VAT on Services in Oman: Place of Supply Clarified for Muscat SMEs

Understanding VAT on Services in Oman

What the Place of Supply Means for Muscat Businesses

The concept of VAT on services in Oman revolves significantly around the place of supply, a fundamental principle determining where a service is considered to be supplied for tax purposes. For businesses operating in Muscat, correctly identifying the place of supply is crucial because it dictates whether VAT must be charged and which jurisdiction’s rules apply. In essence, the place of supply determines if a service is taxable in Oman or exempt because it falls outside Oman’s VAT scope. This distinction impacts pricing, invoicing, compliance obligations, and ultimately the company’s cash flow.

In Oman, the place of supply rules are designed to ensure VAT is applied accurately and fairly, avoiding double taxation or non-taxation of services. These rules are especially relevant for SMEs and entrepreneurs in Muscat who deal with cross-border transactions or digital services, areas where VAT treatment can be complex. For example, services provided to foreign clients may have a different place of supply than those delivered locally, affecting VAT liability. Understanding these rules prevents costly mistakes during tax audits and ensures compliance with Oman’s Tax Authority regulations.

Leaderly’s advisory teams emphasize the importance of mastering place of supply rules for any Muscat-based service provider. Whether you run a consultancy, digital platform, or a traditional business offering services within Oman, knowing when and how VAT applies helps maintain financial clarity and regulatory compliance. These nuances also impact financial reporting and audit readiness, making it a critical knowledge area for finance managers and business owners alike.

How the Place of Supply is Determined for Services in Oman

Criteria for Establishing VAT Obligations

Determining the place of supply for VAT on services in Oman involves several key criteria established by the Oman Tax Authority. Primarily, the general rule is that services are supplied where the supplier is established. However, this rule has numerous exceptions that affect Muscat businesses engaging in international or electronically delivered services. For instance, when services are supplied to a VAT-registered business outside Oman, the place of supply may shift to that location, altering the VAT treatment.

For SMEs in Muscat, the most common scenarios involve services provided to either local consumers or foreign businesses. If the recipient is a business with a valid tax registration in Oman, VAT is charged at the standard rate of 5%. Conversely, if the service is supplied to a non-resident customer or outside Oman’s borders, it could be considered outside the scope of Omani VAT, provided proper evidence is maintained. This distinction is crucial in contracts, invoicing, and accounting records.

Leaderly’s practical approach advises that Muscat SMEs maintain detailed documentation to support the place of supply determination. This includes contracts, proof of recipient’s location, and tax registration details. Failure to apply these rules correctly can trigger VAT assessments, penalties, and interest during tax audits. Therefore, ongoing advisory and tax compliance support tailored to the Oman VAT framework is indispensable for businesses navigating this area.

Special Considerations for Muscat SMEs Offering Digital and Cross-Border Services

VAT Implications for Modern Business Models

The growth of digital services and cross-border supply has added complexity to VAT on services in Oman, especially for SMEs in Muscat operating online platforms, IT services, or consultancy delivered remotely. These businesses must be particularly careful with place of supply rules, as digital and electronically supplied services often fall under special VAT provisions designed to capture tax in the jurisdiction where the customer resides.

Muscat-based entrepreneurs providing digital services to non-resident customers might be exempt from charging Omani VAT, depending on the customer’s status and location. Conversely, supplying services to VAT-registered customers in Oman requires the correct VAT treatment at 5%. These scenarios require a clear understanding of Oman’s VAT law and its implementation to avoid inadvertent non-compliance.

Leaderly’s audit and advisory teams recommend regular training and updated guidance for finance managers of SMEs in Muscat to address these evolving VAT rules. Staying current with the Oman Tax Authority’s updates ensures businesses are neither overcharging nor undercharging VAT, which affects profitability and audit outcomes. This alignment with Oman’s VAT laws fosters trust with customers and authorities alike, creating a solid foundation for sustainable business growth.

