Scenario Planning in Oman: Adapting Muscat Finance Models for Market Uncertainty

Understanding Scenario Planning in Oman’s Financial Landscape

A strategic approach for SMEs and entrepreneurs

Scenario planning in Oman is an essential financial management tool designed to help SMEs, entrepreneurs, and finance managers anticipate and prepare for diverse economic conditions that impact Muscat’s dynamic market environment. Unlike traditional forecasting, which predicts a single outcome, scenario planning allows businesses to envision multiple potential futures. This is particularly critical in Oman, where geopolitical shifts, fluctuating oil prices, and evolving regulatory frameworks introduce significant uncertainty. By using scenario planning, companies can evaluate how various economic, political, or social changes could affect their financial health and operations. This forward-looking methodology supports more resilient decision-making by framing business strategies around plausible scenarios rather than fixed predictions, enabling SMEs to navigate volatility with greater confidence.

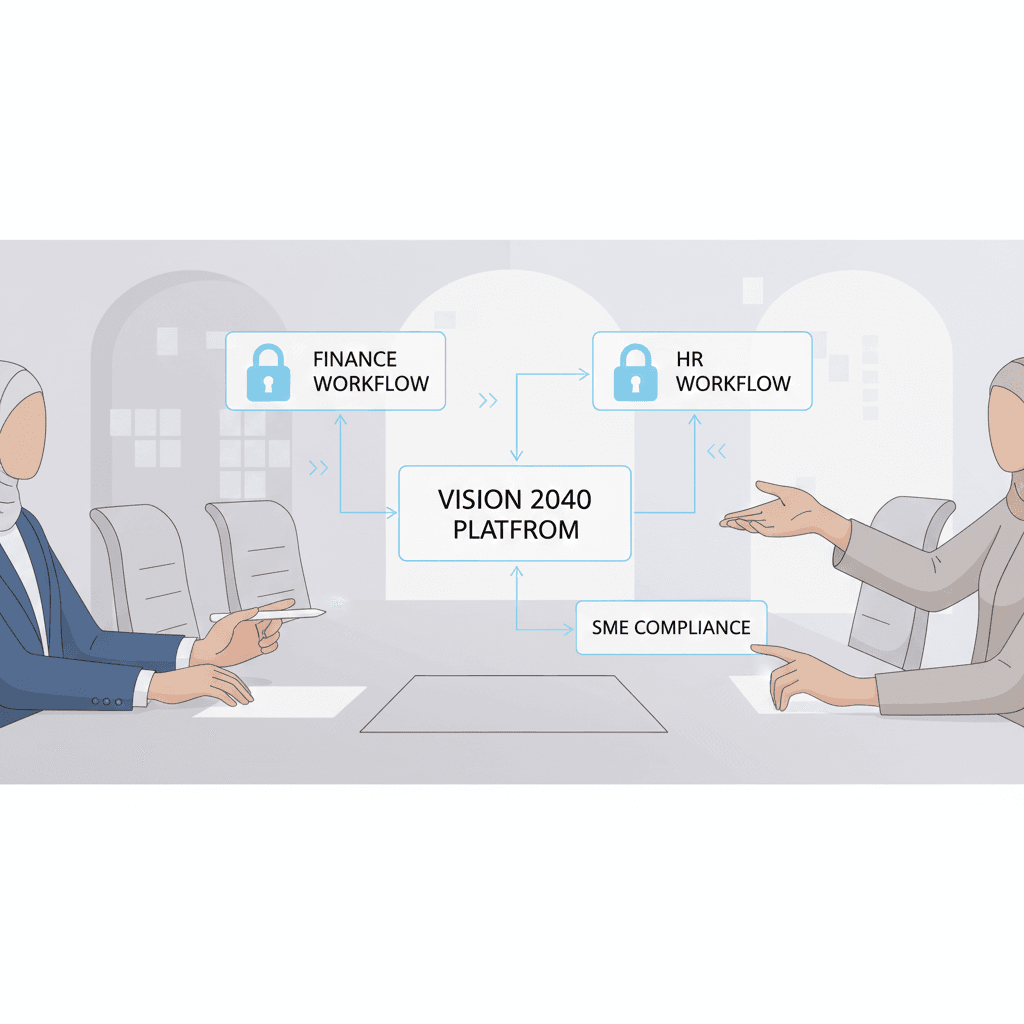

Implementing scenario planning requires a clear understanding of local economic drivers unique to Muscat and Oman. These include the ongoing diversification of Oman’s economy under Vision 2040, VAT and corporate tax changes, and the expanding role of SMEs in the national economy. Each factor presents opportunities and risks that can be modeled through various financial scenarios. For example, changes in tax legislation might increase operating costs, while shifts in export demand could alter revenue streams. Recognizing these factors in scenario planning empowers business leaders to adjust budgeting, investment, and risk mitigation strategies proactively rather than reactively.

Leaderly’s advisory services in Oman emphasize the importance of scenario planning within a broader finance framework. By combining this technique with due diligence, valuation, and feasibility studies, companies can build robust financial models tailored to Muscat’s unique business climate. This approach fosters agility and preparedness, essential qualities for SMEs aiming to thrive amid uncertainty. Leaders who integrate scenario planning effectively position their organizations to capitalize on emerging trends while safeguarding against potential downturns.

Developing Muscat-Specific Finance Models for Uncertain Markets

Aligning financial strategy with local market realities

Developing finance models tailored to Muscat’s market intricacies is a critical next step in successful scenario planning in Oman. These models focus on stress-testing financial statements, cash flows, and capital requirements against various economic scenarios, such as fluctuations in oil prices or changes in import/export regulations. SMEs operating in Muscat face unique challenges, including variable demand patterns and evolving compliance obligations. Customized finance models incorporate these elements, enabling businesses to forecast liquidity needs, profitability, and capital structure adjustments with greater precision.

