Al Wuttayah Internal Controls: Essential Strategies for Admin-Focused SMEs

Understanding Al Wuttayah Internal Controls in SME Contexts

Al Wuttayah internal controls are essential for SMEs operating with complex administrative frameworks, serving as a critical foundation for business success and regulatory compliance. These internal controls encompass the policies and procedures designed to enhance operational efficiency, ensure accurate financial reporting, and maintain adherence to legal requirements. For organizations that depend heavily on administrative functions—such as managing extensive documentation, vendor interactions, or human resources—these controls play a vital role in minimizing risks related to fraud, errors, and inefficiencies. Amid Oman’s evolving regulatory environment, highlighted by the implementation of VAT and the upcoming corporate tax regime, robust internal controls empower SMEs to confidently address compliance challenges and safeguard their operations.

Administrative Complexity and Its Risks for Al Wuttayah SMEs

Administrative-heavy organizations face unique challenges, especially when managing multiple layers of documentation, approvals, and record-keeping. In Al Wuttayah, SMEs often juggle administrative tasks alongside operational duties without dedicated teams, increasing the risk of mismanagement. Weaknesses in internal controls can lead to duplicated efforts, misallocated resources, or worse, financial discrepancies. Such risks extend to inaccurate VAT submissions, overlooked corporate tax obligations, and noncompliance penalties. Implementing structured control frameworks tailored to the administrative environment enables these businesses to mitigate these vulnerabilities and maintain both operational fluidity and regulatory alignment.

Aligning Internal Controls with Oman’s Regulatory Requirements

For SMEs in Al Wuttayah, internal controls are not merely best practice—they are a necessity to meet Oman’s tax and governance standards. The introduction of VAT in 2021 and the upcoming corporate tax have heightened the scrutiny on financial and administrative records. Control mechanisms such as segregation of duties, approval hierarchies, and audit trails ensure that financial transactions are accurately recorded and tax liabilities correctly calculated. Furthermore, these controls support transparency and accountability, which are increasingly valued by stakeholders and regulators alike. Aligning internal control systems with Oman’s compliance framework ultimately safeguards SMEs from costly penalties and reputational damage.

Key Internal Control Strategies for Admin-Heavy SMEs in Al Wuttayah

Successful internal control systems for administrative-heavy SMEs focus on simplification, clarity, and consistent enforcement. First, clearly defined roles and responsibilities prevent overlaps and ensure accountability. Second, systematic documentation of all processes—from invoice approvals to expense reimbursements—creates a verifiable trail crucial for audits and tax inspections. Third, regular monitoring and reviews, whether through internal audits or external advisory services like those offered by Leaderly, help identify weaknesses and areas for improvement. These strategies empower SMEs in Al Wuttayah to control costs, manage risks, and optimize administrative workflows effectively.

Leveraging Technology to Enhance Internal Controls

Integrating digital solutions can significantly strengthen internal controls in administrative-heavy SMEs. Cloud-based accounting and ERP systems automate routine tasks, reduce human error, and maintain up-to-date financial data accessible for compliance checks. For Al Wuttayah businesses, adopting such technologies aligns with Oman’s digital transformation goals while enabling real-time monitoring of cash flow, expenses, and tax obligations. Moreover, automated alerts and workflows can enforce control policies such as approvals before payments, reducing the risk of unauthorized transactions. Leveraging technology in this way allows SMEs to focus on growth while maintaining disciplined administration and compliance.

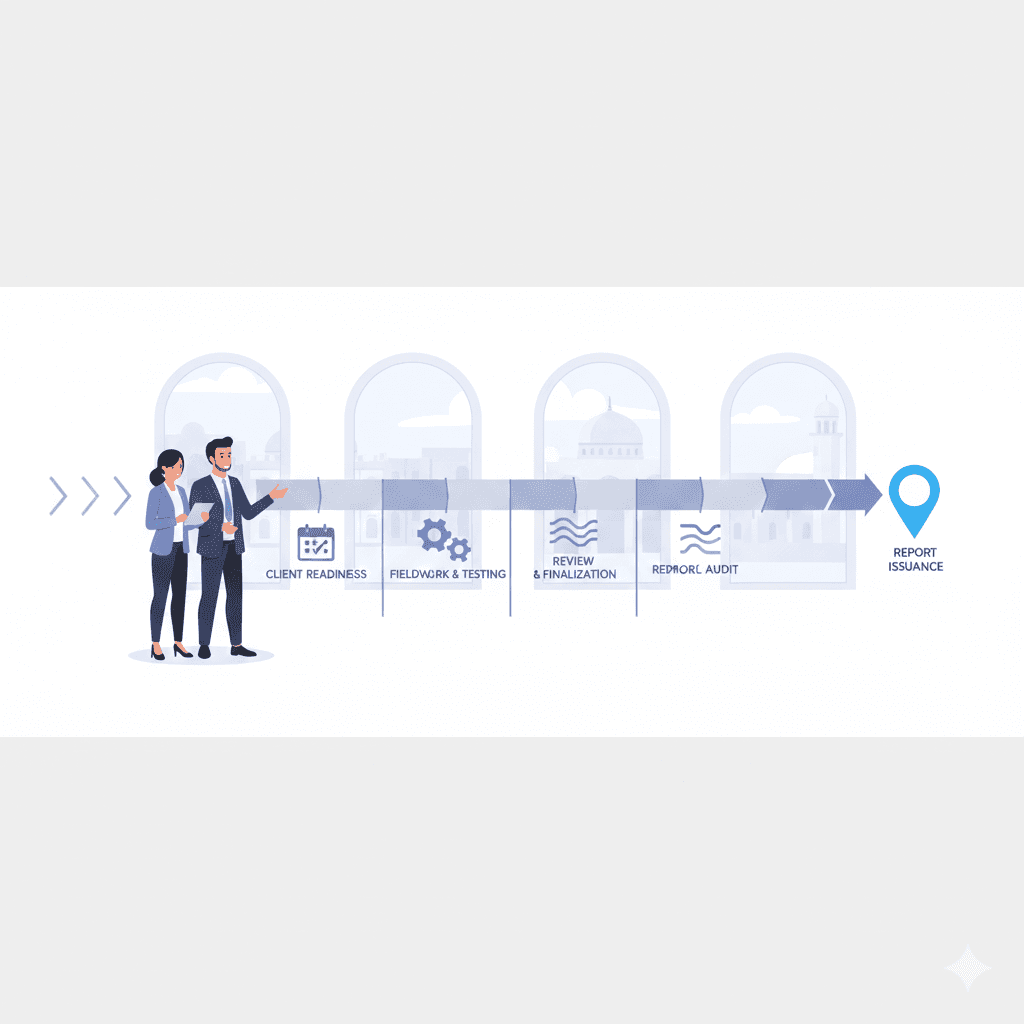

The Role of Advisory Services in Fortifying Internal Controls

While internal controls can be developed in-house, many SMEs in Al Wuttayah benefit from advisory support to design and implement effective frameworks. Specialist firms like Leaderly provide practical guidance tailored to the unique administrative and regulatory context of Omani SMEs. Advisory services include feasibility studies to assess current control weaknesses, due diligence for business transactions, and ongoing consultancy for compliance updates. Such partnerships enable SMEs to stay ahead of regulatory changes, improve governance, and build a foundation for sustainable growth. The integration of audit and accounting expertise ensures that internal controls are robust, relevant, and aligned with business goals.

Conclusion

Al Wuttayah internal controls are indispensable for administrative-heavy SMEs striving to thrive amid Oman’s evolving business and regulatory environment. By understanding the specific risks associated with complex administrative processes and implementing targeted control mechanisms, these organizations can enhance operational efficiency, ensure compliance with VAT and corporate tax obligations, and reduce the risk of financial errors or fraud. Embracing technology and expert advisory services further strengthens this foundation, enabling SMEs to focus on strategic growth with confidence.

Ultimately, well-structured internal controls in Al Wuttayah SMEs do more than satisfy regulatory requirements—they foster transparency, accountability, and resilience. This disciplined approach not only protects businesses from potential pitfalls but also positions them for long-term success in a competitive market. For business owners, finance managers, and entrepreneurs in Oman, prioritizing internal controls is a practical investment that safeguards their enterprise and builds trust with stakeholders, making it a vital cornerstone of sustainable growth.

#Leaderly #AlWuttayahInternalControls #Oman #Muscat #SMEs #Accounting #Tax #Audit