Common Pitfalls in VAT Place of Supply Compliance for Muscat SMEs

Challenges That Can Lead to Financial and Regulatory Risks

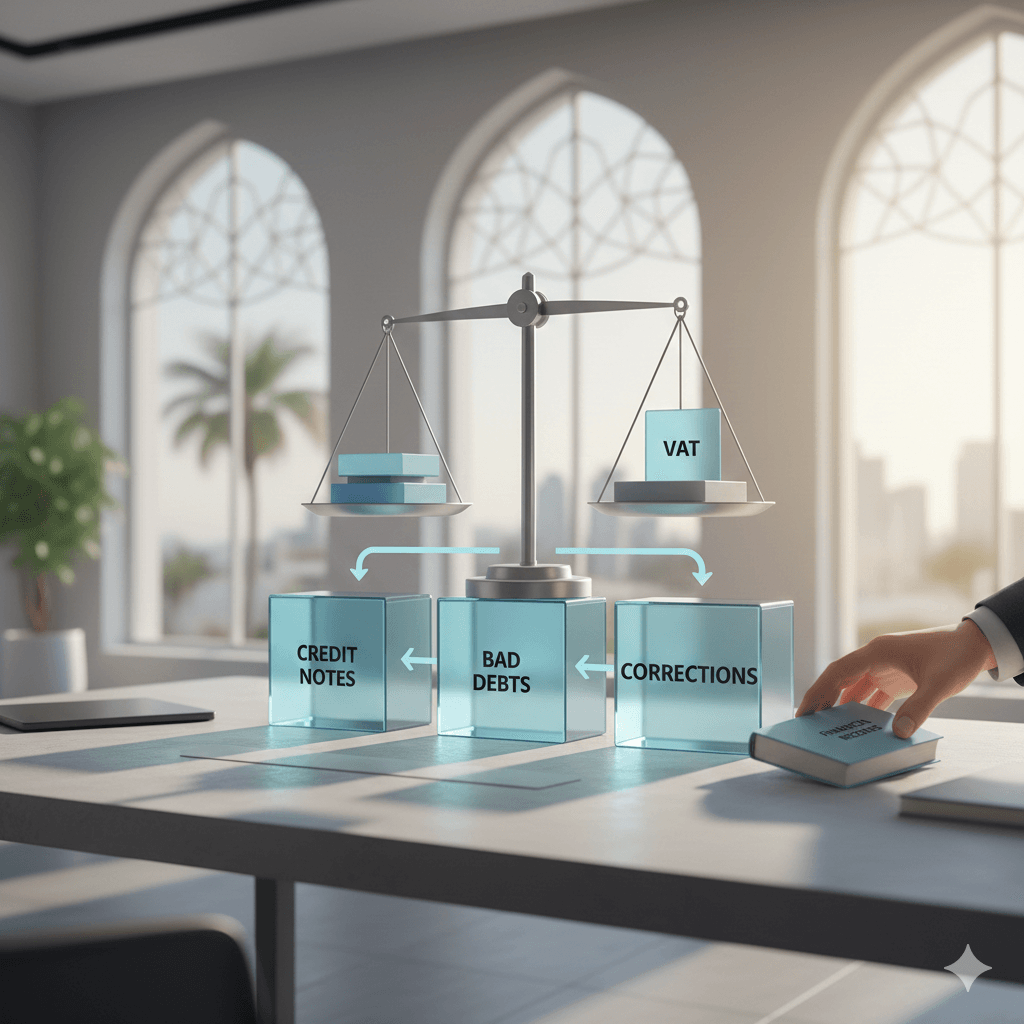

One of the most frequent challenges Muscat businesses face when applying VAT on services is misinterpreting the place of supply rules. This can result in charging VAT where it should not be applied or failing to charge VAT when required, both of which have financial and legal consequences. For SMEs, these mistakes can lead to unexpected VAT liabilities, penalties, and increased scrutiny during tax audits.

