Muscat e-invoicing readiness for SMEs and what finance leaders should prioritise today

Understanding Muscat e-invoicing readiness for SMEs in the Omani regulatory context

Muscat e-invoicing readiness for SMEs is no longer an abstract compliance concept; it is becoming a practical operational requirement that finance teams must actively prepare for. Across Oman, the direction of travel is clear: tax authorities are moving toward greater digitisation, stronger audit trails, and real-time visibility over transactional data. For SMEs operating in Muscat, this means that traditional invoicing practices, manual controls, and loosely documented processes will increasingly be scrutinised. E-invoicing is not simply a software upgrade, but a structural shift in how revenue, VAT, and reporting integrity are managed. Finance managers must understand that readiness involves people, systems, and governance, not just templates and formats. In Oman’s VAT environment, invoices are the primary evidence supporting tax positions, input recovery, and audit defence. Any move toward electronic invoicing therefore has direct implications for cash flow, compliance risk, and management credibility. Muscat-based SMEs that treat e-invoicing as a future problem risk rushed implementations, operational disruption, and exposure during audits. Those that approach it deliberately can strengthen internal controls, improve reporting accuracy, and reduce friction with regulators and stakeholders.

How Muscat e-invoicing readiness for SMEs affects VAT accuracy and audit exposure

One of the most underestimated aspects of Muscat e-invoicing readiness for SMEs is its impact on VAT accuracy and audit defensibility. In an electronic invoicing environment, inconsistencies that were previously hidden in spreadsheets or manual records become visible and traceable. Errors in tax codes, customer classifications, or timing of supply can be identified far more easily by auditors and tax authorities. For SMEs in Muscat, this raises the stakes for invoice quality and data discipline. Finance teams must ensure that VAT treatment is correctly embedded at the transaction level, not corrected retrospectively at month-end. This requires reviewing how invoices are generated, approved, and stored, as well as how they integrate with accounting systems. From an audit perspective, e-invoicing creates a clearer, more consistent trail, but only if controls are designed properly. Poorly configured systems can amplify errors at scale. This is where experienced accounting and tax advisors add value, helping SMEs align invoicing logic with Omani VAT rules, audit expectations, and internal reporting needs without overcomplicating operations.

Governance and internal controls as the foundation of Muscat e-invoicing readiness for SMEs

Beyond technology, Muscat e-invoicing readiness for SMEs depends heavily on governance and internal controls. Electronic invoices formalise what was once informal, turning everyday transactions into regulated data points. Finance teams must therefore clarify who is responsible for invoice creation, validation, correction, and approval. Segregation of duties becomes more visible and more important. SMEs in Muscat often operate with lean teams, which makes control design even more critical. Clear documentation of invoicing policies, exception handling, and escalation processes reduces operational risk and protects decision-makers. Internal reviews, periodic reconciliations, and alignment between sales, finance, and operations are essential to avoid downstream disputes and audit challenges. This is also the stage where advisory support can be particularly valuable, helping businesses design proportionate controls that fit their scale while meeting regulatory expectations. Effective governance ensures that e-invoicing strengthens the business rather than becoming a compliance burden.

System readiness and data quality in Muscat e-invoicing readiness for SMEs

System readiness is a central pillar of Muscat e-invoicing readiness for SMEs, but it is often misunderstood as a purely IT issue. In reality, finance teams must lead the assessment of whether current accounting systems can support structured invoice data, consistent numbering, secure storage, and reliable reporting. Data quality is critical. Customer master data, product classifications, VAT mappings, and chart of accounts must be reviewed and cleaned before e-invoicing is introduced. In Muscat, where SMEs may use a mix of legacy software and manual workarounds, this exercise can uncover long-standing inconsistencies. Addressing them early prevents errors from being embedded into automated processes. Finance managers should also consider integration between invoicing, accounting, and reporting systems to avoid duplication and reconciliation issues. Well-prepared systems improve efficiency, support accurate financial statements, and reduce the time and cost of audits. This is where accounting and audit expertise intersects with technology, ensuring that systems reflect both commercial reality and regulatory requirements.

People, training, and change management for Muscat e-invoicing readiness for SMEs

No discussion of Muscat e-invoicing readiness for SMEs is complete without addressing the human element. Even the best-designed systems fail if teams do not understand how and why processes are changing. Finance staff, sales teams, and operational users must be trained not only on how to issue electronic invoices, but on the compliance implications of errors and delays. Change management is particularly important for SMEs in Muscat, where long-standing practices may be deeply ingrained. Clear communication about roles, responsibilities, and expectations reduces resistance and confusion. Practical training sessions, documented procedures, and accessible support channels help teams adapt confidently. From a leadership perspective, investing in people demonstrates a commitment to compliance and professionalism. Advisors who understand both Omani regulations and SME realities can support this transition by translating technical requirements into practical guidance that teams can actually follow.

