Risk Assessment in Oman: Essential Insights for Muscat Business Leaders

Understanding Risk Assessment in Oman

Defining Risk Assessment for SMEs

Risk assessment in Oman is a critical process for business owners, SME founders, and finance managers, especially within the dynamic Muscat market. At its core, risk assessment involves identifying potential threats that can disrupt business operations, affect financial stability, or lead to compliance issues. These risks range from financial uncertainties, regulatory changes, operational challenges, to external market forces unique to Oman’s economic landscape. By systematically evaluating these risks, business leaders in Muscat can prepare strategically rather than reactively, ensuring that their companies remain resilient. The process requires a practical understanding of Oman’s regulatory environment, including VAT obligations, emerging corporate tax laws, and sector-specific compliance demands that are increasingly enforced.

Why Risk Assessment Matters for Muscat SMEs

Risk assessment in Oman is not merely a bureaucratic obligation but a foundational business discipline that underpins sustainable growth. SMEs in Muscat often face resource constraints that make unexpected disruptions more damaging compared to larger enterprises. A comprehensive risk assessment enables proactive identification and mitigation of these vulnerabilities before they escalate into costly problems. For example, understanding financial risks such as delayed receivables or cash flow shortages can guide better liquidity management. Moreover, given Oman’s evolving tax framework, companies that incorporate risk assessment into their internal controls can avoid penalties and reputational damage by staying ahead of compliance requirements. This forward-looking approach builds stakeholder confidence, essential for attracting investment and securing business partnerships within Oman’s competitive markets.

Key Components of an Effective Risk Assessment in Oman

An effective risk assessment in Oman must integrate three core components tailored for the Muscat business environment: identification, evaluation, and mitigation. First, identification involves cataloging all plausible risks, including economic fluctuations, supply chain interruptions, and regulatory shifts like VAT adjustments or new corporate tax laws. Next, evaluation assesses the likelihood and potential impact of each risk on business objectives. This step requires close collaboration between finance managers and operational leaders to quantify risks realistically. Finally, mitigation focuses on developing actionable strategies—such as diversifying suppliers, strengthening financial controls, or enhancing compliance monitoring—to reduce risk exposure. Local advisory firms like Leaderly play a crucial role in guiding SMEs through this structured approach, offering expertise that aligns risk management with broader business goals.

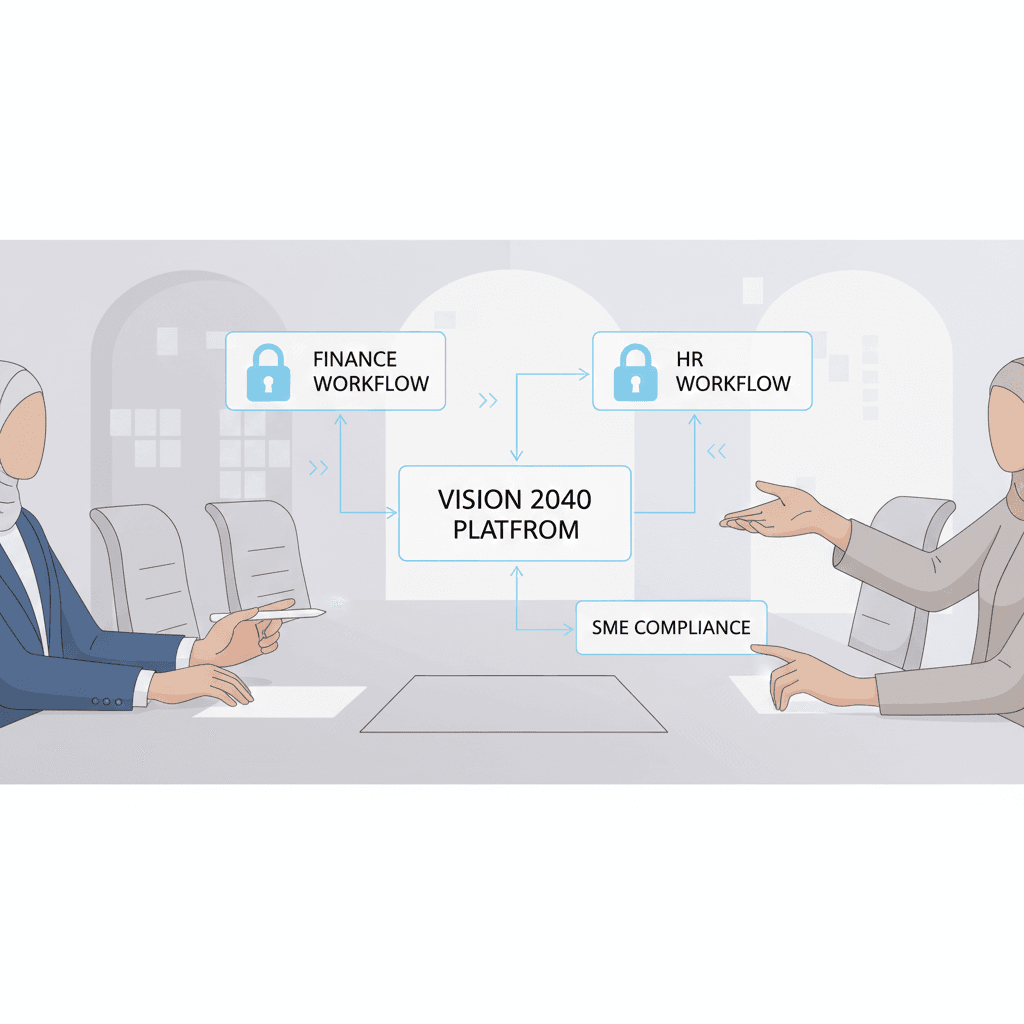

Integrating Risk Assessment with Muscat’s Regulatory Framework

Aligning risk assessment practices with Oman’s regulatory framework is vital for SMEs to maintain compliance and operational integrity. The Muscat business environment is shaped by a growing emphasis on financial transparency and adherence to tax laws, including the introduction of corporate tax and the ongoing enforcement of VAT regulations. A well-conducted risk assessment highlights areas where businesses might be vulnerable to regulatory breaches, such as inaccurate tax filings or insufficient documentation during audits. Addressing these risks early can prevent costly penalties and audit complications. Moreover, regular risk assessments enable businesses to adapt to regulatory changes promptly, ensuring that operational processes and accounting practices remain compliant and robust against evolving legal requirements.

Practical Risk Assessment Tools for Muscat SMEs

For SME owners and managers in Muscat, practical tools for risk assessment range from simple financial health checks to comprehensive advisory-led audits. Financial statements and cash flow forecasts provide an initial gauge of economic risk, while internal audits assess compliance and operational controls. Engaging professional advisory services, such as those offered by Leaderly, adds a layer of expert insight that helps interpret findings in the context of Oman’s specific market conditions. These services can include feasibility studies to assess new ventures, valuation services for investment decisions, and due diligence during partnerships or liquidation processes. By integrating these tools, SMEs can establish a continuous risk monitoring system rather than a one-time exercise, fostering ongoing resilience.

Building a Risk-Aware Culture in Muscat’s SMEs

Developing a risk-aware culture within SMEs in Muscat is essential for embedding risk assessment into everyday decision-making. Business owners and managers must champion transparent communication about risks across all levels of the organization. This cultural shift encourages employees to identify and report risks proactively, whether related to financial controls, operational inefficiencies, or compliance issues. Training programs tailored to Oman’s regulatory context can enhance understanding and commitment to risk management practices. When risk awareness becomes part of the organizational DNA, SMEs are better equipped to anticipate challenges and respond effectively, reducing uncertainty and strengthening business continuity in Muscat’s competitive environment.

Risk Assessment in Oman remains a vital strategic tool for business leaders aiming to secure sustainable growth and regulatory compliance. For SMEs in Muscat, embracing a structured approach to risk—one that integrates identification, evaluation, and mitigation with local legal frameworks—transforms uncertainty into opportunity. By leveraging practical tools and fostering a risk-aware culture, business owners can navigate Oman’s evolving economic landscape with confidence and clarity.

The benefits of thorough risk assessment extend beyond compliance; they enable SMEs to make informed decisions, optimize resources, and build resilience against future disruptions. With the support of experienced advisors familiar with Oman’s market, Muscat’s business leaders can unlock the full potential of risk management, ensuring their ventures thrive amid change and complexity. This proactive stance positions SMEs not just to survive but to lead confidently in Oman’s dynamic economy.

#Leaderly #RiskAssessmentinOman #Oman #Muscat #SMEs #Accounting #Tax #Audit