Retail Accounting in Muscat: Managing Margins, Shrinkage, and Stock Counts Effectively

Understanding Retail Margins in Muscat’s Market

Retail accounting in Muscat begins with a clear grasp of profit margins, which are pivotal for any business operating in Oman’s dynamic retail sector. Margins represent the difference between the cost of goods sold and the sales price, influencing profitability directly. Given the competitive pricing environment in Muscat, SMEs must calculate margins meticulously to sustain operations and growth. Local factors such as import duties, VAT (currently 5%), and fluctuating currency exchange rates affect input costs and ultimately impact retail pricing strategies. Retailers must also consider overheads like rent and labor in Muscat’s commercial hubs, which can be relatively high compared to other regions in Oman.

To optimize margins, business owners in Muscat should adopt robust accounting practices that track costs accurately from procurement through sales. Integration of accounting software tailored for Oman’s VAT and tax regulations can streamline margin analysis, enabling SMEs to adjust pricing models responsively. Furthermore, regular margin reviews aligned with market trends and consumer behavior are essential. Leaderly’s advisory services support such strategic financial assessments, helping businesses identify opportunities to improve profitability without compromising competitiveness.

Understanding margin fluctuations also requires insight into sector-specific challenges in Muscat. For example, retail sectors like electronics and fashion may experience seasonal demand swings, affecting stock levels and pricing flexibility. Local consumer preferences and purchasing power play a crucial role as well. Hence, retail accounting in Muscat must incorporate these nuances to provide accurate financial visibility, empowering SMEs to make data-driven decisions and maintain sustainable margins over time.

Addressing Shrinkage: A Hidden Threat in Muscat’s Retail Accounting

Shrinkage—loss of inventory due to theft, damage, or administrative errors—is a significant concern for retail businesses in Muscat. It erodes profit margins silently and can distort financial reporting if not managed properly. For SMEs, where resources to absorb losses are limited, controlling shrinkage is crucial to maintaining operational health. The challenge in Muscat’s retail landscape is compounded by factors such as high foot traffic in urban centers and the complexity of multi-channel sales models that include physical stores and e-commerce.

Effective shrinkage management starts with accurate inventory records and reconciliation procedures embedded within retail accounting systems. SMEs should implement regular stock audits and leverage technology such as barcode scanning and RFID tagging to enhance traceability. In Oman, compliance with VAT rules necessitates precise stock documentation, so shrinkage can also impact tax reporting and potential liabilities. Leaderly’s audit services often uncover shrinkage issues during routine financial checks, providing clients with actionable recommendations to tighten internal controls and minimize losses.

Furthermore, employee training and awareness programs are essential in Muscat’s retail environments to reduce internal theft, which constitutes a substantial portion of shrinkage. Retail accounting must incorporate these operational controls as part of a broader loss prevention strategy, ensuring financial statements reflect the true state of inventory and profitability. By proactively managing shrinkage, SMEs in Muscat can protect their bottom line and enhance investor and stakeholder confidence.

Stock Counts: Essential Practices for Accurate Retail Accounting in Muscat

Accurate stock counts form the backbone of retail accounting in Muscat, ensuring that inventory values reported in financial statements match physical reality. In Oman’s retail sector, where VAT compliance is mandatory, discrepancies between recorded and actual stock levels can lead to costly penalties and reputational damage. Conducting regular and systematic stock counts allows SMEs to identify losses, adjust accounting entries, and maintain trustworthy financial records. This process also supports better cash flow management by avoiding overstocking or stockouts.

Muscat’s retailers face unique challenges when performing stock counts due to diverse product ranges, frequent deliveries, and multiple sales channels. Employing cycle counting—counting portions of inventory on a rotating schedule rather than a full physical count annually—can improve accuracy and reduce operational disruption. Additionally, implementing integrated Point of Sale (POS) and Enterprise Resource Planning (ERP) systems helps synchronize sales and inventory data in real time, facilitating continuous stock monitoring aligned with accounting records.

Leaderly’s advisory expertise assists SMEs in establishing tailored stock count methodologies suited to their business size and sector. From small boutique stores to larger retail chains in Muscat’s commercial zones, adopting disciplined stock management practices not only strengthens accounting integrity but also enhances decision-making on procurement and sales strategies. Ultimately, thorough stock counting contributes directly to improved financial transparency and strategic business growth in Oman’s evolving retail marketplace.

Improving Profit Margins through Strategic Retail Accounting in Muscat

Enhancing profit margins in Muscat’s retail sector requires more than just pricing adjustments; it demands a comprehensive approach to retail accounting that integrates cost control, revenue optimization, and financial forecasting. SMEs must scrutinize supplier contracts, negotiate better terms, and manage operational expenses meticulously. Detailed cost tracking supported by robust accounting systems allows retailers to identify inefficiencies and cost-saving opportunities across the value chain.

Moreover, accurate margin calculations facilitate smarter stock management decisions, such as prioritizing fast-moving, high-margin products and minimizing investment in slow sellers. Retail accounting in Muscat should leverage sales analytics and customer insights to tailor inventory and pricing strategies to local market conditions. VAT implications also play a vital role in margin management, where compliance and timely filing prevent fines and cash flow disruptions, thereby indirectly safeguarding profitability.

Leaderly’s taxation and advisory services can help businesses model various pricing scenarios and tax impacts, offering SMEs in Muscat clear visibility into potential profit outcomes. This strategic insight empowers entrepreneurs and finance managers to align operational goals with financial realities, ensuring that margin improvements are sustainable and compliant with Oman’s regulatory environment.

