MSQ Consultants Oman Profitability Tracking: Enhancing Financial Clarity for SMEs

Understanding Profitability Tracking in Oman’s SME Landscape

Why tracking profitability by client and project matters

Profitability tracking by client and project is a critical financial discipline for SMEs operating in Oman, especially in dynamic markets such as Muscat. Unlike traditional blanket financial reporting, this approach zeroes in on the profitability of individual clients and projects, offering granular insight that can transform business decision-making. For SMEs, where margins are often tight and resources limited, knowing exactly which clients and projects generate value is essential to maintaining sustainable growth and operational efficiency. By identifying the most profitable elements of the business, companies can prioritize efforts and allocate resources more effectively, avoiding wasted time and capital on unprofitable ventures. This targeted visibility is not just about numbers; it’s about creating a practical roadmap for better management and strategic planning within the Oman business environment.

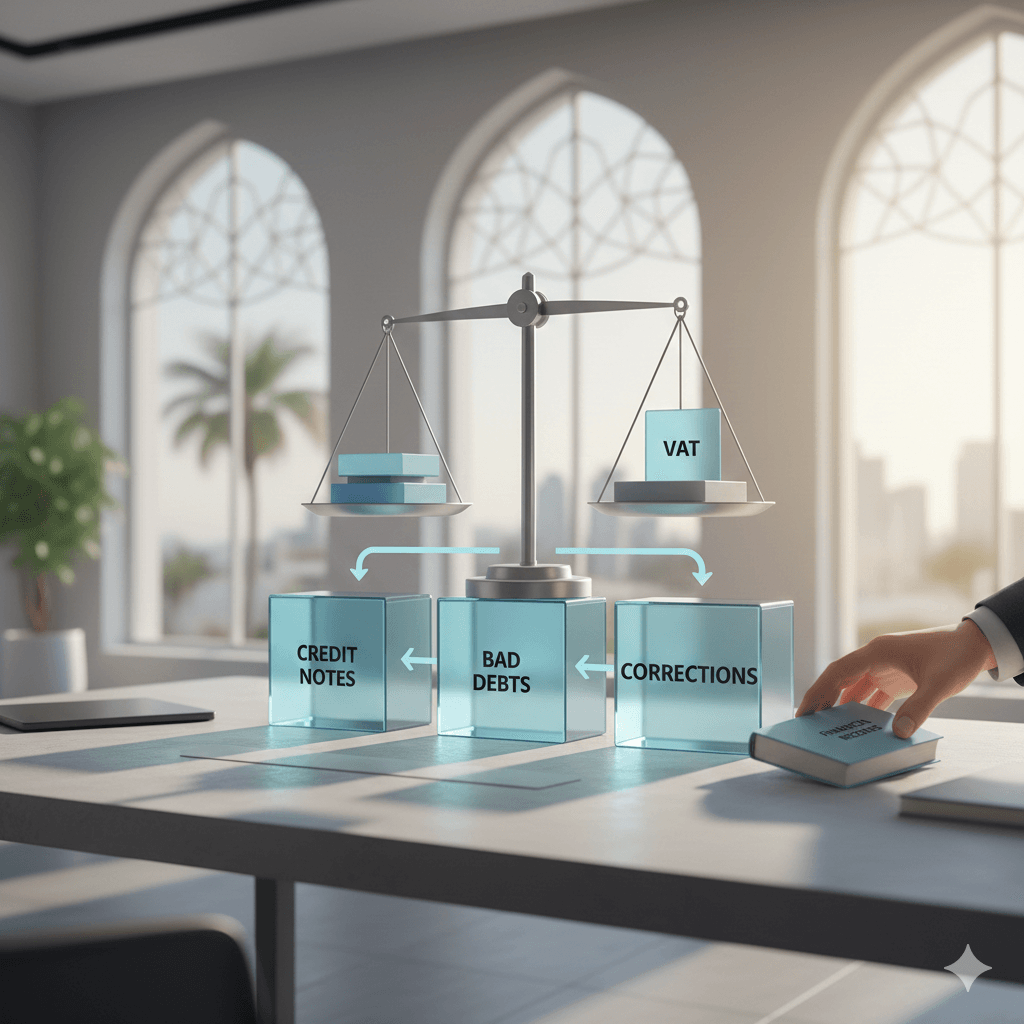

Challenges in Implementing Profitability Tracking for Omani SMEs

Omani SMEs frequently face challenges when attempting to implement profitability tracking by client and project due to several factors. First, the lack of sophisticated financial systems and limited internal accounting expertise can hamper accurate data capture and analysis. Many small and medium enterprises still rely on manual or generic accounting systems that do not segment costs and revenues in a way that reflects client- or project-level profitability. Additionally, complexities such as fluctuating VAT rates and evolving corporate tax requirements in Oman add layers of regulatory compliance that can distract from detailed financial tracking. Without proper advisory and accounting support, SMEs may struggle to achieve the accuracy and consistency required for meaningful profitability analysis, which can result in misinformed decisions or missed opportunities for cost control and revenue enhancement.