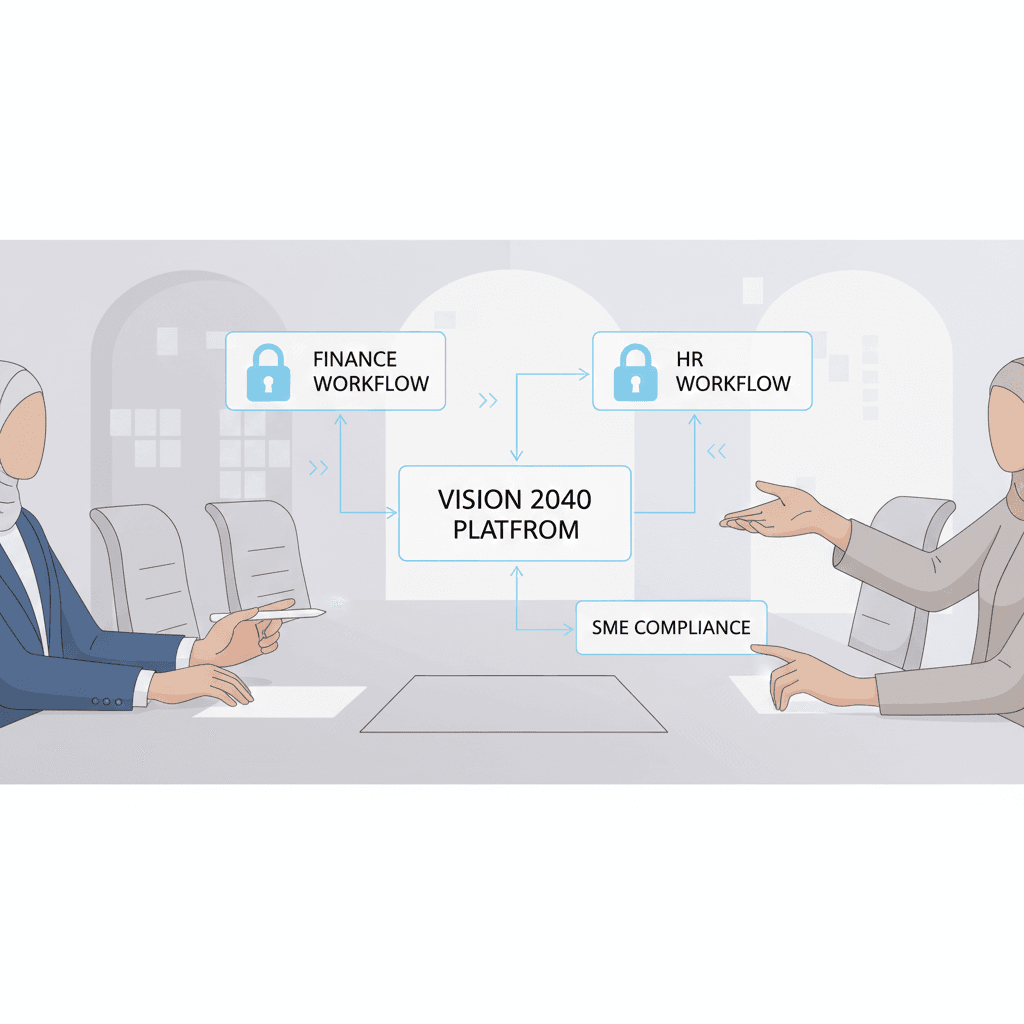

Using Muscat e-invoicing readiness for SMEs to strengthen decision-making and resilience

When approached strategically, Muscat e-invoicing readiness for SMEs can deliver benefits beyond compliance. High-quality invoicing data improves revenue visibility, customer analysis, and cash flow forecasting. Finance managers gain access to more timely and reliable information, supporting better decisions and faster responses to market changes. In Muscat’s competitive SME environment, this operational clarity can be a differentiator. Structured data also supports valuations, due diligence, and strategic reviews, particularly for businesses considering growth, restructuring, or eventual exit. By aligning e-invoicing with broader accounting, tax, and advisory objectives, SMEs can turn a regulatory requirement into a foundation for resilience. The key is to treat readiness as an integrated business initiative rather than a last-minute technical fix.

For SMEs in Muscat, preparing for electronic invoicing is ultimately about control, confidence, and continuity. By focusing on governance, VAT accuracy, system integrity, and people, finance teams can reduce compliance risk while strengthening everyday operations. E-invoicing should not be feared as an external imposition, but understood as part of the natural evolution of financial management in Oman.

Businesses that act early and thoughtfully place themselves in a stronger position to handle audits, support growth, and engage stakeholders with credibility. With the right accounting discipline, tax insight, and advisory perspective, Muscat SMEs can approach e-invoicing readiness with clarity and assurance rather than uncertainty.

#Leaderly #Muscat e-invoicing readiness for SMEs #Oman #Muscat #SMEs #Accounting #Tax #Audit