Oman Corporate Governance Finance Policies Muscat Boards Expect

Understanding the Role of Corporate Governance in Muscat’s Financial Landscape

The foundation for sustainable business success

Oman Corporate Governance Finance Policies have become a pivotal factor for businesses, particularly for SMEs and growing companies operating in Muscat. These policies provide the essential framework that guides how companies manage their financial resources, maintain accountability, and safeguard stakeholders’ interests. Muscat boards increasingly view well-crafted governance policies not just as regulatory requirements but as strategic tools that enhance investor confidence and improve operational efficiency. By clearly defining the responsibilities of boards and management in financial reporting, risk management, and compliance with Oman’s evolving tax regulations—including VAT and corporate tax—these policies help businesses in the capital build transparency and minimize risks related to mismanagement or fraud in a market where investor trust is paramount.

mplementing robust corporate governance policies means Muscat boards expect clear guidelines on financial decision-making processes, internal controls, and reporting accuracy. This ensures that companies are well-prepared to meet regulatory requirements and stakeholder expectations. The governance framework also plays a vital role in shaping business strategies that are financially sustainable and compliant, allowing SMEs to confidently expand and attract external funding. As Oman continues to strengthen its regulatory environment, understanding and integrating these finance policies into corporate governance helps companies stay ahead of compliance challenges and align with best practices internationally, yet tailored to the local business context.

Effective governance goes beyond compliance—it creates a culture of responsibility where board members actively monitor financial health and risks. Oman corporate governance finance policies set expectations for regular audits, independent financial oversight, and transparent communication with shareholders. This approach is critical for SMEs in Muscat, where business owners may juggle multiple roles, and formal governance can provide the structure needed for long-term stability. Ultimately, boards that prioritize governance in finance can navigate complexities such as VAT obligations, corporate tax planning, and valuation assessments with greater confidence, supported by expert advisory services like those offered by Leaderly.

Key Components of Finance Policies Expected by Muscat Boards

From budgeting to risk management: What matters most

Muscat’s corporate governance landscape increasingly demands finance policies that emphasize meticulous budgeting and forecasting. Boards expect finance teams to provide clear, realistic financial plans that align with the company’s strategic goals. Accurate budgeting supports better cash flow management—a vital aspect for SMEs where working capital constraints can limit growth. These finance policies also prioritize effective expense controls to prevent overspending and ensure resources are allocated to high-impact areas. This financial discipline helps companies withstand market fluctuations, particularly in Oman’s dynamic economy, where external factors such as oil price volatility and regulatory shifts can affect business stability.

Risk management forms another pillar of the finance policies Muscat boards require. Identifying, assessing, and mitigating financial risks—including credit, liquidity, and regulatory risks—is central to governance frameworks. Boards expect clear protocols for managing these risks, backed by regular reporting and scenario planning. This ensures that companies do not face unexpected shocks and can respond promptly to regulatory changes, such as VAT audits or new corporate tax rules. Additionally, internal controls like segregation of duties and authorization limits are essential components, reducing the potential for fraud or error. Muscat boards demand evidence of these controls in action, reflecting their commitment to safeguarding company assets and maintaining stakeholder trust.

Transparency and compliance with Oman’s financial regulations are non-negotiable expectations. Finance policies must clearly articulate the company’s approach to statutory reporting, tax compliance, and audit readiness. With Oman’s VAT regime maturing and corporate tax introduction on the horizon, boards expect finance functions to be proactive, working closely with expert advisors to ensure full compliance and optimal tax strategies. These policies guide how financial disclosures are prepared and communicated, providing confidence to shareholders and regulators alike. By integrating these elements into governance practices, Muscat boards enhance the company’s reputation and create a stable foundation for sustainable growth.