Another common pitfall is inadequate documentation supporting the place of supply. Oman’s VAT regulations demand robust evidence such as signed contracts, customer tax registration certificates, and proof of the recipient’s location. Without this documentation, businesses risk having their VAT treatment challenged, causing delays and additional costs in resolving disputes with tax authorities.

Leaderly’s advisory approach for SMEs emphasizes pre-emptive compliance through systematic internal controls and clear record-keeping procedures. Additionally, conducting regular VAT health checks can help identify and rectify any place of supply misapplications before they escalate. Such proactive measures are essential for minimizing risks and safeguarding a business’s reputation and financial health in Muscat’s competitive environment.

Strategic VAT Planning for Muscat SMEs: Leveraging Place of Supply Rules

Enhancing Business Efficiency and Compliance

Understanding and strategically applying the place of supply rules for VAT on services offers Muscat SMEs a competitive advantage beyond compliance. Accurate VAT treatment allows businesses to optimize pricing strategies, improve cash flow management, and avoid costly errors that disrupt operations. For entrepreneurs, this means the ability to bid confidently on contracts, especially cross-border or government tenders where VAT compliance is scrutinized.

Leaderly’s consultancy services integrate VAT place of supply considerations into broader financial and operational planning. By advising SMEs on structuring their service offerings and contractual terms, they help minimize unnecessary VAT costs and enhance the overall financial efficiency of Muscat businesses. This holistic approach supports sustainable growth and positions SMEs to capitalize on expanding opportunities within Oman’s evolving tax landscape.

Furthermore, aligning VAT planning with audit readiness through continuous advisory ensures Muscat SMEs maintain transparency and accountability. This alignment simplifies annual audit processes and reduces the risk of adverse findings, fostering stronger relationships with investors, partners, and regulators. Effective VAT management thus becomes a cornerstone of resilient business practices in Oman’s dynamic market.

Leaderly’s Role in Supporting Muscat SMEs with VAT Place of Supply Compliance

Trusted Expertise for Complex VAT Challenges

Leaderly offers comprehensive support for Muscat SMEs navigating the complexities of VAT on services, particularly regarding place of supply rules. Their expert teams provide tailored audit, accounting, and advisory services designed to meet the unique needs of Oman’s growing business community. By focusing on practical solutions grounded in Oman’s legal framework, Leaderly helps SMEs avoid costly mistakes and maximize VAT efficiency.

From assisting with VAT registration, preparing compliant invoices, to conducting feasibility studies on service supply chains, Leaderly integrates VAT place of supply compliance seamlessly into business operations. Their deep understanding of Omani tax regulations and SME challenges ensures that clients receive proactive advice that strengthens financial controls and promotes tax compliance.

In addition, Leaderly’s ongoing training and updates keep finance teams in Muscat equipped with the latest knowledge on VAT developments. This proactive partnership supports continuous improvement in VAT management and audit readiness, enabling SMEs to focus on growth with confidence. Ultimately, Leaderly positions itself as a trusted advisor empowering Muscat businesses to thrive in Oman’s VAT-regulated environment.

VAT on services in Oman, particularly the place of supply rules, is a complex but manageable area that requires careful attention from Muscat SMEs. Understanding these rules not only ensures compliance but also unlocks practical benefits that support sustainable business growth. By leveraging expert advice and maintaining robust documentation, Muscat entrepreneurs can confidently navigate Oman’s VAT landscape, minimizing risks and maximizing opportunities.

The place of supply principle remains central to applying VAT correctly in Oman, influencing how services are taxed and how businesses operate financially. For SMEs, embracing this concept as part of broader financial planning enables greater clarity and control over tax obligations. With trusted partners like Leaderly, Muscat businesses can confidently address VAT challenges, ensuring they meet regulatory demands while optimizing their competitive edge in Oman’s vibrant market.

#Leaderly #VATonServicesinOman #Oman #Muscat #SMEs #Accounting #Tax #Audit