In practice, these finance models should integrate Oman-specific taxation policies, including VAT and the recent introduction of corporate tax, both of which directly impact profitability and cash flow. Scenario planning requires an understanding of how tax rates or exemptions could change under different regulatory environments, affecting overall business costs. Furthermore, businesses in Muscat must consider the effect of government stimulus packages or economic reforms, which may alter credit availability or investment incentives. By embedding such variables into financial models, companies gain a realistic view of how external factors influence internal financial health.

Leaderly’s approach to financial modeling in Muscat stresses the importance of continuous updates and iterative reviews. Market conditions evolve rapidly, and static models become obsolete quickly. Finance managers and business owners must regularly revisit their scenarios, validate assumptions with real-time data, and adjust strategies accordingly. This cyclical process fosters a culture of proactive financial management rather than reactive crisis response. It also aligns with compliance requirements in Oman, ensuring that accounting and audit practices reflect the latest economic realities. Through scenario-based finance models, SMEs gain a structured method to plan investments, manage risks, and safeguard profitability in uncertain markets.

Integrating Risk Management into Scenario Planning for Omani SMEs

Mitigating financial exposure through informed decision-making

Integrating risk management within scenario planning in Oman is indispensable for SMEs aiming to protect their financial stability. Muscat’s market volatility, driven by both local and global factors, necessitates a comprehensive approach that identifies potential risks, quantifies their financial impact, and develops mitigation strategies. Scenario planning provides the framework for this by allowing businesses to test different “what-if” situations and understand their vulnerability to risks such as currency fluctuations, supply chain disruptions, or changes in consumer behavior.

Effective risk management begins with mapping out probable scenarios that could negatively impact cash flow or profitability. For instance, an SME reliant on imported materials must consider the risk of import tariff changes or transportation delays. Similarly, a company operating in the tourism or hospitality sector needs to model scenarios involving sudden declines in tourist arrivals due to geopolitical tensions or pandemics. By evaluating these possibilities financially, firms can allocate reserves, diversify suppliers, or renegotiate contracts to reduce exposure. This proactive risk management approach is vital to maintaining business continuity in Oman’s unpredictable market environment.

Leaderly’s advisory expertise underscores the synergy between scenario planning and risk management for SMEs in Muscat. Through audit and accounting services, companies receive transparent financial insights that feed directly into scenario models. This holistic view enables businesses to align their operational decisions with both short-term contingencies and long-term strategic goals. Scenario planning thus becomes a living tool, helping SMEs not only survive uncertain markets but also identify opportunities that arise from change. In Oman’s evolving economy, embedding risk management into financial planning is no longer optional but essential for sustainable growth.

Building Financial Resilience Through Adaptive Scenario Planning

Creating agile strategies to thrive amid economic shifts

Financial resilience is the hallmark of successful SMEs in Oman’s fluctuating market, and scenario planning plays a pivotal role in building this resilience. Adaptive scenario planning encourages businesses in Muscat to develop flexible financial strategies capable of responding quickly to changing conditions. This flexibility involves not only anticipating different outcomes but also preparing operational and financial buffers such as contingency funds, diversified revenue streams, and adaptable cost structures. Such strategies enable SMEs to maintain stability even when confronted with adverse scenarios.

Moreover, adaptive scenario planning in Oman requires integrating feedback mechanisms that monitor key performance indicators (KPIs) aligned with different market scenarios. These KPIs help finance managers detect early warning signs of financial stress or opportunity. For example, monitoring liquidity ratios or customer payment behaviors can inform timely adjustments to credit policies or capital expenditures. This data-driven approach enhances decision-making accuracy, allowing SMEs to pivot without compromising growth objectives or compliance with Omani regulations.

Leaderly supports Muscat-based businesses by blending adaptive scenario planning with comprehensive financial advisory services. From audit insights to tax optimization strategies, this integrated support empowers SMEs to refine their scenario assumptions continuously and implement adaptive measures effectively. By fostering an agile financial culture, scenario planning becomes an ongoing discipline that reinforces resilience, enabling businesses to thrive amid Oman’s market complexities and uncertainties.

Leveraging Leaderly’s Advisory for Scenario Planning Success in Oman

Practical support tailored to Muscat’s business environment

Leaderly’s expertise in scenario planning and financial modeling offers indispensable support for SMEs and entrepreneurs in Muscat seeking to master uncertainty. Their advisory services are grounded in deep knowledge of Oman’s tax laws, audit requirements, and economic landscape, ensuring that scenario planning exercises are realistic and actionable. This practical guidance helps businesses move beyond theoretical models to implement strategies that enhance financial stability and growth potential.

By working with Leaderly, companies gain access to rigorous due diligence processes that validate the assumptions underlying scenario plans. This validation ensures that finance models reflect credible market data and regulatory changes, reducing the risk of misguided decisions. Furthermore, Leaderly’s accounting and audit services provide transparent financial reporting that integrates seamlessly with scenario planning frameworks. This alignment strengthens investor confidence and facilitates access to financing, which is critical for SMEs navigating uncertain environments.

Ultimately, Leaderly’s tailored advisory empowers business leaders in Muscat to embed scenario planning as a core financial discipline. This integration transforms how SMEs approach uncertainty, turning potential threats into strategic opportunities. Through ongoing collaboration, companies can continually refine their finance models, manage risk proactively, and build sustainable competitive advantages in Oman’s evolving market.

#Leaderly #ScenarioPlanninginOman #Oman #Muscat #SMEs #Accounting #Tax #Audit