The Practical Impact of Governance on Financial Reporting and Audit Processes

How Muscat boards ensure accuracy and accountability

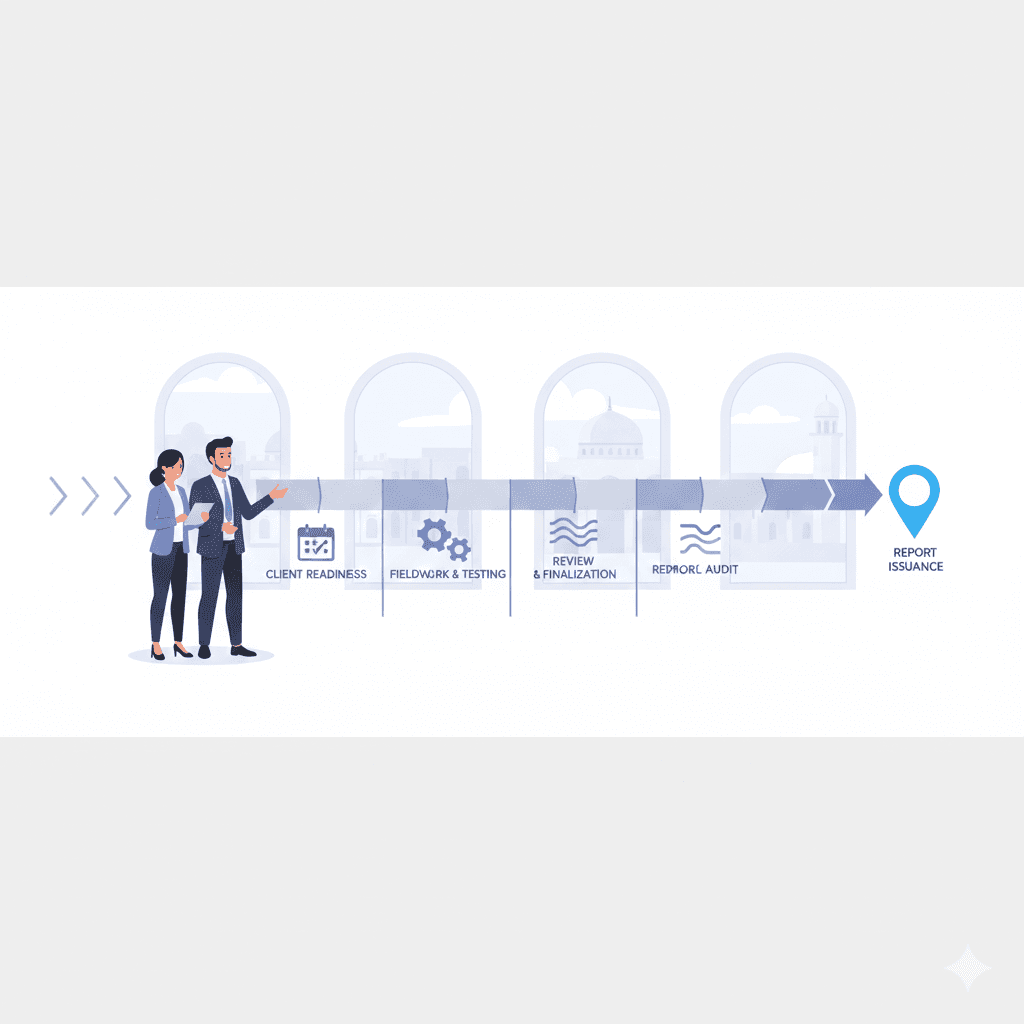

The practical application of Oman corporate governance finance policies is most visible in the realm of financial reporting and audits. Muscat boards rely heavily on rigorous reporting standards to provide an accurate picture of the company’s financial health. This means instituting processes for timely and reliable preparation of financial statements that comply with Omani Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the company’s size and sector. These governance-driven finance policies help prevent misstatements and ensure all financial data is backed by proper documentation. For SMEs in Oman, this can mean the difference between securing critical funding or facing costly delays.

Audit processes in Oman are evolving alongside governance expectations. Boards expect internal and external audits to be thorough and independent, acting as safeguards against financial mismanagement. Corporate governance policies emphasize the role of audit committees in overseeing these activities, ensuring that audit findings lead to meaningful improvements in controls and compliance. Regular audits also help companies prepare for VAT inspections or corporate tax reviews, mitigating risks of penalties or reputational damage. For many SMEs, partnering with specialized audit firms like Leaderly enables them to meet these governance requirements efficiently and effectively, benefiting from expert insights that align with Oman’s unique business environment.

Beyond compliance, governance-focused audit practices foster a culture of continuous improvement. Boards use audit outcomes not only to address current issues but to enhance financial policies and internal controls proactively. This approach builds resilience and adaptability, essential traits for SMEs operating in Muscat’s competitive market. Through governance-aligned financial reporting and auditing, companies create a transparent environment that attracts investors, satisfies regulators, and empowers management with reliable data for decision-making. Ultimately, this drives business performance while upholding the integrity that Oman’s corporate ecosystem increasingly demands.