Mitigating Shrinkage Risks through Effective Controls and Auditing

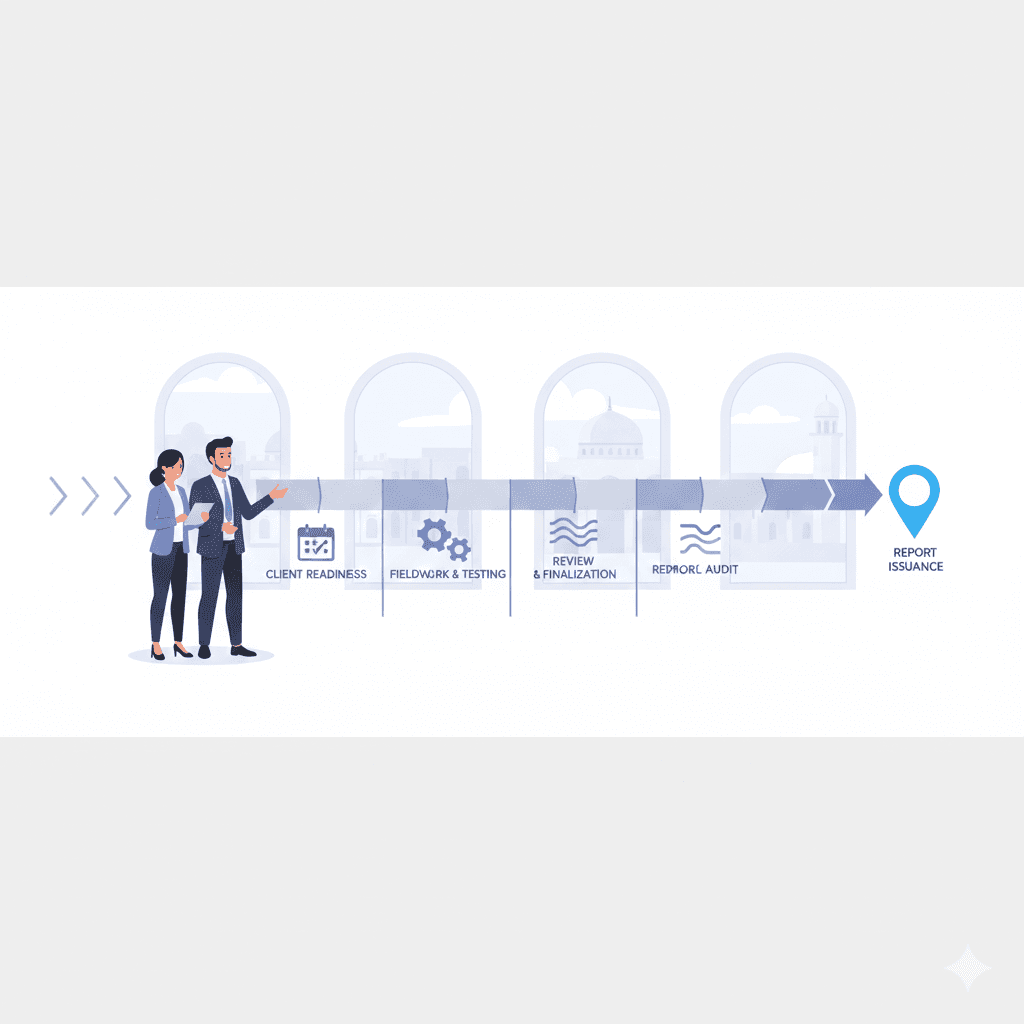

Reducing shrinkage in Muscat’s retail outlets demands a layered approach combining technology, personnel management, and periodic audits. Retail accounting must incorporate shrinkage metrics into financial reporting to quantify losses and guide corrective actions. SMEs should implement strict access controls, surveillance systems, and inventory verification protocols to deter theft and reduce human error.

Regular internal and external audits, such as those conducted by Leaderly’s audit teams, provide an independent assessment of shrinkage levels and internal control effectiveness. These audits often reveal systemic weaknesses or procedural gaps that contribute to inventory loss. By acting on audit findings, businesses can refine policies, enhance staff accountability, and introduce better tracking mechanisms tailored to their operational scale and complexity in Muscat’s retail environment.

Effective shrinkage management also enhances transparency for investors and lenders, who view disciplined inventory control as a sign of strong corporate governance. Ultimately, incorporating shrinkage monitoring within retail accounting frameworks strengthens financial reliability and supports long-term business viability in Oman’s competitive retail sector.

Leveraging Technology to Optimize Stock Counting and Inventory Accuracy

The adoption of digital tools and automated systems is transforming stock counting processes for retail businesses in Muscat. Modern POS and ERP solutions integrate sales, inventory, and accounting functions, offering real-time visibility into stock levels and movements. This integration reduces manual errors and ensures that accounting records reflect actual inventory status promptly, which is critical for SMEs managing VAT compliance and corporate tax reporting in Oman.

Technologies such as barcode scanning, RFID, and mobile inventory apps enable quicker and more accurate stock counts, minimizing operational disruption and labor costs. They also facilitate exception reporting, alerting management to discrepancies that require immediate attention. For SMEs in Muscat, investing in these solutions, even on a modest scale, can significantly improve the reliability of retail accounting and inventory control.

Leaderly’s advisory team supports clients in selecting and implementing technology platforms that align with their business size, sector, and regulatory requirements. By leveraging these tools, retail businesses in Muscat enhance their operational efficiency, improve compliance with Oman’s VAT framework, and gain strategic insights that drive growth. Accurate and timely stock counting is no longer just a routine task but a competitive advantage in the retail marketplace.

Retail accounting in Muscat is not simply about recording transactions; it is a strategic tool that integrates margin management, shrinkage control, and precise stock counts to drive business success. SMEs that embrace disciplined financial practices and technological innovation will be better positioned to navigate Oman’s retail challenges and seize growth opportunities with confidence.

#Leaderly #RetailAccountinginMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit