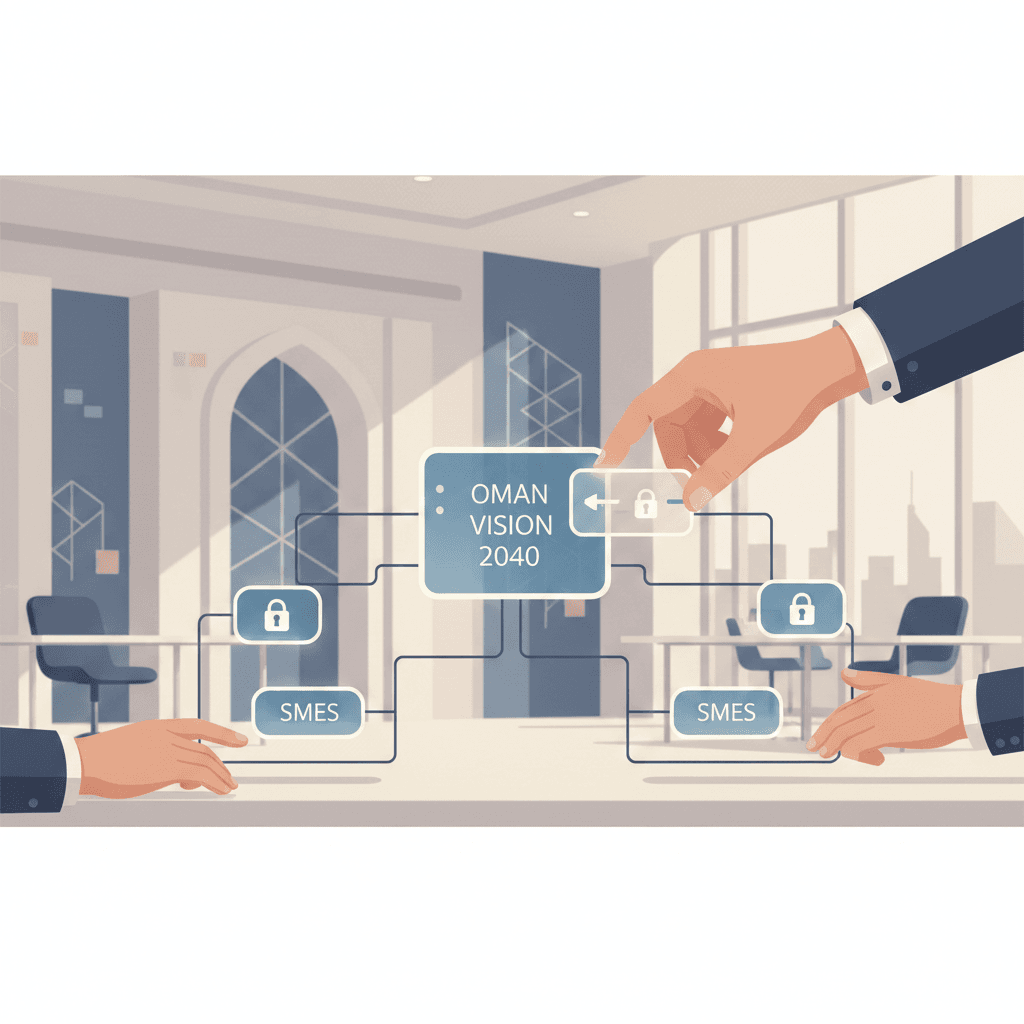

Oman Vision 2040 Secure E-Invoicing: Transforming Tax Compliance for SMEs

The Strategic Role of Oman Vision 2040 Secure E-Invoicing in Tax Compliance

Understanding the Context and Impact on SMEs

Oman Vision 2040 secure e-invoicing marks a pivotal step in modernizing the Sultanate’s tax compliance landscape, particularly benefiting SMEs and entrepreneurs in Muscat and beyond. This digital transformation initiative is designed to automate invoicing processes, ensuring real-time validation and reporting to Oman’s tax authorities. By integrating secure e-invoicing into everyday business operations, the government aims to increase transparency, reduce fraud, and enhance tax collection efficiency. For SMEs, this shift means adapting to new digital workflows that require precise, compliant invoicing aligned with VAT and emerging corporate tax frameworks. Rather than just a technical upgrade, secure e-invoicing under Vision 2040 serves as a catalyst for operational excellence and regulatory trust, offering businesses a clearer path to compliance with Oman’s evolving tax environment.

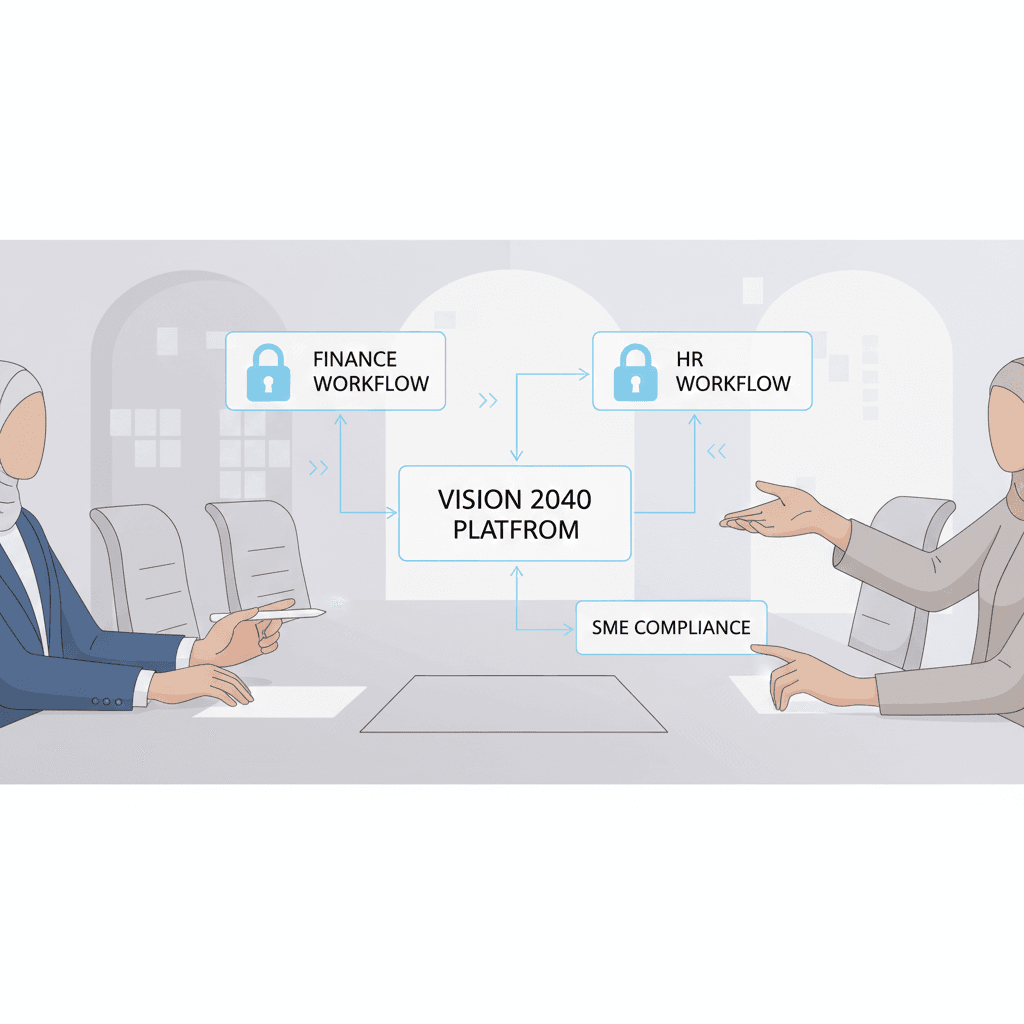

The adoption of secure e-invoicing brings greater accountability to SMEs by ensuring every transaction is traceable and auditable through an encrypted digital platform. This technology enables automatic validation of invoices against tax rules before they are issued, minimizing human error and the risk of non-compliance penalties. For finance managers and business owners, understanding the governance and technical architecture of Oman Vision 2040 secure e-invoicing is critical to leveraging its benefits effectively. It also provides an opportunity to streamline accounting operations, optimize cash flow management, and reduce the administrative burden associated with manual tax reporting.

Furthermore, Oman Vision 2040 secure e-invoicing aligns with global best practices in tax digitization, positioning Oman competitively in the international market. This forward-thinking approach supports the Sultanate’s broader economic diversification goals by fostering a trusted and transparent business environment. As SMEs adjust their systems and processes to comply, they contribute directly to the national agenda of fiscal accountability and sustainable growth. Ultimately, secure e-invoicing acts not only as a compliance tool but also as a strategic enabler for SMEs seeking to thrive in Oman’s dynamic economic landscape.

Practical Implementation Challenges for SMEs under Oman Vision 2040 Secure E-Invoicing

Bridging the Gap Between Policy and SME Readiness

Implementing Oman Vision 2040 secure e-invoicing poses several practical challenges for SMEs, ranging from technological adaptation to human resource training. Many SMEs in Muscat may initially struggle with the integration of digital invoicing software into their existing accounting frameworks, especially those reliant on manual or semi-automated processes. It requires investing in reliable IT infrastructure and selecting compliant e-invoicing solutions that align with Oman’s regulatory standards. Finance managers must also ensure data security and privacy measures are robust enough to handle sensitive tax information transmitted through digital channels.

Beyond technology, there is a learning curve for SME owners and staff who must understand the new e-invoicing workflows, submission deadlines, and compliance obligations. This calls for focused training and advisory services that explain not only how to operate the software but also why strict adherence to digital invoicing is vital for avoiding penalties and supporting business continuity. Many SMEs benefit from professional advisory firms that provide due diligence assessments and feasibility studies to tailor e-invoicing implementation plans suited to their operational scale and sector-specific requirements.

Another practical consideration lies in the transitional phase where SMEs operate alongside legacy invoicing systems. Synchronizing these with new digital platforms demands careful planning to avoid disruptions in cash flow and invoicing accuracy. Moreover, the evolving tax regulations under Oman Vision 2040, including VAT updates and the introduction of corporate tax, require SMEs to remain agile in updating their e-invoicing configurations. Close collaboration with auditing and accounting experts, such as those provided by Leaderly, helps SMEs anticipate changes and embed compliance within their financial governance frameworks efficiently.

Optimizing Tax Compliance Through Oman Vision 2040 Secure E-Invoicing Technology

Leveraging Automation for Accuracy and Efficiency

Oman Vision 2040 secure e-invoicing represents a technological leap forward in automating tax compliance, bringing tangible benefits in accuracy, efficiency, and cost reduction for SMEs. By utilizing an electronic platform that validates and archives invoices in real-time, businesses minimize the risk of tax errors and improve reconciliation speed. Automation allows finance teams to focus on strategic financial management rather than tedious manual entries and corrections. This is particularly critical in Muscat’s fast-growing SME ecosystem, where efficient tax processes can translate directly into enhanced cash flow and improved business resilience.

The digital nature of secure e-invoicing facilitates seamless integration with enterprise resource planning (ERP) systems, accounting software, and tax reporting tools, providing SMEs with a comprehensive financial oversight mechanism. This connectivity empowers finance managers to generate real-time tax reports, monitor VAT obligations, and prepare for audits with confidence. Moreover, automated compliance reduces the chances of incurring penalties or fines due to inaccurate filings, supporting SMEs in maintaining strong relationships with Oman’s tax authorities.

By embedding secure e-invoicing within their operations, SMEs can also unlock advisory benefits such as more precise business valuations and liquidity management insights. Reliable invoice data supports robust feasibility studies and due diligence processes essential for funding or expansion decisions. The transparency and traceability offered by secure e-invoicing align with Oman Vision 2040’s emphasis on governance, economic diversification, and digital innovation. SMEs that harness this technology gain a competitive edge through improved financial discipline and compliance, contributing to long-term sustainability in Oman’s evolving business environment.

Regulatory Compliance and Risk Management in Oman Vision 2040 Secure E-Invoicing

Ensuring Alignment with Oman’s Evolving Tax Framework

The regulatory environment governing Oman Vision 2040 secure e-invoicing is designed to enforce strict compliance with VAT and corporate tax requirements while safeguarding data integrity and privacy. For SMEs in Muscat and across the Sultanate, understanding the legal obligations related to e-invoicing is critical to mitigating risks and avoiding costly penalties. The system mandates that every invoice issued be digitally signed and reported to tax authorities within specified timelines, establishing a clear audit trail. This demands rigorous internal controls and consistent adherence to compliance protocols.

Oman’s tax authorities have also introduced comprehensive guidelines to support SMEs transitioning to secure e-invoicing, emphasizing accuracy in invoice content and timely submissions. Failure to comply may result in fines, delayed tax refunds, or reputational damage. Therefore, SMEs must establish robust internal governance frameworks that incorporate regular audit processes and periodic reviews of invoicing practices. External advisory services specializing in taxation and audit, such as those offered by Leaderly, can provide critical support by conducting due diligence and compliance assessments to identify vulnerabilities and recommend corrective actions.