Aligning Oman Corporate Governance Finance Policies with Strategic Business Growth

Boards leverage governance to enable expansion and investment

Oman corporate governance finance policies are increasingly viewed by Muscat boards as enablers of strategic business growth. These policies provide a framework for disciplined financial management that supports decision-making around investments, acquisitions, and market expansion. For SME owners and entrepreneurs in Muscat, embedding governance in finance policies means clearer visibility of risks and opportunities, enabling more confident pursuit of growth initiatives. Robust financial controls, accurate reporting, and risk assessments help boards evaluate new ventures with precision, reducing uncertainty in a complex market environment.

Governance policies also play a crucial role in valuation and due diligence processes, which are vital during business sales, mergers, or capital raising. Muscat boards expect finance teams to prepare comprehensive financial records and transparent disclosures that facilitate accurate valuations. This preparedness attracts investors and partners by demonstrating reliability and financial health. Additionally, these governance frameworks support liquidity planning and cash flow management critical for sustaining operations during expansion phases. SMEs in Oman that adopt these practices can navigate the challenges of scaling while maintaining compliance with VAT and corporate tax obligations.

Beyond growth, corporate governance finance policies serve as a foundation for sound exit strategies, including liquidation or restructuring. Muscat boards rely on clear policies to guide such complex decisions, ensuring that the company’s financial affairs are handled responsibly and transparently. Advisory services tailored to Oman’s regulatory environment, such as those from Leaderly, support boards in managing these transitions effectively. By aligning governance with strategic objectives, companies not only protect their current assets but also create value that endures through every stage of their business lifecycle.

Building a Governance Culture That Supports Financial Integrity in Oman SMEs

From policy to practice: Embedding governance in everyday operations

The most successful Oman corporate governance finance policies are those embedded deeply into the company’s culture and daily practices. Muscat boards recognize that governance is not just a document or a checklist—it is an ongoing commitment to financial integrity and accountability. Cultivating this culture requires clear communication from leadership, continuous training, and the establishment of routines that reinforce governance principles. For SMEs, this might include regular finance reviews, adherence to audit recommendations, and proactive engagement with tax authorities. These practices build a resilient organization where governance is integral to every financial decision.

Practical implementation also means empowering finance teams with the right tools and expertise to fulfill governance expectations. In Oman, where many SMEs face resource constraints, outsourcing certain advisory or audit functions to trusted partners like Leaderly can provide the specialist support needed to maintain compliance and control. Boards expect finance leaders to collaborate closely with these experts to stay abreast of regulatory changes and incorporate best practices tailored to Oman’s business context. This partnership approach helps SMEs keep governance policies relevant and effective in real-world operations.

Ultimately, embedding governance in financial management strengthens the entire business ecosystem in Muscat. It drives transparency that benefits stakeholders, from investors to customers, and supports Oman’s broader economic goals of promoting sustainable, responsible business practices. Boards that champion this culture position their companies not just to survive but to thrive in an increasingly regulated and competitive environment, laying the groundwork for long-term success and trust.

Conclusion

Oman corporate governance finance policies are no longer optional but essential frameworks that Muscat boards expect to guide every facet of financial management. These policies bring structure, transparency, and accountability, addressing the unique challenges faced by SMEs operating in Oman’s dynamic economic landscape. By focusing on key areas such as budgeting, risk management, reporting, and audit processes, boards enable companies to meet compliance requirements while enhancing strategic decision-making. This governance focus ensures that financial integrity is maintained, risks are mitigated, and opportunities are seized confidently, supported by expert advisory and audit services tailored to Oman’s regulatory environment.

For SMEs and entrepreneurs in Muscat, embedding strong governance policies within finance functions unlocks practical value beyond compliance. It fosters a culture of responsibility and continuous improvement, equipping businesses to grow sustainably and attract investor confidence. Through these governance practices, companies are better prepared to navigate VAT complexities, corporate tax obligations, and financial reporting demands with clarity and confidence. Ultimately, Oman’s corporate governance finance policies act as a cornerstone for building resilient, transparent businesses that contribute meaningfully to the country’s economic vision.

#Leaderly #OmanCorporateGovernanceFinancePolicies #Oman #Muscat #SMEs #Accounting #Tax #Audit