Muscat Subscription Revenue Recognition for SMEs Under Omani VAT and Audit Review

Why Muscat subscription revenue recognition differs from traditional sales

Muscat subscription revenue recognition requires a different mindset from traditional invoicing because revenue is earned over time, not at the moment cash is received. Many Omani SMEs still rely on invoice dates or bank receipts to record income, which can create serious distortions when subscriptions are billed monthly, quarterly, or annually in advance. Under Oman’s accounting and VAT environment, revenue must reflect the actual delivery of service, access, or usage during each accounting period. This distinction becomes especially important during audits, where inspectors look beyond invoices and examine whether revenue timing reflects economic reality.

For example, a Muscat-based IT firm charging an annual software subscription cannot recognize the full amount as revenue in the month of billing. Instead, the income should be allocated across the twelve-month service period. Failure to apply this approach inflates short-term profits and understates future obligations, which can mislead management decisions and raise red flags during statutory audits. Auditors increasingly expect SMEs to demonstrate a clear revenue allocation methodology that aligns with accepted accounting principles and local regulatory expectations.

The challenge is amplified because many subscription contracts include bundled services, upgrades, or support components. Each element may carry a different revenue pattern, yet SMEs often treat them as a single line item. Proper Muscat subscription revenue recognition involves identifying performance obligations, mapping them to billing cycles, and ensuring the accounting system mirrors operational delivery. This is not theoretical compliance; it directly affects credibility with banks, investors, and regulators.

VAT implications of Muscat subscription revenue recognition

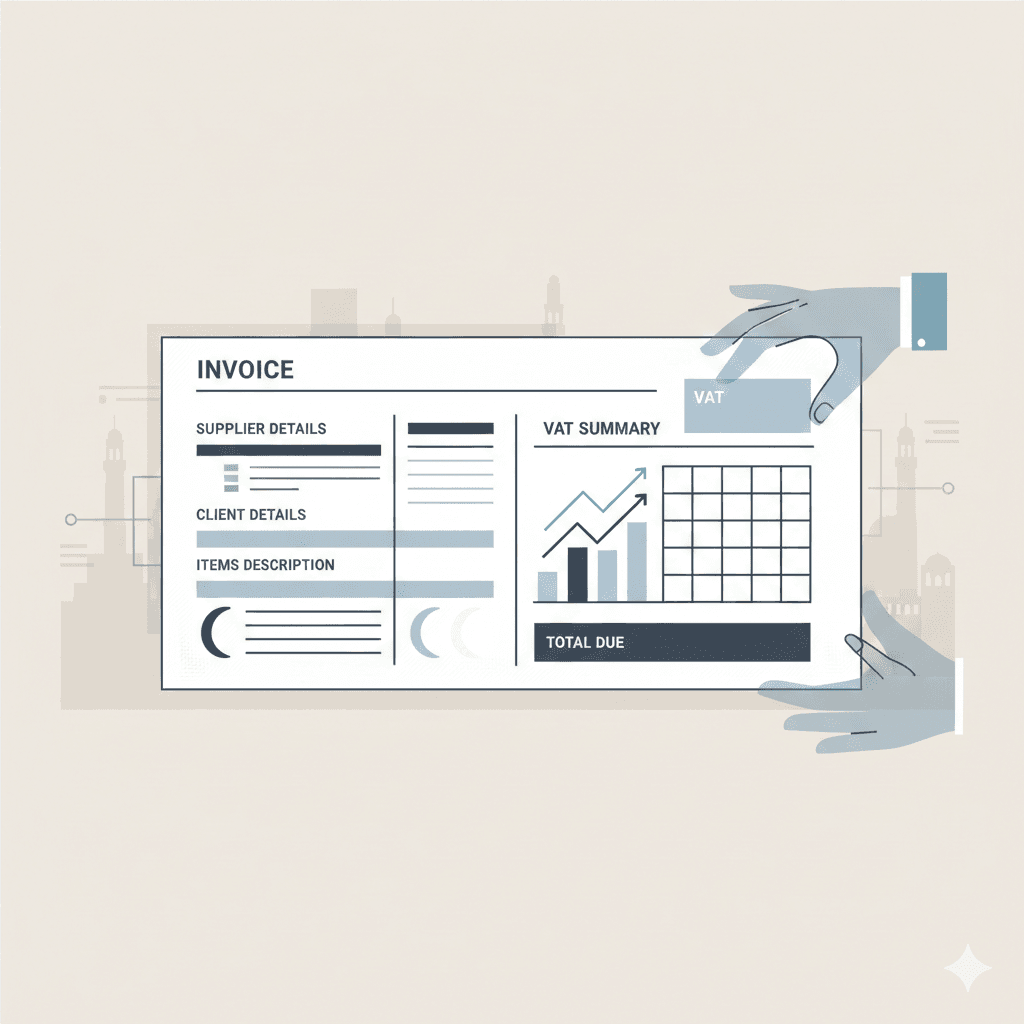

VAT treatment adds another layer of complexity to Muscat subscription revenue recognition. In Oman, VAT is generally triggered by the earlier of invoice issuance or payment receipt, but revenue recognition for financial reporting follows service delivery. This timing mismatch often confuses SME finance teams, leading to errors where VAT output and revenue figures do not reconcile logically. While VAT may be declared upfront on advance invoices, revenue must still be deferred until earned, creating temporary balance sheet liabilities that must be tracked accurately.