How MSQ Consultants Oman Profitability Tracking Empowers SME Growth

MSQ Consultants offer tailored profitability tracking solutions designed specifically for SMEs in Oman, focusing on clear, actionable financial insights by client and project. Their approach integrates seamlessly with existing accounting and audit frameworks, ensuring compliance with Oman’s VAT and corporate tax regulations while providing detailed profitability reports. This empowers SMEs to uncover hidden profit centers and identify loss-making clients or projects early, enabling timely corrective measures. The consultancy’s advisory services also support feasibility studies and due diligence processes, helping SMEs evaluate new ventures with a profitability-first mindset. By using MSQ Consultants’ expertise, business owners and finance managers in Oman gain confidence in their financial data, which strengthens strategic planning, pricing strategies, and client negotiations.

Practical Steps to Implement Profitability Tracking in Muscat SMEs

For SMEs in Muscat looking to adopt profitability tracking by client and project, the process begins with establishing a structured cost allocation framework. This involves identifying direct and indirect costs associated with each client or project and ensuring these are recorded consistently within the accounting system. Collaboration with professional auditors and accounting advisors, such as those at Leaderly and MSQ Consultants, can simplify this process by providing tailored tools and methodologies aligned with local regulations. Equally important is the training of finance teams to interpret profitability data correctly, turning raw figures into actionable business insights. As SMEs refine their profitability tracking, they should integrate tax considerations—like VAT reconciliation and corporate tax impacts—into their analysis, ensuring a comprehensive financial picture.

Leveraging Profitability Data for Strategic Decision-Making in Oman

Once profitability tracking systems are in place, SME leaders in Oman can leverage this data to make informed strategic decisions. This includes refining client portfolios by focusing on higher-margin clients and renegotiating contracts or pricing with less profitable ones. Project selection becomes more disciplined, prioritizing initiatives with better return profiles and cutting projects that drain resources. Additionally, profitability insights enable smarter resource allocation, optimizing workforce deployment and operational costs to enhance overall margins. In the competitive business climate of Muscat, these data-driven decisions differentiate successful SMEs, allowing them to adapt swiftly to market changes while maintaining compliance with evolving fiscal policies. MSQ Consultants’ advisory services often guide SMEs through these transformations, ensuring financial clarity leads to sustainable growth.

Future-Proofing SMEs with Ongoing Profitability Monitoring and Advisory

Sustained profitability requires continuous monitoring, not a one-time assessment. SMEs in Oman must adopt ongoing profitability tracking practices that evolve with business and regulatory changes. MSQ Consultants emphasize the importance of regular financial reviews and audits to maintain accuracy and relevance. This proactive approach helps SMEs detect trends, spot emerging risks, and adjust pricing or project scopes promptly. Moreover, advisory services focused on feasibility, valuation, and liquidation assist businesses in preparing for expansion, restructuring, or exit strategies based on solid profitability data. By integrating profitability tracking into their core financial operations, SMEs can future-proof their businesses against market volatility and regulatory shifts common in Oman’s growing economy.

The integration of client- and project-level profitability tracking into SME financial management in Oman is more than an accounting exercise—it is a strategic imperative. With the right systems and expert advisory, companies can transform opaque financial data into a clear, actionable business advantage. For SMEs operating in Muscat, partnering with experienced consultants like MSQ Consultants and Leaderly ensures that profitability tracking is not only compliant with local tax laws but also tailored to drive growth and sustainability. This approach empowers business owners and finance managers to navigate Oman’s evolving economic landscape with confidence and precision.

Ultimately, the success of profitability tracking lies in its practical application—using detailed insights to sharpen decision-making, optimize client relationships, and select profitable projects. For Omani SMEs, this means enhanced financial control, stronger competitive positioning, and a foundation for long-term prosperity. As the business environment continues to advance, embracing these tools and advisory services will be critical for SMEs striving to lead and excel in Oman’s vibrant market.

#Leaderly #MSQConsultantsOmanProfitabilityTracking #Oman #Muscat #SMEs #Accounting #Tax #Audit