliation. These include fluctuating customer volumes, multiple shifts and staff handling payments, and the integration of digital and traditional sales recording methods. Variability in peak and off-peak hours complicates the timing and accuracy of reconciliation. Moreover, many SMEs struggle with manually intensive reconciliation processes, often relying on spreadsheets or paper records that are prone to human error and delays. Compounding this is the need for strict compliance with Oman’s VAT regulations, which require accurate, timely sales reporting for tax filings. These challenges create a risk of revenue leakage, delayed cash management decisions, and penalties from tax authorities if inaccuracies arise. For hospitality SMEs, overcoming these challenges requires not only proper training but also adoption of effective financial controls and technologies tailored to the local market dynamics of Azaiba.

The Role of Technology in Simplifying Reconciliation Processes

Technological solutions play a vital role in simplifying daily sales reconciliation for Azaiba’s hospitality SMEs. Modern point-of-sale (POS) systems integrated with inventory management and financial reporting software reduce manual effort by automatically capturing sales data and generating real-time reports. Cloud-based platforms enable remote access and synchronization across multiple outlets, facilitating consolidated reconciliation. Additionally, digital payment gateways streamline card and mobile wallet transactions, making electronic payment reconciliation more efficient and accurate. Importantly, these technologies support compliance with Omani VAT requirements by automatically calculating tax components and preparing compliant reports. Hospitality businesses can benefit from tailored advisory services to select and implement suitable financial technologies that align with their operational scale and complexity. Leaderly’s advisory expertise helps SMEs navigate these options, ensuring investments in technology deliver tangible improvements in reconciliation accuracy and financial oversight.

Implementing Best Practices for Daily Sales Reconciliation in Azaiba

Effective daily sales reconciliation begins with establishing robust internal controls and clear operational procedures tailored to the hospitality environment in Azaiba. This includes assigning responsibility to specific staff for daily reconciliation tasks, setting cut-off times aligned with business shifts, and maintaining transparent documentation of all transactions. Cash counts should be independently verified, and any variances immediately investigated and documented. Incorporating a segregation of duties—such as separating sales recording from cash handling—minimizes fraud risks. SMEs should also integrate reconciliation schedules into their routine accounting processes, enabling timely reporting and cash flow management. Importantly, hospitality businesses must ensure their reconciliation practices capture VAT accurately, reflecting Oman’s evolving taxation environment. Leaderly’s audit and accounting services provide practical guidance and verification to reinforce these internal controls, delivering confidence in daily financial reporting.

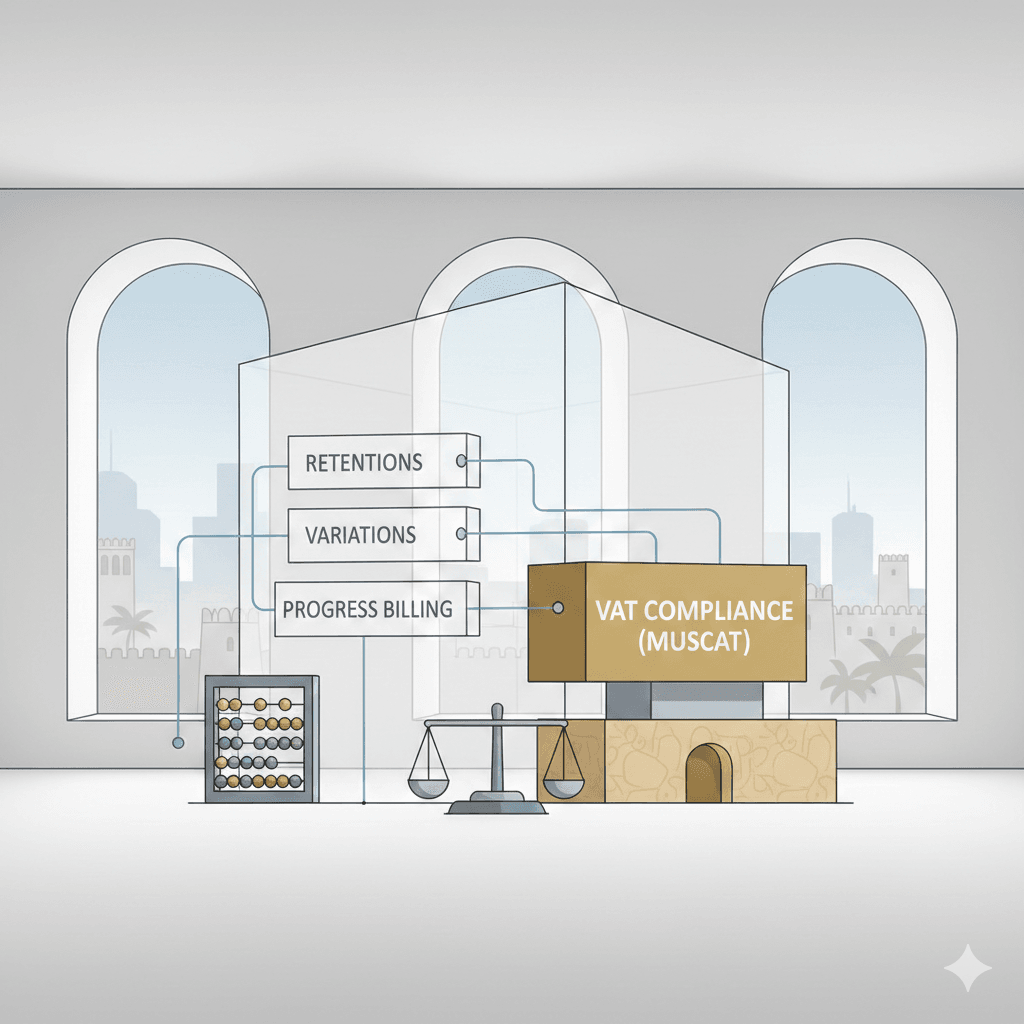

How VAT and Taxation Impact Daily Sales Reconciliation in Hospitality

Oman’s VAT framework has introduced significant considerations for hospitality SMEs in Azaiba regarding daily sales reconciliation. Every transaction must be accurately recorded with the applicable tax rate, ensuring that VAT collected from customers is correctly accounted for and remitted. Incomplete or inaccurate reconciliation can lead to discrepancies in VAT filings, exposing businesses to penalties and audits. SMEs must also consider corporate tax implications, which require detailed and transparent revenue tracking. Daily reconciliation supports these obligations by providing precise sales data that feeds into monthly or quarterly tax returns. Proper handling of VAT invoices, credit notes, and electronic receipts during reconciliation reduces risks of non-compliance. Tax advisory services, like those from Leaderly, assist hospitality businesses in understanding and implementing these tax-related requirements within their reconciliation processes, ensuring both regulatory compliance and optimal tax planning.

Financial Advisory for Sustainable Growth in Azaiba’s Hospitality SMEs

Beyond day-to-day reconciliation, effective financial management supports sustainable growth for hospitality SMEs in Azaiba. Financial advisory services help businesses conduct feasibility studies, assess valuation, and plan for expansion or liquidation with accurate financial data grounded in reliable sales records. Daily sales reconciliation data forms the backbone of cash flow forecasts, budgeting, and performance analysis. SMEs can leverage these insights to make informed decisions about pricing strategies, staff allocation, and inventory management. Furthermore, routine reconciliation enhances financial transparency, making businesses more attractive to investors, lenders, and partners. Leaderly’s advisory expertise extends beyond compliance to help hospitality SMEs in Azaiba develop financial discipline that drives profitability and resilience in a competitive market.

Daily sales reconciliation in Azaiba’s hospitality sector is more than a routine task—it is a strategic financial control that directly influences business sustainability and growth. By addressing sector-specific challenges through technology adoption, robust internal controls, and tax compliance integration, SMEs can safeguard their revenue and improve cash flow visibility. These measures not only protect against errors and fraud but also position businesses for confident decision-making and regulatory compliance in Oman’s evolving economic landscape.

For hospitality entrepreneurs and finance managers in Azaiba, embedding effective reconciliation practices supported by professional advisory and audit services is essential. It transforms daily operational data into actionable financial intelligence, ensuring the business remains agile and competitive. With the right approach, Azaiba’s hospitality SMEs can harness the power of daily sales reconciliation as a foundation for long-term success in Muscat’s dynamic market.

#Leaderly #AzaibaHospitalityFinance #Oman #Muscat #SMEs #Accounting #Tax #Audit