Consider a Muscat-based training provider offering six-month subscription access to online content. VAT may be due immediately upon invoicing, yet only one-sixth of the revenue should be recognized in each month. If this distinction is not documented clearly, auditors may question whether VAT has been overclaimed or revenue prematurely recognized. Tax authorities increasingly scrutinize subscription models because they are prone to misalignment between cash flow, VAT reporting, and income recognition.

To manage this, SMEs need disciplined documentation linking contracts, invoices, VAT returns, and revenue schedules. Muscat subscription revenue recognition must be supported by clear audit trails showing how deferred revenue is calculated and released over time. This is where professional advisory support becomes valuable, not to complicate processes, but to design systems that withstand inspection while remaining practical for growing businesses.

Audit expectations around Muscat subscription revenue recognition

Auditors in Oman are paying closer attention to Muscat subscription revenue recognition because recurring models can easily mask financial performance if not handled correctly. During an audit, reviewers do not rely solely on accounting entries; they test contracts, service logs, access records, and customer communications to confirm that revenue recognition aligns with actual delivery. SMEs that lack structured documentation often struggle to defend their figures, even if their intentions were reasonable.

A common audit issue arises when businesses change pricing, upgrade packages, or offer promotional extensions without adjusting revenue schedules. From an audit perspective, these changes alter the pattern of earned income and must be reflected accordingly. If adjustments are not recorded, auditors may propose revenue restatements, which can affect profit figures, loan covenants, and stakeholder confidence. Muscat subscription revenue recognition is therefore not just an accounting exercise but a governance matter.

Practical audit proof includes signed contracts, clear service descriptions, system-generated access logs, and reconciliation between deferred revenue balances and active subscriptions. SMEs that prepare these elements proactively experience smoother audits and fewer disputes. Advisory firms like Leaderly often assist in translating operational data into audit-ready financial evidence, bridging the gap between how the business runs and how auditors assess compliance.

Designing systems that support Muscat subscription revenue recognition

Effective Muscat subscription revenue recognition starts with system design rather than manual corrections at month-end. SMEs should ensure their accounting or ERP platforms can handle deferred revenue, automated allocation, and contract-based recognition. Relying on spreadsheets may work temporarily, but as subscription volumes grow, manual tracking becomes risky and error-prone, especially under audit pressure.

The system should mirror the commercial reality of the subscription model. Billing frequency, service period, renewal terms, and cancellation policies must feed directly into revenue schedules. When a customer cancels early or upgrades mid-cycle, the system should automatically adjust deferred balances. This level of control not only improves accuracy but also provides management with realistic performance insights, avoiding the illusion of inflated short-term profitability.

Leaderly’s accounting and advisory experience with Omani SMEs shows that well-designed systems reduce both tax risk and audit costs. When Muscat subscription revenue recognition is embedded into daily operations, finance teams spend less time explaining numbers and more time using them to guide strategic decisions.

Strategic decision-making linked to Muscat subscription revenue recognition

Beyond compliance, Muscat subscription revenue recognition directly influences strategic planning for SMEs. Subscription businesses often appear cash-rich because payments are received upfront, but this cash is not entirely earned. Misinterpreting this can lead to overexpansion, premature dividend distributions, or underestimation of future obligations. Accurate revenue recognition provides a clearer picture of sustainable income versus temporary cash flow.

For entrepreneurs seeking financing or partnerships, transparent subscription revenue reporting builds credibility. Banks and investors increasingly understand subscription economics and expect to see deferred revenue treated correctly. Inflated revenue figures may initially impress, but they often unravel during due diligence, damaging trust. Proper Muscat subscription revenue recognition supports realistic valuations and smoother negotiations.

This is where integrated advisory support matters. By aligning accounting treatment, VAT compliance, and financial forecasting, SMEs can present a coherent financial narrative. Leaderly’s valuation and feasibility advisory work often uncovers how improved revenue recognition practices materially change business insights, not just compliance outcomes.

Preparing SMEs for future regulatory scrutiny in Muscat

Regulatory scrutiny around Muscat subscription revenue recognition is likely to increase as Oman’s tax and audit frameworks mature. Subscription models are expanding across sectors, and authorities are developing deeper expertise in reviewing them. SMEs that adopt robust practices early will be better positioned to adapt without disruption.

Preparation involves more than technical compliance. It requires training finance teams to understand the logic behind revenue timing, documenting policies clearly, and reviewing them periodically as business models evolve. A written revenue recognition policy tailored to subscription activities can be a powerful tool during audits, demonstrating intent, consistency, and professionalism.

SMEs that view Muscat subscription revenue recognition as a strategic discipline rather than a regulatory burden gain resilience. They are better equipped to scale, withstand audits, and engage confidently with stakeholders. Professional firms like Leaderly play a role not by imposing complexity, but by translating regulatory expectations into workable, business-friendly systems.

Muscat subscription revenue recognition sits at the intersection of accounting accuracy, VAT compliance, and strategic clarity for Omani SMEs. When handled correctly, it transforms recurring billing from a compliance risk into a source of financial stability and insight. Clear allocation of income over service periods, supported by disciplined documentation, allows businesses to present financial statements that reflect true performance rather than temporary cash positions.

For SMEs in Muscat, the practical value lies in confidence. Confidence during audits, confidence in tax filings, and confidence when making growth decisions. By embedding proper recognition principles into systems and processes, businesses reduce friction with regulators and auditors while gaining a more reliable foundation for planning. This balanced approach reflects the kind of financial maturity that supports sustainable growth in Oman’s evolving commercial landscape.

#Leaderly #Muscat subscription revenue recognition #Oman #Muscat #SMEs #Accounting #Tax #Audit