Moreover, Oman Vision 2040 secure e-invoicing plays a vital role in enhancing fraud prevention and financial transparency. By creating a centralized, immutable digital record of all transactions, it becomes significantly harder for businesses or third parties to manipulate invoices or evade taxes. This aligns with the broader national objectives of fostering a trustworthy business climate and attracting foreign investment. SMEs that embrace these compliance measures demonstrate their commitment to good governance, positioning themselves favorably for growth opportunities within Oman’s diversifying economy.

Driving SME Growth Through Strategic Advisory in Oman Vision 2040 Secure E-Invoicing

Integrating Advisory Services for Sustainable Compliance and Growth

Oman Vision 2040 secure e-invoicing not only facilitates compliance but also offers SMEs a strategic opportunity to leverage advisory services for sustainable business growth. Implementing secure e-invoicing effectively requires more than just software adoption; it demands an integrated approach where auditing, accounting, tax planning, and financial advisory work in concert. SMEs that engage with experienced professionals benefit from tailored feasibility analyses, risk assessments, and valuation services that ensure their e-invoicing systems are optimized for compliance and operational efficiency.

Advisory services can guide SMEs through complex tax environments by providing clarity on VAT and corporate tax implications embedded within the secure e-invoicing framework. They also help businesses prepare for financial audits and facilitate smooth tax filings by aligning internal records with government requirements. Through continuous advisory engagement, SMEs can anticipate regulatory changes under Oman Vision 2040 and adapt proactively, minimizing disruptions and safeguarding their financial health. Such partnerships enable SMEs to focus on core business activities while maintaining confidence in their tax compliance processes.

Ultimately, secure e-invoicing under Oman Vision 2040 should be viewed as part of a broader business transformation strategy. By integrating advisory insights with automated tax technology, SMEs in Muscat can improve transparency, boost efficiency, and reduce risks. This holistic approach strengthens financial governance and contributes to building resilient enterprises ready to capitalize on Oman’s evolving economic landscape. Partnering with trusted experts ensures SMEs maximize the benefits of this digital shift while meeting all regulatory obligations seamlessly.

Enhancing Financial Transparency and Trust with Oman Vision 2040 Secure E-Invoicing

Building Confidence Among Stakeholders and Tax Authorities

Oman Vision 2040 secure e-invoicing fosters a culture of transparency that benefits SMEs, their clients, and regulatory bodies alike. By adopting a system where invoices are securely generated, validated, and transmitted digitally, SMEs provide verifiable proof of transactions that build trust with customers and suppliers. This transparency reduces disputes over payments and supports timely cash flow management, a critical factor for SME sustainability in competitive markets like Muscat.

For tax authorities, secure e-invoicing enhances data accuracy and timeliness, enabling more efficient tax collection and reducing administrative burdens. This mutual trust between businesses and regulators is essential for creating a stable tax environment that encourages compliance and discourages evasion. SMEs demonstrating strong compliance through secure e-invoicing benefit from improved reputations, potentially gaining easier access to credit and investment opportunities within Oman’s financial ecosystem.

Moreover, the integrity of the e-invoicing system aligns with Oman Vision 2040’s broader goals of economic diversification and digital innovation. Transparent financial practices strengthen the overall business climate, attracting foreign investment and encouraging entrepreneurship. SMEs that proactively embrace secure e-invoicing position themselves as responsible corporate citizens and leaders in Oman’s economic future, ready to meet the challenges and opportunities of a digitally-driven market.

In conclusion, Oman Vision 2040 secure e-invoicing represents a transformative evolution in tax compliance for SMEs operating in Muscat and throughout the Sultanate. By automating invoice validation and reporting, it not only enhances regulatory adherence but also fosters greater operational efficiency, financial transparency, and risk management. SMEs embracing this digital shift gain a strategic advantage, aligning their growth ambitions with Oman’s national economic vision and digital agenda.

To navigate this transition successfully, SMEs should adopt an integrated approach combining technology adoption with expert advisory services in accounting, taxation, and audit. This enables businesses to optimize compliance, mitigate risks, and leverage real-time financial insights for better decision-making. Oman Vision 2040 secure e-invoicing is not merely a compliance obligation but a gateway to stronger governance, improved financial health, and sustainable growth within Oman’s vibrant SME sector.

#Leaderly #OmanVision2040SecureEInvoicing #Oman #Muscat #SMEs #Accounting #Tax #Audit